GST RATE AND ITS IMPLICATIONS

GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages.

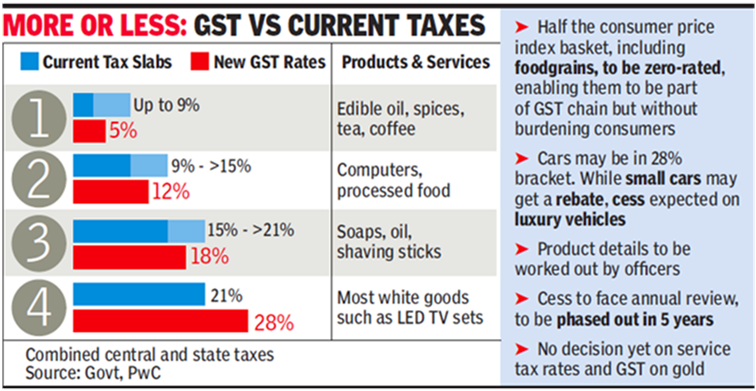

Anatomy of GST rates

At classification level around one-fifth of the items are in GST exempted category, around one-fifth under 28% rate category and one-sixth under 12% category.

Most of the item shall come under 18% tax rate. Most of the food items have been exempted or fetch lowest rate of 5% which is important given high poor percentage in society.

Within services category luxury services and services considered to be anti-social like gambling are under 28% category.

Under the goods category, petroleum products, alcohol, electricity, real estate and several food subcomponents have been kept outside GST ambit.

Under services, health and education, amongst some others, have been excluded.

Four products luxury cars, aerated drinks, tobacco and related 'paan' products would also fetch additional Cess.

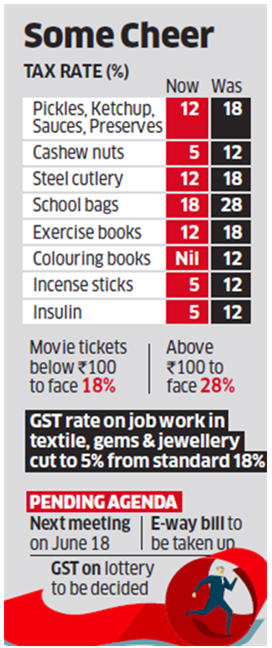

The council has recently revised rates on 66 items such as pickles, sauces, fruit preserves, insulin, cashew nuts, insulin, school bags, colouring books, notebooks, printers, cutlery, agarbattis and cinema tickets, following representations from industry.

Restaurants, manufacturers and traders having a turnover of up to Rs 75 lakh can avail of the composition scheme with lower rates of 5%, 2% and 1%, respectively, with lower compliance, against Rs 50 lakh previously. A GST rate of 5% will be applicable on outsourcing of manufacturing or job work in textiles and the gems and jewellery sector. Bleaching and cleaning of human hair, a big industry in Midnapore, will not face any tax.

Implications on various sectors of GST rates

The progressive tax structure would make sure that states do not face any revenue shortfall due to GST. It is likely that more comprehensive service tax coverage increases their revenues. Then, if any shortfall does remain, the Centre will take care of it.

Moreover, with a view to keep inflation under check, essential items including food, which presently constitute roughly half of the consumer inflation basket, will be taxed at zero rate. The cess is expected to provide additional resources to the central government to compensate states for losses incurred. This will be based on the compensation formula.

Impact on Important sectors

- Construction and Infrastructure

The composite supply of works contract in this sector will fall under the 18% GST rate with full input tax credit (ITC). The GST rate may seem higher than the current tax rates as the effective tax incidence for an average construction contract in the pre-GST era is typically in the range of 11-18%, which is lower in comparison to the announced GST rate of 18%. The difference is more pronounced for the construction services which fall under the service tax exemption category.

Despite higher rates, the sector is likely to benefit under GST regime from the availability of input tax credit. As under the current tax regime the benefit of input tax paid is not fully available, the benefits arising out of input tax credit on the raw-materials available under the GST regime would result in an overall neutral tax incidence for construction services.

Cement prices are expected to go up marginally, as the GST Council has announced a tax rate of 28 per cent on the product. The cement industry says the rate is above what was expected, and the increase will most likely be passed on to consumers. - Hospitality sector

Goods and Services Tax (GST) rate levy on the hospitality sector is within the range of 2 to 28 %. hoteliers have termed it as a "killer step" for the tourism and hospitality industry, which is already reeling under rising costs of basic commodities, labour and the recent liquor ban on highways. It will certainly have an adverse effect on the industry, particularly for the mid and high category hotels which will fall under the 18 and 28 % GST rate. - Engineering, Capital Goods & Power Equipment

Introduction of GST is expected to improve the prospects of engineering, capital goods and power equipment (ECPE) sector by simplifying the tax structure. The complexity in this sector is that companies are involved simultaneously in manufacturing of goods and rendering of services. A comprehensive tax like GST would combine the state and central taxes in a single structure and the tax credit would be available at each stage of production and final sale so that double taxation could be avoided. This would bring in more cost competitiveness to the domestic players. - Automobile sector

Currently taxes paid by car manufacturers are 27.6% to max 45.1% and the GST rates on automobile sector would be 28%. So rates seem to be revenue neutral though gains would occur from easy compliance and less cascading effect.

Criticism of rates according to some experts

- It compromises on simplicity. The multiplicity of tax rates for services will add complexity to the compliance in the GST regime.

- Around 19% of services have been under the highest slab of 28% which caters to daily needs of middle class. Thus the middle class will now have to bear the brunt of higher prices.

Conclusion

A well-designed GST in India is expected to simplify and rationalize the current indirect tax regime, eliminate tax cascading and put the Indian economy on high-growth trajectory. The proposed GST levy may potentially impact both manufacturing and services sector for the entire value chain of operations, namely procurement, manufacturing, distribution, warehousing, sales, and pricing.

GST is one indirect tax for the whole nation, which will make India one unified common market. The GST intends to subsume most indirect taxes under a single taxation regime. GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stages of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. This is expected to help broaden the tax base, increase tax compliance, and reduce economic distortions caused by inter-state variations in taxes.

Why GST has been proposed?

Our Constitution empowers the Central Government to levy excise duty on manufacturing and service tax on the supply of services. Further, it empowers the State Governments to levy sales tax or value added tax (VAT) on the sale of goods. This exclusive division of fiscal powers has led to a multiplicity of indirect taxes in the country. In addition, central sales tax (CST) is levied on inter-State sale of goods by the Central Government, but collected and retained by the exporting States. Further, many States levy an entry tax on the entry of goods in local areas.

This multiplicity of taxes at the State and Central levels has resulted in a complex indirect tax structure in the country that is ridden with hidden costs for the trade and industry. In order to simplify and rationalize indirect tax structures, Government of India attempted various tax policy reforms at different points of time. A system of VAT on services at the central government level was introduced in 2002. The states collect taxes through state sales tax VAT, introduced in 2005, levied on intra-state trade and the CST on inter-state trade. Despite all the various changes the overall taxation system continues to be complex and has various exemptions.

This led to the idea of "One nation One Tax" and introduction of GST in Indian financial system. This is simply very similar to VAT which is at present applicable in most of the states and can be termed as National level VAT on Goods and Services with only one difference that in this system not only goods but also services are involved and the rate of tax on goods and services are generally the same.

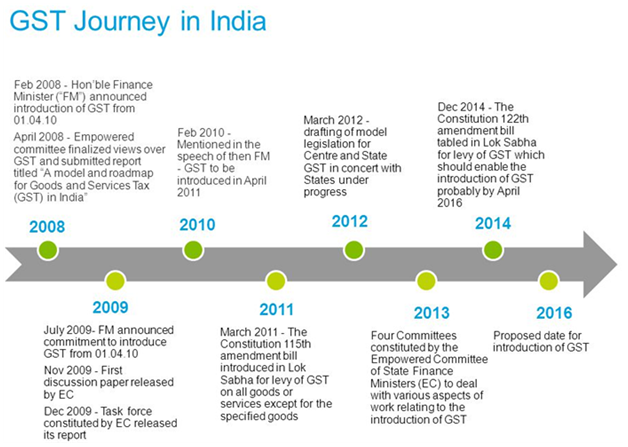

What are the major chronological events that have led to the introduction of GST?

GST is being introduced in the country after a 13 year long journey since it was first discussed in the report of the Kelkar Task Force on indirect taxes. A brief chronology outlining the major milestones on the proposal for introduction of GST in India is as follows:

- In 2003, the Kelkar Task Force on indirect tax had suggested a comprehensive Goods and Services Tax (GST) based on VAT principle.

- A proposal to introduce a National level Goods and Services Tax (GST) by April 1, 2010 was first mooted in the Budget Speech for the financial year 2006-07.

- Since the proposal involved reform/restructuring of not only indirect taxes levied by the Centre but also the States, the responsibility of preparing a Design and Road Map for the implementation of GST was assigned to the Empowered Committee of State Finance Ministers (EC).

- Based on inputs from Govt of India and States, the EC released its First Discussion Paper on Goods and Services Tax in India in November, 2009.

- In order to take the GST related work further, a Joint Working Group consisting of officers from Central as well as State Government was constituted in September, 2009.

- In order to amend the Constitution to enable introduction of GST, the Constitution (115th Amendment) Bill was introduced in the Lok Sabha in March 2011. As per the prescribed procedure, the Bill was referred to the Standing Committee on Finance of the Parliament for examination and report.

- Meanwhile, in pursuance of the decision taken in a meeting between the Union Finance Minister and the Empowered Committee of State Finance Ministers on 8th November, 2012, 'Committee on GST Design', consisting of the officials of the Government of India, State Governments and the Empowered Committee was constituted.

- This Committee did a detailed discussion on GST design including the Constitution (115th) Amendment Bill and submitted its report in January, 2013. Based on this Report, the EC recommended certain changes in the Constitution Amendment Bill in their meeting at Bhubaneswar in January 2013.

- The Empowered Committee in the Bhubaneswar meeting also decided to constitute three committees of officers to discuss and report on various aspects of GST as follows:- (a) Committee on Place of Supply Rules and Revenue Neutral Rates; (b) Committee on dual control, threshold and exemptions; and (c) Committee on IGST and GST on imports.

- The Parliamentary Standing Committee submitted its Report in August, 2013 to the Lok Sabha. The recommendations of the Empowered Committee and the recommendations of the Parliamentary Standing Committee were examined by the Ministry in consultation with the Legislative Department. Most of the recommendations made by the Empowered Committee and the Parliamentary Standing Committee were accepted and the draft Amendment Bill was suitably revised.

- The final draft Constitutional Amendment Bill incorporating the above stated changes were sent to the Empowered Committee for consideration in September 2013.

- The EC once again made certain recommendations on the Bill after its meeting in Shillong in November 2013. Certain recommendations of the Empowered Committee were incorporated in the draft Constitution (115th Amendment) Bill. The revised draft was sent for consideration of the Empowered Committee in March, 2014.

- The 115th Constitutional (Amendment) Bill, 2011, for the introduction of GST introduced in the Lok Sabha in March 2011 lapsed with the dissolution of the 15th Lok Sabha.

- In June 2014, the draft Constitution Amendment Bill was sent to the Empowered Committee after approval of the new Government.

- Based on a broad consensus reached with the Empowered Committee on the contours of the Bill, the Cabinet on 17.12.2014 approved the proposal for introduction of a Bill in the Parliament for amending the Constitution of India to facilitate the introduction of Goods and Services Tax (GST) in the country. The Bill was introduced in the Lok Sabha on 19.12.2014, and was passed by the Lok Sabha on 06.05.2015. It was then referred to the Select Committee of Rajya Sabha, which submitted its report on 22.07.2015.

- Lok Sabha and Rajya Sabha has unanimously passed the 122nd Constitutional Amendment Bill in August, 2016 which later got the assent of the President.

What are the features of the GST Bill?

The salient features of the Bill are as follows:

- Conferring simultaneous power upon Parliament and the State Legislatures to make laws governing goods and services tax;

- Subsuming of various Central indirect taxes and levies such as Central Excise Duty, Additional Excise Duties, Service Tax, Additional Customs Duty commonly known as Countervailing Duty, and Special Additional Duty of Customs;

- Subsuming of State Value Added Tax/Sales Tax, Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States), Octroi and Entry tax, Purchase Tax, Luxury tax, and Taxes on lottery, betting and gambling;

- Dispensing with the concept of 'declared goods of special importance' under the Constitution;

- Levy of Integrated Goods and Services Tax on inter-State transactions of goods and services;

- GST to be levied on all goods and services, except alcoholic liquor for human consumption. Petroleum and petroleum products shall be subject to the levy of GST on a later date notified on the recommendation of the Goods and Services Tax Council;

- Compensation to the States for loss of revenue arising on account of implementation of the Goods and Services Tax for a period of five years;

- Creation of Goods and Services Tax Council to examine issues relating to goods and services tax and make recommendations to the Union and the States on parameters like rates, taxes, cesses and surcharges to be subsumed, exemption list and threshold limits, Model GST laws, etc. The Council shall function under the Chairmanship of the Union Finance Minister and will have all the State Governments as members.

|

Taxes Going to Subsumed Under GST At the Central level, the following taxes are being subsumed: 1. Central Excise Duty, 2. Additional Excise Duty, 3. Service Tax, 4. Additional Customs Duty commonly known as Countervailing Duty, and 5. Special Additional Duty of Customs. At the State level, the following taxes are being subsumed: 1. Subsuming of State Value Added Tax/Sales Tax, 2. Entertainment Tax (other than the tax levied by the local bodies), Central Sales Tax (levied by the Centre and collected by the States), 3. Octroi and Entry tax, 4. Purchase Tax, 5. Luxury tax, and 6. Taxes on lottery, betting and gambling.

|

Why is Dual GST required?

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. Both the levels of Government have distinct responsibilities to perform according to the division of powers prescribed in the Constitution for which they need to raise resources. A dual GST will, therefore, be in keeping with the Constitutional requirement of fiscal federalism.

Bills for implementation of GST regime

Bills passed for the implementation of GST regime:

- The Central Goods and Services Tax Bill 2017 (The CGST Bill)

- The Integrated Goods and Services Tax Bill 2017 (The IGST Bill)

- The Union Territory Goods and Services Tax Bill 2017 (The UTGST Bill)

- The Goods and Services Tax (Compensation to the States) Bill 2017 (The Compensation Bill)

- The CGST Bill makes provisions for levy and collection of tax on intra-state supply of goods or services or both by the Central Government.

- IGST Bill makes provisions for levy and collection of tax on inter-state supply of goods or services or both by the Central Government.

- The UTGST Bill makes provisions for levy on collection of tax on intra-UT supply of goods and services in the Union Territories without legislature. Union Territory GST is akin to States Goods and Services Tax (SGST) which shall be levied and collected by the States/Union Territories on intra-state supply of goods or services or both.

- The Compensation Bill provides for compensation to the states for loss of revenue arising on account of implementation of the goods and services tax for a period of five years as per section 18 of the Constitution (One Hundred and First Amendment) Act, 2016.

Applicability of GST

- GST is applicable on the supply of goods and services.

- GST is not levied (initially) on:

- Petroleum crude

- High speed diesel

- Motor spirit(petrol)

- Natural gas

- Aviation Turbine fuel

- Alcoholic liquor for human consumption is exempted from GST.

- Tobacco and tobacco products will be subjected to GST. The centre may apply excise duty on tobacco.

Examples - GST at work

Let us suppose that GST rate is 10%, with the manufacturer making value addition of Rs.30 on his purchases worth Rs.100 of input of goods and services used in the manufacturing process. The manufacturer will then pay net GST of Rs.3 after setting-off Rs.10 as GST paid on his inputs (i.e. Input Tax Credit) from gross GST of Rs.13. The manufacturer sells the goods to the whole-seller. When the whole-seller sells the same goods after making value addition of (say), Rs.20, he pays net GST of only Rs.2, after setting-off of Input Tax Credit of Rs.13 from the gross GST of Rs.15 to the manufacturer. Similarly, when a retailer sells the same goods after a value addition of (say) Rs.10, he pays net GST of only Re.1, after setting-off Rs.15 from his gross GST of Rs. 16 paid to whole-seller. Thus, the manufacturer, whole-seller and retailer have to pay only Rs.6 (= Rs.3+Rs.2+Re.1) as GST on the value addition along the entire value chain from the producer to the retailer, after setting-off GST paid at the earlier stages. The overall burden of GST on the goods is thus much less.

How will be Inter-State Transactions of Goods and Services be taxed under GST in terms of IGST method?

In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State.

How would GST be administered in India?

GST Council will be tasked with optimizing tax collection for goods and services by the State and Centre. The Council will consist of the Union Finance Minister (as Chairman), the Union Minister of State in charge of revenue or Finance, and the Minister in charge of Finance or Taxation or any other, nominated by each State government.

The GST Council will be the body that decides which taxes levied by the Centre, States and local bodies will go into the GST; which goods and services will be subjected to GST; and the basis and the rates at which GST will be applied.

Composition of GST Council

GST council consists of:

- The Union Finance Minister (as Chairman),

- The Union Minister of State in charge of Revenue or Finance,

- The Minister in charge of Finance or Taxation or any other Minister, nominated by each state government.

All decisions of the GST Council will be made by three-fourth majority of the votes cast; the centre shall have one-third of the votes cast, and the states together shall have two-third of the votes cast.

The GST Council will make recommendations on:

- Taxes, cesses, and surcharges to be subsumed under the GST,

- Goods and services which may be subject to, or exempt from GST,

- The threshold limit of turnover for application of GST,

- Rates of GST,

- Model GST laws, principles of levy, apportionment of IGST and principles related to place of supply,

- Special provisions with respect to the eight north eastern states, Himachal Pradesh, Jammu and Kashmir, and Uttarakhand,

- And related matters.

How will IT be used for the implementation of GST?

For the implementation of GST in the country, the Central and State Governments have jointly registered Goods and Services Tax Network (GSTN) as a not-for-profit, non-Government Company to provide shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders. The key objectives of GSTN are to provide a standard and uniform interface to the taxpayers, and shared infrastructure and services to Central and State/UT governments. GSTN is working on developing a state-of-the-art comprehensive IT infrastructure including the common GST portal providing front end services of registration, returns and payments to all taxpayers, as well as the backend IT modules for certain States that include processing of returns, registrations, audits, assessments, appeals, etc. All States, accounting authorities, RBI and banks, are also preparing their IT infrastructure for the administration of GST. There would no manual filing of returns. All taxes can also be paid online. All mis-matched returns would be auto-generated, and there would be no need for manual interventions. Most returns would be self-assessed.

This Act has the potential to usher in monumental changes in the indirect tax regime in India.

Though Indian states have achieved Political Integration in 1950's with the integration of Princely states in Indian Union, economic Integration was still missing. Passing of GST is a shining example of cooperative federalism where States and Centre have ceded their power to tax and come up with a single tax system to realize the dream of one Economic India with ‘One Market’. Thus, GST once again has shown Unity in Diversity of Indian Society. However, Economic integration is still not achieved as Constitution needs some changes in this regard.

GST: a shining example of Cooperative federalism

In our Federal System both Centre and States have power to impose taxes. The division of such taxation powers is given in Union and State List under 7th Schedule. With the spirit of cooperative federalism, under GST, both Centre and States have given up taxation powers and as a product following taxes have been eliminated.

|

Central taxes that would be subsumed under the GST are |

State taxes that would be subsumed under the GST are |

|

|

The Constitution of India has also been amended accordingly. This fundamental reordering of federal fiscal relations for the cause of common good shows the strength and resolve of the federal structure.

This convergence for the cause of larger public good has been made possible, initially due to the mechanism of the Empowered Committee of Ministers (EC) and later the GST Council. Under the GST regime, the Centre & States will act on the recommendations of the GST Council. GST Council comprises of the Union Finance Minister, Union Minister of State for Finance and all Finance Ministers of the States. 2/3rd of voting power is with the States and 1/3rd with the Centre which reflects the accommodative spirit of federalism.

Though the Constitution provides for decisions being taken by a 3/4th majority of members present and voting, all decisions till now (before july, 1, 2017) have been taken unanimously by consensus. The very fact that there has been no need to resort to voting to take any decisions taken till now in 18 meetings held so far reflects the spirit of "One Nation, One Aspiration, One Determination". In this context it is important to note that credit for the new law does not go to one party or one government but it's a shared legacy of all.

The participation of all States and Centre in the framing of GST laws has led to the following features in the GST Laws. These features signify spirit of cooperative federalism.

- Harmonisation of GST laws across the country: Even though Centre and each State legislature have passed their own GST Acts, they are all based on the Model GST law drafted jointly by the Centre & the States. Consequently, all the laws have virtually identical provisions.

- Common Definitions: There are common definitions in the CGST and SGST Act.

- Common Procedures / Formats: There are common procedures; common formats in all laws, even the sections and subsections in CGST Act and SGST Act are same. UTGST Act provides that most of the provisions in CGST Act, as stated in Section 21 shall apply to UTGST Act also.

- Common Compliance Mechanism: GSTN, a not-for-profit, non-government company promoted jointly by the Central and State Governments, is the common compliance portal and the taxpayers shall interface with all states as well as Centre through this portal.

Other significant areas, where such co-operation has been displayed by the Centre and States are as under: - Joint Capacity Building Efforts: Joint Capacity Building efforts by Centre as well as all the States are being organised wherein for the first time the training of officers of Centre and State is being conducted under the auspices of National Academy of Customs, Indirect Taxes and Narcotics (NACIN). NACIN has formed a Joint Coordination Committee in each State comprising of Centre, State and NACIN Officers for overseeing Capacity Building efforts.

- Joint Trade Awareness & Outreach Efforts: Centre along with the State Government Officials has been organising Joint Trade Awareness & Outreach programs wherein for the first time the Officers came together to create GST awareness amongst Trade and other stakeholders.

- Cross Empowerment of Officers of Centre as well as States: Though GST will be jointly administered by Centre and State, for ensuring ease of doing business, but the individual taxpayer will have a single interface with only one Tax Authority either Centre or State.

- Joint Implementation Committees: In order to ensure smooth rollout of GST, the GST Council has formed a three tier structure consisting of: the Office of the Revenue Secretary, GST Implementation Committee (GIC) and eight Standing Committees. In addition, eighteen Sectoral Groups representing various sectors of the economy have been set up. All these Committees viz. GST Implementation Committee (GIC), Standing Committees and Sectoral Groups have representation of Centre and State Officers in the spirit of cooperative federalism to ensure quick administrative decisions required before and after the rollout and ensure effective coordination for smooth implementation of GST.

Indeed, GST in India in its conception, enactment and implementation is an example of real 'co-operative federalism' at work, in tune with the unique character of India - 'Unity in Diversity'.

Economic Integration

Under GST regime the entire country will become one market and it will be an economic integration of India. India would become one uniform market with seamless transfer of goods and services.

|

GST: Economic Integration of Jammu and Kashmir With the implementation of the Goods and Service Tax in Jammu and Kashmir, an important chapter has been opened in the history of centre-state relations - a chapter that has completely integrated the state with India in economic terms, though political integration has happened 70 years ago. While other states of the union draw their power to tax from Article 246 of the Indian Constitution, Jammu and Kashmir draws it from Section 5 of its own constitution. However, recently State Assembly has adopted the 101st Constitutional Amendment and enacting a State GST law rendering Section 5 of the Jammu and Kashmir Constitution ineffective for all practical purposes. |

However, Constitution still provides room for states to levy tariff and non-tariff barriers. Article 302 gives Parliament the power to restrict free trade between and within states on grounds of public interest. Similarly, Article 304 (b) allows state legislatures to restrict trade and commerce on grounds of public interest. Of course, states can only impose restrictions in areas that are either on the state or concurrent list. The gist of these provisions is that both the Centre and the States have considerable freedom to restrict trade and commerce that hinder the creation of one India. Such Strong power is not found in other International experiences.

The United States has a very strong interstate commerce clause in the Constitution. In US, residuary powers are reserved to the states (and not the Union, as is the case in India), states are constitutionally barred from regulating interstate trade and commerce as it was felt that such power would fundamentally hamper free trade and movement.

Even under European Common Market, it is now accepted that countries within the EU must not, except under narrow circumstances, restrict the four freedoms of movement: of goods, services, capital, and people.

Under WTO which has a membership of 164 countries with widely varying income levels and political systems, and more diversity then Indian states such powers as given in Indian Constitution are not found.

The contrast between Articles 302 and 304 (b) of the Constitution and Article XX of the General Agreement On Tariff and Trade (GATT) WTO show that, reasons for invoking departures from free trade principles are more clearly and narrowly specified in the WTO than in the Constitution which instead refers to an open-ended "public interest". Thus for true economic integration clauses have to be amended

Conclusion

The phrase Unity in Diversity has been the hallmark of Indian Society which embraces diversity in terms of Caste, Creed, Colour, Culture, Customs, Cuisine and Clothing (7C). The new chapter of cooperation has been added within this diversity by implementation of GST through cooperation between Centre and States which economically integrates India and strengthen its unity.

However, economic integration is still not real on the question of creating one economic India, technology, economics, and politics have been surging ahead. Perhaps, it is time for the Constitution to catch up to further facilitate this surging internal integration i.e. Article 302 and 304(b) should be amended. Here again such amendment requires coming together of States and Centre with the spirit of cooperative federalism.

GST is the biggest tax reform since 1991 when India opened its market first. Potentially one of the most dynamic economies in the developing world, India is hampered by a bewildering array of state-by-state tax codes that discourage doing business across state borders. The GST is widely viewed as a breakthrough that will allow the authorities to confront the problem, eventually creating a more unified economy that will allow businesses to expand nationwide far more easily.

Far from being only a tax reform, design of GST would have far reaching Macro-economic effects. It is expected that in long run Tax to GDP ratio will improve both for centre and states. As a consequence it will improve fiscal health of Centre and States and provide them with wherewithal to improve state capacity in delivery of basic services, augment infrastructure, etc. Another impact will be on ease of doing business which will improve many folds by this reform. Last but not the least, Logistic sector will see far reaching changes which will reduce cost of transportation and increase in competitiveness.

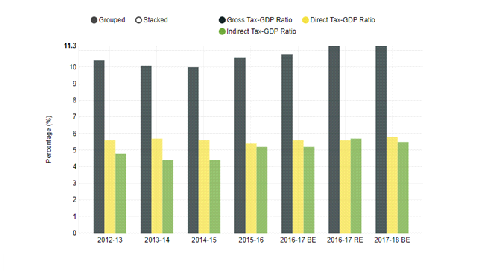

Tax to GDP ratio

A country's tax-GDP ratio is an important indicator that helps to understand how much tax revenue is being collected by the government as compared to the overall size of the economy. A higher tax-GDP ratio gives more room in a government's budget so that it can spend more without borrowing. However, despite many years of high growth, India's tax-GDP ratio continues to remain low. The cursory look at indirect tax-to GDP ratio shows that indirect tax to GDP ratio is around 5% and Direct tax to GDP ratio is at 5.5%. In this context, GST shall increase tax ratio.

It has also been noticed at times that businesses report a different data in their annual VAT return as compared to their Income Tax return. Many businesses deflate the value of profit to attract less income tax liability. Tax evaders who windowdress their books at the year end to lessen their tax liability will find it harder to do so. Such actions were possible before, as the Income Tax Department did not have any access to the data which is filed under the state VAT laws. However, under the new regime, GSTN will be the single repository to all these transactions and the Income Tax Department will have access to such data thus having a clear picture of the total sales and purchases, and eventually the overall profitability, of every business. In this way Direct tax to GDP ratio will improve.

Under the GST law, every sale invoice will get uploaded on the Goods and Services Tax Network's common GST portal. GSTN will ensure a 100% reconciliation of sale invoice of the supplier and the purchase invoice of the buyer. So far, returns filed under the VAT law or CST law do not require validation from the buyer, so we can expect more accurate value being reported under the new regime. This will increase the indirect tax to GDP ratio.

So, new regime makes it tough to evade taxes. This likely to improve the overall compliance rate and would also reduce the size of black economy.

Fiscal Health of States

The successful implementation of GST will result in additional revenue through simpler and easier tax administration, supported by robust and user-friendly IT (information technology) systems and improvement in tax compliance.

Thus the GST is expected to reduce administrative costs for collection of tax revenue and improve revenue efficiency while uniformity in tax rates and procedures will lead to economy in compliance cost.

|

Revenue Efficiency - It is the amount spent by government to realize a rupee of tax. Expenditure includes expenditure on tax compliance system like salary of revenue officials, establishment cost etc. As compliance under GST is through IT platform, cost of collecting revenue will decline thereby increasing revenue efficiency. |

The GST regime will also increase the shareable pool of resources, resulting in transfer of large funds to the states for developmental works. Such an outcome will also ensure debt sustainability of states in the long term. This will be an important outcome because according to recent RBI report on State debt, two states have breached fiscal deficit threshold of 3% as mandated in State level FRBM.

Under GST central cess will be subsumed into the GST and in turn increase the divisible pool of resources which is to the advantage of states. This is because Cess is levied by central government for a specific purpose like education cess to fund SSA. The proceeds go only to Central Government, but these cess are subsumed under GST and GST is collected by both Centre and States hence state revenue shall increase. Similarly, revenue of States will increase as earlier Excise duty on production and Service Tax on services were assigned to Centre but now GST on production and Services will go to States too.

Another aspect of GST which is that GST is a destination based tax. This means that proceeds from tax collection are appropriated by state in which final sale is made irrespective of state in which the product is manufactured. This aspect of GST will improve the fiscal health of the poorest States - for example, Uttar Pradesh, Bihar, and Madhya Pradesh - who happen to be large consumers. These states are expected to generate resources to augment their state capacity in delivering basic services like law and order, Education and Health Services and improve physical infrastructure to attract manufacturing.

Ease of doing Business

Presently, the Central Government levies gamut of taxes like Central Excise duty, Service Tax, CST and states levy tax on retail sales (VAT), entry of goods in the State (Entry Tax), Luxury Tax, Purchase Tax, etc. Large number of taxes created high compliance cost for the taxpayers in the form of number of returns, payments, etc. In fact, it is said that our tax laws have created a situation where business decisions are based on tax considerations rather than logical economical factors. All these issues created a need for one tax that will be able to mitigate number of these problems to a large extent and ease the way business in which is done.

|

GST impact on Ease Of Doing Business Ranking The Ease of Doing Business Index is an index created by the World Bank Group. Higher rankings (a low numerical value) indicate better, usually simpler, regulations for businesses and stronger protections of property rights. A nation's ranking on the index is based on the average of 10 sub-indices, which among other includes "Paying Taxes" Index. New GST regime would improve India's rank under this sub-index and consequently ranking in overall Index would improve. India is currently placed at 130 out of 189 countries. The Prime Minister hopes to bring India amongst the top 50 countries on the rankings and GST is a step in this direction. |

Specifically, ways in which GST would facilitate ease of doing business are as follows:

- Simpler tax regime with fewer exemptions.

- Reductions in the multiplicity of taxes that are at present, governing our indirect tax system leading to simplification and uniformity.

- Reduction in compliance costs.

- No multiple records keeping for a variety of taxes - so lesser investment of resources and manpower in maintaining records.

- More efficient neutralization of taxes especially for exports thereby making our products more competitive in the international market and give boost to Indian exports.

- Simplified and automated procedures for various processes such as registration, returns, refunds, tax payments, etc.

- All interaction to be through the common GSTN portal- so less public interface between tax authorities and tax payer

- Timelines to be provided for important activities like obtaining registration, refunds, etc.

Logistics

Logistics is considered to be the backbone of manufacturing and trading activities in the economy. It has a critical role to play for developing countries like India. It can be fairly assumed that a well organized and mature logistics industry has the potential to leapfrog the "Make In India" initiative to its desired position.

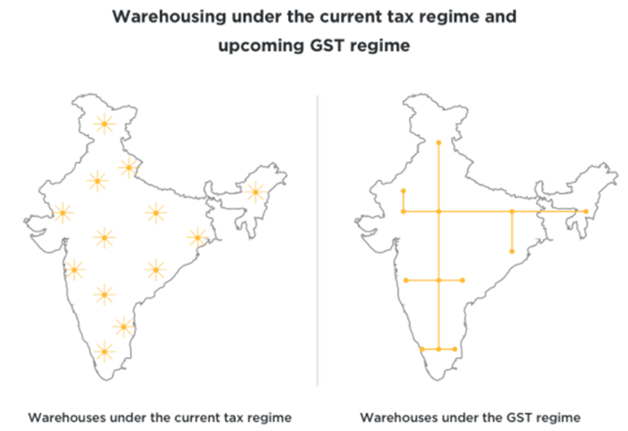

So far, logistics players in India have been maintaining multiple warehouses across states to avoid CST levy and state entry taxes. Most of these warehouses are operating below their capacity and thus adding to their operational inefficiencies. On the other hand movements of truck carrying goods take a lot of time mainly due to stoppage at state check- posts for payment of taxes. India has approximately 600 check posts.

According to a Ministry of Road Transport and Highways (MORTH) study, a typical truck spends nearly 16% of the time at check posts. A truck in India covers an average annual distance of only 85,000 km as compared to 150,000 to 200,000 km in advanced countries. Goods carriage vehicles in India barely travel 280 km per day against a world average of 400 km per day.

However, under GST, most of the current challenges of this industry will be a story of the past as India will become one single market wherein goods can move freely inter-state without any levy. Many companies are expected to migrate from a current strategy of 'multiple warehousing' to the 'hub and spoke' model as tax treatment across India will be same. GST will further bring warehouse consolidation across the country and we can witness mega logistic hubs and high investments in infrastructure wherein 100% FDI has already been allowed. As an outcome of GST, warehouse operators and e-commerce players have already shown interest in setting up their warehouses at strategic locations such as Nagpur, which is the zero mile city of India and is well connected throughout. Another favourable outcome would be seamless movement of Truck across India thus cutting delivery time and cost.

Boost to Make in India

GST will give a major boost to the Government of India's 'Make in India' initiative by making goods or services produced or provided in India competitive in the national and international markets. The currently prevalent Counter-veiling Duty (CVD) on imported goods will be replaced under GST regime by the integrated tax (IGST) which is simply the sum total of Central GST +State GST. This will bring parity in taxation on domestic and imported products, and thereby provide protection to domestic industry.

Under the GST regime, exports will be entirely zero rated, unlike the present system where refund of some taxes is not allowed due to fragmented nature of indirect taxes between the Centre and the States. This means that input tax credit of tax paid on input supplies would be available to the exporter even though no tax is required to be paid on final export supplies. The exporters also have an option to pay IGST on export supplies and claim refund for the same for which a fast track mechanism has been provided. This will boost Indian exports thereby improving the balance of payments position.

Conclusion

It is clear that GST is not only a tax reform but a structural reform which will change the trajectory of growth. It will improve the fiscal capacity of states which would ensure that they do not have to fall back on borrowings to fill the fiscal deficit and for businesses it will make doing business relatively easy which along with changes in logistic sector will improve export competitiveness of Indian products and may put India on the path of 'Export led Growth'.

The Goods and Services Tax is the biggest tax reform since independence, according to NITI aayog CEO Amitabh Kant GST will help India achieve 9 per cent growth rate. Several experts have also said that GST is estimated to boost GDP by 1-2 per cent and bring down inflation by 2 per cent over the long term.

The Proposed Benefits of GST are:

- The GST will usher in a nationwide common market and subsume a multiplicity of Central and State taxes.

- The GST will increase the resources available for poverty alleviation and development.

- The GST will facilitate 'Make in India' by making one India. The current tax structure unmakes India, by fragmenting Indian markets along State lines. These distortions are caused by three features of the current system: the Central Sales Tax (CST) on inter-State sales of goods; numerous intra-State taxes; and the extensive nature of countervailing duty exemptions that favours imports over domestic production. In one fell swoop, the GST would rectify all these distortions: the CST would be eliminated; most of the other taxes would be subsumed into the GST; and because the GST would be applied on imports, the negative protection favouring imports and disfavouring domestic manufacturing would be eliminated.

- The GST would improve tax governance.

- The Indian GST will be a leap forward in creating a much cleaner dual VAT which would minimise the disadvantages of completely independent and completely centralised systems. A common base and common rates (across goods and services) and very similar rates (across States and between Centre and States) will facilitate administration and improve compliance while also rendering manageable the collection of taxes on inter-State sales. At the same time, the exceptions - in the form of permissible additional excise taxes on special goods (petroleum and tobacco for the Centre, petroleum and alcohol for the States) - will provide the requisite fiscal autonomy to the States.

- However, in lieu of it, it is important to analyze impact of GST on three subsectors of economy namely, Agriculture, Industries and Services. The analysis of these sub-sectors will help us determine how GST will aid in faster economic growth.

Impact on Agriculture

In the agriculture sector we shall look at how GST will impact cost of agriculture inputs, Supply chain of agriculture products and unification of agriculture in one national market.

a) Agricultural Inputs

Any input taxes placed on inputs used in the farm sector such as seeds, fertilisers, pesticides, tractors etc, contribute to increase in cost of farm output. On the other hand, farm output prices are controlled by market forces on which farmer has little control. As the input price rises and output price remains stagnant, the farmer will have no option but to absorb the cost, thus increasing his burden. Indian farmer is already reeling under tremendous pressure from many ends and the increased burden of taxes will create a crater in his income. In this context let's look at tax incidence on some major inputs

Seeds - Seeds were exempted both under earlier tax structure and under new GST regime.

Tractors - The tax incidence on Tractor's inputs combined with VAT on final product takes the total tax incidence for the industry to levels of ~ 12-13%. The fixation of a GST rate of 12% on tractors and on tractor inputs@18% would allow the manufacturers to take credit of the cumulative input duties and taxes. Thus, the total tax incidence on tractors would remain at broadly similar levels and its implementation is neutral for the tractor industry.

Fertilizers - Fertilisers an important element of agriculture was previously taxed at 6% (1% Excise + 5% VAT). In the GST regime, the tax on fertilisers has been reduced to 5%. Thereby reducing cost for farmers

Pesticides - Pesticides currently attract an excise duty of 12.5 per cent. But under GST regime, crop protection products like pesticides are taxable at 18%. So, this might increase tax burden on farmer.

So, by and large either tax incidence under GST regime is similar to incidence under earlier tax structure.

|

Agriculture Input |

Tax burden under previous Tax Regime |

Tax burden under GST Tax Regime |

|

Seeds |

Nil |

Nil |

|

Tractors |

12-13% |

12% |

|

Fertilizers |

6% |

5% |

|

Pesticides |

12.5% |

12% |

- b) Supply chain

One of the major issues faced by the agricultural sector is the transportation of agriculture products across state lines all over India. Agricultural commodities are perishable in nature in varying degrees therefore trade is influenced by the time required for transportation. The Economist reports that long distance trucks in India are parked for 60 per cent of the time during transportation. Currently, trucks wait outsides for hours to pay taxes on borders of states and cities. These taxes are State entry tax and Octroi. However, GST will subsume State entry tax and Octroi this means seamless movement of trucks. Thus, simple uniform tax regime is expected to improve the transportation time, and curtail wastage of precious food as well as it would ease interstate movement of agricultural commodities which would improve marketing efficiency, facilitate development of virtual markets through warehouses and reduce overhead marketing cost.

c) Agriculture Trade

The taxes applicable on agricultural trade vary from state to state. The degree of market distortions on account of variation in the levy of market taxes/cess applicable on different commodities in different states are presented in Table below:

|

Sr. |

Name of the |

|

|

Sales Tax |

||

|

No. |

State |

|

|

|

|

|

|

1 |

Andhra |

All Commodities (except Maize, |

|

|

Pradesh |

Jowar, Ragi, Bajra, Coarse grains) 4 % |

|

2 |

Assam |

All commodities (except rice, wheat, pulm, |

|

|

|

f&v, fish, gur, atta, maida etc.)-4-8 % |

|

3 |

Delhi |

F & V- nil Oilseeds-3 % Methi-7 % |

|

4 |

Gujarat |

1.Spices --3%, 2.Aniseed-- 2%, 3.Cotton |

|

|

|

--4%, 4. Isabgol—2 %, 5. Cummin-2%, |

|

|

|

6. Ajwain—2 % |

|

|

|

|

|

5 |

Goa |

1.Betelnut –2% |

|

|

|

2.Cashewnut – 2% |

|

|

|

Coconut, F&V, Cattle & Milk exempted |

|

|

|

from Sales Tax |

|

6 |

Haryana |

F&V – nil, Food grains—4 % |

|

|

|

Pulses—4 %, Oilseeds—4 % |

|

7 |

Karnataka |

1.Foodgrains-nil |

|

|

|

2.Pulses -2% 3.Oilseeds-4% |

|

8 |

Rajasthan |

F & V—nil, Foodgrains—4 % |

|

|

|

Pulses & Oilseeds—2% |

|

|

|

Coarse grains--nil |

|

9 |

Uttar |

Foodgrains-4 % |

|

|

Pradesh |

Pulses-2 % |

|

|

|

Oilseeds & Others- 4 % |

The implementation of GST is a move towards making One National Agricultural Market on account of subsuming all kinds of taxes/cess on marketing of agricultural produce.

Impact on Industries

Industrial sector mainly consist of Manufacturing, Construction, Mining and Utilities (electricity, gas water etc.). Manufacturing is the main sub-sector among these and we shall analyze the impact of GST on Manufacturing.

The share of Manufacturing in GDP is stagnant at 16%, however the share is 42% in China. Some of the reasons for such a low share are multiple indirect tax legislations which have led to significant compliance and administrative costs, classification and valuation disputes. So, tax reforms are critical and necessary to give a boost to an already flagging sector.

There will be reduction in tax burden on majority of manufactured goods post GST implementation. A look at important components of manufacturing like automobiles sector reveal that effective tax rate would reduce in Automobile sector the biggest benefit would go to SUV segment. Under FMCG, by and large tax burden would reduce. The biggest relief would be in Soap and Hair oil segment.

Automobiles

| Segment | Total pre GST rate | GST |

Cess |

Effective GST | Change |

| Two/ three wheelers | 30.2% | 28.0% |

With GST the government intends to achieve the two major goals: Reduce tax evasion & Simplify compliance for tax payers.

In the prevailing tax systems, there are several cases where the government has not been able to detect evasion and loss of tax revenues. As a result, it has become a challenge for the department concerned to track the input claims against the liability of the seller. There have also been numerous cases of duplication of claims on input tax, fraudulent claims, input tax claims that do not correspond with tax liability declared by the seller, or seller who has not furnished his tax liability.

In order to overcome this, GST has introduced technology. It seeks to establish a uniform interface for the taxpayer and a common and shared IT infrastructure between the center and states. It will thereby integrate multiple tax department websites, bringing all the tax administrations (center, state, and union territories) to the same level of IT maturity, with uniform formats and interfaces for taxpayers and other external stakeholders. Unlike the present-day taxes, GST is going to be on a digital platform from its inception.

Institutional mechanism

For the implementation of the technology associated with the GST, the Goods and Services Tax Network (GSTN) has been established. It is a non-profit, public private partnership company. Its primary purpose is to provide IT infrastructure and services to central and state governments, taxpayers and other stakeholders, thereby facilitating the implementation of the Goods and Services Tax (GST).

GSTN will perform the overall functions of GST IT system which are mentioned below:-

- Assisting in Registration Process.

- Transmitting the returns to the Central and State Government.

- Calculation of IGST.

- Confirming or matching the payment details with banking network.

- Giving MIS reports or Data to the Central and State Government and it includes all information of taxpayer.

- Giving analysis of taxpayers' profile.

- Running the matching engine for matching, reversal and reclaim of input tax credit.

- Generate business intelligence and analytics.

The salient features are:

- The GSTN server, with an open Application Program Interface (API), will provide convenience and an all user interface by connecting seamlessly with third party applications used by taxpayers through their mobiles, tablets and desktops.

- Such a move will help taxpayers in automating invoice matching from their software itself without the need to log on to the portal, thereby ensuring simplicity of compliance and savings of time. Technology will also bring in efficiency in tax administration for returns filing, registration, data exchange and effectual auditing, monitoring, investigation and performance analysis with minimal or zero human intervention.

- For businesses too, technology will be key to survive and thrive in the post-GST era. Given that invoice matching is a crucial component of GST and is linked to stringent timelines, it would need a solution that is both agile and accurate.

- Companies would also have to deploy software that has the desired robustness to talk to the GSTN system, and also helps them in achieving reliable, accurate, and immediate compliance. Besides, they would have to move from manual to automated systems to ensure speedy and timely invoice matching. As a starting point, companies would have to understand the impact of GST and technology on their business. They would have to acknowledge the important of compliance and decide on the right software solution to adhering to the compliance requirements.

About GST Suvidha Provider (GSP)

GST Suvidha Provider (GSP) and Application Service providers (ASP) will be the significant players in the success of the tax regime.

GSP is an acronym of GST Suvidha Provider. Through GSP, it allows user or taxpayers to execute the provisions of GST through the online platform. A GSP is considered as an enabler for the taxpayer to comply with the provisions of the GST law through the web platform. Through GSP, Tax Payers or Individuals can file their returns.

GSP's are controlled by the government and it operates as per the MoU. An agreement is signed between GSTN (a government body) and GSP. Through GSP and ASP, users or taxpayers file their returns online. In GSP and ASP, users or taxpayers have to fill their necessary details and automatically returns will be calculated. It also focuses on taking out the details of the tax payer and convert them into the GST Returns. These GST Returns are then filed on behalf of the taxpayer with GSTN via GSP.

About Application Service Providers (ASP)

ASP is an acronym of Application Service Provider. Taxpayer or users can file their GST taxes with the support of ASP partners or existing software. ASPs can develop an end- to-end solution for corporates, consultants, and taxpayers. Through ASPs, the taxpayer and consultants can manage the sale or purchase of goods and services and GST filing.

A large number of companies have an options to file return via Application Service Provider (ASP). In ASP, organizations or businesses must have to share the detailed data of sales and purchase of Goods and Services to the ASP. After then ASP providers will prepare the GST Returns and file the returns through GSP (GST Suvidha Provider).

ASP will play the vital role in filing returns as well as it saves the time of users. It collects all data or information from the taxpayers or users and then converts them into tax returns. ASP will take care of five roles which are mentioned below:-

- Data Protection & Privacy:- ASP will handle most of the sensitive data of an organization. This data includes who do you sell and where? What do you sell? How much do you sell and at what price? It's not all. An ASP has also required information about purchases. Overall an ASP will gather data or information from the taxpayers for filing the returns.

- Data Verification:- The details you submitted to ASP will be used for filing GST Returns. Make sure that details you have provided is true and authenticated as belonging to you without a doubt. Any mislead details or data can lead to incorrect returns which will lead to liabilities for the tax filing entity. The responsibility of filing correct returns lies with the company and its corporate officers.

- Data Archiving & Retrieval:- ASP will provide long term Data Archiving and Retrieval. At ASP, you will store data of 8 years beyond the date of filing of the annual returns for the year will be stored.

- Audit Features: - ASP will maintain all information details in the system starting from the from the point of upload till the creation of the returns. Cross check the audit features are available as a part of the ASP Platform.

- Application and Process Control:- Filing return is the responsibility of the corporate officers. So it's essential to establish and ASP will provide you full control of the process. Filing accurate returns is essential in the context of India because raising of all disputes in case of inconsistency is the responsibility of the filer. Not filing the dispute in particular time can lead to the material impact on the net tax liability.

Conclusion

Use of technology will also enable efficient tax administration for registration, returns filing, data exchange, and effective investigation, monitoring, auditing and performance analysis with little or no human intervention. It will also provide several user-friendly features such as offline capabilities, alerting capabilities, mobile/tablet interface, and additional mechanisms to avoid duplicity of data.

As this tax system is being implemented for the first time in India, businesses will encounter several challenges during the initial stages of implementation. However, once systems are streamlined, the two important objectives envisaged - curbing tax evasion, and increasing tax revenue and ease of compliance for taxpayers will be achieved.

The success of this transformation will help our nation create history in the world of GST compliance.

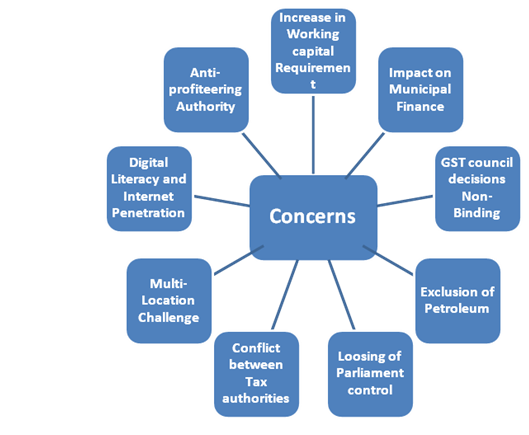

GST is a structural reform which will change the entire taxation landscape. However, any reform has its own set of opportunities as well as benefits; on the other hand reforms also bring with them new set of concerns. In this article, we shall look at some of the important concerns that the new GST regime has raised.

Some of the concerns have been discussed below:

a) Formation of Anti-profiteering Authority

Primary objection to anti-profiteering is additional compliance burden, increase in litigation and potential harassment at the hands of the taxman. Australia and Malaysia are closest international examples where such authority was created post GST rollout. However, in Malaysia, it led to widespread litigation and was found to be administratively difficult to implement. Overseas experience indicates that anti-profiteering provisions are only effective if there is a significant lead-in time to allow the relevant authority to educate consumers and businesses as to their respective rights and obligations. It is this education process that has the greatest impact on consumer confidence and business behaviour.

|

Anatomy of Anti-profiteering Authority Section 171 of the CGST Act creates the obligation on businesses to pass on to the recipients any reduction in the rate of tax or the benefit of input tax credit by way of commensurate reduction in prices. It provides enablement to the central government to set up the Authority or authorise an existing Authority to monitor and enforce compliance with the requirements of the provision. Under this provision, a five-member anti-profiteering authority will be set up to decide on levying penalty if businesses do not pass on the benefit of price reduction to consumers under the goods and services tax regime. The authority, to be headed by a retired secretary-level officer, can take suo motu action, besides acting on complaints of profiteering. The authority will have a sunset date of two years and will decide on penalty to be levied. It would ask the businesses to refund the price reduction on a proportionate basis to consumers. As per the structure, the complaints of profiteering would first come to the Standing Committee comprising tax officials from states and the Centre. It would forward the complaint to the Directorate of Safeguards (DGS) for investigation, which is likely to take about 2-3 months to complete the inquiry. On completion of investigation, the report would be submitted to the anti-profiteering authority which would decide on the penalty. |

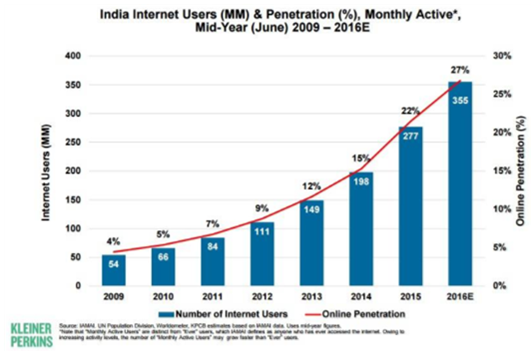

b) Digital literacy and Internet Penetration

Under GST, around 37 returns have to be filled in a year on GST portal. This kind of arrangement requires access to internet and being digitally literate. However, India performance on these two aspects is very low; deficiencies are severe in rural India. Today, the digital divide in India is real - illiteracy rate is 25-30 per cent and digital illiteracy is even higher. According to some estimates, computer literacy in India is just 6.5%. In terms of internet penetration, the estimated internet penetration has reached only 27% in 2016.

c) Increase in compliance cost for Multi-location Goods and Services Provider

Multi-location service providers such as banks, telecom operators, airlines and insurance companies are staring at huge compliance burden with the Goods and Services Tax (GST). These service providers would need to take State-wise registrations in place of current centralised registration, file monthly returns instead of six-monthly increasing the compliance manifold. For ex- Currently, a service provider operating in 20 States can operate with one centralised registration and is required to file two returns in a year. Against this, under GST, they need to get registered in 20 States and file close to 740 returns in a year. A similar manifold increase in the compliances is expected for a supplier of goods as well.

d) Conflict between Centre and State tax authorities

Under GST regime, State authorities will scrutinise 90 per cent of all assesses with turnover of Rs.15 million or less. The remaining 10 per cent will be assessed by the Centre. For turnover above Rs.15 million, Centre and states will assess 50 per cent each. Such a division of assessment power will increase conflict between Centre and states taxing authority. One related issue is that, earlier taxation and assessment of services was in the realm of Central government but now, any firm either dealing in goods or services would also come under state authorities as per above mentioned formula. This would be troublesome in short run as states authorities may not have capability to handle service providing businesses.

e) No Parliamentary approval needed for CGST rates

The Central GST Bill, 2017 allows the central government to notify CGST rates, subject to a cap. This implies that the government may change rates subject to a cap of 20%, without requiring the approval of Parliament. Under the Constitution, the power to levy taxes is vested in Parliament and state legislatures. Though the proposal to set the rates through delegated legislation meets this requirement, the question is whether it is appropriate to do so without prior parliamentary scrutiny and approval.

The Constitution does not allow a tax to be levied or collected except by authority of law. Currently, most laws which levy taxes such as income tax, and service tax specify tax rates in the principal law, and any changes in these rates requires the approval of Parliament.

f) Exclusion of petroleum from GST

The Central government will continue to impose excise duty on five petroleum products (petroleum crude, high speed diesel, motor spirit, natural gas and aviation turbine fuel), while the State governments will continue to impose VAT on these petroleum products.

Currently, credit of excise duty paid on specified petroleum products is available. However, exclusion of petroleum products from GST will add to the cost of manufacture as excise duty on such products would not be creditable under the GST regime. Petroleum products such as high speed diesel, are common fuels used in various manufacturing processes, as also for transportation of inputs and final products.

Therefore, industries that consume petroleum products as their main inputs (such as the fertilizer industry which use natural gas as an important input) will get significantly impacted by this exclusion.

g) Increased working capital

Working capital is a common measure of a company's liquidity, efficiency, and overall health. It is the cash available for day-to-day operations of an organization. Impact on working capital may be significant for the manufacturing sector. Under the current regime, stock transfers are not subject to tax. However, under the GST regime, stock transfers are deemed to be supplies and are subject to GST. Though GST paid at this stage would be available as credit, realization of this GST would only occur when the final supply is concluded. This would likely result in cash flow blockages and therefore companies would have to rethink their supply chain management strategies to minimize this impact on their cash flows. This would be worrisome for MSME sector as this sector is typically capital constrained.

|

What are stock transfers? - Stock transfer refers to moving of goods from one part of the distribution chain to another of same legal entity. Since stock transfer happens between units of the same legal entity, there shall not be any sale. How stock transfer treatment would differ for intra-state and inter-state transfers - In GST regime, payment of tax on stock transfer depends on whether the supplying and receiving units are in the same state or not. In case both the units are in the same state and have same GSTIN, then no GST is payable. On the other hand, if the units are situated in different states, then each unit to register separately in the respective states and therefore GST payable on such supplies. |

h) Impact on Municipal Finance

Income from taxes constitute about two-third of the revenue accounts of the municipalities and over one half of the total income from all the sources. A variety of taxes are levied by the urban local government in different states. The most common taxes are property tax/house tax, profession tax, vehicle tax, Octroi, tolls.

GST will subsume Octroi and Entry tax which are main sources for local bodies. While GST is expected to be divided between the Centre and states based on a mutually acceptable formula, urban local bodies will have to deal with a huge fiscal gap once these taxes are scrapped to make way for the new taxation system. There is no provision given by 14th finance commission as how ULB/PRI would be compensated in the wake of GST. This depletion of revenue would have serious implication on city rejuvenation programs.

i) GST Council decisions Non-Binding

The GST Council will decide very important aspects of the tax, including the base, rates, allocation of tax base among the States, administrative architecture and compliance procedures. However, Centre and the States retain the power to design taxes as they consider appropriate within the defined framework. The GST Council's decision will not be binding on them and will only be recommendatory. What happens when States deviate from the collective decisions?

It is in this context that the role of the dispute resolution mechanism becomes crucial. It is not clear at this stage how the mechanism will function and whether the decisions of the dispute resolution authority will be binding.

j) Registration Issue

The first area of concern lies in the registration of users for the website. According to the most recent numbers, 60 percent of the taxpayers from State Tax databases have registered themselves on to the platform.

Yet, only 6.5 percent of taxpayers from the Central Tax databases had registered seven days before the 31st March registration deadline.

Inadequate outreach on the part of the central government can be pointed out to be the main culprit for the lack of registered users.

A lack of timely migration can cause serious issues for the viability of the GST as the IT infrastructure is the only possible way to track and properly implement the nascent tax system.

k) Auditing Issue

Along with the registration challenge, the GSTN has also been dealing with an auditing issue. Ascertaining and verifying the accuracy of the data within the GSTN would seem to be a Herculean task, given its 70 million expected users.

In order to do so, the Comptroller and Auditor General of India (which has been tasked with the audit), would need access to all GSTN data. Yet, the GSTN has refused data access to the CAG for auditing purposes, citing its private entity status (51 percent of the organisation is owned by private Indian financial institutions) and stating that it is only acting as the holder of the information.

Without a proper audit of the data within the platform, there is no way to ascertain the functionality of the GSTN.

Trust in the GSTN has already been brought up as an issue, with the lack of transparency into the majority privately owned organisation being cited as a crucial concern.

|

Goods and Services Network (GSTN) The process of tracking inter State transactions will be extremely complex and will require an infallible IT system. The clearinghouse mechanism envisaged in the dual model GST will handle humungous data. Designing and developing an IT infrastructure of such a size and complexity will be a herculean task. For this purpose, a Special Purpose Vehicle (SPV) called the Goods and Service Tax Network (GSTN) has been set up by the Government to create enabling environment for smooth introduction of GST. |

Conclusion

The Goods and Services Tax is a much needed tax reform, and if implemented correctly, can do wonders for India's economy. Along with eliminating double taxation and lowering product price, the GST can also assimilate the informal sector into the greater Indian economy and provide a much needed boost for India's lagging export market.

Yet there are implementation issues that could be problematic for India's small businesses and, perhaps more importantly, undermine public trust in the GST. The issues surrounding the GSTN can be managed if more time is given for continued enrolment of taxpayers and thorough testing of the IT infrastructure. Additionally, giving time for the CAG to conduct a thorough audit would allow for any functionality issues with the GSTN to be brought to light, preventing costly public trust issues.

Similarly, the problems with the anti-profiteering clause can be ironed out with more time and the implementation of widespread education and price monitoring policies in the lead-up to the GST. The formation of a committee to handle all complaints, creation of an audit unit specifically geared towards anti-profiteering testing, and putting in place regulations outlining what specifically constitutes anti-profiteering can help build corporate and public trust in the GST.

Government has launched National Digital Literacy Mission for addressing the challenge of Digital Literacy. It is also important to relook at the targets given that GST is a reality. It is only when these concerns are addressed GST shall achieve the Goal of 'One Nation, One Tax and One Market'.