Telecom Sector – Problems, Challenges and Opportunities

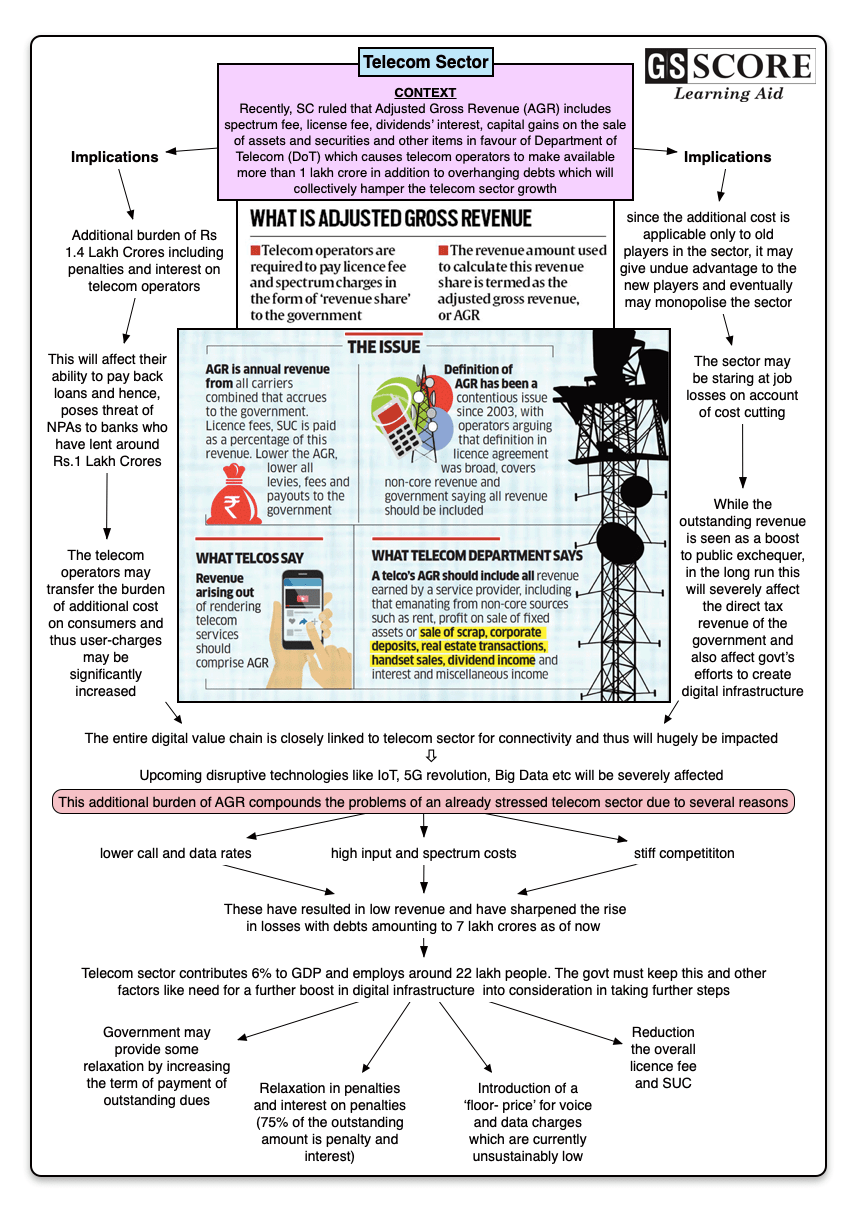

Recently, SC ruled that Adjusted Gross Revenue (AGR) includes spectrum fee, license fee, dividends’ interest, capital gains on the sale of assets and securities and other items in favour of Department of Telecom (DoT) which causes telecom operators to make available more than 1 lakh crore in addition to overhanging debts which will collectively hamper the telecom sector growth.

Issue

Context

Recently, SC ruled that Adjusted Gross Revenue (AGR) includes spectrum fee, license fee, dividends’ interest, capital gains on the sale of assets and securities and other items in favour of Department of Telecom (DoT) which causes telecom operators to make available more than 1 lakh crore in addition to overhanging debts which will collectively hamper the telecom sector growth.

Background

- Indian telecom companies, especially private mobile telephony players have reformed the communication landscape and placing India on the cusp of a potential digital transformation.

- Indian telecom sector is going through the worst business phase in the recent history saddled with debt, huge losses and policy overhang.

- India’s Telecom sector stands second in the world in terms of market share, added $ 400 billion to India’s GDP in 2014 and will create 4 million jobs by 2020 (GSM Association)

- The deregulation of Foreign Direct Investment (FDI) norms has made the sector one of the fastest growing and a top five employment opportunity generator in the country.

- Tele-density of Indian telecom industry (wireless plus wire line) has grown from a low of 3.60% in March 2001 to 84% in March 2016. The mobile subscriber base (GSM and CDMA combined) has grown from under 2 mn at the end of FY 1999–2000 to 1033.63 mn at the end of March 2016. This substantial leap, both in terms of number of consumers as well as revenues from telecom services has contributed significantly to the growth of Indian GDP and also provided much needed employment.

Analysis

Market Size and Analysis

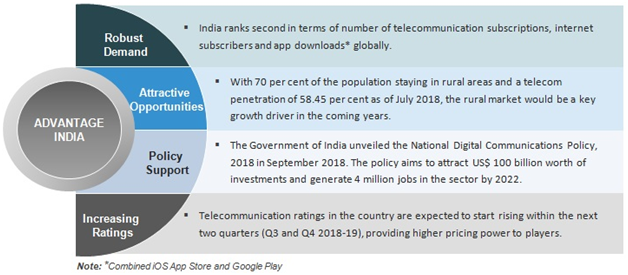

- India ranks as the world’s second largest market in terms of total internet users (604.21 million as of December 2018), the world’s second largest telecommunications market and the second largest market in terms of number of app downloads.

- The country remained as the world’s fastest growing market for Google Play downloads in the second and third quarter of 2018.

- Over the next five years, rise in mobile-phone penetration and decline in data costs will add 500 million new internet users in India, creating opportunities for new businesses.

Problems and Challenges

- Fragmented market

- The market is divided into many players which makes the bteclcom business economically unviable.

- According to TRAI, the market share of various telcos as of May 2019 is

- BSNL - 9.98% (BSNL+MTNL =10.28%)

- Vodafone - 33.36%

- Airtel – 27.58%

- Huge Accumulated Debt:

- Telecom sector has a debt of about Rs. 4 lakh crore.

- SC order on AGR has added to the liability of telecom operator to make 1.3 lakh crore payment to the government. AGR Dispute dates back to 2005 and the claim amount has been because of interest and penalities.

- Vodafone has a debt of Rs 98,000 crores and spectrum fee of Rs. about 20,000 crores while Bharti Airtel has a debt of 1 lakh crores and spectrum fee of 22, 000 crores

- This move will leave just one player in the fray –Reliance Jio Infocomm.

- Fitch Ratings hasput Bharti Airtel on ‘Negative rating watch’

|

What is AGR Issue?

Implications

|

- Huge Losses:

- Telecom sector was muddled by the already infamous 2G scam (later proved incorrect)

- Price War: Telecom sector turned into a war zone with the entry of Reliance Jio Infocomm in 2016 with free voic and data services

- Vodafone and Idea (Merged in 2018) and Bharti Airtel reduced tariffs to match the heavily discounted offers from Jio which took a toll on their own profitability.

- BSNL records 3400 crore net loos in FY 2019 and MTNL 14,000 crore net loss.

- Airtel reports 30 crore loss in first quarter of 2019

- Policy Overhang:

- Steep spectrum price, and heavy levies

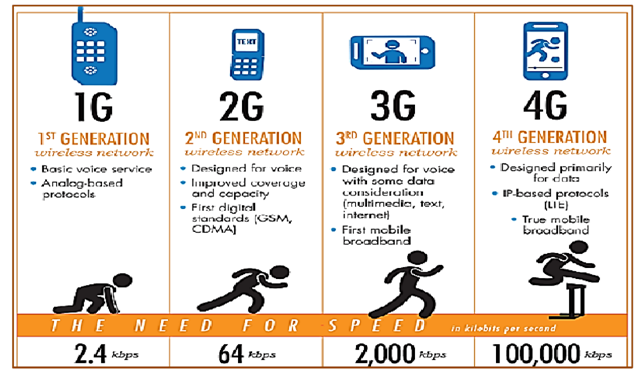

- Substantial Investments in 4G Infrastructure: Telecom operators have already incurred huge capex to roll out 4G infrastructure. Rolling out of 4G infrastructure is critical for higher Internet speed in India. It is estimated that 90% of the users in India will access the Internet through mobile by 2020.

- Lack of Telecom Infrastructure in Semi-rural and Rural areas: Service providers have to incur huge initial fixed cost to enter semi-rural and rural areas. Key reasons behind these costs are lack of basic infrastructure like power and roads, resulting in delays in rolling out the infrastructure. Lack of trained personnel to operate and maintain the cellular infrastructure is another challenge.

- Pressure on Margins Due to Stiff Competition: With competition heating up post entry of Reliance Jio, other telecom players are feeling the heat of substantial drop in tariff rates both for voice and data (more significant for data subscribers). TRAI needs to fix a base price and help create a level playing ground for all players.

- Rapidly Falling ARPU (Average Revenue Per User): The heady days of rising ARPU (average revenue per user) are long over. But the ARPU decline now is sharp and steady, which, combined with falling profits and in some cases serious losses, is prompting the Indian telecom industry to look at consolidation as the only way to boost revenues.

- Delays in Roll Out of Innovative Products and Services: Substantial delays in roll out of data based products and services are hampering the progress of telecom sectors. This is primarily due to the non-conducive environment resulting out of government policies and regulations.

- Limited Spectrum Availability: Available spectrum is less than 40% as compared to European nations and 50% as compared to China. Hence, it is imperative that spectrum auctioning at sustainable prices is the need of the hour.

- Low Broad Band Penetration: Low broadband penetration in the country is a matter of concern and the government needs to do a lot more work in the field to go up in the global ladder. As per white paper presented on broadband at the last ITU (International Telecommunication Union), broadband penetration in India is only 7%.

Opportunities

- Pressure on Margins Due to Stiff Competition: With competition heating up post entry of Reliance Jio, other telecom players are feeling the heat of substantial drop in tariff rates both for voice and data (more significant for data subscribers). TRAI needs to fix a base price and help create a level playing ground for all players.

- Rapidly Falling ARPU (Average Revenue Per User): The heady days of rising ARPU (average revenue per user) are long over. But the ARPU decline now is sharp and steady, which, combined with falling profits and in some cases serious losses, is prompting the Indian telecom industry to look at consolidation as the only way to boost revenues.

- Delays in Roll Out of Innovative Products and Services: Substantial delays in roll out of data based products and services are hampering the progress of telecom sectors. This is primarily due to the non-conducive environment resulting out of government policies and regulations.

- Limited Spectrum Availability: Available spectrum is less than 40% as compared to European nations and 50% as compared to China. Hence, it is imperative that spectrum auctioning at sustainable prices is the need of the hour.

- Low Broad Band Penetration: Low broadband penetration in the country is a matter of concern and the government needs to do a lot more work in the field to go up in the global ladder. As per white paper presented on broadband at the last ITU (International Telecommunication Union), broadband penetration in India is only 7%.

- Expeditious Roll-out of 4G Services: While Airtel had already completed roll-out of 4G services across 296 towns, Vodafone having completed roll out of its 4G services on a pan-India basis and Reliance Jio also entering the fray, has boosted the customer utilisation of high-end data products.

- Infrastructure Sharing: Since telecom business is heavy on capex and as much as 40%– 60% of the Capex is utilized for setting up and managing the Telecom infrastructure. With ARPU and revenue per tower declining over time, sharing of tower and other infrastructure is imminent. By sharing infrastructure, operators can optimize their capex, and focus on providing new and innovative services to their subscribers. In the long run, this is what will differentiate them from the competition.

- Availability of Affordable Smart Phones and Lower Tariff Rates: With new players both domestic and international entering the Indian handset manufacturing market, cost of smart phones is dropping gradually. To add to this Reliance Jio has dramatically reduced the voice and data tariff rates as a result of which other players too are lowering tariff rates. Marked increase in Telecom subscriber base (expected to touch 5bn by 2020)

- Rural Telephony–Connecting the Real India: As per the data shared by the Telecom Minister Ravi Shankar Prasad, close to 55,669 villages in India are devoid of telephony services. The objective, under the National Telecom Policy, includes improving the rural teledensity to 70% by 2017 (stood at 42.4% in 2016), while 100 per cent penetration is aimed for 2020.

|

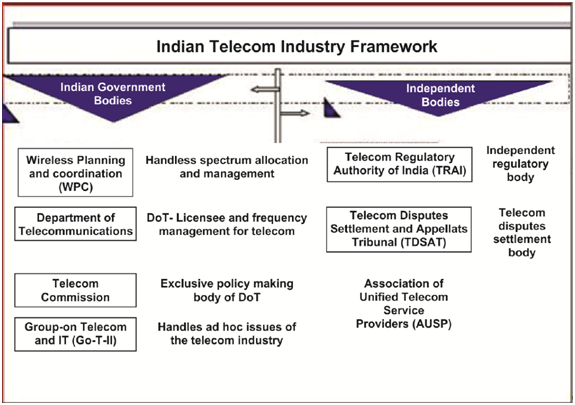

Indian Telecom Industry Framework Current Indian Telecom industry framework has been bifurcated into:

|

|

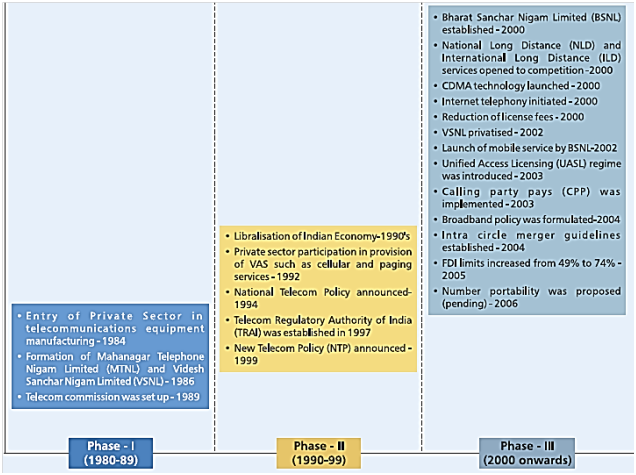

Brief History

Evolution

|

|

Public Telcos (BSNL & MTNL) – A Case Study Problems

Steps by Government

Suggestions Governance Reforms:

Disinvestment:

|

Steps by Government

- Cellular Operators Association of India (COAI) held that taxes and levies on telecom operators in India are the highest in the world. They pressed for waivers from the government and postponement of airwave auction payments due for 2020/21 and 2021/22

- Accordingly, Government set up a special panel to address telecom sector woes after SC order on AGR issue. On the basis of the pane recommendations, cabinet committee has approved the proposal of giving two-year moratorium for spectrum payment to telcos. However, 2-year moratorium will not reduce debt on the telecom sector as government will charge interest on the deferred payment. It will help industry if government aligns interest with prime lending rate or floating method instead of fixed rate of 9.5 per cent.

- Revival Package of 70,000 crore for BSNL and MTNL.

Way out

There is immense potential for growth in terms of revenue and employment generation and enhanced customer experience through consistent improvement in technology, policy and business model of telecom players.

- Policy Support:

- Scrapping of the current system of Iicence fee (LF) and spectrum usage charges as a percentage of AGR

- The government is apparently already considering a 20-year payment with NPV protected which is a welcome step.

- Growth in Embedded Devices: Usage of embedded devices requiring mobile connectivity is growing exponentially. This will provide telecommunication companies chance to increase revenue.

- Quality of Service: Service providers need to maintain their focus on providing high quality data and voice services that are reliable and affordable.

- IoT Expansion: With expansion of IoT (Internet of things) and more streaming of content, data consumption will continue to grow.

- MVAS & Cloud Computing: MVAS market in India is estimated to be worth USD$ 13.34 billion in 2015 as per IAMAI (Internet and Mobile Association of India) while that for cloud computing is estimated to be worth USD$ 1.08 billion as per research firm Zinnov.

Learning Aid