IMPACT OF DEMONETIZATION ON BANKING SECTOR

Demonetization is a tool to battle Inflation, Black Money, Corruption and Crime, discourage a cash dependent economy and help trade. Its policy of the government by banning Rs. 500 and Rs.1000 currency notes has influenced all almost all the corner of the economy.

Hereby analyzing the impact of demonetization on Banking Sector.

A study by Bhupal Singh and Indrajit Roy, RBI directors from the monetary policy department and department of statistics and information management, published in August this year showed that the excess deposits accrued to the banking system due to demonetisation range between Rs 2.8-4.3 trillion.

“Excess deposit growth in the banking system during the demonetisation period (i.e., November 11, 2016 to December 30, 2016) works out to 4-4.7 percentage points. If the period up to mid-February 2017 is taken into account to allow for some surge to taper off, excess deposit growth is in the range of 3.3-4.2 percentage points.

The liquidity boost resulting from the demonetisation announcement on November 8, 2016 has stayed with the banking sector a year after the event, helping banks reduce their high-cost deposits and boosting their current account and savings account (CASA) ratio.

CASA is abbreviation of current Account Savings Account. It is the ratio which indicates how much of the total deposits with bank in the current account and savings account. In a simple language, the deposits with the bank are in the current account and savings account. Banks do not pay interest on the current account deposits and pays a very low% of interest on savings on account deposits. Hence, it is a good measures to get deposits at no or very low cost.

Thus influences of demonetization are:

• Increase in Deposits: Demonetization has increased the deposits in Banks. Unaccounted money in the form of Rs.500 and Rs.1000 were flowing to the Banks and the sizes of deposits have been increased. It helped the banks to grab the deposits and increase their deposits.

Bulk of the deposits so mobilised by SCBs have been deployed in: (i) reverse repos of various tenors with the RBI; and (ii) cash management bills (CMBs) issued under the Market Stabilisation Scheme (which is a part of investment in government securities in the balance sheet of banks). Loans and advances extended by banks increased by Rs.1,008 billion. The incremental credit deposit ratio for the period was only 18.2 per cent. Additional deposits mobilised by commercial banks have been largely deployed in liquid assets.

• Fall in cost of Funds: Over the past few months, the deposits are increased. It led the banks to keep a major part of deposits in the form of cash deposits. PSU Banks have a lion share (over 70%) of the deposits and biggest gainers of the rise in deposits, leading to lower cost of funds.

Surplus liquidity conditions have helped facilitate the transmission of monetary policy to market interest rates. Post demonetisation, several banks lowered their domestic term deposit rates and lending rates. The median term deposit rates of SCBs declined by 38 bps during November 2016-February 2017, while the weighted average term deposit rate of banks declined by 24 bps (up to January 2017). Combined with the sharp increase in low cost CASA deposits, the overall cost of borrowings declined, allowing banks to reduce their lending rates.

• Demand for Government Bonds: After sharp rise in deposits on post demonetization, banks started lending such surplus deposits to the RBI under the reverse repo options. PSU Banks, particularly, deployed excess funds in government bonds. The return on bond investment is likely to add 15 to 20 per cent increase in the earnings of banks.

• Sagginess in Lending: Lending growth of the banks is considerably less even after demonetization and its impact of growth in the amount of public deposit. Banks have tried to lend the money to the needy group by reducing their interest rates, but it shrunk over the last few months.

Opening of Jan Dhan Account

Post-demonetisation, 23.3 million new accounts were opened under the Pradhan Mantri Jan Dhan Yojana (PMJDY), bulk of which (80 per cent) were with public sector banks. Of the new Jan Dhan accounts opened, 53.6 per cent were in urban areas and 46.4 per cent in rural areas. Deposits under PMJDY accounts increased significantly post demonetisation. The total balance in PMJDY deposit accounts peaked at Rs. 746 billion as on December 7, 2016 from Rs. 456 billion as on November 9, 2016 - an increase of 63.6 per cent. As there were reports regarding the use of these accounts to convert black money into white, the Government issued a warning against the misuse of such accounts.

Push to Digital Banking

A cashless economy is one in the flow of cash within an economy is non-existent and all transactions have to be through electronic channels such as direct debit, credit and debit cards, electronic clearing, payment systems such as Immediate Payment Service (IMPS), National Electronic Funds Transfer and Real Time Gross Settlement in India.

Benefits of Cashless economy

• Reduced instances of tax avoidance because it is financial institutions based economy where transaction trails are left.

• Curb generation of black money.

• IT will reduce real estate prices because of curbs on black money.

• It will place universal availability of banking services to all as no physical infrastructure is needed other than digital.

• There will be greater efficiency in welfare programmes as money is wired directly into the accounts of recipients.

• Reduced cost of printing notes, instances of their soiled or becoming unusable, counterfeit currency.

• Reduced costs of operating ATMs.

• Speed and satisfaction of operations for customers as no delays and queues, no interactions with bank staff required.

Digital transaction platforms

• UPI: Unified Payment Interface (UPI) allows you to make payments using your mobile phone as the primary device for transactions, through the creation of a ‘virtual payment address’, which is an alias for your bank account. UPI was launched by the National Payment Corporation of India (NPCI).

• BHIM App: The Bharat Interface for Money (BHIM) in an initiative by the Govt to enable fast,secure and reliable cashless payments through mobile phones. BHIM is Aadhaar-enabled, inter- operable with other Unified Payment Interface (UPI) applications and bank accounts, and has been developed by the National Payments Corporation of India (NPCI). This seals the government’s push towards digital payments after the demonetization that resulted in the scrapping of high-value Rs 1,000 and Rs 500 currency notes.

• Aadhar Pay: There are lots of payment apps in the market. These are the UPI apps, SBI Pay, Paytm, Phonepe, Freecharge, mobile wallets etc. But, the Adhaar Payment App is special as you can pay through the Adhaar Payment App without phone. It is possible because you the customer does not require the app. The merchant or a person, who want money, have to arrange a smartphone, app, etc. The payer don’t require anything. This app is made for the merchants and shopkeepers. Customer would only enjoy its benefits. The Adhaar Payment Appuses your fingerprints for the authentication. On the basis of this authentication, the money ispaid from your Aadhaar linked account.

• IMPS: Immediate Payment Service (IMPS) is an instant interbank electronic fund transfer service through mobile phones. It is also being extended through other channels such as ATM, Internet Banking, etc.

• POS terminals: A point-of- sale (POS) terminal is a computerized replacement for a cash register. Much more complex than the cash registers of even just a few years ago, the POS system can include the ability to record and track customer orders, process credit and debit cards, connect to other systems in a network, and manage inventory. Generally, a POS terminal has as its core a personal computer, which is provided with application-specific programs and I/O devices for the particular environment in which it will serve.

• USSD: USSD (Unstructured Supplementary Service Data) is a Global System for Mobile(GSM) Communication technology that is used to send text between a mobile phone and an application program in the network. Applications may include prepaid roaming or mobile chatting.

Challenges of a cashless rural economy

• Currency dominated economy: High level of cash circulation in India. Cash in circulation amounts to around 13 per cent of India’s GDP.

• Transactions are mainly in cash: Nearly 95 per cent of transactions take place in cash. Large size of informal/unorganized sector entities and workers prefer cash based transactions. They don’t have required digital literacy.

• ATM use is mainly for cash withdrawals and not for settling online transactions: There are large number of ATM cards including around 21 crore Rupaya cards. But nearly 92 per cent of ATM cards are used for cash withdrawals. Multiple holding of cards in urban and semi-urban areas show low rural penetration.

• Limited availability of Point of Sale terminals: According to RBI, there are 1.44 million PoS terminals installed by various banks across locations at the end of July 2016. But most of them remain in urban/ semi-urban areas.

• Mobile internet penetration remains weak in rural India: For settling transactions digitally, internet connection is needed. But in India, there is poor connectivity in rural areas. In addition to this, a lower literacy level in poor and rural parts of the country, make it problematic to push the use of plastic money on a wider scale. This is being overcome by application BHIM (Bharat Interface for Money) launched by the Prime Minister which will work on USSD i.e without mobile internet.

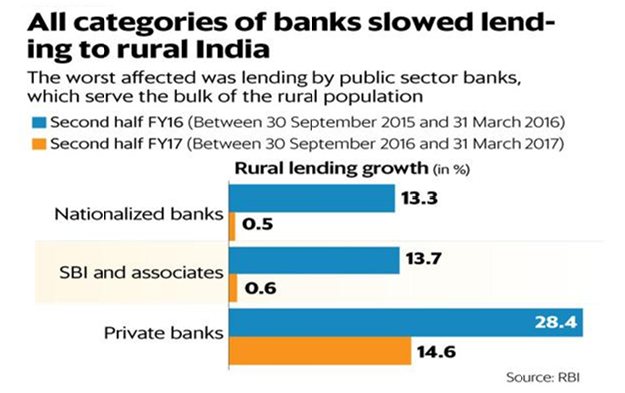

Demonetization crippled rural bank lending

The note ban hurt rural India, loan growth was far below its pre-demonetisation levels.

Indeed, in the second half of FY2017, bank lending to rural Haryana, Punjab, Goa, Maharashtra and Kerala contracted. Lending to rural Maharashtra fell by as much as 9.2%. Putting that in perspective, bank loans in the second half of FY16 to rural Haryana increased by 18% and to rural Punjab by 12.2%, while rural Maharashtra saw an increase in lending of 5.8%. Not a single state had showed a contraction in rural lending in the second half of FY16. In other words, the slowdown in rural lending in the second half of FY17 was very abnormal and may be attributed largely to demonetisation.

The rural parts of western India bore the brunt, with credit growth falling by 5.1% in the second half of FY17. Rural northern India and metropolitan western India also saw very low credit growth.

Nationalized banks’ credit growth was 2.7% in the FY17 second half, compared to 8.8% growth in second half FY16. SBI and its associates saw their credit growth fall to 7.8% in the second half of FY17 compared to 13.7% in the second half of the previous year. Private banks’ credit growth was 10.1% in the second half of FY17 compared to 18.8% in the year-ago period. Clearly, every category of banks was affected.

The negative impacts are because of regulation, costs of demonetisation, loss of opportunity and short-term damage to economy.

• The 100% cash reserve requirement (CRR) on incremental deposits meant that banks did not earn any interest on Rs 3 lakhs crores of deposits for nearly a fortnight.

• The waiver of ATM charges would result in banks losing Rs 20 in every transaction.

• The waiver of merchant discount rate on cards would result in banks losing 1% in every card transaction.

• Banks use third parties like cash logistics companies for cash transportation. Moving out Rs 15 lakh crore of currency notes and moving in Rs 7 lakh crore plus from currency chests would have cost several thousand crore.

• As banks have been focused on exchanging currency notes, they have not been able to sell any loan products.

• Some SME businesses have seen their sales drop 50–80% and could default in their instalments. They won’t immediately be classified as NPAs because of some relaxations, but if the delay persists bank NPAs might worsen.

• Uncertainty has resulted in drop in spending on high value items from credit cards. These are the transactions which are converted into EMIs and banks earn from them.

Demonetization has led to the increase in the use of plastic cards, online Banking, opening of new accounts, number of customers in the branches and the use of ATM.

On 8th November demonetization was announced with the aim of the action was fourfold: to curb corruption; counterfeiting; the use of high denomination notes for terrorist activities; and especially the accumulation of “black money”, generated by income that has not been declared to the tax authorities.

It followed a series of earlier efforts to curb such illicit activities, including:

• The creation of the Special Investigative Team (SIT) in the 2014 budget;

• The Black Money and Imposition of Tax Act 2015;

• Benami Transactions Act 2016;

• The information exchange agreement with Switzerland;

• Changes in the tax treaties with Mauritius, Cyprus and Singapore; and

• The Income Disclosure Scheme.

Demonetisation was aimed at signalling and emphasizing the government’s determination to penalize illicit activities and the associated wealth. India’s demonetization was unprecedented in international economic history because:

• It was highly secretive and sudden.

• It was carried out in normal economic and political condition exemplified by macro-economic stability and fastest GDP growth rate. All other sudden demonetisations have occurred in the context of hyperinflation, wars, political upheavals, or other extreme circumstances.

In India there were two previous instances of demonetisation, in 1946 and 1978, the latter not having any significant effect on cash, but the recent action had large, albeit temporary, currency consequences.

Globally new monetary policy tools like negative interest rates policy and ‘helicopter drops’ of money have been employed to stimulate growth and increase money supply. India on the other hand instead of expanding money supply has squeezed it and it can be called as ‘reverse helicopter drop’ or ‘helicopter hoover’.

Benefits of demonetization

A. Tax on black money: Demonetization offered three options for black money holders:

• Declare their income, deposit it and pay tax rate with penalty.

• Continue to hide and suffer 100% tax rate.

• Launder their money.

Anecdotal evidence says that there was money laundering through various methods like:

• Retime the accrual of money and then depositing in account.

• Paying intermediaries to convert black money into white (as commission, payment for standing in queue, depositing in others account).

Despite these demonetization provided following benefits:

• In all these cases, black money holders still suffered a substantial loss, in taxes or “conversion fees”.

• Laundering run the risk of punitive taxes and prosecution, in addition to the fees or taxes already paid because of continuous surveillance and data mining by government on spooky deposits.

• The December 30, 2016 Ordinance has declared the unreturned notes as no longer constituting legal tender and this will extinguish RBI liability and increase its net worth.

In this sense, demonetisation has affected a transfer of wealth from holders of illicit black money to the public sector, which can then be redeployed in various productive ways – to retire government debt, recapitalize banks, or even redistribute back to the private sector.

B. Tax compliance

• Demonetization has shown state’s resolve to crack down on black money.

• Social condemnation: Since this action has commanded support amongst the population, demonetisation shows that black money will no longer be tolerated by the wider public.

These two effects if combined with other incentive measures can result into behavioural change among people and greater tax compliance.

• Demonetisation could also aid tax administration in another way, by shifting transactions out of the cash economy and into the formal payments system.

• As a result, the tax-GDP ratio, as well as the size of the formal economy, could be permanently higher.

• It will channel more savings into financial system. It will help banks in providing more loans at lower rates.

• In the longer-term, if demonetisation is successful, it will reduce the equilibrium cash-GDP and cash-deposits ratio in the economy. This will increase financial savings which could have a positive impact on long run growth.

Potential long term benefits

Though it will take several years to see the impact of demonetization on illicit transactions, on black money, and on financial savings, there are some signs pointing to change.

A. Impact on Digitization: One intermediate objective of demonetisation is to create a less-cash or cash-lite economy, as this is a key to channelling more saving through the formal financial system and improving tax compliance.

Watal Committee has recently estimated that cash accounts for about 78 percent of all consumer payments.And there are many reasons for this situation. Cash has many advantages:

• It is convenient, accepted everywhere, and

• Its use is costless for ordinary people, though not of course for society at large.

• Cash transactions are also anonymous, helping to preserve privacy, which is a virtue as long as the transactions are not illicit or designed to evade taxation.

In contrast, digital transactions face significant impediments:

• They require special equipment, cell phones for customers and Point-of-Sale (POS) machines for merchants, which will only work if there is internet connectivity.

• They are also costly to users, since e-payment firms need to recoup their costs by imposing charges on customers, merchants, or both.

At the same time, these disadvantages are counter balanced by two cardinal virtues.

• Digital transactions help bring people into the modern “wired” era.

• They bring people into the formal economy, thereby increasing financial saving, reducing tax evasion, and levelling the playing field between tax-compliant and tax-evading firms (and individuals).

In the wake of the demonetisation, the government has taken a number of steps to facilitate and incentivize the move to a digital economy. These include:

• Launch of the BHIM (Bharat Interface for Money) app for smart-phones based on the new Unified Payments Interface (UPI) which has created inter-operability of digital transactions.

• Launch of BHIM USSD 2.0, a product that allows the 350 million feature phone users to take advantage of the UPI.

• Launch of Aadhar Merchant Pay, aimed at the 350 million who do not have phones. This enables anyone with just an Aadhar number and a bank account to make a merchant payment using his biometric identification.

• Reductions in fees (Merchant Discount Rate) paid on digital transactions and transactions that use the UPI.

• There have also been relaxations of limits on the use of payment wallets.

• Tax benefits have also been provided for to incentivizedigital transactions.

• Encouraging the adoption of POS devices beyond the current 1.5 million, through tariff reductions.

As a result of all these number of digital transactions has increased considerably. Data from the National Payments Corporation of India (NPCI) show that RuPay-based electronic transactions increased by about Rs. 13,000 crore in case of POS transactions and about Rs. 2,000 crore in e-commerce, an increase of over 300-400 percent. Same has been the case with debit card, credit card and AEPS (Aadhar-Enabled Payments System) transactions.

The success of digitalization will depend considerably on:

• The inter-operability of the payments system. The Unified Payments Interface (UPI) created by the NPCI is the technology platform that will be the basis for ensuring interoperability. But to ensure this, individual banks should facilitate not thwart inter-operability.

• As digital payments increase the security features of these e-payment systems will need to inspire trust, to ensure this trend continues.

B. Impact on Real estate sector

• Demonetization can have profound impact on real estate prices as black money was used evade taxes on property sale and have resulted into inflated prices. According to Knight Frank and Survey calculations real estate prices in eight major cities has

started declining post demonetization.

• Reduction in real estate prices is desirable as it will lead to affordable housing for the middle class, and facilitate labour mobility across India currently impeded by high and unaffordable rents.

Short term impacts

A. Impact on GDP: Demonetisation is potentially:

• An aggregate demand shock, because it reduces the supply of money and affects private wealth (especially of those holding unaccounted money and owning real estate);

• An aggregate supply shock to the extent that cash is a necessary input for economic activity (for example, if agricultural producers require cash to pay labour);

• And an uncertainty shock because economic agents face imponderables related to the impact and duration of the liquidity shock as well as further policy responses

To analyze the impact of demonetization on GDP in a macro-assessment on five broad indicators are focused:

• Agricultural (rabi) sowing;

• Indirect tax revenue, as a broad gauge of production and sales;

• Auto sales generally, as a measure of discretionary consumer spending, and two-wheelers in particular as it is the best available indicator of rural and demand of the less affluent;

• Real estate prices; and

• Real credit growth

The high frequency indicators present a mixed picture.

• Agricultural sowing, passenger car sales, and overall excise taxes bear little imprint of demonetisation;

• Sales of twowheelers show a marked decline after demonetisation;

• Credit numbers were already looking weak before demonetisation, and those pre-existing trends were further reinforced after November 8.

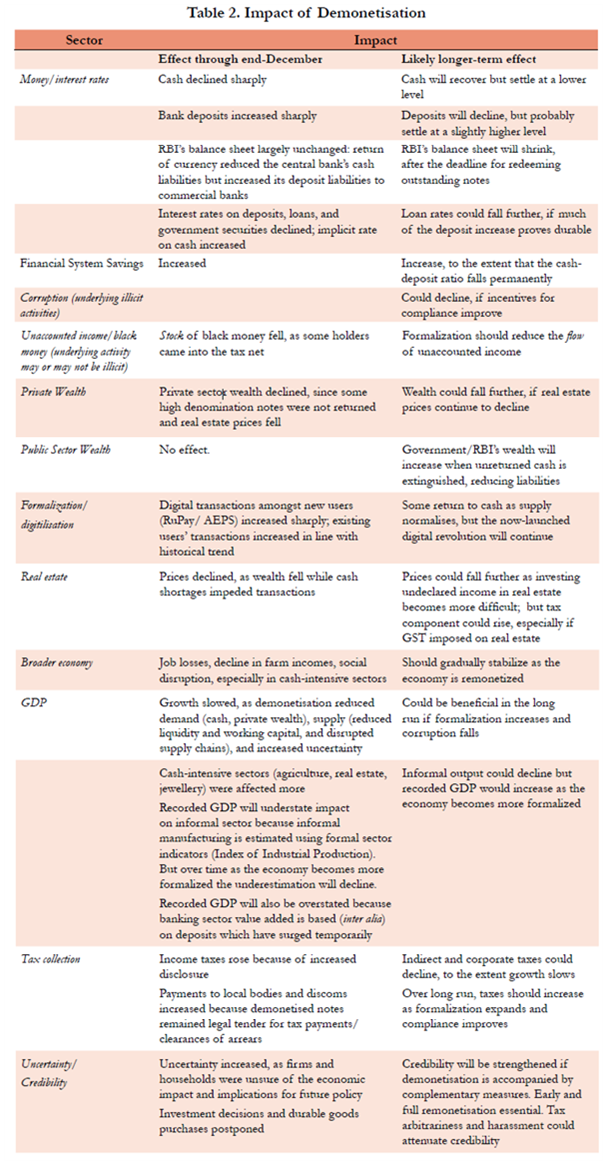

Impact of Demonetization (Tabular Format)

Supplementary Reading

A. Experience of demonetization around world

1. Ghana 1982 -

• Measures: Demonetisation of 50 cedi notes in 1982; no exchange facility for long; freeze on bank deposits

• Rationale: Excess liquidity and inflation

• Effect: Loss of confidence in the banking system

2. Brazil 1990

• Measures: Collor Plan: monetary contraction by freezing all deposits above certain limit .Deposits upto a ceiling denominated in the old currency (cruzado novo) were converted to the new currency (cruzeiro) at parity.

• Rationale: To fight hyperinflation

• Effect: Contraction of output; price moderation only very gradual due to uncontrolled re- injection of liquidity

3. Australia (1988, 2015)

• Measures: Introduction of next generation notes with tactile features.

• Rationale: Prevent counterfeit

• Impact: The first country to have a full series of circulating polymer bank notes

4. Singapore (1999, 2004)

• Measures: The Portrait notes, the fourth series of currency notes, were launched in September 1999 with sophisticated security features (1999). Discontinued issuance of S$10,000note and instructed banks to stop re- circulating it since October 2014; but still remained legal tender (2004).

• Rationale: Mitigate higher money- laundering risks associated with large-value cash transactions.

Introduction

Microfinance Institutions (MFIs), irrespective of legal form, seek to promote financial inclusion by providing financial services to clients of financially un-served and under-served households. Over time, the microfinance sector has become an integral part of the financial infrastructure catering to the vulnerable sections of society in India. In the Indian microfinance industry NBFC-MFIs hold a significant share and are regulated by RBI. As on date, there are 71 NBFC-MFIs registered with the RBI.

Demonetisation and micro-finance sector

• In November 2016, the Indian government launched a huge demonetisation drive when they banned 500 and 1000 Rupees notes. In a country where 69% of the population lived in rural areas and 90% of the transactions are cash based, the move was paralysing.

• For the Micro Finance industry this came as a blow too. Most of the borrowers of the MFIs are based in rural areas; they borrow in cash and repay in cash. Typically, MFIs that have had a repayment rate of 99% have had a fall of upto 12% in repayment rates. For many MFIs the non-performing assets (NPA) have risen by 7-10%.

• ICRA’s estimates show that MFIs (including some erstwhile ones that have now become small finance banks) raised nearly Rs.5, 500 crore through the securitisation route in the first six months of FY17. However, they raised only around Rs.1,650 crore in the second-half of the fiscal, resulting in total securitisation volumes of around Rs.7,150 crore for the full year.

• In comparison, MFI securitisation volumes had increased by 80 per cent to around Rs.9,000 crore in FY16. Securitisation involves pooling of assets such as micro loans, and creation and issuance of securities backed by cash flows from the underlying assets.

• The dip in micro loan securitisation volumes is primarily due to the impact of the demonetisation event on the portfolio of most MFIs.

Negative impacts have been discussed below:

• Impact on collections:

a) Microfinance entities traditionally use cash in their lending and recovery operations. The installments on microfinance loans have weekly / fortnightly / monthly collections of small denominations. On account of non-availability of cash post demonetization, the borrowers were not in a position to service their loans which led to delay and drop in collection rates.

• Impact on lending:

a) Despite the efforts to increase cashless disbursement, majority of the disbursements were still cash based. Because of the withdrawal limits imposed on current accounts, MFIs were not able to withdraw cash for further disbursement and the incremental disbursements were restricted to the collections.

b) The main reason for this significant drop in disbursements was due to the focus of MFIs shifting from disbursements to collections and they also adopted a wait and watch approach in order to comprehend the position.

• Impacts on farmers:

a) Particularly farmers and SMEs that make up most of the customers are affected in a big way. The drying up of liquidity that the demonetisation drive has caused has affected cash dependent rural communities in a big way.

b) In Tamil Nadu, farmers-suicide due to debt issues is almost a daily occurrence. There have been several cases where farmers have had to borrow from local lenders at higher rates, to pay off the MFIs, as MFIs tend to be stricter on their debt collection dates.

• Interruption in economic activities in rural economy:

a) Inability in the repayment of dues and hence lack of new credit will hinder the business of small farmer and entrepreneurs. This have drastically affect the blossoming rural economy.

• Delay in loan repayment:

a) Repayment of loans to MFIs has dropped as it is unable to accept cash in older denominations from the poor people which has affected its ability to repay the banks. Banks would block the process of financial support to MFIs, which would lead to shutting down of many NBFC MFIs. This would also have an adverse impact on SMEs.

• Threat to existence of small MFIs:

a) Outstanding dues of these institutions will further hinder the availability of term loan from the lending institutions imposing a threat to their survival. Despite 60 days extension by RBI in due repayment, political interference is making the prospect of recovery less optimistic.

b) MFIs with high financial leverage and low collections efficiencies are expected to face deterioration in their credit profile.

Positive impacts have been discussed below:

• While these are certainly tragic incidents, there are various avenues the government and the MFIs have explored and continue to explore. One positive outcome of it all is that, the top 8 MFIs in India that hold about 40% of the market share, have now been provided the small finance bank licenses. This would mean they can have their own cash out points and the demonetisation drive is very likely to increase usage of their accounts.

• MFIs have also been lobbying with the Reserve Bank of India (RBI) to extend deadlines for the usage of the banned currency notes and farmers have had some special exemptions to this extent.

• RBI has also provided MFIs with a further 90 days extension before classifying loans as NPAs, if payments were due in November and December 2016.

• There have been some signs of recovery in certain parts of the country where repayments had fallen immediately after demonetisation.

• Due to demonetisation and the push for a cashless economy, awareness has been created regarding use of technology like e-wallets, PAytm, USSD, AEPS, etc which would drive the people towards financial inclusion.

• Though this demonetization has brought adverse impact on the rural economy, it should be taken a step to connect the rural people with the banking sector directly.

• More focus on opening accounts under PMJDY which would promote financial inclusion.

• This move is expected to ‘break the ice’ between marginalized, illiterate and ignorant rural people and banks and hence providing them to approach the main stream avenue of credit.

• MFIs are increasingly looking for cashless disbursement and collection through Jan-Dhan accounts and by leveraging technology. With 8 NBFC-MFIs converting into Small Finance Banks (SFBs) by March 2017, the competitive environment is bound to undergo a major shift within the microfinance industry as a whole. As these entities are expected to remain focused on microfinance, cashless disbursement and collection of loans is bound to increase in the future.

• Even though the collections are less, many MFIs are conducting center / group meetings to make borrowers aware of the impact on their credit profile due to default on repayment and the role credit bureaus. These meetings are also used to educate the borrowers to overcome any kind of slowdown in their business activities and to encourage banking habits in order to move towards non-cash based model.

Way Forward

According to a December, 2015 Reserve Bank of India report titled “Report of the Committee on Medium-term Path on Financial Inclusion”, the number of branches per 1, 00,000 of population in rural and semi-urban areas is less than half of that in urban and metropolitan areas.

• The presence of ATMs is also very low in rural areas. However, NBFC-MFIs have a very strong reach in rural areas and semi-urban areas where banks have a considerably lower penetration.

• Therefore, with a view to mitigate the hardship and financial crunch currently being faced by NBFC-MFIs and the rural and semi-urban community, the government / RBI may consider the following:

1. Exchange of SBNs:

a. The Government may take advantage of the extensive infrastructure and reach that NBFC-MFIs have in rural and semi-urban areas by allowing them to be eligible to exchange SBNs against valid compliance documents and by putting in place other checks and balances.

2. Acceptance of SBNs:

a. NBFC-MFIs may be allowed to act as facilitators and collect repayment of loans from their customers through SBNs until December 30, 2016 while complying with all other control and KYC requirements stipulated by the RBI in this regard.

b. This would help reduce cases of unintentional defaults in loans and also ensure that the overall asset quality of the NBFC-MFI sector does not get eroded.

3. Enhance the withdrawal limits:

a. In order to provide necessary operational flexibility and at the same time being mindful of the growing business needs, the Government/ RBI may consider relaxing the daily / weekly withdrawal limits for companies involved in the micro-financing sector.

Conclusion

If MFIs, particularly the smaller MFIs, continue to experience worsening repayment rates and defaults, their sustainability is questionable. Bearing in mind the importance of microfinance for financial inclusion and livelihoods of a client-base of around 40 million, demonetisation has dealt a severe blow to the microfinance sector in more ways than one. It has considerably damaged the repayment behaviour and credit discipline that is central to the success of the microfinance model. Even if there is recovery in sight in the coming quarters, the report highlight the tremendous stress that the sector has borne following demonetisation.

Domestic Remittance Market

The domestic remittance market is growing at a faster pace with the help of organised money transfer channels, mobile money transfer and business correspondents (BCs) of banks.

Nearly 100 million migrants have travelled to Tier-I cities in search of jobs. This results in the overall domestic remittance market growing at an average rate of 10.3 per cent during 2007-13.

Remittances from migrant workers contribute more than 50 per cent to the overall domestic remittances market.

Traditionally, a migrant worker can transfer money by visiting a post office, or depositing the money in bank branches, or handing over the money to friends/families who are travelling back home.

At present, migrant labours prefer to send money through instant money transfer products compared to the bank route, NEFT (National Electronic Funds Transfer), because of the efficiency and convenience the products offer. Through these channels, a migrant labour can make transactions at his convenience at an agent located near his home.

The Domestic Money Transfer is a service launched by the Reserve Bank of India. The RBI allows banks to create their own merchant outlets or enable their partner company’s merchants to facilitate general public with money transfer service.

The service offers to transfer or deposit money in bank accounts by simply visiting the local mobile shop, kirana stores, and chemist outlets etc. These merchants are registered either with a master bank correspondent or prepaid instrument issuer company.

Customers can deposit or transfer Rs. 25000 in a month to their own or others accounts. This service is widely used by the migrants working in the metro cities and those who send money to their families and businesses on regular basis.

The service felicitates the customers and eases the banks in terms of managing their customers in the decentralized way and giving the liberty to perform transactions even after “bank timings”.

Benefits of Domestic Remittances

• Increased domestic remittances have a positive impact on the nation’s economic growth.

• Domestic remittances also eliminate difficulties associated with credit rationing.

• These remittances finance needs for consumption or capital expenditures.

• On a macroeconomic level, raising the total capacity of financing of investments through domestic remittances will improve the local economic situation.

• Domestic remittances can also provide support in counter-cyclic conditions when when local market situations are not favourable.

Demonetisation and Domestic Remittance Market

On 8 November 2016, the Government of India announced the demonetisation of all Rs.500 and Rs.1,000 banknotes of the Mahatma Gandhi Series. The government claimed that the action would curtail the shadow economy and crack down on the use of illicit and counterfeit cash to fund illegal activity and terrorism. The sudden nature of the announcement and the prolonged cash shortages in the weeks that followed created significant disruption throughout the economy, threatening economic output.

The Specified Bank Notes (Cessation of Liabilities) Ordinance, 2016 was issued by the Government of India on 28 December 2016, ceasing the liability of the government for the banned bank notes.

This has impacted the firms associated with movement of domestic remittances.

Effects of demonetization on remittance business:

• Firms related to remittance movement have a Prepaid Payments Instruments (PPI) licence from the Reserve Bank of India (RBI) and act as business correspondents (BCs) for banks.

• They set up their “money transfer counters” in kirana stores, medical shops, and mobile recharge outlets.

• Their software platforms and logistics systems for cash collection facilitate domestic remittances that are paid in the form of cash by the remitter and deposited in the bank account of the beneficiary.

• Operating with relaxed KYC (know your customer) norms, they channelize small-value remittances with a limit of Rs.5,000 per transaction and a monthly cap of Rs.25,000 per remitter.

• Thus, these firms belong to an intermediate zone between the fully cash-based courier system and the entirely digital systems of a bank-to-bank transfer or a mobile-wallet transaction.

• Before demonetisation, Rs.4,000 crore per month was remitted through this channel.

After demonetization, a big drop in the business numbers has been recognized across the country. The current trend shows a downfall of 60% of total business.

• Shortfall of valid currency notes in the market has stopped remittance transactions.

• RBIs instructions to the industry of not accepting the Old Currency Notes.

• There could be some regular people enjoying the service to convert their illegal money into white. After demonetization, it has been stopped.

• Businesses with cash transactions are almost stopped; people are not paying each others, not accepting payments.

• The number of “Wallet to bank transfer” transactions using multiple mobile apps has increased.

• Banks have started promoting UPI and other modes and mobilizing public to do fund transfer using their mobiles.

• To enjoy the high session, some wallet companies have waived off the transaction changes on money transfer.

• “Switching” charges are officially waived off.

Conclusion

The failure of incomes in the informal sector to recover to the levels they would have reached without demonetisation appears to be an important factor for the weakness in the business correspondents (BC) remittances market. Steps need to be taken to reduce the impact of demonetization on remittance sector.

Introduction

• The labour market in India has been witnessing numerous uncertainties including the problem of world recession, and growing ‘automation’ particularly in the manufacturing sector. Today major policy change like ‘demonetization’ is likely to make the employment scenario further volatile by causing uncertainties to rise in labour market.

• Demonetization is the act of stripping a currency unit of its status as legal tender. It occurs whenever there is a change of national currency: The current form or forms of money is pulled from circulation and retired, often to be replaced with new notes or coins.

• The opposite of demonetization is remonetisation, in which a form of payment is restored as legal tender.

• On 8th November 2016, the Government of India has announced the demonetization of all 500 and 1000 banknotes of Mahatma Gandhi Series.

• The move was taken to curb the menace of black money, fake notes and corruption by reducing the amount of cash available in the system.

Effect of Demonetization on Employment:

• The Centre for Monitoring Indian Economy has estimated that 1.5 million jobs were lost after demonetization. Alongside this loss of jobs, there has been a decline in the labour force participation rate (LPR).

• For a developing economy like India, a drop in labour participation rate is a sign of an economic slowdown.

• The All India Manufacturers’ Organization (AIMO), which represents traders and small-, medium- and large-scale industries, conducted survey and has found a drop in employment of 60 per cent and loss in revenue of 55 after demonetization last year.

• Effect on Medium and large scale industries:

a) Medium and large scale industries engaged in infrastructure projects, such as big-ticket road construction, reported a 35% cut in employment and 45% revenue loss. The industries like foreign companies, engaged in export-oriented activities reported 30% job losses and 40% revenue fall.

b) In the manufacturing sector, medium and large scale industries reported the least job-losses are 5% and took a revenue hit of 20%.

c) It is further found that labour intensive units such as food and beverage, tobacco, textile, leather, wood and jewelry employ nearly half of the total workers in the organized manufacturing sector of the economy. Given that nearly 84 percent of total factories have employment in the range of 0 to 99 are affected by the recent move of the government.

• Effect on Informal Sector:

a. The informal sector presently employs more than 80% of India’s workforce. It includes workers in small and medium industries, grocers, barbers, maids and others.

b. More than 95% of total transactions in informal sector are in cash form. The decision of sudden ‘demonetization’ therefore led the labor market dynamics changed significantly by rendering millions of informal workers exposed to increased uncertainty in employment; they resorted to ‘reverse migration’.

c. Within manufacturing, labour intensive sectors such as textiles, leather and gems and jewelry have already reported considerable job losses due to supply chain and market disruptions.

d. Demonetization is considered as a means of increasing formality in informal sector. But a 2009 OECD study on informal economies concluded that enforcing formality can be counterproductive and lead to an increase in poverty.

e. Many daily wage workers or contract workers were rendered jobless due to paucity of cash in the system. But even after re-monetization the number of new recruits has been reduced considerably as compared to pre demonetization.

f. The 2016-17 economic survey also point out the decrease in demand for MGNREGA work in the aftermath of demonetization.

• Effect on Agriculture:

a. Agriculture was expected to grow at 4% this year according to, but demonetization is likely to dent that forecast. The impact is visible in different sub-segments. Winter crops such as wheat, mustard, chickpeas are due for sowing in a fortnight. Wheat prices were already up due to low stocks and anticipated shortfall in 2015-16 output and have firmed up further as demonetization.

b. The vulnerability of the small farmers in agriculture is best exemplified by the predominance of marginal and small holdings in the country. Marginal and small holdings account for 85 per cent of the landholdings. Farmers failed to find buyers or due to dearth of cash ended up getting low prices.

• Effect on Self-Employment:

a. Most of the self-employed workers lose their employment during the months of cash crunch. They don’t able to sell their products because of cash crunch and lack of digital transactions facilities.

Concerns:

• The drop in labour participation is in line with CMIE’s observation that new investments have been falling. For a developing economy like India, a drop in labour participation rate is a sign of an economic slowdown.

• Unlike in developed countries where labour participation is falling because of structural (ageing) reasons, India is a growing economy with a young population.

• A slowdown hurts the younger new labour force. This is already evident. During January-April 2017, job losses were concentrated in the younger age brackets.

Way Forward

The decline in the Labour Participation Ratio should be a matter of deep concern for the Indian economy. Persons may drop out of the labour force due to discouragement, the inability to find a job. In the meantime, they may take up part-time jobs to make ends meet or may be compelled to start a small business (“forced entrepreneurship”) as a desperate move for their very survival.

A remedy for this dismal state of affairs will not be forthcoming until the government recognizes the reasons behind this phenomenon. Government should focus on ensuring growth, job creation and investment. The urgent need is to get the private sector to start investing. One way to avoid winds of deflation is to kick-start private investments.

There is a concerted attempt to improve ease of doing business, and technology is being used to deliver public services without leakages.

Demonetization of the notes of higher denomination has also been one of the recent step of the Government to unearth black-money.

Demonetisation is a radical monetary step in which a currency unit is declared as an invalid legal tender. This is usually done whenever there is a change in the national currency of a nation.

On November 8, 2016 Prime Minister announced that Rs 500 and Rs 1000 denomination notes will become invalid and all notes in lower denomination of Rs 100, Rs 50, Rs 20, Rs 10, Rs 5, Rs 2 and Re 1 and all coins will continue to be a valid legal tender.

He also added that new notes of Rs 2,000 and Rs 500 will be introduced. There was also no change effected in any other form of currency exchange like cheque, Demand draft (DD), payments made through credit cards and debit cards.

Why the government has banned Rs 500 and Rs 1000 notes particularly?

• Some 68% of all transactions in the country are cash-based, and the Reserve Bank of India has estimated that the banned currency notes formed over 86% of all currency in circulation.

• As per the data provided by the RBI, there are 16.5 billion (45% of currency stock in 2014-15) ‘500 rupee’ note and 6.7 billion (39% of currency stock in 2014-15) ‘1000 rupee’ notes are in circulation at present. It has been pointed out that any economic cost in printing these notes is likely to outweigh in terms of benefit it would bring to India and Indian economy.

• In India, the rationale behind banning Rs 500 and Rs 1000 notes is that unaccounted money used in corruption or any deals takes place in the form of high-value notes of Rs 500 and Rs 1000 bills. These higher denomination notes are often found to be used for funding terrorism and corruption.

• The Financial Action Task Force (FATF), a global body that monitors the criminal use of the international financial system has observed that high-value currency units are often used in money laundering schemes, racketeering, and drug and people trafficking.

• In addition, these notes constitute a huge percentage of money spent during general elections by political parties, candidates in India.

Impact of demonetisation on black money

• Better tax compliance: This move is likely to lead to better tax compliance, raise the Tax to GDP ratio and improved tax collection. This could lead to lower borrowing and better fiscal management. Also with lower cash transactions in the near term, inflation may see downtrend in the near term. Also with higher tax to GDP ratio, the government may also get enough headroom to reduce the income tax rates, which can lead to higher disposable income with people and can improve consumption demand in the medium to long term.

• Real Estate Check: Demonetisation is seen as a check on the real estate sector where prices get pushed up artificially, reducing the availability of affordable housing for the poor and the middle class. Claiming that removal of high denomination currency notes of Rs 1,000 and Rs 500 would lead to decline in real estate prices making affordable housing available to all.

At present, there is excessive use of cash in real estate sector due to large cash transactions in areas such as purchase of land and housing property. The real estate prices get pushed up artificially. This reduces the availability of affordable housing for the poor and middle class.

So now, greater over-the-board transaction will lead to a decline in real estate prices making affordable housing available to all.

• Parallel economy burst: The move is expected to curb the parallel economy as the owners of black money will not be in a position to deposit the money with them in the banks. It is likely to temporarily stall the circulation of large volume of counterfeit currency and prevent funding for anti-social activities like smuggling, terrorism, espionage etc.

The Income Tax department will be benefited with the move, as there will be more specific data gathered in the process which could help in catching the defaulters.

• Check Terror Funding: It will put a stop to the neighbouring countries drug cartels and terrorists of supplying high value currency into India.

• Check Fake notes: The move will also reduce the flow of fake currency in Indian markets as data shows that most of the counterfeit currency in circulation exists in high-denomination notes of Rs 500 and Rs 1000.

According to the Reserve Bank of India’s annual report published this year, more than 2.61 lakh counterfeit notes in the denomination of Rs 500 were detected by banks in the year 2015-2016 while another 1.43 lakh fake notes of Rs 1000 were detected. By value, counterfeit notes of Rs 500 and Rs 1000 accounted for more than 92% of all the fake currency detected by banks across the country.

• SOFT MONEY surge – Online transactions and other modes of payment: There is a massive surge in the online transactions and other modes of payment. E-wallets, digital transaction systems, e-banking, usage of plastic money are expected to see increase in demand. Eventually this should lead to strengthening of these systems and the concerned infrastructure.

Under the cash crunch situation in Banks, the role played by Automated Teller Machines (ATMs) in dispensing cash is hugely important and their success in disbursing the cash effectively is, to a great extent, going to decide the fate of the demonetisation scheme.

With the demonetisation move resulting in a drop in donations, some of the famous temples in Gujarat have started introducing e-wallets, ATMs with deposit facility and swipe machines to accept cashless donations.

Recent data

Number of Suspicious Transaction Reports filed by banks during 2016-17 has gone up from 61,361 in 2015-16 to 3,61,214; the increase during the same period for Financial Institutions is from 40,333 to 94,836 and for intermediaries registered with SEBI the increase is from 4,579 to 16,953.

Based on big data analytics, cash seizure by Income Tax Department has more than doubled in 2016-17 when compared to 2015-16; during search and seizure by the Department Rs.15,497 crore of undisclosed income has been admitted which is 38% higher than the undisclosed amount admitted during 2015-16; and undisclosed income detected during surveys in 2016-17 is Rs.13,716 crore which is 41% higher than the detection made in 2015-16.

Undisclosed income admitted and undisclosed income detected taken together amounts to Rs.29,213 crore; which is close to 18% of the amount involved in suspicious transactions. This process will gain momentum under ”Operation Clean Money” launched on January 31, 2017.

The exercise to remove the anonymity with currency has further yielded results in the form of

• 56 lakh new individual tax payers filing their returns till August 5, 2017 which was the last date for filing return for this category; last year this number was about 22 lakh;

• Self-Assessment Tax (voluntary payment by tax payers at the time of filing return) paid by non-corporate tax payers increasing by 34.25% during April 1 to August 5 in 2017 when compared to the same period in 2016.

With increase in tax base and bringing back undisclosed income into the formal economy, the amount of Advance Tax paid by non-corporate tax payers during the current year has also increased by about 42% during 1st April to 5th August.

Further actions were taken under the law to stop operation of bank accounts of these struck off companies. Actions are also being taken for freezing their bank accounts and debarring their directors from being on board of any company. In the initial analysis of bank accounts of such companies following information has come out which are worth mentioning:

• Of 2.97 lakh struck off companies, information pertaining to 28,088 companies involving 49,910 bank accounts show that these companies have deposited and withdrawn Rs.10,200 crore from 9th November 2016 till the date of strike off from RoC;

• Many of these companies are found to have more than 100 bank accounts – one company even reaching a figure of 2,134 accounts;

Simultaneously, Income Tax Department has taken action against more than 1150 shell companies which were used as conduits by over 22,000 beneficiaries to launder more than Rs.13,300 crore.

Post demonetization, SEBI has introduced a Graded Surveillance Measure in stock exchanges. This measure has been introduced in over 800 securities by the exchanges.

Inactive and suspended companies many a time are used as harbours of manipulative minds. In order to ensure that such suspicious companies do not languish in the exchanges, over 450 such companies have been delisted and demat accounts of their promoters have been frozen; they have also been barred to be directors of listed companies. Around 800 companies listed on erstwhile regional exchanges are not traceable and a process has been initiated to declare them as vanishing companies. Demonetization appears to have led to acceleration in the financialisation of savings.

Criticisms

The decision to demonetize Rs 500 and Rs 1000 notes is misconceived and will not address the problem of black money for the following reasons:

• Demonetisation will only affect those who conduct transactions in cash, are not a part of the formal banking system or have not converted their cash into assets.

• Black money is generated through evasion of taxes on income from lawful activities and money generated from illegal activities. In the absence of steps to curb the generation of black money, demonetization is a futile exercise, as it proved to be in 1978.

• As per the Indian Statistical Institute, Kolkata study done on behalf of the National Investigation Agency (NIA), Rs 400 crores worth of fake currency is in circulation in the Indian economy. This is only .028% of Rs 14,180 billion worth currency demonetised in Rs 500 and Rs 1000 notes.

• Two of the most vulnerable sectors that have traditionally been exploited for parking crime proceeds and black money is the property, and gems and jewellery market. These sectors have also been used for the temporary investment of terror funds. Unless transactions are made transparent and reflect real market value, black money and terror funds will continue to find their way into these businesses.

• FICN can potentially be reintroduced into India after a break by Pakistan. In order to sustain action, the following are suggested:

a. Enhance detection measures at public sector banks which have lagged behind some of the private banks over the years.

b. Establish a forensic cell which monitors each case of counterfeit currency to better understand the technology being applied to counterfeit notes. This must contribute to future measures to enhance security against counterfeiting.

c. The involvement of Pakistan established through a Special Court judgement in 2014 should be built upon to enhance international diplomatic pressure.

Conclusion

Demonetization provides an opportunity to encourage a shift to a digital economy. This is an essential requirement to not only reduce corruption but also create an electronic trail for transactions. This will help bring transparency into the financial transactions of individuals and organizations thereby constraining corruption, criminal proceeds, money laundering and the finance of terrorism, which are all linked given the common channels employed for transferring funds. While demonetization is likely to encourage it, incentives by the government for payment of bills can further encourage people to take up plastic and e-money options. This is also likely to be enhanced by the forces of market economy which are already offering money back options.

Demonetisation is an important step in the fight against the finance of terrorism. However, it should neither be the first nor the last, if the interlinked threats of corruption, crime and the finance of terrorism have to be controlled. These must also not be addressed simply within departmental and ministerial silos. Instead, an all-of government approach is imperative if each of these challenges is to be met.

Economic growth slowed to 5.7 per cent in the first quarter of 2017-18 against 6.1 per cent in the preceding quarter. This was sharply below market expectations and came on the back of large-scale destocking undertaken by manufacturers ahead of the Goods and Services Tax rollout and the lingering impact of demonetization.

What does the latest data by CSO reveals?

The GDP recorded a growth of 7.9 per cent in April-June quarter last year. The April-June growth estimate, the lowest in at least five quarters, trended down on account of a sharp deceleration in manufacturing growth.

Trade, hotel, transport, communication and services related to broadcasting” witnessed a pickup by growing 11.1 per cent in April-June from 8.9 per cent last year, while growth in “public administration, defence and other services” (in Gross Value Added terms) was clocked at 9.5 per cent in April-June as against 8.6 per cent last year.

The Gross Value Added or GVA growth, which serves as a more closely watched estimate for quarterly growth, remained unchanged from the previous quarter at 5.6 per cent in April-June but fell sharply from the 7.6 per cent growth recorded in the April-June quarter last year.

Only three of eight sectors showed a pickup in GVA growth in April-June. Construction and financial services sectors recorded a slowdown with the GVA for “financial, insurance, real estate and professional services” sector growing at 6.4 per cent, down from 9.4 per cent last year.

GVA growth for the construction sector declined to 2.0 per cent in April-June from 3.1 per cent last year. GVA growth for “agricultural, forestry and fishing” declined marginally to 2.3 per cent from 2.5 per cent in the corresponding period last year, data showed.

Government view on demonetization

Finance Minister said that the demonetisation exercise had ended the “anonymity” around the money and identified it with its owner, enabling the government to bring it into the tax net.

The RBI Annual Report reveals that almost all demonetised notes have been returned to the central bank.

According to statement demonetisation has not completely eradicated black money but kept a check on a large part of it. The result of demonetisation has been that more and more people will now be compelled to come into the tax net, a fact evident from both direct and indirect tax numbers.

What are some arguments which prove failure of demonitisation to remove Black Money?

Demonetisation carried out on the incorrect premise that black money means cash. It was thought that if cash was squeezed out, the black economy would be eliminated. But cash is only one component of black wealth: about 1% of it. It has now been confirmed that 98.8% of demonetised currency has come back to the Reserve Bank of India. Further, of the Rs.16,000 crore that is still out, most of it is accounted for. In brief, not even 0.01% of black money has been extinguished.

Black money is a result of black income generation. This is produced by various means which are not affected by the one-shot squeezing out of cash. Any black cash squeezed out by demonetisation would then quickly get regenerated. So, there is little impact of demonetisation on the black economy, on either wealth or incomes.

The government now argues that it is good that black money has been deposited in the banks because those depositing it can now be caught. But the government had tried to prevent people from depositing demonetized currency by changing rules during the 50-day period.

The government changed the goalpost earlier in November 2016 when it suggested that the real aim of demonetisation was a cashless society. Now it says that idle money has come into the system, the cash-to-GDP ratio will decline, the tax base will expand, and so on. But none of these required demonetisation and could and should have been implemented independently. Further, anticipating the failure of demonetisation in 2016 itself, the government started saying that demonetisation is only one of the many steps to tackle the black economy.

The government’s argument that cash coming back to the banks will enable it to catch the generators of black income, and there will be formalisation of the economy, does not hold. Much of the cash in the system is held by the tens of millions of businesses as working capital and by the more than 25 crore households that need it for their day-to-day transactions.

The big failure of demonetisation is that it was carried out without preparation and caused big losses to the unorganised sector.

Why there was a need for a Cost Benefit Analysis Of Demonetisation?

The RBI Annual Report reveals that almost all demonetised notes have been returned to the central bank. This number does not include the old notes with District Central Cooperative Banks for the short window when they were of demonetisationallowed to accept deposits. It also does not include the notes within Nepal. The shortfall of Rs 16,050 crore between the notes in circulation when the notes were demonetised and those that were returned, could therefore also be made up once these notes are returned to the RBI.

There is no doubt that those with holdings of unaccounted cash lost some of their wealth in the process of laundering it. To some extent, taxes were paid on it in the process of legitimising it. But in addition to that, illicit wealth was redistributed from black money holders to money launderers. Whether the money launderer was a company owner, a bank employee or a Jan Dhan account holder, there was now a new breed of criminals with wealth obtained from illegal means. The total reduction in black money was therefore much smaller than what might have been envisaged.

International evidence suggests that few countries address the problem of black money by demonetising their currencies. If the problem is large-scale crime, corruption, bribery, bureaucrat-politician nexus, rent seeking, tax evasion etc. the answer lies in reforming the criminal justice system, law and order, administrative reforms, bringing transparency in the functioning of the state and rationalisation and simplification of the tax system. In this context, the GST will be a far more effective mechanism to bring down tax evasion in indirect taxes considering the greater incentive for compliance that its design holds.

• Demonetisation had provided an opportunity to encourage a shift to a digital economy. This will help bring transparency into the financial transactions of individuals and organisations thereby constraining corruption, criminal proceeds, money laundering and the finance of terrorism, which are all linked given the common channels employed for transferring funds. While demonetisation is likely to encourage it, incentives by the government for payment of bills can further encourage people to take up plastic and e-money options. This is also likely to be enhanced by the forces of market economy which are already offering money back options.