GS SCORE Courses

We at GS SCORE provide IAS coaching in Delhi. We provide a 1 Year and 2 Year UPSC Classroom Foundation course. This Classroom course is a mix of informative and interactive classroom lectures, comprehensive study material and Test series in line with the demand of the exam. We cater to all the major Optional Subjects in online and offline mode. Modular Courses have always been our strength especially in GS Paper IV and Essay Classes. To provide all round development we provide Prelims, Mains and Optional Test series.

Batch Started: 21st April, 2024

Prelims Improvo : Improve the Targeted Subject Area

Batch Starts: 3rd May, 2024

ITS 2025 - 1 Year Integrated Test Series (Prelims and Mains)

Batch Starts: 17th June, 2024

Sociology Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 15th June, 2024

Anthropology Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 6th May, 2024

IAS 2025-26: GS Analyst - Weekly Current Affairs Classes

Batch Starts: 29th April, 2024

Public Administration Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 29th April, 2024

Geography Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 27th April, 2024

Political Science Optional Q&A (Test Series) for UPSC 2025

Batch Started: 22nd April, 2024

IAS Prelims 2024: Current Affairs Revision Classes

Batch Started: 18th April, 2024

ITS 2026 - 2 Years Integrated Test Series (Pre Cum Mains)

Batch Started: 24th December, 2023

Public Administration Optional Test Series 2024

Batch Started: 23rd December, 2023

Political Science (PSIR) Optional Test Series 2024

Batch Starts: 6th May, 2024

IAS 2025-26: GS Analyst - Weekly Current Affairs Classes

Batch Started: 22nd April, 2024

IAS Prelims 2024: Current Affairs Revision Classes

Batch Started: 21st April, 2024

Prelims Improvo : Improve the Targeted Subject Area

Batch Starts: 3rd May, 2024

ITS 2025 - 1 Year Integrated Test Series (Prelims and Mains)

Batch Starts: 17th June, 2024

Sociology Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 15th June, 2024

Anthropology Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 29th April, 2024

Public Administration Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 29th April, 2024

Geography Optional Q&A (Test Series) for UPSC 2025

Batch Starts: 27th April, 2024

Political Science Optional Q&A (Test Series) for UPSC 2025

Batch Started: 22nd April, 2024

IAS Prelims 2024: Current Affairs Revision Classes

Batch Started: 18th April, 2024

ITS 2026 - 2 Years Integrated Test Series (Pre Cum Mains)

Batch Started: 24th December, 2023

Public Administration Optional Test Series 2024

Batch Started: 23rd December, 2023

Political Science (PSIR) Optional Test Series 2024

Latest Updates

The aspirants need to supplement their current affairs preparation with Daily,Weekly or Monthly Current Affairs compilations such as GS Analyst Monthly Current Affairs Magazines. Our All India Marking system creates a competitive atmosphere for prelims. To boost one's performance by a huge margin, it is advised that students go by the previous years' current affairs and revise them properly. This should be supplemented with previous years' questions.

Topper’s Corner

Our toppers set new milestones carrying our baton of glorious legacy of successful results. Check out our Topper’s Interviews, Copies, General Studies and Essay Copies to see the hard work we put in for our students.

Download Toppers Test Copy

View allGeneral Studies & Essay: MEDHA ANAND CSE Rank-13

DownloadGeneral Studies & Essay: AKASH VERMA CSE Rank-20

DownloadGeneral Studies & Essay: PAWAN KUMAR GOEL CSE Rank-28

DownloadHistory Optional: NAUSHEEN CSE Rank-9

DownloadHistory Optional: NIDHI GOYAL CSE Rank-91

DownloadPSIR Optional: KUNAL RASTOGI CSE Rank-15

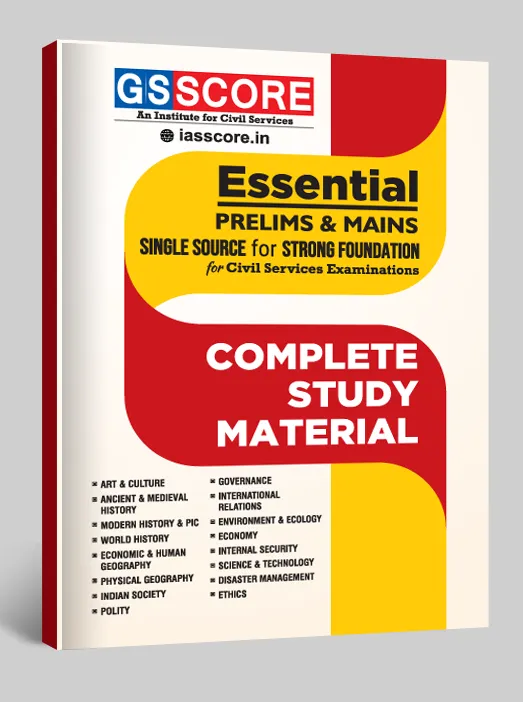

DownloadUPSC Study Material

GS SCORE Study Material is designed keeping both Prelims and Mains in mind. For Prelims Study Material, we provide Subject-Wise and CSAT booklets to our students. Our Mains Study Material acts as a one-stop solution for Subject-wise booklets (covering both static and contemporary topics), Micro-detailed Syllabus, Practice Workbooks, PYQs, Practice Sets and more. A separate Essay Workbook is also provided for the holistic preparation of the students.