Daily Current Affairs for UPSC

Mastering the UPSC IAS Exam involves a comprehensive strategy, with a crucial emphasis on staying updated with current affairs. Often feared by students, this component is dynamic and unpredictable, creating a huge gap between reading the newspaper and effectively utilizing Current Affairs for UPSC examination.

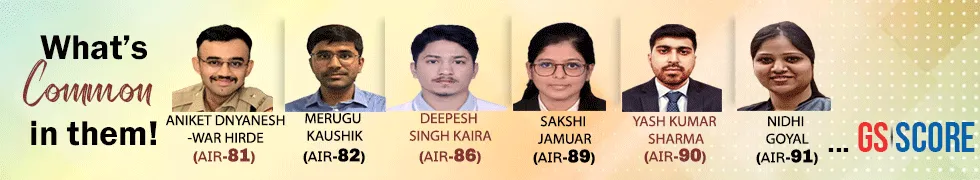

GS SCORE GS Analyst Daily current affairs for UPSC is your ultimate destination for current affairs that keep you ahead in your UPSC preparation journey. We offer comprehensive resources tailored specifically for UPSC aspirants, including Daily UPSC current affairs for Prelims and Mains, Weekly Current Affairs Classes, In-depth Analysis, and daily prelims current affairs MCQs quizzes.

From daily editorials to insightful articles, we cover all aspects of current affairs for UPSC preparation, ensuring you stay well-informed about the latest developments nationally and internationally. Don't miss out on the opportunity to strengthen your knowledge and analytical skills with our comprehensive coverage of the latest current affairs. Start exploring now to maximize your chances of success in the UPSC examination.

8th July 2025 (9 Topics)

The Election Commission’s Special Intensive Revision of electoral rolls in Bihar has drawn criticism for imposing complex citizenship documentation, raising fears of mass voter exclusion and a backd...

India's Maternal Mortality Ratio (MMR) has declined to 93 per 1,00,000 live births during 2019–21 (as per SRS data), but stark regional disparities, persistent systemic delays, and avoidable deaths ...

India's assumption of the BRICS Chairmanship in 2025 has sparked concerns over the forum’s declining strategic relevance and internal contradictions, especially in light of shifting global power dyn...

Prime Minister Narendra Modi met the President of Bolivia, Luis Arce Catacora, on the sidelines of the 17th BRICS Summit in Rio de Janeiro, where both leaders reviewed the bilateral relationship, with...

Fresh clashes between Chin ethnic armed groups—CNDF and CDF-H—in Myanmar’s Chin State have led to the displacement of around 4,000 Chin refugees, who crossed into Mizoram’s Champhai district t...

Delhi is getting its fifth waste-to-energy (WTE) plant, located in Bawana, with a capacity to process 3,000 tonnes of waste daily. Waste Segregation at Source and Waste-to-Energy in India Solid Wa...

The PARAKH RashtriyaSarvekshan Dissemination Portal has been recently launched to provide open access to national and state-level student performance data, helping States/UTs to develop evidence-based...

Brazil is hosting the 17th BRICS Summit in 2025, marking the first major summit of the newly expanded 11-member BRICS bloc, with a focus on Global South cooperation and inclusive governance reform. �...

The Registrar General of India (RGI) has announced that the 2027 Census will be India's first digital Census, introducing self-enumeration via a web portal and the use of mobile applications for real-...