12th August 2025 (13 Topics)

Context:

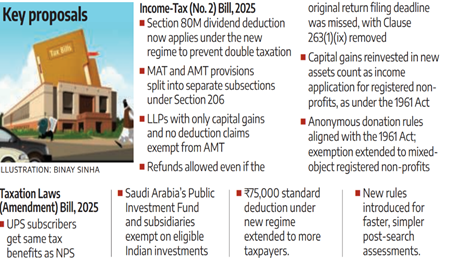

The Lok Sabha has passed the Income Tax (No. 2) Bill, 2025, replacing the Income Tax Act, 1961, with a shorter and more simplified law, while expanding powers of tax officials in search operations.

Income Tax Bill, 2025

Objective of the Bill

- Simplify, rationalise, and shorten the Income Tax Act, 1961.

- Incorporates recommendations of the Select Committee chaired by Baijayant Panda.

Key features:

- Volume Reduction: Sections cut from 819 ? 536; chapters from 47 ? 23; removal of 283 sections and 24 chapters.

- Language Simplification: Introduces “tax year” instead of ‘financial year’ and ‘assessment year’.

- Clear Tax Framework: Defines taxable income, compliance rules, and restrictions on certain activities.

- Virtual Digital Assets: Statutory definition for cryptocurrencies, NFTs, etc., with specific taxation provisions.

- Tax Slabs: No change; existing slabs and rebates retained for continuity.

- Redundant Provisions Removed: Outdated laws like Fringe Benefit Tax

- Taxpayer’s Charter: Lists rights and responsibilities to enhance transparency.

- ADR Mechanism: Provides alternate dispute resolution for quicker settlements.

- Presentation: Use of 57 tables and 46 formulae for clarity.

- Policy Impact: Aligns with Ease of Doing Business, supports digital economy taxation, and maintains revenue stability.