Context

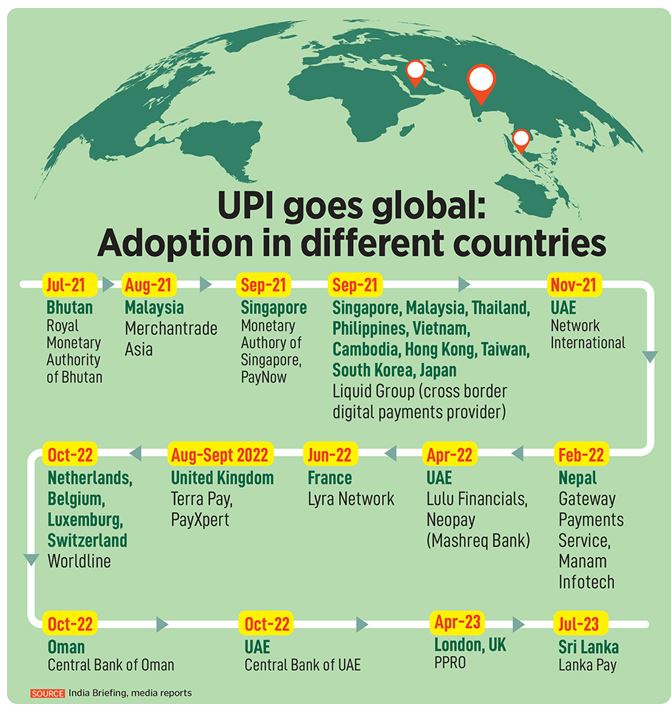

Prime Minister Narendra Modi along with President of Sri Lanka and Prime Minister of Mauritius jointly inaugurated the Unified Payments Interface (UPI) services in Sri Lanka and Mauritius.

What is UPI?

- Unified Payment Interface (UPI) is an advanced version of the Immediate Payment Service (IMPS). It facilitates real-time, round-the-clock funds transfer between bank accounts.

- UPI merges multiple bank accounts into a single mobile application, allowing users to seamlessly transact across participating banks.

- Its simplicity, security, and interoperability have made it a game-changer in the digital payments ecosystem.

Key Features and Benefits:

- Instant Transactions: UPI enables lightning-fast transactions. Whether you’re splitting a restaurant bill or paying utility bills, UPI ensures near-instant settlements.

- Mobile-Centric: UPI thrives on mobile devices. A simple app or USSD code (*99#) connects users to their bank accounts. No need for physical cards or cumbersome paperwork.

- 24x7 Availability: UPI doesn’t take weekends off. It operates round the clock, making it convenient for users with varying schedules.

- Security Measures: UPI employs robust security features like two-factor authentication, PINs, and biometrics. Users can transact confidently, knowing their money is safe.

- Seamless Integration: UPI integrates effortlessly with various services: bill payments, online shopping, and even donations. QR codes simplify merchant payments.

Impact on Financial Inclusion:

- UPI has democratized digital payments:

- Rural Empowerment: Even in remote villages, vendors accept UPI payments. Farmers, artisans, and small businesses benefit.

- Financial Literacy: UPI encourages financial literacy. People learn about banking, digital security, and budgeting.

Impact

- 100 Billion Transactions: UPI handled over 100 billion transactions last year.

- GEM Trinity: Bank accounts, Aadhar, and mobile phones facilitated transactions worth Rs 34 lakh crores (approx. 400 billion USD).