27th September 2025 (11 Topics)

Context:

The United States has announced a 100% tariff on the import of branded and patented pharmaceutical products from October 1, 2025.

Implications of U.S. Tariff Decision on Indian Pharmaceutical Sector

U.S. Tariff Announcement

- Scope of Tariff: A 100% tariff on branded or patented pharmaceutical products, along with tariffs on other goods such as kitchen cabinets and heavy trucks.

- Legal Basis: Implemented under Section 232 of the U.S. Trade Expansion Act of 1962, allowing tariffs citing “national security.”

Impact on Indian Pharma Exports

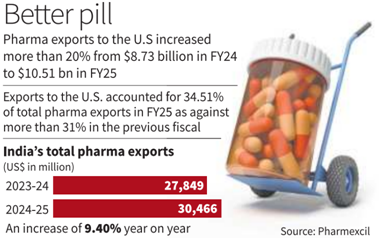

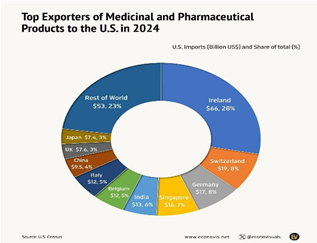

- India’s Pharma Share: India accounts for nearly 40% of U.S. generic imports; the U.S. is India’s largest pharmaceutical export market.

- ‘Branded Generics’ at Risk: While pure generics may remain unaffected, branded generics sold under U.S. brand names could face tariffs, creating uncertainty for Indian exporters.

Domestic Industry Concerns

- Affected Companies: Indian pharma majors such as Sun Pharma, Dr. Reddy’s, Lupin, Cipla, and Aurobindo may be impacted.

- Compliance Burden: Companies are awaiting clarity on documentation to determine product categorisation between generics and branded products.

Global Trade Repercussions

- EU Reaction: European countries are expected to respond with countermeasures, potentially escalating trade tensions.

- Supply Chain Vulnerability: High-value patented drugs, heavily dependent on global supply chains, face the most immediate risk.

Policy and Regulatory Dimensions

- Indian Government Response: The Production-Linked Incentive (PLI) scheme is being positioned to boost local API (Active Pharmaceutical Ingredient) and drug manufacturing capacity.

- Strategic Vulnerabilities: Overdependence on the U.S. market highlights the need for diversification of export destinations.

More Articles