Context

Recently, the Union Finance Minister has said that the decline in India’s foreign exchange reserves is largely due to the valuation changes arising from an appreciating U.S. dollar.

Background

- The GDP growth for Q1 of the current financial year 2022-23 at 13.5% is the highest among the large economies.

- The Government expenditure is now tilted towards capital rather than revenue, strengthening the foundations for medium-term growth.

- Touching 13.5% GDP growth in Q1 enabled India to cross the pre-pandemic level by 3.8%.

- Bolstering consumer confidence and revival of contact-intensive activities.

- Gross fixed capital formation (GFCF) growth shot up to 20% in Q1.

- Both exports and imports are growing at double digits but import growth is more robust than that of exports, reflecting the revival of the domestic economy.

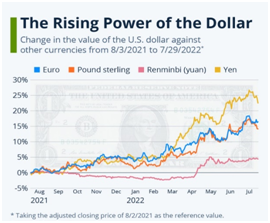

How Dollar affects other Currencies?

- The U.S. dollar has been a bedrock of the global economy and a reserve currency for international trade and finance.

- Like any other fiat currency, the dollar's relative value depends on the economic activity and outlook of the United States.

- In addition to fundamentals and technical factors, market psychology and geopolitical risk also influence the dollar's value on the world market.

India and Strengthening Dollar:

- India’s foreign exchange reserves at $537.5 billion as of September 23, 2022, arein a favorable position with most peer economies.

- Two-thirds of the decline in reserves is due to valuation changes arising from an appreciating U.S. dollar and higher U.S. bond yields.

- External indicators like net international investment position and short-term debt also indicate lower vulnerability.

- India’s external debt to GDP ratio is the lowest among major emerging market economies (EMEs).

|

Forex Reserves:

|

Impacts:

- Elevated imported inflation pressures

- Continuing appreciation of the U.S. dollar

- Withdrawal of monetary accommodation

Possible Implications:

- The Russia-Ukraine war could further disrupt the global energy system.

- Fresh supply concerns in the winter for critical commodities such as crude oil and natural gas.

- Inflation control remains a major concern in developed economies.

Concerns for Global Economy

- Mounting inflationary pressures

- Currency depreciation

- Rising debts

- Shrinking fiscal space

Measures to be taken:

- Adopt a people-centric approach driven by innovation

- Nurture new growth drivers

- Bringing the 2030 Agenda for Sustainable Development back on track