30th August 2022 (8 Topics)

Context

Pradhan Mantri Jan Dhan Yojana (PMJDY), the National Mission for Financial Inclusion completed eight years of successful implementation.

About

Pradhan Mantri Jan-Dhan Yojana (PMJDY)

- PMJDY is National Mission for Financial Inclusion to ensure access to financial services, namely, a basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner.

- Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account.

- Pillars of PMJDY, namely-

- Banking the Unbanked

- Securing the Unsecured

- Funding the Unfunded

PM Jan Dhan Yojana (PMJDY): Objectives

- To ensure access to various financial services like availability of basic savings bank account

- To provide access to need-based credit, remittances facility, insurance, and Pension.

Benefits under PMJDY

- One basic savings bank account is opened for unbanked person.

- There is no requirement to maintain any minimum balance in PMJDY accounts.

- Interest is earned on the deposit in PMJDY accounts.

- Rupay Debit card is provided to PMJDY account holder.

- Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

- An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

- PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

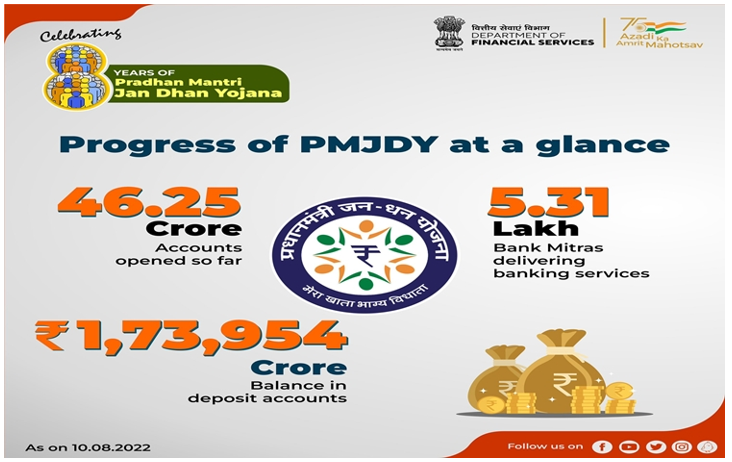

Progress Report of PMJDY:

- More than 46.25 crore beneficiaries banked under PMJDY since inception, amounting to over one lakh 73 thousand crore rupees.

- PMJDY Accounts grew three-fold from 14.72 crore in March 2015 to 46.25 crore as on the 10th August, 2022.

- 56 percent Jan-Dhan account holders are women and 67 percent of Jan Dhan accounts are in rural and semi-urban areas.

- 94 crore RuPay cards have been issued to PMJDY account holders.

- Only 8.2 per cent of PMJDY accounts are zero balance accounts.

- Deposits have increased 7.60 times with an increase in accounts by 2.58 times between August 2015 and August 2022. The average deposit per account is ?3,761.

More Articles