29th February 2024 (8 Topics)

Context

The recent agitations by several state government (especially Kerala and Karnataka) have highlighted many disquieting issues in the practice of fiscal federalism in India.

Where is the change required?

The following issues need urgent redressal.

- Keeping share out of state’s reach: First, the Union government has sought to keep an increasing share of its proceeds out of the divisible pool so that they need not be shared with States.

- Not doing the mandatory: Secondly, the government has also not been devolving the shares of net proceeds to the States as mandated by successive FCs.

What is net divisible pool?

- The net divisible pool, or net proceeds, is that part of the gross tax revenue from which a share would have to be vertically devolved by the Union to all States.

- Such shares are assigned by each FC for a five-year period.

What is covered in net proceeds?

- All taxes of the Union.

- Earlier, all corporation taxes and customs duties were fully absorbed by the Union, and only income taxes and excise duties were shared with the States.

- However, with changes over the years, culminating in a constitutional amendment in 2000, all taxes of the Union were added to the net proceeds.

- The catch: Cesses and surcharges under Article 270 and Article 271 were kept out of the net proceeds.

So, the net proceeds consists of the gross tax revenue after the deduction of cesses, surcharges and the cost of collection of taxes.

Aren’t many cesses and surcharges subsumed into the GST system?

- Over the past decade or more, several cesses and surcharges were introduced by the Union government.

- When the Goods and Services Tax (GST) was initiated in 2017, the expectation was that many cesses and surcharges would be discarded and subsumed into the GST system.

|

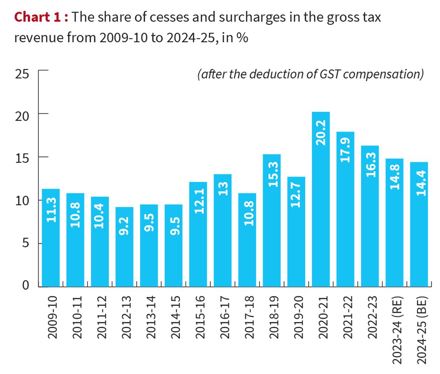

The numbers (& the mismatch) The following data is provided by government over the specified period:

|

- On the contrary, new cesses and surcharges continued to be introduced, and many old cesses and surcharges remained outside the GST system.

- For instance, the Agriculture Infrastructure and Development Cess was introduced as recent as in 2021-22.

The expansion of cesses and surcharges have led to the exclusion of an increasing share of the gross tax revenue from net proceeds.

CAG Report:

- Cesses and surcharges have also been subjected to critical scrutiny by the Comptroller and Auditor General (CAG).

- All cesses must be transferred to a reserve fund in the Public Account of India after their collection.

- In its reports the CAG has uncovered numerous instances of either non-transfer or short transfer of the collected amounts to the respective funds.

What needs to be done?

- Finance Commission:

- Sharing of resources from the divisible pool, and the extent of cesses and surcharges, must be matters of critical importance for the 16th FC.

- The FC must take initiative to correct historical wrongs in vertical devolution through compensations to the States.

- It must instruct the Union government to publish accurate estimates of “net proceeds” in the budget documents.

- It must also arrange to provide shortfalls in devolution over the last decade as a lump sum untied grant to States.

- Union Government:

- The Union government must legislatively act to have strict limits on the collection of cesses and surcharges

- Cesses and surcharges should automatically expire after a short period and must not be rechristened under another name.

More Articles