The Baba Kalyani led committee constituted by the Ministry of Commerce and Industry to study the existing SEZ policy of India has recently submitted its report.

Issue

Context

- The Baba Kalyani led committee constituted by the Ministry of Commerce and Industry to study the existing SEZ policy of India has recently submitted its report.

Background

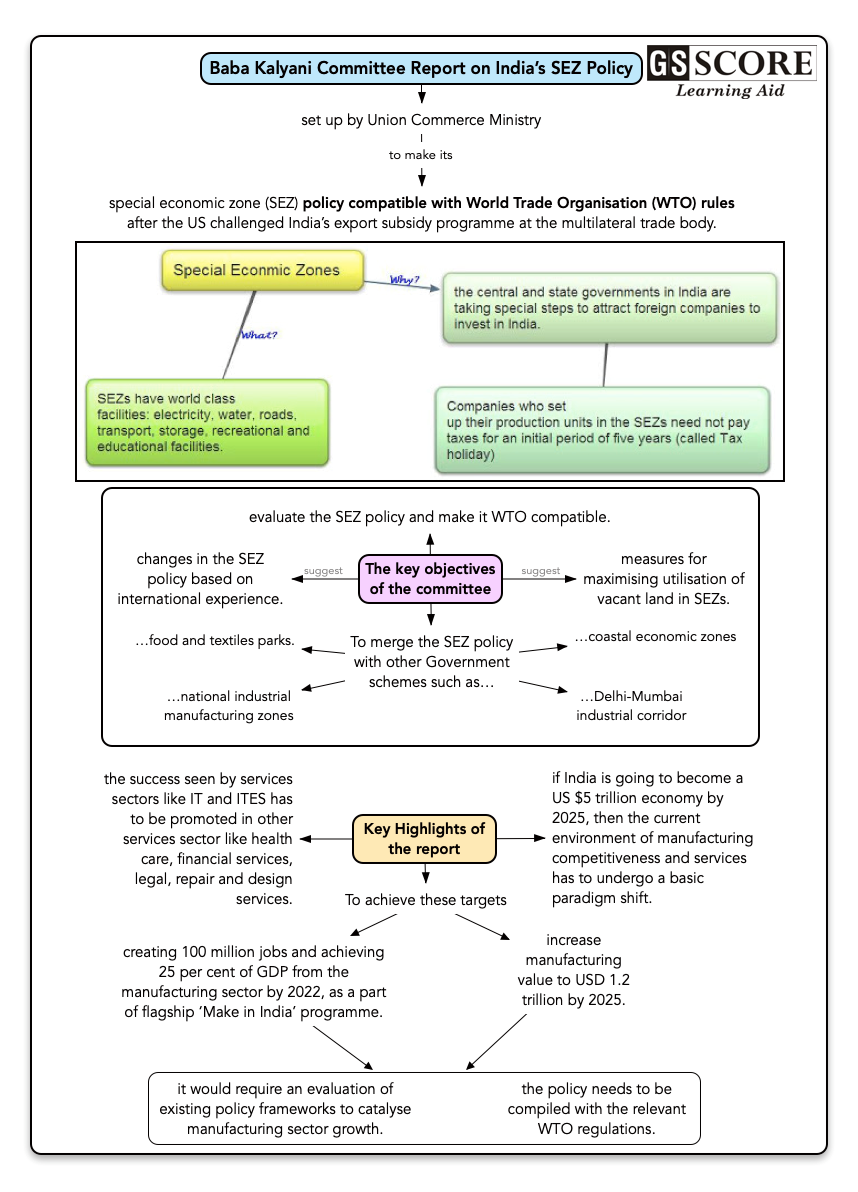

The Union Government has set the target of creating 100 million jobs and achieving 25 per cent of GDP from the manufacturing sector by 2022, as a part of its flagship ‘Make in India’ programme. The Government also plans to increase manufacturing value to USD 1.2 trillion by 2025.

While these are ambitious plans to propel India into a growth trajectory, it requires an evaluation of existing policy frameworks to catalyse manufacturing sector growth. At the same time, the policy needs to be compiled with the relevant WTO regulations.

About

- In June 2018, the committee was tasked to make special economic zone (SEZ) policy compatible with World Trade Organisation (WTO) rules after the US challenged India’s export subsidy programme at the multilateral trade body.

- India’s SEZ Policy was implemented from April 1, 2000. Subsequently, the Special Economic Zones Act, 2005 was enacted.

- The commerce ministry has been consistently lobbying with the finance ministry to exempt units in the SEZs from the minimum alternate tax (MAT), imposed on them in 2011.

Key objectives of the committee included:

- To evaluate the SEZ policy and make it WTO compatible.

- To suggest measures for maximising utilisation of vacant land in SEZs.

- To suggest changes in the SEZ policy based on international experience.

- To merge the SEZ policy with other Government schemes such as coastal economic zones, Delhi-Mumbai industrial corridor, national industrial manufacturing zones and food and textiles parks.

Key Highlights of the report

- If India is to become a US $5 trillion economy by 2025, then the current environment of manufacturing competitiveness and services has to undergo a basic paradigm shift.

- The report notes that the success seen by services sectors like IT and ITES (IT enabled services) has to be promoted in other services sector like health care, financial services, legal, repair and design services.

Analysis

Special Economic Zones in India

- They are certain localities which offer tax and other incentives to their resident businesses. Until 2000, India did not have SEZs, and instead had a number of export processing zones (EPZs), which, although similar in structure to the modern SEZ, failed to attract many firms to India.

- India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia's first EPZ set up in Kandla in 1965.

- The government, accordingly, introduced the SEZ. Structured closely on the already successful model of China, they are designed to help stimulate both foreign and domestic investment, boost India’s exports, and create new employment opportunities.

- India’s Special Economic Zone Act, 2005 further amended the country’s foreign investment policy and converted its EPZs to SEZs, with notable zones including Santa Cruz (Maharashtra state), Cochin (Kerala state), Kandla and Surat (Gujarat state), and more.

- The SEZ Rules, 2006 lay down the complete procedure to develop a proposed SEZ or establish a unit in an SEZ.

India’s SEZ Policy

- The main objectives of the Special Economic Zones Act, 2005 are:

- generation of additional economic activity

- promotion of exports of goods and services

- promotion of investment from domestic and foreign sources

- creation of employment opportunities

- development of infrastructure facilities

- The SEZ Rules provide for:

- Simplified procedures for development, operation, and maintenance of the Special Economic Zones and for setting up units and conducting business in SEZs;

- Single window clearance for setting up of an SEZ;

- Single window clearance for setting up a unit in a Special Economic Zone;

- Single window clearance on matters relating to Central as well as State Governments;

- Simplified compliance procedures and documentation with an emphasis on self-certification.

Advantages/Incentives for setting up a Unit in an Indian SEZ

- Duty free import and domestic procurement of goods for the development, operation, and maintenance of the company.

- 100 percent income tax exemption on export income for first five years, 50 percent for five years thereafter, and 50 percent of the export profit reinvested in the business for the next five years. These incentives will be withdrawn from April 1, 2020 (Sunset Clause), pending an extension, which is currently under discussion.

- Exemption from the Goods and Services Tax (GST) and levies imposed by state government. Supplies to SEZs are zero rated under the IGST Act, 2017, meaning they are not taxed.

- External commercial borrowing (ECB) is allowed up to US$500 million a year without restriction. For developers of an SEZ, the ECB channel may be availed after receiving government approval, and only for providing infrastructure facilities in the zone. However, ECB will not be permissible for development of integrated township and commercial real estate within the SEZ.

- Permission to manufacture products directly, as long as the goods companies are producing fall within a sector which allows 100% FDI.

Major Issues with SEZ Policy

- Fiscal incentives such as stamp duty exemption have not been uniformly implemented in all states.

- With respect to land, there is no earmarking of sites for SEZs by the Government or provision of initial infrastructure. The long gestation period till notification further makes the land unusable.

- Moreover, there is no clear exit mechanism for the SEZ developers in the policy.

- Some experts have also expressed concern that there is probably too much emphasis on products from SEZs being used for exports only.

- At the application stage, some experts question the necessity for a two-stage process itself.

Reasons for failure of SEZs in India

- In India, SEZs were set up to provide a hassle-free environment for exports and to replicate China’s success in using SEZs to boost manufacturing and employment. But the policy seems to have backfired.

- Far from turning India into a powerhouse of manufacturing exports, the control-free industrial enclaves have become centres of corruption and scams.

- As per a research paper by Meir Alkon of Princeton University, this is because of the failure of local Indian politicians to select SEZ sites that offer maximum development potential. Site selection for SEZs has been guided by self-serving agendas rather than considerations of growth and development.

- Local politicians often influence bureaucrats at state-owned industrial development corporations to secure land for personal gains. As such, sites for SEZs are selected based on real estate speculation rather than the economic potential of a region.

- If not for profit through land deals, local politicians also use site selection of SEZs to target specific ethnic and caste groups to create vote banks.

- State governments in India suffer from an ‘incumbency disadvantage’, where they hold office for shorter durations, which discourages them from pursuing long-term development of their region.

- In contrast, China’s local leaders have a greater incentive to develop more productive SEZs. Promotions of local leaders in China are often based on parameters such as GDP (gross domestic product) growth in their jurisdictions, which means they are more motivated to pursue local development.

- Many of India’s SEZ’s now lie vacant, hurting not just economic growth but also equity. As real estate businesses have thrived under the guise of SEZs, rich fertile lands have been diverted away from farmers without any real development.

Way Forward

- Government should undertake comprehensive social-impact study to determine the compensation due to farmers for taking away their livelihoods. The government should also return the unutilised land back to farmers.

- Performance-measuring mechanisms should be put in place so that the promoters can be held accountable.

- There is a need for greater coordination across different ministries and departments of the central government and between the central and state governments.

- As India competes with other countries to attract businesses and FDI, the incentives given to SEZs in India should be more predictable and in line with what is offered by competing countries in Asia.

Learning Aid

Practice Question:

Recently Baba Kalyani committee set up to study the existing SEZ policy of India has submitted its report to the government. In this light, analyse the major challenges associated with SEZ policy of India.