Context

In a recent development Union Finance Minister Nirmala Sitharaman has made an announcement that the government is extending a guarantee of Rs 30,600 crore to the National Asset Reconstruction Company Ltd (NARCL) to help clear stressed loans.

Background

- This announcement is in line with the In Budget 2021-22 when the finance minister had announced for setting up of a bad bank to resolve the bad loans.

- National Asset Reconstruction Company Limited” (NARCL) has been incorporated under the Companies Act, which will be tasked to acquire stressed assets worth Rs 2 lakh crore from various commercial banks.

- Then another entity- “India Debt Resolution Company Ltd (IDRCL)”, will try to sell the stressed assets in the market. Jointly NARCL-IDRCL forms the new bad bank.

Analysis

What is a Bad Bank?

- It is a corporate structure that takes charge ofthe toxic assets held by banks in a separate entity.

- It is established to buy non-performing assets (NPAs) from a bank and later selling them in the market.

- This relieves the commercial banks from getting rid of their stressed assets and enables them to focus on resuming their normal banking operations.

Need for a Bad Bank:

- To put it simply, commercial banks accept deposits and provides loans to their customers. The deposits are considered a liability because the bank is supposed to return the money to the depositor and also pay the interest on those deposits. On the contrary, the loans that banks give is considered as their assets because in this case, the bank can earn interest and this is the money that borrower will have to return.

- This business model is based on the idea that the earnings made by the banks by lending money to the borrowers will be more than what it would have to pay to its depositors. But in scenarios where the borrowers fail to repay the principal amount or the interest. This aggravates the risk of a loan converting into a non-performing asset (NPA).

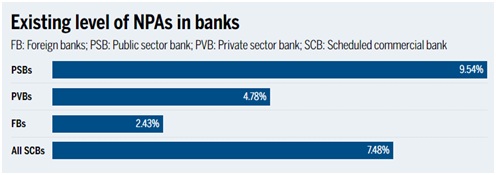

- The overwhelming chunk of the NPAs is lying mostly with the public sector banks, owned by the government and hence by the public. To keep these banks running the government is sometimes forced to recapitalise them, using the taxpayer’s money so that the bank can continue with the lending and funding economic activities.

- To set free the banks from these stressed assets or NPAs, the need for the creation of bad banks aroused. An entity where the stressed assets can be parked. Now the commercial banks can resume their usual business operation, especially lending and the bad bank would try to sell these assets in the market.

NPAs that banks have:

- The total bad loans in the Indian Banking system amount to Rs 8.35 lakh crore in March 2021.

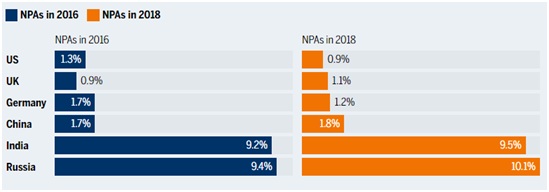

- According to the World Bank data, the share of NPA to gross loans in Indian banking is significantly higher compared to developed western economies.

- According to the financial stability report issued by RBI, the (CRAR) of SCBs increased from 14.7 percent in March 2020 to 16 percent in March 2021.

CRAR is also known as Capital Adequacy Ratio (CAR) measures a bank's financial stability by measuring its available capital as a percentage of its weighted credit risk exposure. The Basel III norms stipulated a capital to risk-weighted assets of 8%.A higher CRAR shows that the bank is better capitalised to handle NPAs.

Working of NARCL-IDRCL:

- The transfer of bad loans will be done in a phased manner. Under this framework, the NARCL has purposed to acquire stressed assets of about Rs 2 lakh crore. About Rs 90,000 crore worth of bad loans has been planned to transfer in the first phase.

- At first, the NARCL will purchase bad loans from banks. It will pay 15% of the agreed price in cash and the remaining 85% will be in the form of “Security Receipts”. When the assets are sold in the market, with the help of IDRCL, the commercial banks will be paid back the remaining amount.

- If the bad bank fails to sell the bad loan or sells it at a loss then the government guarantee will be invoked and the difference between the price that the bad bank will be getting and what the commercial bank was supposed to pay will be paid from the corpus of Rs. 30,600 crores have been ensured by the government.

Concerns involved:

- From the perspective of the NPA laden bank, this move is going to help but from the perspective of the government and the taxpayer,the situation is a bit tricky.

- The burden of recapitalising the PSBs or giving guarantees for security receipts will always come from the taxpayer’s pocket. This opens up a new topic for discussion “a new form of socialism for the capitalists”, where the burden of the bad investments and business decisions of the borrower is transferred to the taxpayers.

Benefits:

- Consolidation of debts, single-point decision making in Insolvency and Bankruptcy Code (IBC) 2016.

- It will incentivise quicker action and resolution, thereby getting a better value realisation of the bad assets.

- Market expertise can be engaged for value enhancement.

- Banks will be able to focus on increasing business and credit growth.

- The government of India will enhance the liquidity of the Security Receipts (SRs) as it is being backed by them, also the SRs are tradable.

Conclusion:

The 4R strategy of Recognition, Resolution, Recapitalisation and Reform, has positively contributed towards enhancing the performance of Public Sector Banks (PSBs). On these lines, the government made its intention clear to set up an Asset Reconstruction Company (ARC) along with an Asset Management Company (AMC) to take the charge of stressed debts and thereafter dispose of them to buyers for value realisation. The National Asset Reconstruction Company Limited (NARCL) and India Debt Resolution Company Limited (IDRCL)structure will consolidate the fragmented debt across the various lenders so that quicker can be taken for a better value realisation. In long run, the only sustainable solution to the problem of NPAs rests in improving the lending operation by PSBs, because that’s where the problem begins.