As the world increasingly digitalises, industries around the globe are integrating new and innovative technologies and digital products to capitalise on the transformation. One of the key developments is the possible introduction of central bank digital currencies (CBDCs) to offer more diversified formats of central bank money.

Context

As the world increasingly digitalises, industries around the globe are integrating new and innovative technologies and digital products to capitalise on the transformation. One of the key developments is the possible introduction of central bank digital currencies (CBDCs) to offer more diversified formats of central bank money.

Background

- The landscape of payments is changing rapidly. In recent years, many proposals for digital money have appeared to facilitate the turn away from cash and a few systems are already in operation.

- Naturally, the ongoing pandemic has contributed to the surging use of digital currency as more shopping is done online. A technological revolution is underway.

- The rise of blockchain and the simultaneous development of cryptocurrencies and mobile payment systems have fuelled a new wave of both excitement and scepticism at the same time.

- Today, central banks are keen on designing their own network of digital payments by officially issuing what is called a Central Bank Digital Currency or CBDC.

- The novelty of such general-purpose CBDCs lies in its character of being legal tender. This transition can contribute to diversity and innovation in the payment market.

Analysis

What is CBDC?

- Central Bank Digital Currency is a digital version of so-called “fiat money,” or the regular currency a country uses, as established and regulated by its government.

- In simpler terms, it is a digital payment instrument that is denominated in a national currency and issued by a central bank.

- Unlike private virtual currencies whose value is based on its ownership, distribution and trading on exchanges, a CBDC’s intrinsic value is equivalent to any other form of money issued by the central bank.

- According to a report (2019) by the Bank for International Settlements (BIS), central bankers around the world are growing more optimistic about the eventual efficacy of CBDCs.

|

Features of CBDC The BIS report also lays down core features of a CBDC, prime among which is the ability to use a CBDC as easily as cash.

|

How is it similar and different to cryptocurrency?

- Central Bank Digital Currency is similar to cryptocurrencies because it uses blockchain technology as its core means of representation. Also, it’s digital.

- Central Bank Digital Currency differs from cryptocurrency because unlike the latter, the former is issued, centralized and regulated by the monetary authority (in most cases governments) of the issuing country.

The following table provides an idea of how CBDC compares with existing form of fiat money and cryptocurrency.

|

Characteristics |

Fiat currency |

Cryptocurrency |

CBDC |

|

Issued by |

Central Bank |

Private entities |

Central Bank |

|

Backed by |

Assets such as government securities |

NA |

Assets such as government securities |

|

Legal medium of exchange |

Yes |

No |

Yes |

|

A store of value |

Yes |

Yes |

Yes |

|

Determination and fluctuation of value |

Monetary policy, trade and market |

Only market |

Monetary policy, trade and market |

|

Intermediary institutions |

Required |

Not required |

Not required |

|

Cost of money |

High — printing and distribution |

Mining cost — very high |

Low |

|

Security and maintenance |

High |

Low |

Low |

|

Traceability |

Low |

High |

High |

|

Payments and settlement system |

Limited acceptability |

Near universal acceptability |

Universal acceptability |

|

Monetary policy |

Slower transmission |

NA |

Possibility of near-real time transmission |

|

Financial stability |

Stable — rush to cash |

Very unstable |

Difficult to answer with existing empirical evidence |

|

Scalability |

Low |

High |

High |

|

Privacy |

Not a concern |

Not a major concern |

Normative, but can be a major concern |

Where does India stand?

- In India, the idea of a digital rupee has been explored but has not gained much traction.

- In its 2017-18 annual report, the Reserve Bank of India said that “an inter-departmental group has been constituted by the Reserve Bank to study and provide guidance on the desirability and feasibility to introduce a central bank digital currency.”

- In 2019, a panel headed by then Finance Secretary Subhash Chandra Garg had recommended a digital rupee, while simultaneously suggesting a crackdown on private cryptocurrencies.

|

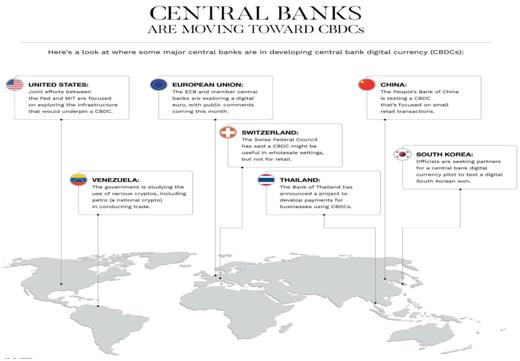

CBDCs On The Drawing Board

|

What are the benefits of CBDC?

- A Central Bank Digital Currency presents myriad benefits that could help a bank achieve stronger monetary and financial stability, including

- the creation of a more robust payment landscape

- helping to reduce the formation of new (and potentially risky) cryptocurrencies

- facilitating more innovative and efficient modes of payment

- adapting better to the payment needs of tomorrow’s digital economy

- enhancing the availability of a central bank’s issued money, improving ways a central bank can respond to cash declines

- helping to bring about more efficient cross-border payments

- Like fiats, CBDC can be used for a variety of functions, from making payments to acting as a store of value to official units of account.

- There could be other economic benefits too. Globally, 1.7 billion people remain unbanked; CBDC accounts could be incorporated into mobile-phone wallets, boosting financial inclusion in emerging markets.

Challenges and Issues

- Conflict due to trans-nationality nature: As far as the trans-nationality of electronic money is considered, national jurisdictions and the broader cyberspace could conflict over monetary control soon.

- Instability at international level: At its extreme, its ability to flow too freely across borders compared to traditional currencies could create instability internationally.

- Threat to cyber security: The broader cyberspace that hosts such platforms is notorious for its lack of transparency, security threats, and potential for malevolent activities.

- Technology failure: Technology failures are commonplace, especially in the government.

- Depletion of demand: There is an additional concern that if the public is allowed to convert their deposits into their CBDC accounts, commercial banks may be robbed of their primary funding source.

Conclusion

What happens with CBDCs will have far-reaching implications on the future of digital finance, including cryptocurrency and digital securities. Whoever leads this race and determines the outcome of its infrastructure and operation, will most certainly gain a significant advantage and may have the possibility to spearhead many of the other innovations that come from this technology.