|

Gross non-performing assets (GNPA):

|

Context

Recently, the Reserve Bank of India (RBI) released the Report on ‘Trends and Progress of Banking in India 2021-22’.

About

About the Report:

- This report is statutory compliance in accordance with the Banking Regulation Act 1949.

- This Report presents the performance of the banking sector, including co-operative banks and non-banking financial institutions, during 2021-22.

- It has highlighted the gradual strengthening of the growth momentum in the Indian banking sector.

Key Highlights:

- Double Digit Growth: Scheduled commercial banks (SCBs) have registered double-digit growth in 2021-22.

- Strengthening of capital to risk-weighted assets ratio (CRAR) of SCBs

- Decline in gross non-performing assets (GNPA) ratio of SCBs.

- Reasons for decline in GNPAs: Banks have given write-offs or upgradation; greater scrutiny and monitoring of loans; greater recovery of loans after the Insolvency and Bankruptcy Act 2016.

- Improvement in the financial performance of urban co-operative banks (UCBs)

Areas of concern:

- Retail loans may become a source of Systemic risk: There is evidence of a building up of concentration in retail loans.

- Retail loans are generally unsecured, meaning they do not require any collateral. These are generally taken for personal use.

- Indian banks are showing “Herding Behaviour”: The banks were found diverting lending away from the industrial sector towards retail loans.

What is the reason behind the drastic shift in the sectors that the banks funded?

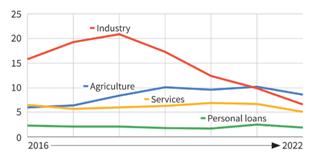

- Bad loans in the industry sector: There has been a very high share of bad loans in the industry sector till 2018. It can be seen in the figure provided.

- But it has been brought down by recovery mechanisms such as insolvency and bankruptcy code and also by issuing fewer fresh loans to the industries.

- On the other hand, bad loans are barely there in the retail sector.

Bank Credit in India:

- Bank credit in India refers to credit lending by various scheduled commercial banks (SCBs) to various sectors of the economy.

- The RBI follows the practice of classifying the credit-related data under the food and non-food credit (NFC) categories.

- The food credit indicates the lending made by banks to the Food Corporation of India (FCI) mainly for procuring food grains. It is a small share of the total bank credit.

- The major portion of the bank credit is non-food credit which comprises credit to various sectors of the economy (Agriculture, Industry, and Services) and also in the form of personal loans.

Three challenges in Indian financial services

To enable India’s journey towards a USD 5 trillion economy the financial services industry needs to work with the stakeholder ecosystem to address three key issues:

- Bridging the credit gap:

- To enhance the credit-to-GDP ratio the policymakers need to open up alternative capital sources for public sector banks and address the credit gap faced by MSMEs.

- Digital innovation across the financial sectors:

- Given that 70% of the market share belongs to public sector banks, these banks need to be incentivized to aggressively drive the digital agenda.

- Focus on building ESG into the financial system:

- The other key challenge for India is to drive sustainable growth around environmental, climate and social paradigms.

- Financial service providers will need to work to bring their economic objectives into harmony with the new ESG rules and regulations and change their business models.

|

ESG fund/investment

|