Context

The International Monetary Fund (IMF) has lauded India’s Direct Benefit Transfer (DBT) Scheme as a “logistical marvel” that has benefitted millions of people.

Direct benefit Transfer (DBT):

- The DBT scheme that began as a pilot in 2013-14, when the Government of India, introduced the Direct Benefit Transfer or DBT scheme to streamline the transfer of government-provided subsidies in India.

- DBT Mission was created in the Planning Commission to act as the nodal point for the implementation of the DBT programme.

- The scheme was later expanded under PM Narendra Modi.

- The Government introduced the scheme with the objective of improving the delivery system and redesigning the existing procedures in welfare schemes.

- DBT aims to transfer subsidy benefits from various Indian welfare schemes directly into the beneficiary’s bank accounts.

- To avail of the DBT benefits, beneficiaries must ensure they link their bank account to their Aadhaar number.

- Since the inception of the DBT scheme, the Government has launched 450 projects and reached over 900 million people.

Objectives of DBT:

- Curbing pilferage and duplication

- Accurate targeting of the beneficiary

- Reduced delay in payments

- Electronic transfer of benefits, minimizing levels involved in benefit flow.

Reasons behind the efficient DBT:

- An enabling policy regime: Proactive government initiatives and supportive regulatory administration allowed the private and public sector entities in the financial sector to overcome longstanding challenges of exclusion of a large part of the population.

- Creation of a dedicated ecosystem: These are essential elements of the pioneering ecosystem created by the government for the aggressive rollout of the ambitious DBT programme, achieving impressive scale in a short span of six years.

- Mission-mode approach for financial inclusion: The government endeavored to open bank accounts for all households, expanded Aadhaar to all, and scaled up the coverage of banking and telecom services.

- Public Finance Management System through Aadhar: It evolved the Public Finance Management System and created the Aadhaar Payment Bridge to enable instant money transfers from the government to people’s bank accounts.

- Participation of various stakeholders for extensive UPI: The Aadhaar-enabled Payment System and Unified Payment Interface further expanded interoperability and private-sector participation.

- Directly receiving of subsidies: This approach not only allowed all rural and urban households to be uniquely linked under varied government schemes for receiving subsidies directly into their bank accounts but also transferred money with ease.

Components of DBT:

- Primary components in the implementation of DBT schemes include a Beneficiary Account Validation System, a robust payment and reconciliation platform integrated with RBI, NPCI, Public & Private Sector Banks, Regional Rural Banks, and Cooperative Banks (core banking solutions of banks, settlement systems of RBI, Aadhaar Payment Bridge of NPCI), etc.

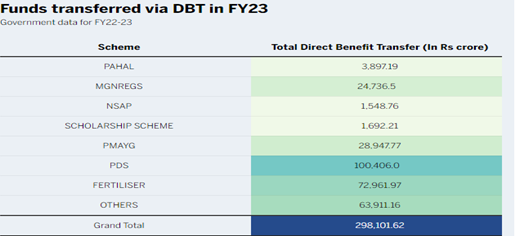

- In FY2022-23 so far, 303 crore DBT transactions amounting to Rs 298,101 crore have taken place across 318 schemes.

Advantages of Direct Benefit Transfer

- DBT transfers help expedite the flow of funds and information securely while reducing the possibility of fraud.

- It eliminates the need for intermediaries, including government officers, in transferring the subsidy amount directly into the beneficiary accounts.

- It brings about transparency and reduces instances of pilferage from the distribution of Central Government-sponsored funds.

- DBT ensures accurate targeting of beneficiaries.

- Beneficiaries can link only one bank by seeding the fund deposits to their Aadhaar details to avoid duplication of subsidies.

- It enables the Government to simultaneously reach out to both citizens and beneficiaries of the scheme.

- DBT will bring efficiency, effectiveness, transparency, and accountability to the Government system and infuse confidence among citizens in governance.

Accomplishments:

- Enabling Instant Money Transfer: It evolved the Public Finance Management System and created the Aadhaar Payment Bridge to enable instant money transfers from the government to people’s bank accounts.

- Integration of Households into govt. schemes: The Aadhaar-enabled Payment System and Unified Payment Interface further expanded interoperability and private-sector participation.

- India has come a long way primarily on account of the aggressive rollout of the DBT programme.

- This has been made possible by the inclusive financial sector system where the most marginalized sections of society have been uniquely linked to the formal financial network.

- It evolved the Public Finance Management System and created the Aadhaar Payment Bridge to enable instant money transfers from the government to people’s bank accounts.

- The Aadhaar-enabled Payment System and Unified Payment Interface further expanded interoperability and private-sector participation.

- The DBT programme has reached commanding heights toward achieving the government’s vision of “sabka vikas”.

- Rural Areas: In rural Bharat, DBT has allowed the government to provide financial assistance effectively and transparently to farmers with lower transaction costs – be it for fertilizers or any of the other schemes including the PM Kisan Samman Nidhi, PM Fasal Bima Yojana, and PM Krishi Sinchayi Yojana- thus becoming the backbone for supporting the growth of the agricultural economy.

- The benefits received under the Mahatma Gandhi National Rural Employment Guarantee Act and Public Distribution System drive the rural demand-supply chain.

- Urban India: In urban India, the PM Awas Yojana and LPG Pahal scheme successfully use DBT to transfer funds to eligible beneficiaries.

- Various scholarship schemes and the National Social Assistance Programme use the DBT architecture to provide social security.

- DBT under rehabilitation programmes such as the Self Employment Scheme for Rehabilitation of Manual Scavengers opens new frontiers that enable social mobility of all sections of society.

- Pandemic: The efficacy and robustness of the DBT network were witnessed during the pandemic. It aided the government to reach the last mile and support the most deprived in bearing the brunt of the lockdown.

- From free rations to nearly 80 crore people under the Pradhan Mantri Garib Kalyan Yojana, fund transfers to all women Jan Dhan account holders and support to small vendors under PM-SVANidhi, DBT helped the vulnerable to withstand the shock of the pandemic.

- Global Recognition: Recently, the President of the World Bank Group, had also urged other nations to adopt India’s move of targeted cash transfer instead of broad subsidies noting that “India managed to provide food or cash support to a remarkable 85 percent of rural households and 69 per cent of urban households.

- An ambitious vision, holistic approach, and a multi-pronged strategy enabled the DBT ecosystem to deliver impact at a phenomenal scale — an accomplishment that has been acknowledged by the IMF and World Bank.

Challenges of Direct Benefit Transfers in India:

- Poor implementation may make beneficiaries worse off.

- The value of transfers may be inadequate (especially if they are not indexed to market prices and inflation).

- Access to banks/ATMs and markets may vary across locations.

- Recipients may also use cash for non-food items, which might be their preference but would reduce the impact on policy goals for food security and nutrition.