Context

Supreme Court in Association of Democratic Reforms and Anr. vs Union of India & Ors. held that the Electoral Bonds Scheme was unconstitutional for violating the right to information of voters.

Framework of Political Funding before Introduction of Electoral bonds

- Companies Act, 2013: Section 182 empowers Indian companies to contribute to political parties, subject to board authorization and disclosure requirements. However no corporate entity could donate more than 5% of its total profit or 10% of its revenue to any political party.

- Income Tax Act, 1961: Contributions to recognized parties or electoral trusts are eligible for tax deductions under the Income Tax Act.

- Prevention of Corruption Act, 1988 (POCA): POCA addresses concerns of bribery by requiring a tangible nexus between contributions and undue favors from public servants.

- Foreign Contributions: Amendments to the Representation of People Act, 1951, and the Foreign Contributions (Regulations) Act, 2010, permit political contributions by Indian companies with foreign investment within prescribed limits.

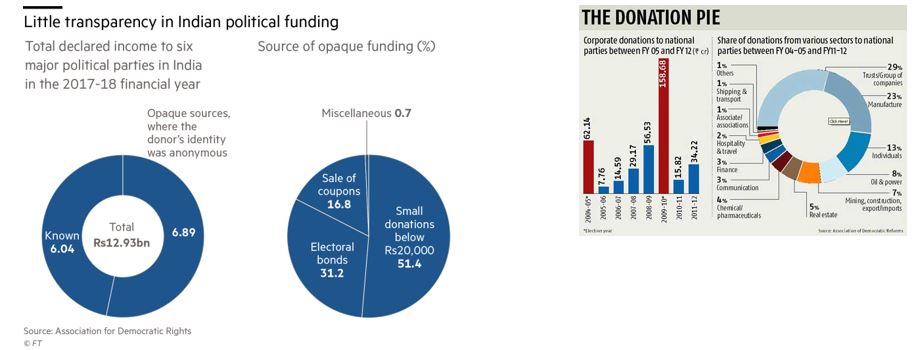

- Donor Anonymity: While Companies Act provisions do not mandate disclosing recipient parties, political parties must annually submit contribution details to the Election Commission of India (ECI), making donor information public. Electoral trusts allow for anonymity, but aggregate donation amounts to each party must be disclosed.

- Public Disclosure: Political parties were required to publicly disclose all donations above ?20,000. This transparency measure aimed to ensure that citizens knew who was funding political parties.

The Introduction of Electoral Bonds

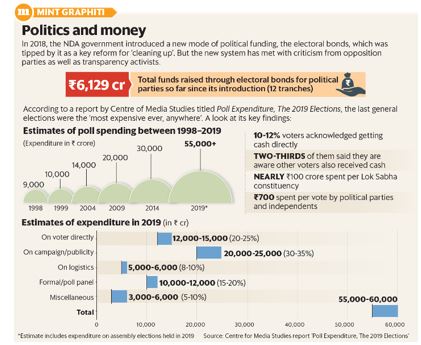

In 2016 and 2017, the Indian government introduced the Electoral Bond Scheme via amendments to four key acts: the Representation of the People Act, 1951 (RPA), the Companies Act, 2013, the Income Tax Act, 1961, and the Foreign Contributions Regulation Act, 2010 (FCRA).

What is an Electoral Bond?

An electoral bond is like a promissory note. It is a bearer instrument payable to the bearer on demand. Unlike a promissory note, which contains the details of the payer and payee, an electoral bond has no information on the parties in the transaction at all, providing complete anonymity and confidentiality to the parties.

Features of Electoral Bond

- Bearer Bonds: Electoral bonds are interest-free bearer bondsor monetary instruments. They can be purchased by both companies and individuals from authorized branches of the State Bank of India (SBI).

- Denominations: These bonds are available in multiples of ?1,000, ?10,000, ?1 lakh, ?10 lakh, and ?1 crore.

- Anonymity: The unique feature of electoral bonds is their anonymity. The name and other details of the donor are not entered on the instrument. This makes electoral bonds a discreet way to contribute to political parties.

- Donation Mechanism: To make donations, one needs a KYC-compliant account. The political parties must encash the bonds within a stipulated time.

- No Cap on Purchases: There is no limiton the number of electoral bonds that a person or company can purchase.

- Verified Accounts: Political parties that secured at least 1% of the votes polledin recent Lok Sabha or State Assembly elections and are registered under the RPA can receive funding via electoral bonds. The bond amounts are deposited in verified accounts with the Election Commission of India (ECI).

- Availability: Electoral bonds are not available for purchase at all times. They are open for a period of 10 daysin a gap of four months (January, April, July, and October). Additionally, they are open for 30 days during Lok Sabha election years.

Challenges to the Amendments

Two Non-Governmental Organisations—Association for Democratic Reforms (ADR) and Common Cause— and the Communist Party of India (Marxist) filed petitions in the Supreme Court challenging the amendments. At the outset, the petitions argued that the Finance Acts were wrongfully passed as money bills to prevent higher scrutiny by the Rajya Sabha. This challenge is tagged with the larger challenge to the use of money bills under Article 110. Petitioners also argued that the scheme allowed “non-transparency in political funding” and legitimized electoral corruption at a “huge scale.”

Key Issues of the case

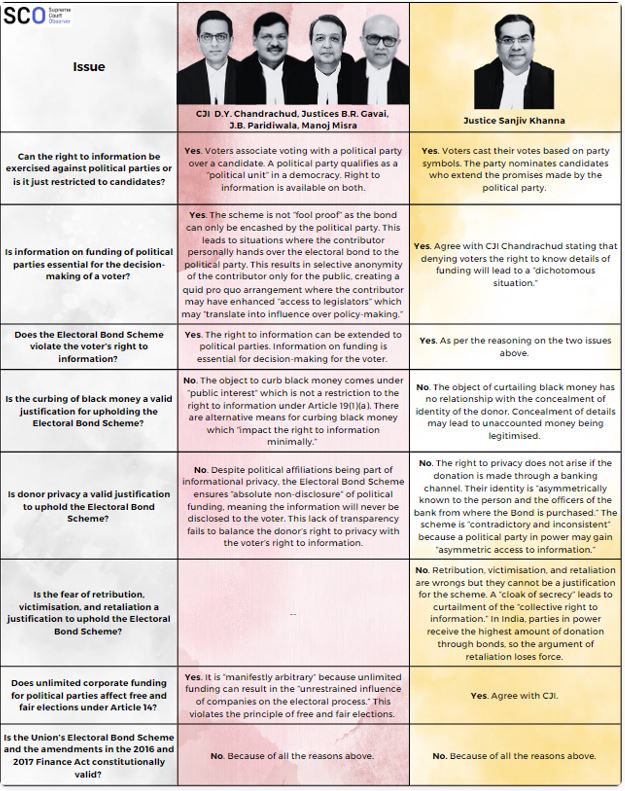

- Is the electoral bond scheme constitutional?

- Does the electoral bond scheme violate the voters’ right to information?

- Can the Scheme allow anonymity with the view to protect donors’ right to privacy?

- Does the electoral bond scheme threaten the democratic process, and free and fair elections?

Election Commission’s View

- ECI’s Opposition:

- The ECI claimed that the scheme undermines transparency in political finance.

- They warned against the repercussions on transparency due to exempting political parties from sharing contribution details.

- The affidavit highlighted concerns about unchecked foreign funding influencing Indian policies.

- Union Government’s Rejoinder:

- They viewed it as a pioneering step in electoral reforms.

- The scheme aims to ensure transparency and accountability in political funding.

- By limiting issuance to the State Bank of India and requiring KYC details, they address concerns about unregulated cash donations and black money.

Supreme Court’s Verdict

On February 15, 2024, the Supreme Court struck down the electoral bonds scheme, declaring it “unconstitutional”. Here are the key points from the ruling:

1. Majority Beneficiaries:

- The court observed that a majority of contributionsthrough electoral bonds had gone to political parties that were ruling parties at both the Centre and the State

- Audit reports revealed this trend from 2017-18 to 2022-23.

2. Corporate Influence:

- 94%of the value of donations came from electoral bonds of ?1 crore, indicating significant corporate funding.

- This raised concerns about the quantum of corporate influence

3. Unknown Sources Income:

- The share of income from unknown sourcesfor national parties increased from 66% (2014-15 to 2016-17) to 72% (2018-19 to 2021-22).

- Electoral bond income accounted for 81% of the total unknown income of national parties (2019-20 to 2021-22)

4. Immediate Action:

- The Supreme Court invalidated the scheme and directed the State Bank of India (SBI)to cease issuing electoral bonds

- SBI must provide the Election Commission of India (ECI) with detailed records of all electoral bond contributions received by political parties since the scheme’s interim order in 2019.

Judgement Matrix

Political Funding Reforms

- In political landscapes worldwide, the regulation of campaign finance plays a pivotal role in ensuring fair and transparent elections.

- While the United States emphasizes individual candidate campaigns, parliamentary systems like India prioritize party-centric politics.

- Thus, the primary focus of the campaign finance framework in India needs to be parties, not individual candidates.

- A fruitful party funding framework must give attention to at least four key aspects — regulation of donations, expenditure limits, public financing, and disclosure requirements.

Regulating Donations

- Scope of Regulation: Different jurisdictions impose varying restrictions on donors, including bans on foreign contributions and limits on individual or corporate donations.

- Contributions vs. Expenditure Limits: While some countries, like the US, enforce contribution limits, others, such as the UK, rely on expenditure limits to curb the influence of money in politics.

Expenditure Limits

- Limit on Corporate Donations: While electoral bonds allow corporate donations, there should be a reasonable cap on the percentage of profit or revenue that a corporation can contribute.

- Individual Contribution Limits: Set individual contribution limits to prevent undue influence by wealthy donors.

- Mitigating Financial Arms Races: Expenditure limits alleviate the pressure on parties to engage in excessive fundraising, ensuring a more level playing field.

- Legal Challenges: The US faces obstacles in implementing expenditure limits due to constitutional interpretations safeguarding freedom of expression.

Public Financing

- Methods of Allocation: Various countries adopt diverse approaches to public funding, including criteria-based distribution and innovative initiatives like democracy vouchers.

- Challenges and Criticisms: Concerns arise regarding the potential for public funding to inadvertently support extremist candidates and the inability to fully address private money in politics.

|

State Funding of Elections Committees:

The Indrajit Gupta Committee (1998) endorsed state funding of elections, seeing “full justification constitutional, legal as well as on ground of public interest” in order to establish a fair playing field for parties with less money. The Committee recommended two limitations to state funding. Firstly, that state funds should be given only to national and state parties allotted a symbol and not to independent candidates. Secondly, that in the short-term state funding should only be given in kind, in the form of certain facilities to the recognised political parties and their candidates. The 1999 Law Commission of India report concluded that total state funding of elections is “desirable” so long as political parties are prohibited from taking funds from other sources. The Commission concurred with the Indrajit Gupta Committee that only partial state funding was possible given the economic conditions of the country at that time. Additionally, it strongly recommended that the appropriate regulatory framework be put in place with regard to political parties (provisions ensuring internal democracy, internal structures and maintenance of accounts, their auditing and submission to Election Commission) before state funding of elections is attempted. “Ethics in Governance”, a report of the Second Administrative Reforms Commission (2008) also recommended partial state funding of elections for the purpose of reducing “illegitimate and unnecessary funding” of elections expenses. The National Commission to Review the Working of the Constitution, 2001, did not endorse state funding of elections but concurred with the 1999 Law Commission report that the appropriate framework for regulation of political parties would need to be implemented before state funding is considered. |

Disclosure Requirements

- Balancing Transparency and Anonymity: Disclosure mandates aim to deter quid pro quo arrangements, but concerns persist regarding donor protection and the need for a balanced approach.

- International Models: Examples from jurisdictions like the UK and Germany highlight strategies to balance transparency with donor anonymity, often based on thresholds for reporting.

- Real-Time Reporting: Implement a system for real-time reporting of donations on a publicly accessible platform. Citizens should be able to track contributions instantly.

|

Lessons from Chile Anonymity Experiment: Chile's "reserved contributions" system aimed for complete donor anonymity, but challenges emerged due to informal coordination between donors and political parties. |