Context

EU has recently agreed to label investments in some gas and nuclear power plants as environment-friendly.

About

WHAT IS THE EU TAXONOMY?

About:The EU taxonomy regulation describes a framework to classify “green” or “sustainable” economic activities executed in the EU.

Previously, there was no clear definition of green, sustainable or environmentally friendly economic activity.

Aim: The EU taxonomy regulation creates a clear framework for the concept of sustainability, exactly defining when a company or enterprise is operating sustainably or environmentally friendly. Compared to their competitors, these companies stand out positively and thus should benefit from higher investments. Thereby, the legislation aims to reward and promote environmentally friendly business practices and technologies.

The EU Taxonomy is not a mandatory list of economic activities for investors to invest in.

Criteria for classification:

It also sets out four conditions that an economic activity has to meet to be recognised as Taxonomy aligned/sustainable economic activity: -

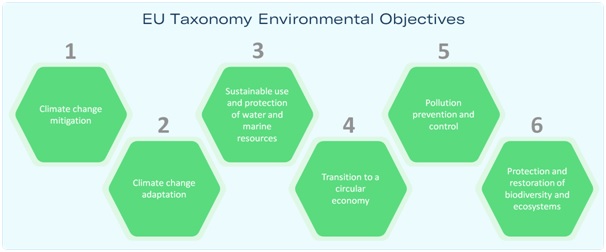

- Making a substantial contribution to at least one environmental objective;

- Doing no significant harm to any other environmental objective;

- Complying with minimum social safeguards;

- Complying with the technical screening criteria.

WHAT'S THE TAXONOMY FOR?

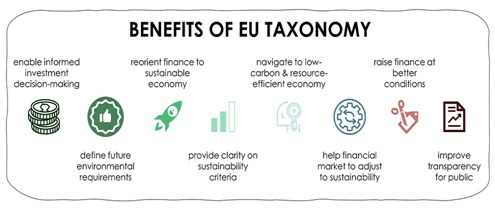

- It is a tool that helps in translating the climate and environmental objectives into clear criteria.

- It will create a frame of reference for investors and companies.

- It will support companies in their efforts to plan and finance their transition, help mitigate market fragmentation.

- It will protect against green washing and accelerate financing of those projects that are already sustainable and those in transition.

- Sustainable finance framework- It is an important element of a much broader sustainable finance framework that will deliver a complete toolkit for financing the transition.

- Aids in the implementation of European Green Deal- The added value of the EU Taxonomy is that it can help scale up investment in green projects that are necessary to implement the European Green Deal.

|

EUROPEAN GREEN DEAL The European Union’s (EU) Green Deal is the EU’s main new growth strategy to transition the EU economy to a sustainable economic model, ensuring

Objective: To become the first climate neutral continent by 2050, resulting in a cleaner environment, more affordable energy, smarter transport, new jobs and an overall better quality of life. |

WHO DOES IT APPLY TO?

- Providers of financial products - including pension providers - in the EU must disclose which investments comply with the taxonomy's climate criteria. For each investment, fund or portfolio, they must disclose what share of underlying investments comply with the rules.

- Large companies and listed firms must also disclose what share of their turnover and capital expenditure complies.

- That means polluting companies can get recognition for making green investments.

- For example, if an oil company invested in a wind farm, it could label that expenditure as green.

WHAT MAKES A “GREEN” INVESTMENT?

The rules classify three types of green investments.

- First, those that substantially contribute to green goals, for example, wind power farms.

- Second, those that enable other green activities, for example, facilities that can store renewable electricity or hydrogen.

- Third, transitional activities that cannot be made fully sustainable, but which have emissions below industry average and do not lock in polluting assets or crowd out greener alternatives.

WHAT DOES IT SAY ABOUT GAS AND NUCLEAR ENERGY?

- The rules for gas and nuclear energy, however, have been long delayed amid intense lobbying from governments who disagree on whether the fuels help fight climate change.

- The European Parliament supported that proposal in a vote, paving the way for the new rules to add gas and nuclear power plants to the EU "taxonomy" rulebook from 2023 which will enable investors to label and market investments in them as green.

|

GAS:

NUCLEAR:Nuclear is eligible if new plants that are granted construction permits by 2045 avoid significant harm to the environment and water resources.

|