The RBI has announced its calendar for purchasing G-secs. It is Government Securities Acquisition Programme orG-SAP 1.0, aimed at providing more comfort to the bond market.

Context

The RBI has announced its calendar for purchasing G-secs. It is Government Securities Acquisition Programme orG-SAP 1.0, aimed at providing more comfort to the bond market.

Background

- The RBI has announced its liquidity measures to ensure that the banks loosen their wallets and needy segments of the economy get credit at reasonable rates.

- This, in turn, will help the RBI to do its job as the enabler of government borrowing and its role of in-charge of financial stability.

- It looks similar to quantitative easing of advanced economies, but the RBI programme is short-term in nature, confined to G-secs and is not targeted to stimulate the economy

Analysis

What is the plan?

- The plan is to pave a pathfor stable and orderly evolution of the yield curve in addition toa comfortable liquidity situation in the economy.

- It is an attempt to ensure compatible financial conditions for the recovery to gain traction.

- For Q1 (Financial year) of 2021-22, therefore, it has been decided to announce a G-SAP worth ?1 lakh crore.

What are government securities, or g-secs?

- The government borrows through the issue of government securities called G-secs and Treasury Bills or Gilt-edged securities.

- It is a loan taken by the government and falls under capital receipts.

- It is the total amount of money that a government borrows to fund its spending on public services and benefits.

- When the tax revenue falls short in financing the government's spending programme, the government announces an annual borrowing programme in the Budget.

It is debt instruments(it’s a liability and one has to pay interest for it)issued by the government to borrow money. The two key categories are:

-

- Treasury bills areshort-term financial instrumentsthat mature in 91 days, 182 days, or 364 days, and

- Dated securities are long-term financial instruments, which mature anywhere between 5 years and 40 years.

- TheG-secs are not tax-free.

- These are generally considered as one of the safest forms of investment because they are backed by the government. So, the risk of default is almost nil. Still, they are not completely risk-free, as they are always subjected tofluctuations in interest rates.

- Previously to improve retail participation the retail investors are allowed to directly open their gilt accounts with RBI, and trade in government securities.

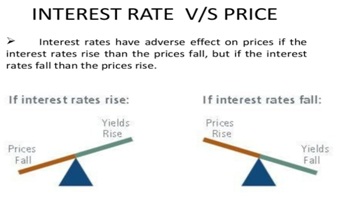

Why does bond yield go up and down?

- Let's understand it using an example. If the GDP of the economy is going down and the share market is plunging. The investors will pull out their money from the equity market and invest it in a safer instrument like government bonds.Because of this, the demand for government bonds (securities) increases and the bond prices go up.

- A fall in interest rates makes bond prices to rise, and bond yield to fall.

- Rising interest rates results in bond prices to fall, and bond yield to rise.

What are the economic implications of an increase in bond yield?

- Bond yields possess great signalling abilities about inflation path and economic direction.

- A rise in yield indicates a rise in interest rates in the economy.

- Yields also reflect the status of the centre’s market borrowing to fund its expenditure.

- Higher yields raise borrowing costs for the governments and companies, hurting their ability to service debt and makes new investments.

- This has a limiting effect on their profits and stock prices.

How is G-SAP different from the regular Open Market Operations (OMOs)?

- The RBI intermittently purchase Government bonds from the market through Open Market Operations (OMOs). The G-SAP is in a way an OMO but there is a commitment by the central bank to the markets that it is certainly going to purchase bonds worth a specific amount. The intention is to give comfort to the bond markets. In other words, it can be said that G-SAP is an OMO with a ‘distinct character’.

Open market operations (OMO): It is an act by the central bank of buying or selling short-term Treasury’s and other securities in the open market to keep a check on the money supply, thus affecting the short-term interest rates. - The RBI has said that the positive externalities of G-SAP 1.0 operations can be looked at in the backdrop of those segments of the financial markets that rely on the G-Sec yield curve as a pricing benchmark.

Definition of Positive Externality: This occurs when the consumption or production of good results in a benefit to a third party. Ex: When one consumes education, it gets a private benefit. But in the whole process, there are also benefits to the rest of society.

What other benefits does the G-SAP offer?

- The market is always interested in knowimg the Open Market Operations (OMO) purchase calendar of the RBI, and now it has been provided to the market through this announcement on G-SAP.

- It will provide comfortto the bond market participants with regard to RBI’s commitment to support the bond market in this fiscal year (FY22).

- A structured purchase program will definitely settle the investor's nerves and help market participants to bid better through scheduled auctions and reduce the instability in bond prices.

- The structured programme will help reduce the gap between the repo rate and the 10-year government bond yield. That, in turn, will help to reduce the cost of borrowing for the Centre and states in this fiscal year (FY22).

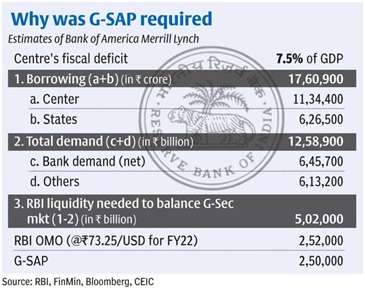

Why G-SAP?

Government borrowing plays an important role in the government's finances to meet its spending requirements to meet its fiscal targets.

- The G-SAP 1.0, has promised to buy government bonds worth ?1 lakh crore from the secondary market in the first quarter of 2021-22 to ease the bond markets. Yields of 10-year bond yields, that had floated around 5.90% prior to the Union Budget had shot higher past 6.20% since then, mainly due to the large central government borrowing of ?12.03 lakh in FY22.

What Is a Secondary Market?

It is a place where the investors buy and sell securities from other investors. Examples of popular secondary markets are the National Stock Exchange (NSE), the New York Stock Exchange (NYSE), the NASDAQ, National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

- This excessive liquidity was dragging bond prices lower and pushing yields higher.

- RBI hopes that with this purchase, yields on long term G-secs, which had spiked beyond 6 per cent in the last couple of months, will cool down.

- The economy is seemingly recuperating from the pandemic, the RBI through its liquidity measures also wants to ensure that the banks loosen their purse strings and needy segments of the economy get credit at reasonable rates. Their plan is to do this by TLTRO mechanism to ensure to keep a check on the right amount of liquidity in the economy and keeping an eye over the growth too.

The TLTRO or Targeted Long Term Repo Operation, allows banks to borrow money from the RBI at the repo rate to lend to companies (targeted sectors) and NBFCs. - But this time we are also observing an “Operation Twist”.The RBI is buying up long-term government bonds and selling short-term ones so that,borrowing costs didn’t go up.

How does increased government borrowing affect government finances?

- The interest obligation on its past debt forms a big part of the government's fiscal deficit. If the government resorts to increasing its borrowings, more than what it has projected, then its interest costs also go up which may bring a higher fiscal deficit into the picture.

- It badly hurts the government's finances and its prospective investment plans. A larger borrowing programme increases its public debt. Also, during the current times when the GDP growth is subdued, it will lead to a higher debt-to-GDP ratio.

Conclusion:

There seems a conflict between the RBI’s role as inflation warrior and that as an expediter of government borrowings. So, the G-SAP programme is meant to ensure there’s an ‘orderly evolution of the yield curve’, keeping in mind the present state of the economy which definitely requires cheaper money and the need of government which has to do the borrowing to manage its fiscal deficits. Dynamics of the character that RBI has to playas an in-charge of financial stability makes its job more challenging.