Recent public spat between RBI and central government over interference of later in policy formulation of RBI has drawn criticism. The recent impasse between RBI and the government arises from a recent ill-timed and ill-advised speech by RBI deputy governor Viral Acharya. The speech followed some unnecessarily tough posturing from the government, threatening to invoke the dreaded Section 7 of the RBI Act.

Issue

Context:

Recent public spat between RBI and central government over interference of later in policy formulation of RBI has drawn criticism. The recent impasse between RBI and the government arises from a recent ill-timed and ill-advised speech by RBI deputy governor Viral Acharya. The speech followed some unnecessarily tough posturing from the government, threatening to invoke the dreaded Section 7 of the RBI Act.

CONTRADICTING VIEWS OF RBI AND GOVERNMENT

- Demonetisation:

RBI had to take blame for demonetization chaos which caused many deaths, problems of law and order and delay in proper rolling out of newly printed currency due to mismanagement. - CVC report on Nirav Modi case

CVC report in Nirav Modi case had blamed RBI for poor auditing. CVC had already warned about the misuse of Letter Of undertaking (LoU) which was ignored by central bank. - Opposition of “ Project Shashakt”

RBI had opposed Project Shashakt which was forcibly implemented by central government later.

Project Shashakt:

- Project Shashakt aims to resolve the problem of stressed assets of public sector banks through resolution of bad loans, depending on their size. It includes an SME approach, a bank-led resolution approach, an asset management company (AMC)/ alternate investment fund (AIF)-led approach, an NCLT / IBC-led approach and an asset trading platform approach.

- India’s Public Sector Undertaking (PSU) banks make up 70 per cent of the total bad loans of banking industry.

- Opposition to setup payment regulator outside RBI

- RBI had opposed government’s bid to setup an independent payment regulator outside RBI.

- The Payment and Settlement System (PSS) Act had recommended that the payments regulator should be an independent regulator with the chairperson appointed by the government in consultation with the RBI. This had been opposed by the central bank, which wants the chairperson to be from the central bank with a casting vote.

- For providing liquidity through capital reserves

The government had sought the governor’s views on using RBI’s capital reserves for providing liquidity. This was declined by the governor. - Withdrawal of prompt corrective action

Government wanted RBI to withdraw Prompt Corrective Action for public sector banks for easing constraints on banks for loans to small and medium enterprises (SMEs). IMF has also suggested the same for revival of banking sector.

Provisions of Government’s interference in RBI’s governance:

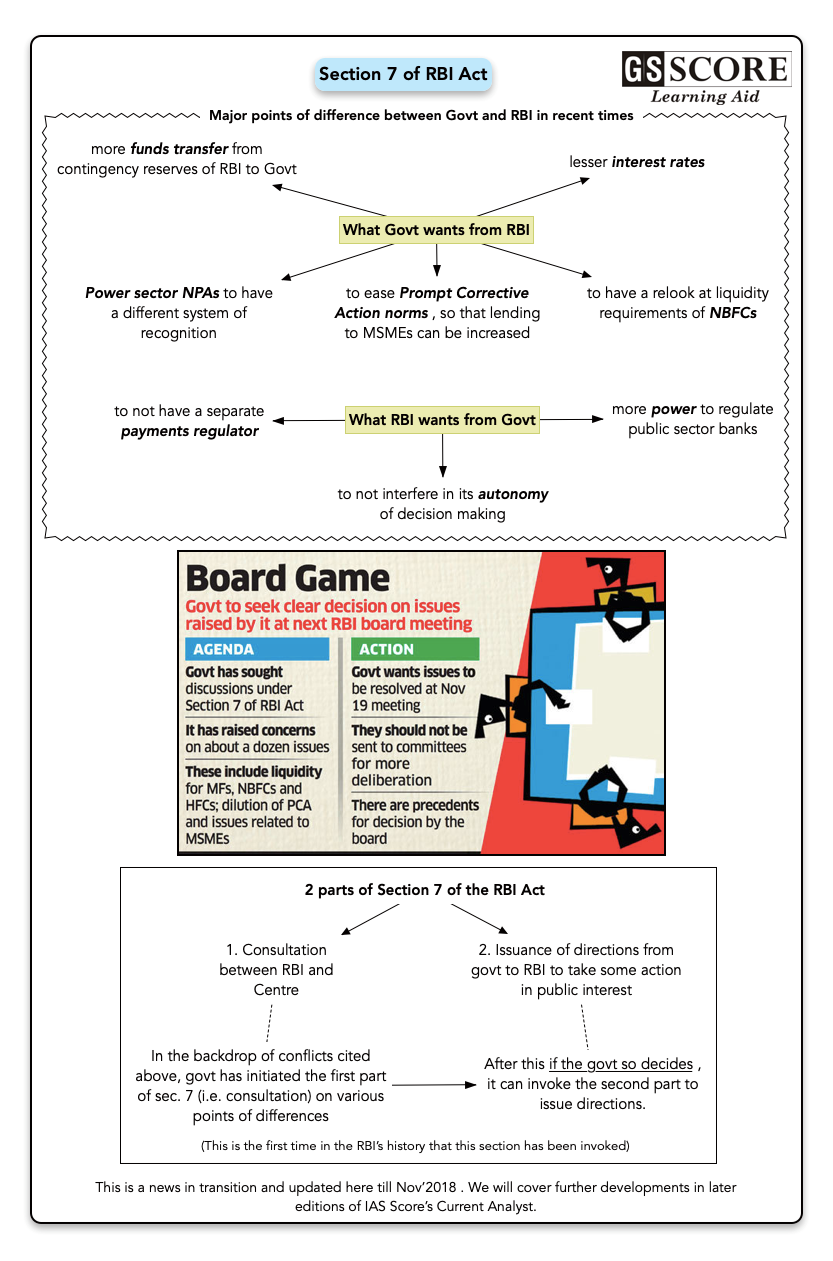

- According to the RBI Act’s Section 7 (1), “the central government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest”

- The Allahabad high court, in a judgment in August, said the government could issue directions to RBI under Section 7 of RBI Act.

- However, the government has only initiated consultations with RBI on different issues under Section 7 (1) and not invoked it.

Analysis

Has Government really crossed its executive powers in this case?

- First instance: During the hearing of a case filed by the Independent Power Producers Association of India in Allahabad high court challenging RBI’s circular regarding exemption to power companies in certain cases, court said that government could issue directions to RBI under Section 7 of RBI Act. Hence, government was only following guidelines by the court.

- Second instance: The government sought the governor’s views on using RBI’s capital reserves for providing liquidity.

- Third instance: It pertained to regulatory issues, which includes withdrawal of Prompt Corrective Action for public sector banks, thus easing constraints on banks for loans to small and medium enterprises (SMEs).

In all the above cases the government has only initiated consultation process with RBI on different issues under Section 7 (1) and not invoked it. Hence, it can be said that government has only used its power under RBI act to advise the central bank.

Way forward:

The RBI believes it is protecting hard-earned reserves from politicians who are likely to fritter it away. The elected government believes that it represents the public interest and no unelected technocracy should usurp that function. The government is after all the 100% shareholder, and the central bank’s rating is clearly bounded by the sovereign rating.

The best way to bridge the two is to organize a conditional release of reserves. For example, One condition could be that it should only be used to recapitalize banks. Another could be a pre-designed advance payment of annual dividend. Finally, it could be a reserve-for-share swap where the government gives the RBI shares in non-bank public sector units (PSUs) in return for excess reserves.

Concomitant with recapitalization of PSU banks should be a timetable for governance reform—granting the RBI the authority to regulate PSU banks and creating a government bank holding company that permits a series of board and management changes in PSU banks so that the current problem is not repeated.

Learning Aid

Practice Question:

Independence and autonomy of institutions like RBI is critical for India. However, these can’t happen over large public interest. Examine.