Context

India's current account deficit (CAD) is expected to hit a 36-quarter high in the June quarter.

About

Details:

- India's current account deficit likely widened to its highest in nearly a decade in the April-June quarter.

- Worsening global factors has led to expensive imports, which has taken a toll on India's trade deficit. It is the highest since the global financial crisis of 2008.

What is a Current Account Deficit (CAD)?

- The current account deficit is a measurement of a country’s trade where the value of the goods and services it imports exceeds the value of the products it exports.

- CAD comprises a trade account (imports and exports of merchandise goods), services account (imports and exports of services), and net income from abroad (such as remittances).

- Out of these three components, the dent to CAD is our trade account. The surplus in the services account and net income from abroad are smaller in comparison to the deficit in the trading account.

Looking deeper into the components of CAD:

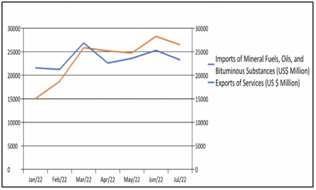

- Mineral fuels, oils, and bituminous substances form the largest component of India’s imports and it outweighs total service exports.

- The trade deficit has further increased on account of a stronger US dollar (that is, a depreciating rupee) and a rise in the price of crude oil in the international market.

- Apart from mineral fuels, another product category that has contributed most to the rising CAD is Natural or Cultured Pearls, Semiprecious Stones, Diamonds, and Gold.

- This category – comprising as the name says, pearl, diamonds, and semiprecious stones – suffered because of the Russian invasion of Ukraine. Due to a shortage in supply of rough diamonds and semiprecious stones from Russia, India had to import similar items from high-cost supplying countries in Africa.

Controlling CAD is important for the following two reasons:

- It has an important implication on growth as it is closely related to national investment and saving.

- It affects exchange rates and hence the export competitiveness of a given economy.

What happens if the current account deficit keeps worsening?

- Depreciation of Rupee: Due to the ballooning current account deficit, the demand for foreign currency will rise, leading to the depreciation of the home currency.

- Depleted foreign exchange reserves: The Reserve Bank of India will continue to defend against the fall of the rupee from the mighty dollar's rise and this depletes the forex reserves. It is expected that the reserves will fall to $523 billion by end of this year.

- Rise in imported inflation: Another aspect of the depreciating rupee is the rise in imported inflation, which in turn, leads to an uptick in broad-based inflation in India.

- Costlier Imports: The depreciating rupee has made imports costlier, therefore, for a country like India, which imports costly items and commodities like crude oil, semiconductors, and electronic goods, the burden on the exchequer is rising and this is pushing the current account deficit higher.

- Flight of Capital: The depreciating currency and rising current account deficit will lead to a capital flight away from India.

- It is also going to affect investor sentiments and macroeconomic stability.

- For the currency to be stable, it is important to keep the current account deficit in check. Usually, the current account deficit widens due to higher trade deficits.

How CAD can be handled?

- The Current Account Deficit could be reduced by boosting exports and curbing non-essential imports such as gold, mobiles, and electronics.

- The RBI ensures that the rupee does not fall sharply, as this could increase inflation in the economy. It conducts periodic ‘intervention’ in the foreign exchange markets by selling foreign currency and buying the rupee.

- Currency hedging and bringing easier rules for manufacturing entities to raise foreign funds could also help.

- The government and RBI could also look to review debt investment limits for FPIs, among other measures.