Context

Energy security and shift to a green future have put the focus on rare earth elements. However, India is import dependent on critical minerals. Thus, it needs “mining reforms, US partnership”.

Background

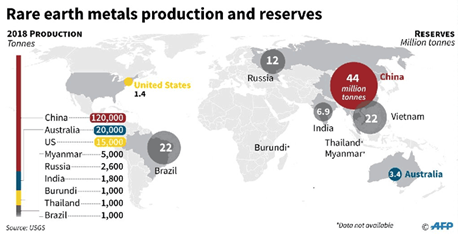

- China is one of the leading producers globally of critical minerals, with an estimated 70 percent of the global production.

- In order to break the dominance and reduce dependence on China in mining and processing rare earth minerals, the United States recently announced the formation of a global alliance called the Mineral Security Partnership (MSP).

- Apart from the US, the other countries to have joined this partnership are: Australia, Canada, Finland, France, Germany, Japan, the Republic of Korea, Sweden, the UK, and the European Commission.

- Apart from the US, the other countries to have joined this partnership are: Australia, Canada, Finland, France, Germany, Japan, the Republic of Korea, Sweden, the UK, and the European Commission.

Analysis

What is Minerals Security Partnership (MSP)?

|

Members Australia, Canada, Finland, France, Germany, Japan, the Republic of Korea, Sweden, the United Kingdom, the United States, and the European Commission |

- MSP is an ambitious new alliance formed by the US to secure supply chains of critical minerals.

- The goal of the alliance is to ensure that critical minerals are produced, processed, and recycled in a manner that supports the ability of countries to realise the full economic development benefit of their geological endowments.

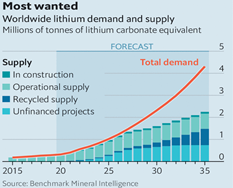

- The focus would be on the supply chains of minerals such as Cobalt, Nickel, Lithiumand also the 17 “rare earth” minerals.

- However, India is not a part of this partnership.

What is the aim of MSP? (Decrease Dependency On China For Critical Minerals)

- China is responsible for around half of the worldwide production of rare earth minerals.

- According to the US Geological Survey, 38 per cent of world production of rare earth minerals in 1993 was in China, 33 per cent in the US, 12 per cent in Australia, and five per cent each in Malaysia and India.

- However, China accounted for more than 90 per cent of the world production of rare earth minerals in 2008. By 2011, China accounted for 97 per cent of world production.

- Since 1990, supplies of rare earth minerals became an issue because the Chinese government began to change the amount of rare earth minerals it allows to be produced and exported, and also started limiting the number of Chinese and Sino-foreign joint venture companies that could export rare earth minerals from China.

- The MSP is aimed at reducing dependency on China for rare earth minerals, according to media reports.

- Both the MSP and the Australia-India Critical Minerals Investment Partnership are aimed at unlocking the benefits of the critical minerals sector.

|

Australia-India Critical Minerals Investment Partnership

|

What Are Critical Minerals?

- Critical minerals are mineral resources that are essential to the economy, and whose supply may be disrupted, and the 'criticality' of which changes with time as supply and society's needs change.

What are Rare Earth metals?

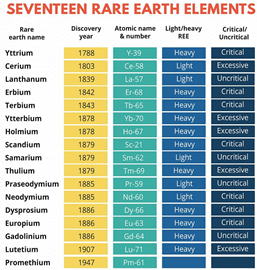

- The 17 rare earth elements (REE) include the 15 Lanthanides (atomic numbers 57 — which is Lanthanum — to 71 in the periodic table) plus Scandium (atomic number 21) and Yttrium (39).

- REEs are classified as

- light RE elements (LREE)

- heavy RE elements (HREE)

- They were discovered in 18th-19th century, with Yttrium being the first and Promethium the last discovered rare earth element.’

|

India’s position on Rare earth metal production

|

Why these metals are ‘rare’ and ‘significant’?

- REEs are an essential — although often tiny — component of more than 200 consumer products, including mobile phones, computer hard drives, electric and hybrid vehicles, semiconductors, flat screen TVs and monitors, and high-end electronics.

- They are known as "rare" because it is very unusual to find them in a pure form, but it turns out there are deposits of some of them all over the world - cerium, for example, is the 25th most common element on the planet.

- The term "earth" is simply an archaic term for something you can dissolve in acid.

India’s concerns

- Some of the rare earth elements available India are: Lanthanum, Cerium, Neodymium, Praseodymium and Samarium. While others classified as heavy RE elements such as Dysprosium, Terbium, Europium are not available in extractable quantity.

- India relies heavily on China for HREE, which is one of the leading producers with an estimated 70 per cent of the global production.

- Hence, there is a lot at stake for India.

- Therefore, India wants to explore the possibility of how it can join the 11-member group.

|

The plan

|

Conclusion

Although the two countries have different resource endowments and capabilities, their green future has potential to build a more developed, resilient and sustainable clean energy supply chain.