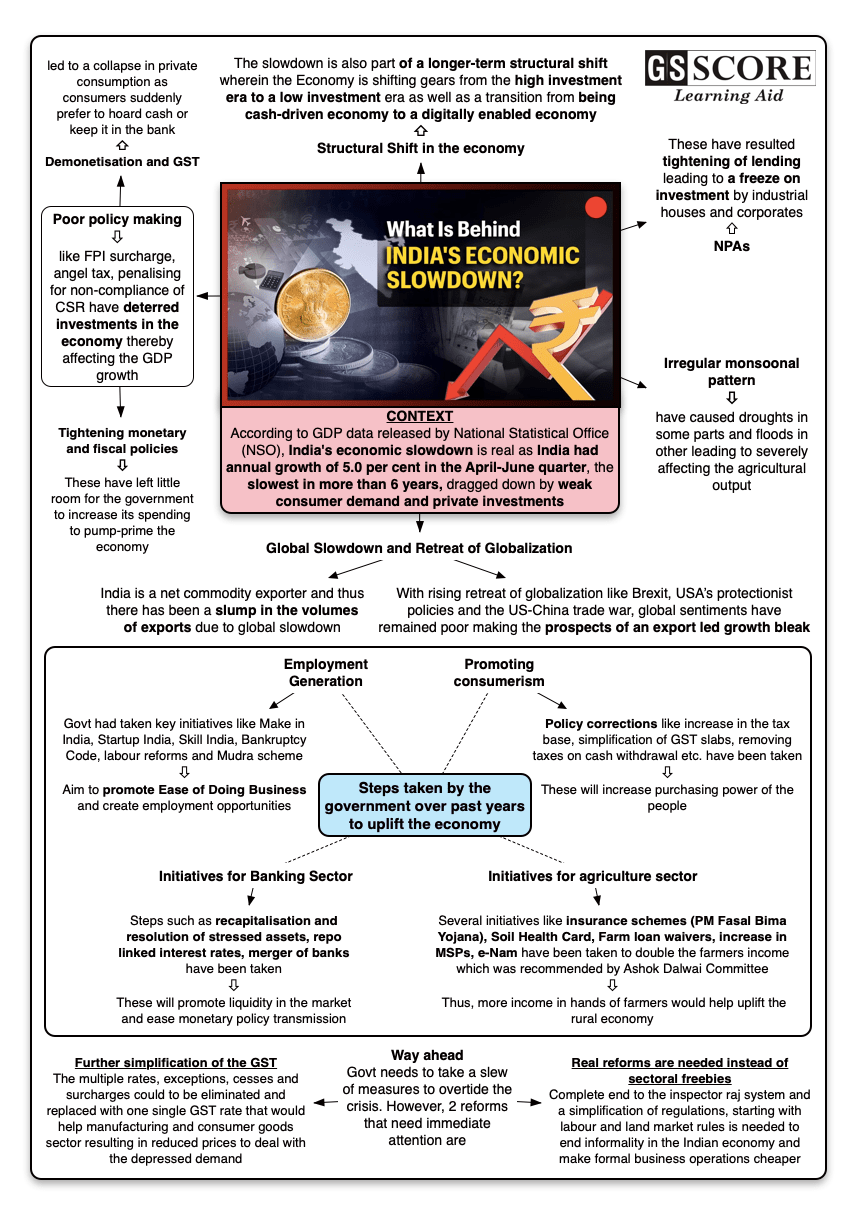

According to GDP data released by National Statistical Office (NSO), India's economic slowdown is real as India had annual growth of 5.0 per cent in the April-June quarter, the slowest in more than 6 years, dragged down by weak consumer demand and private investments.

Issue

Context

According to GDP data released by National Statistical Office (NSO), India's economic slowdown is real as India had annual growth of 5.0 per cent in the April-June quarter, the slowest in more than 6 years, dragged down by weak consumer demand and private investments.

Background

- India has been one of the fastest growing large economies in the world and today is considered as the world’s seventh-largest economy by nominal GDP and the third-largest by purchasing power parity.

- According to several studies, India’s growth rate should stabilise at 8% during the next decades, ranking the country as the world’s fastest-growing economy.

- However, India’s deepening slowdown has now left the economy on the verge of stalling.

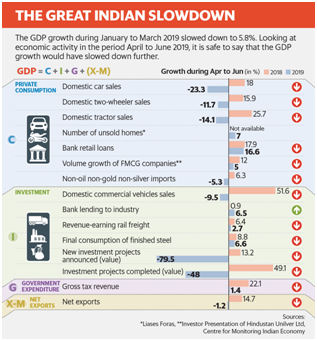

The great Indian Slowdown

- The figure below compares a series of 15 economic indicators and reflects how the economic activity during the period April to June 2019 has slowed down.

Analysis

Reasons for current economic slowdown in India

- Poor policy making like FPI surcharge, angel tax, penalising for non-compliance of Corporate Social Responsibility (CSR) have deterred investments in the economy thereby affecting the GDP growth.

- Tightening monetary and fiscal policieshaveleft little room for the government to increase its spending to pump-prime the economy.

- NPAs of Banks and Too Much Debt on corporates affecting investment cycle- NPAs haveresulted tightening of lendingleading to a freeze on investment by industrial houses and corporates. The IL&FS crisisalso triggered the Non-Banking Financial Companies' (NBFC) credit crunch in 2018..

- Global Slowdown and Retreat of Globalization-

- India is a net commodity exporter and thus there has been a slump in the volumes of exports due to global slowdown.

- With rising retreat of globalization like Brexit, Trump’s protectionist policiesand the US-China trade war, global sentiments have remained poor making the prospects of an export led growth bleak.

- Structural Shift in the economy - The slowdown is also part of a longer-term structural shift wherein the Economy is shifting gears from the high investment era to a low investment era as well as a transition from being cash-driven economy to a digitally enabled economy.

- Irregular monsoonal pattern causing droughts in some parts and floods in another has severely affected the agricultural output, transportation facilities leading to imbalance in trade of commodities thereby affecting the economic growth.

- Demonetisation and GST has led to a collapse in private consumption as consumers suddenly prefer to hoard cash or keep it in the bankand investmentshave also been affected mainly by thesmall and medium businesses (SMEs)as they are forced to withhold inventories until they are compliant with the new rules and regulations.

Steps taken by the government over past years to uplift the economy

- Promoting consumerism – Policy corrections like increase in the tax base, simplification of GST slabs, removing taxes on cash withdrawal etc. have been taken to increase purchasing power of the people.

- Agriculture – Several initiatives like insurance schemes (PM Fasal Bima Yojana), Soil Health Card, Farm loan waivers, increase in MSPs, e-Nam have been taken to double the farmers income which was recommended by Ashok Dalwai Committee.Thus, more income in hands of farmers would help uplift the rural economy.

- Banking Sector –Steps such as recapitalisation and resolution of stressed assets, repo linked interest rates, merger of banks have been taken to promote liquidity in the market and ease monetary policy transmissions.

- Employment Generation in various sectors - The Government had taken key initiatives likeMake in India, Startup India, Skill India, Bankruptcy Code, labour reforms and Mudra scheme topromote Ease of Doing Business to create employment opportunities.

Way forward

- Further simplification of the GST -The multiple rates, exceptions, cesses and surcharges need to be eliminated and replaced with one single GST rate that would help manufacturing and consumer goods sector resulting in reduced prices to deal with the depressed demand.

- Real reforms are needed instead of sectoral freebies - Complete end to the inspector raj system and a simplification of regulations, starting with labour and land market rules is needed to end informality in the Indian economy and make formal business operations cheaper.

- Devise new ways to both, revive the agriculture and boost rural consumption.

- There is a need to infuse liquidity in the system for capital formation

- Recognise new exports opportunities emerging because of America-China trade war.

Learning Aid