Objectives:

- The IBC provides comprehensive legal framework for insolvency and bankruptcy proceedings which has completed 7 years since its introduction as IBC code in 2016.

- Establishing a consolidated framework for insolvency resolution of corporations, partnership firms and individuals in a time-bound manner, seeks to tackle the non-performing asset (NPA) problem in two ways.

Need of IBC: Historical Background

- Earlier existing mechanism such as were complex, fragmented And overlapping authority hindering the resolution proceedings.

- Acts such as Companies act. 1956, the Sick Industrial Companies (Special Provisions) Act, 1985, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act), the Recovery of Debts due to Banks and Financial Institutions Act (RDDBFI Act), 1993 and others were available to deal with insolvency proceedings.

- They generally dealing with the broad guideline and mechanism while insolvency procedures require the time bound resolutions in more specified manner considering the rising

|

Basics Background of Insolvency Mechanism: why IBC and how? India’s NPA ratio is among the highest with comparable countries.(5.9% as of 2022) Additionally Twin Balance sheet problem were hampering the economy and health of Banks. IBC Provides the Basic solutions to these Major Issues which hammers Indian economy growth Non-performing Assets (NPA): When a person delays the payment of the loan or an amount which was due on him through the delay in payment in either interests or installments or principal amount, that particular loan or amount is termed as Non-Performing Asset. Any defaulted or arrears loans or advances will be categorized as non-performing assets (NPA) when it completes the period of 90 days without repayment |

Three major types of NPA based on Non Repayment Period

|

Substandard Assets |

Assets which are NPA for a period of less than or equal to 12 months |

|

Doubtful Assets |

Assets which are substandard category for a period of 12 months |

|

Loss Assets |

Assets which have very low value, it can no longer continue as a bankable asset, there could be some recovery value. |

Insolvency Mechanism

IBC, a framework for initiating an insolvency resolution process when a debtor is unable to pay its debts. It consist of a two-step process for corporate debtors facing insolvency with a minimum default amount of Rs. 1,00,00,000.

Step1: Insolvency Resolution Process: It is creditor led process that evaluates various options for the company’s revival and take n necessary measures accordingly.

Step2: Liquidation: If revival attempts fail or unviable, creditors can opt for winding up the company. At this stage debtor’s assets are distributed among the creditors in accordance with the Code’s provisions.

Philosophy Behind introduction

- To streamline and expedite the insolvency resolution process in India.

- Inculcate behavioural change to debtors to ensure sound decision-making and to stabilise the Businesses

- To give right to recovery of debt in speedy and holistic manner to creditors

- Focuses from debtor-in-control’ to ‘creditor-in-control’.

- To resolve non-performing loans at debtor, a major concern for creditor.

Institutional Framework:

Insolvency and Bankruptcy Board of India (IBBI)

- It works as the regulator for Insolvency Professionals, Insolvency Professional Agencies, Insolvency Professional Entities and Information Utilities.

- It also writes and enforces rules for processes, corporate insolvency resolution, corporate liquidation, individual insolvency resolution and individual bankruptcy under the Code.

- It members includes the Reserve Bank of India, as well as the Ministries of Finance, Corporate Affairs, and Law.

Insolvency Professionals: A specialized group of licensed professionals, they manages the resolution process, assess debtor’s assets value and provides essential information to creditors to for informed decision making

Insolvency Professional Agencies: Insolvency professionals are affiliated under insolvency professional agencies. It conducts the exams and enforces a code of conduct for IPs

Information Utilities: They records the debts own to debtor which is informed by the creditors, it includes information includes comprehensive records of debt, liabilities, and defaults.

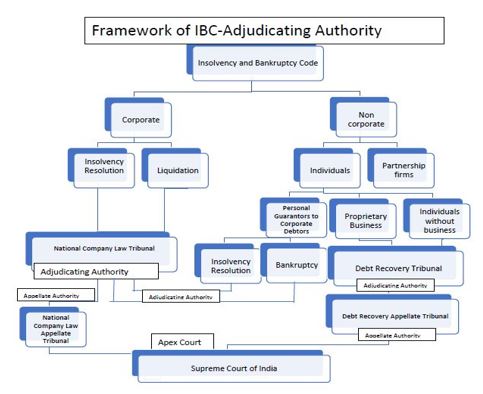

National Company Law Tribunal (NCLT):

- It is the sole Adjudicatory Authority responsible for handling all corporate insolvency proceedings under the Insolvency and Bankruptcy Code.

- No other court or tribunal has the power to grant a stay against actions initiated before the NCLT.

- Appeals against NCLT orders are directed to the National Company Law Appellate Tribunal (NCLAT), and any further appeals from NCLAT order can be file in the Supreme Court of India.

- It strictly removes the jurisdiction of civil courts concerning matters governed by the Code.

National Company Law Appellate Tribunal (NCLAT):

It is the adjudicating authority which listens the Appeals against NCLT orders and any further appeals from NCLAT orders are heard by the Supreme Court of India. The Code explicitly removes the jurisdiction of civil courts concerning matters governed by the Code.

Committee of Creditors (COCs): It is formed by the Interim Resolution Professional once the Corporate Insolvency Resolution Process(CIRP) is initiated against a Corporate Debtor. Committee of Creditors (CoC) is a committee consisting of Financial Creditors of the Corporate Debtor.

Key Stakeholders:

Creditors:

Under the Insolvency and Bankruptcy Code, 2016, a “creditor” means any person to whom a debt is owed, and includes among others, a financial creditor, an operational creditor, a secured creditor, and an unsecured creditor.

- Financial creditors: Financial Creditor-As per Section 5(7) “financial creditor” means any person to whom a financial debt is owed. As per Section 5(8) of the Code, “financial debt” means a debt along with interest, if any, which is disbursed against the consideration for the time value of money.

- operational creditors: As per Section 5(20), “operational creditor” means a person to whom an operational debt is owed and includes any person to whom such debt has been legally assigned or transferred;

- secured creditor: Section 3(30) of the IBC defines to mean a creditor in favour of whom security interest is credited.

- Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor’s property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.

- Deep haircuts – it includes writing off loans and accrued interest on the loan. The illustration below gives a glimpse of the so-called haircuts, which is actually a part of the loss to FCs.

Case studies

- NCLT led resolution plan resulted in the 92% recovery of debt resulted in deep haircut (Reliance Communications Infrastructure Ltd. (RCIL)).Additionally It has taken four years to complete the Resolution Plan (RP) as against the stipulated maximum of 330 days.(these are the deep haircuts)

- only 5% of the loan been recovered by the banks(Videocon case)

Current issues in effective IBC Implementation

- 60% of the IPs inspected were found to be indulging in malpractices.(finding of parliament committee on finance )

- Slow disciplinary action on 123 Insolvency Professionals (IPs) out of 203 inspections conducted till date.

- Delays in Repayments :During the resolution plan approval, only about 15% is paid by the purchaser and the repayment takes years without any further interest collected by the banks, according to the (RBI’s financial stability report)

- An increase in the average resolution time from 324 to 653 days versus the stipulated 330 days

- Lack of digitisation of the IBC ecosystem. It led to the insolvency process beyond the statutory limits.

- Deep Haircuts: cases such as haircuts of as much as 95 per cent are being granted during the insolvency resolution.

- Piling up of Backlogs : 13,000 cases stuck in various stages of IBC resolution, significant delay in the pre-IBC admission stage (650 days in fiscal 2022 increased from about 450 days in fiscal 2019)

- lack of Clear Definition It leads the vague interpretation of the code’s provisions and the absence of clear precedents have posed challenges.

- Different interpretations It includes i NCLTs, appellate tribunals, and higher courts, have created ambiguity and inconsistency, leading to prolonged litigation and delays in resolving cases.

Recent Positives amendments and achievements

- Now IBC allows approval for sale of assets/resolution plan on a segregated basis.

- the number of National Company Law Tribunal benches increased

- Sector-specific amendments, provision for audit of corporate debtor, and modifications in Form-G2 will also improve the process

- A whopping 18,629 applications seeking more than ?5,29,000 crore are noted to have been resolved even prior to being admitted.

- Post the implementation of IBC, as per the World Bank’s report, India’s rank in resolving insolvency went from 136 in 2017 to 52 in 2020.

Important supreme court judgments

- SC in Mobilox Innovations Vs Kirusa held that the operational debt should be free from any pre-existing dispute.

- The Supreme Court in Kridhan Infrastructure Vs Venketesan Sankaranarayan, held that the insolvency resolution should not suffer from an indefinite delay without any legitimate cause wrt. the timelines fixed under the IBC.

- The IBC also bars certain individuals from submitting a resolution plan The Supreme Court in Chitra Sharma Vs Union of India held that it ensures no backdoor entry in CRIP proceedings.

- Though the National Company Law Tribunal (NCLT) is endowed with broad residuary jurisdiction under the IBC to decide upon all questions. However SC in the Jaypee Kensington case held that there was no scope for interference with the commercial wisdom of the CoC. If an adjudicating authority found any shortcomings it has to send back to the CoC for re-submission.

Way forward

- IBC Requires improved operational infrastructure, providing clarity in legal interpretation.

- It should ensure simple procedures, developing a robust insolvency ecosystem.

- To ensure effective insolvency, robust mechanisms for cross-border insolvency should bew in place.

- The RBI must also implement its own earlier decision to have a maximum ceiling of credit to a single corporate house at ?10,000 crore.

- Continuous Improvement evaluation, stakeholder consultations, and timely amendments are necessary to overcome these challenges and make the IBC a more efficient and responsive framework for insolvency resolution in India.

- “The IBC’s effectiveness can be increased using CDE approach, where C stands for Capacity augmentation, D for Digitalisation and E for Expansion of pre-pack resolutions to large corporates.”(crisil)

- The government needs to cater appropriate budgetary allocations to upskilling insolvency professionals, improvement of tribunal infrastructure and digitisation of the insolvency resolution process.

Conclusion: Though IBC has undoubtedly revived India’s insolvency regime. It has also solved the twin problem of NPAs and deteriorating credit discipline.( ?2.5-lakh crore has been introduced back into the banking system from 2016 upon resolution of insolvencies under IBC). However, IBC also has areas that requires improvement such time bound resolution, exact value resolution (no deep haircuts) .