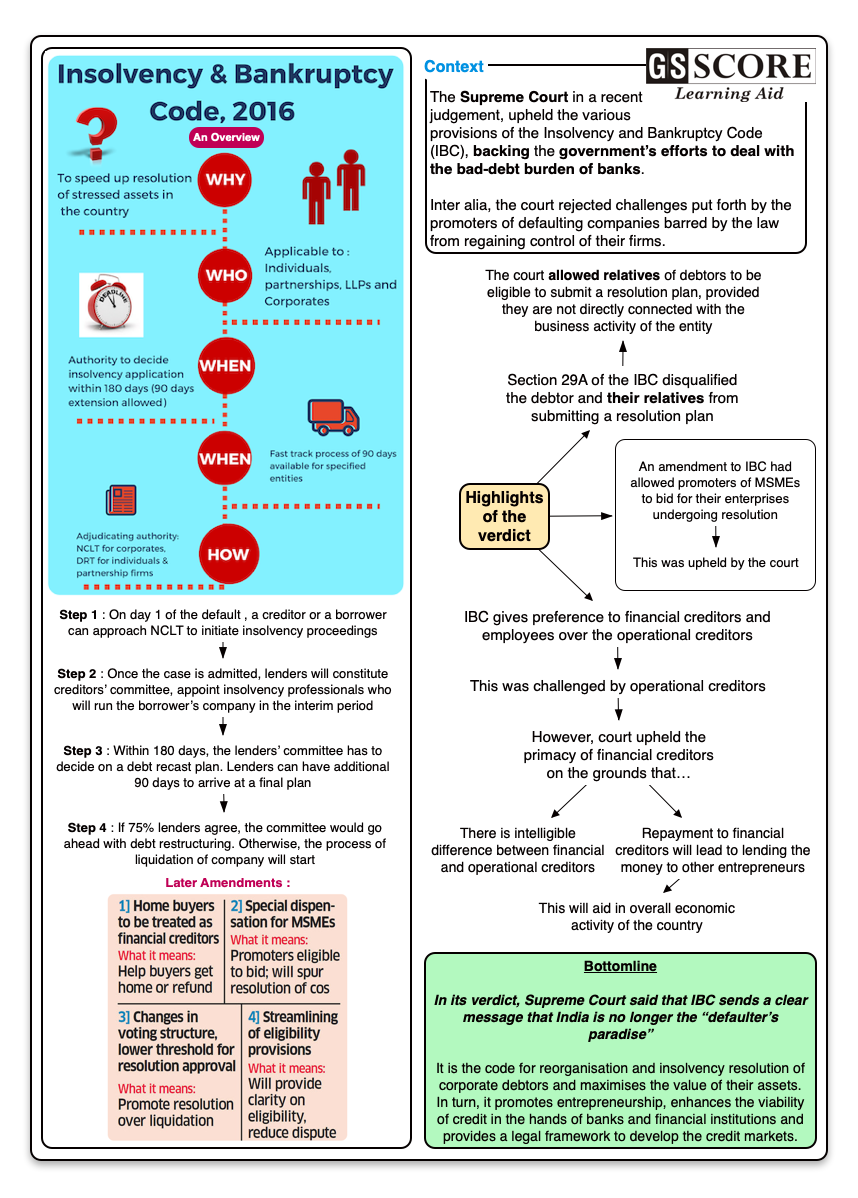

- The Supreme Court upheld the Insolvency and Bankruptcy Code (IBC), backing the government’s efforts to deal with the bad-debt burden of banks.

- The Court rejected challenges put forth by the promoters of defaulting companies barred by the law from regaining control of their firms.

Issue

Context:

- The Supreme Court upheld the Insolvency and Bankruptcy Code (IBC), backing the government’s efforts to deal with the bad-debt burden of banks.

- The Court rejected challenges put forth by the promoters of defaulting companies barred by the law from regaining control of their firms.

- This ruling has far-reaching implications for the promoters of big defaulting companies on the block such as Essar Steel and Bhushan Power & Steel.

About:

- Bhushan Power & Steel’s promoters had challenged the constitutional validity of Section 29A. Beleaguered firm's promoters, the Ruias, offered to repay around Rs 54,389 crore to all the lenders - or 100% of the debt it owes - and exit the insolvency process after the CoC had voted for ArcelorMittal's Rs 42,000-crore bid.

- The Ruias were depending on Section 12A of the IBC to bail them out. This section allows for a withdrawal of an insolvency application before the bidding process starts if 90% of the creditors' committee by voting share approves it.

Classification of financial creditors

- The Code defines two types of creditors: (I) financial creditors, who have extended a loan or financial credit to the debtor, and (ii) operational creditors, who have provided goods or services to the debtor, the payment for which is due.

- Financial creditors could be secured or unsecured. Secured creditors are those whose loans are backed by collateral (security).

- For example, person A decides to open a restaurant. He takes a loan from a bank to buy the property for the restaurant, using the property premises as the collateral. His friend B lends him some funds to manage the initial expenses, such as payment of salary to chefs and other support staff, buying produce, etc.

- In this example, the bank and friend B are financial creditors. The bank is a secured financial creditor since the loan is backed by a collateral (the restaurant premises), and friend B is an unsecured creditor. The chefs and staff at the restaurant are operational creditors. The supplier of produce is also an operational creditor.

Provisions questioned by the petitioners:

- IBC provides preferential treatment to financial creditors over operational ones (suppliers of goods).

- Operational creditors, such as the suppliers of products and services to bankrupt companies and contractors, have long complained of landing a raw deal under the IBC. Currently, the Committee of Creditors (CoC) constituted for bankrupt firms only comprise all financial creditors, like banks. And since operational creditors don't have a place in the CoC, they have no voting rights when the committee decides on what to do with an asset. That's why several operational creditors had moved the court arguing that the bankruptcy code violates Article 14.

Background behind Insolvency and Bankruptcy Code:

- In India, the legal and institutional machinery for dealing with debt default has not been in line with global standards. The recovery action by creditors, either through the Contract Act or through special laws such as the Recovery of Debts Due to Banks and Financial Institutions Act, 1993 and the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, has not had desired outcomes.

- Similarly, action through the Sick Industrial Companies (Special Provisions) Act, 1985 and the winding up provisions of the Companies Act, 1956 have neither been able to aid recovery for lenders nor aid restructuring of firms. Laws dealing with individual insolvency, the Presidential Towns insolvency Act, 1909 and the Provincial Insolvency Act. 1920 are almost a century old.

- This has hampered the confidence of the lender. When lenders are unconfident, debt access for borrowers is diminished. This reflects in the state of the credit markets in India. Secured credit by banks is the largest component of the credit market in India. The corporate bond market is yet to develop.

Analysis

Insolvency and Bankruptcy Code

- The code has four pillars of institutional infrastructure.

- The first pillar of institutional infrastructure is a class of regulated persons, the ‘Insolvency Professionals’. They would play a key role in the efficient working of the bankruptcy process. They would be regulated by ‘Insolvency Professional Agencies.

- The second pillar of institutional infrastructure is a new industry of `Information Utilities'. These would store facts about lenders and terms of lending in electronic databases. This would eliminate delays and disputes about facts when default does take place.

- The third pillar of institutional infrastructure is in adjudication. The NCLT will be the forum where firm insolvency will be heard and DRTs will be the forum where individual insolvencies will be heard. These institutions, along with their Appellate bodies, viz., NCLAT and DRATs will be adequately strengthened so as to achieve world class functioning of the bankruptcy process.

- The fourth pillar of institutional infrastructure is a regulator, ‘The Insolvency and Bankruptcy Board of India’. This body will have regulatory over-sight over the Insolvency Professional, Insolvency Professional agencies and information utilities.

The Insolvency and Bankruptcy Code (Second Amendment) Bill, 2018 – Key features:

- Allottees under a real estate project should be treated as financial creditors (debate is open for want of clarity over secured/unsecured creditors).

- The voting threshold for routine decisions taken by the committee of creditors has been reduced from 75% to 51%.

- During the insolvency resolution process, a committee consisting of financial creditors will be constituted for taking decisions (by voting) on the resolution process.

- The Code prohibits a person from being a resolution applicant if his account has been identified as a non-performing asset (NPA) for more than a year.

- The Code also bars a guarantor of a defaulter from being an applicant.

- A resolution applicant may withdraw a resolution application, from the National Company Law Tribunal (NCLT), after such process has been initiated. Such withdrawal will have to be approved by a 90% vote of the committee of creditors.

- The ineligibility criteria for resolution applicants regarding NPAs and guarantors will not be applicable to persons applying for resolution of MSMEs.

Insolvency resolution process:

- During a corporate insolvency resolution process, a committee consisting of all financial creditors is constituted to take decisions regarding the resolution process. This committee may choose to: (I) resolve the debtor company, or (ii) liquidate (sell) the debtor’s assets to repay loans. If no decision is made by the committee within the prescribed time period, the debtor’s assets are liquidated to repay the debt. In case of liquidation, secured creditors are paid first after payment of the resolution fees and other resolution costs. This is followed by payment of employee wages and then payment to all the unsecured.

Way forward:

- The existing Section 29(A) of the IBC, 2016 has also been fine-tuned to exempt pure play financial entities from being disqualified on account of NPA.

- Similarly, a resolution application holding an NPA by virtue of acquiring it in the past under the IBC, 2016, has been provided with a three-year cooling-off period, from the date of such acquisition (such NPA shall not disqualify the resolution application during the currency of the three-year grace period).

- IBC has ended “defaulters’ paradise” – as mentioned by the Supreme Court in this judgment.

- Hence it becomes crucial to facilitate smooth functioning of the code. Government has to bring all key players/stakeholders and bring out a detailed action strategy of the IBC.

Learning Aid

Practice Question:

Post Supreme Court’s judgment in the case of Essar Steel and Bhushan Power & Steel, the word in the economic corridors is that the “defaulters’ paradise” has ended. Do you think that IBC will hold ground and deliver where schemes like SARFAESI couldn’t? Substantiate your answer by including recent amendments moved by the government to the IBC 201