Context

The 15th Finance Commission has recommended maintaining States’ share in the divisible pool of tax collections at the same level of 42% for 2020-21.

Background

- To factor in the changed status of the erstwhile State of Jammu & Kashmir, the rate at which funds may be shared with the States has been reset at 41%.

- This is after adjusting 1 percentage point for the needs, including special ones of the two new Union Territories of J&K and Ladakh.

- An official said that the actual pool of funds available to States will be equivalent to what they were receiving from the 42% share granted by the 14th Finance Commission, as the number of States is now 28 instead of 29.

- The one percentage point reduction is what would have been earmarked for J&K as a State.

Main aspects of 15th finance commission

- Vertical Devolution: It recommends the distribution of the net proceeds of taxes of the Union between Union and the States.

- Horizontal Devolution: It allocates among the States the proceeds of the Vertical Devolution.

- Post Devolution Revenue Deficit Resources To Local Bodies: Article 280 (3) (bb) and Article 280 (3) (c) of the Constitution mandate the Commission to recommend measures to augment the Consolidated Fund of a State to supplement the resources of Panchayats and Municipalities based on the recommendations of the respective State Finance Commissions (SFCs). This also includes augmenting the resources of Panchayats and Municipalities.

- Grants: It has to look at the States, where the devolution alone could not cover the assessed gap. It takes into account the expenditure requirements of the States, the tax devolution to them and the revenue mobilisation capacity.

- Disaster Management: Allocations for disaster management are also done.

Recommendations for six years by the 15th Finance Commission

- 15th Finance Commission was appointed on November 27, 2017.

- Originally, it was to submit report by October 30, 2019 for five years i.e., for the period 2020-21 to 2024-25.

- Now, Finance Commission is submitting two reports. Interim Report for 2020-21 and the Main Report covering the period of five years beginning April 1, 2021 and ending March 31, 2026.

- The first report was placed in Parliament.

Why The Recommendation Period Is For Six Years This Time?

- Dimension 1: The abolition of Statehood to Jammu and Kashmir required the Commission to make an estimation excluding the Union Territory.

- Dimension 2:

- The deceleration in growth and low inflation has substantially slowed down the nominal GDP growth, which is the main tax base proxy.

- Making projections of tax revenues and expenditures based on this could have posed serious risks.

- Dimension 3: Moreover, poor revenue performance of tax collection and more particularly Goods and Services Tax, combined with the fact that the compensation agreement to the loss of revenue to the States was effective for only two years of the period covered by the Commission’s recommendations (till 2022) posed uncertainties.

Summary of the Recommendations

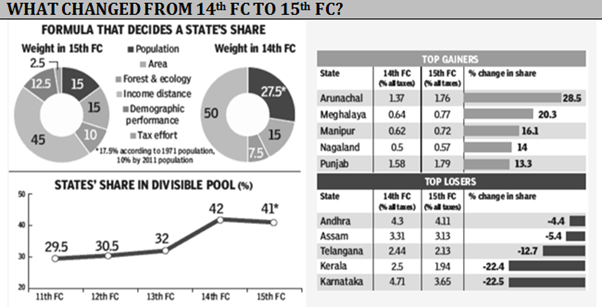

- Changes in the horizontal devolution methodology

- Major changes:

- In addition to income distance, population, area and forest cover, it has used two additional factors, demographic performance and tax effort.

- It assigned 15% weight to the 2011 population.

- It reduced the weight of income distance to 45%, it increased the weight to forest cover and ecology to 10%.

- Demographic performance is given 12.5% and tax effort is given 2.5%.

- Towards balancing

- By keeping the weight of 2011 population at 15% and giving additional 12.5% to demographic performance, which was the inverse of fertility rate, the Commission has shown sensitivity to the concerns of these States.

- Consequences

- In the relative shares in tax devolution, among the major States, the biggest loser is Karnataka. The other States which lost heavily include Uttar Pradesh, Kerala, Telangana and Andhra Pradesh.

- Kerala and Andhra Pradesh have post-devolution gaps and hence qualify for revenue deficit grants.

- What are the reasons?

- The major reason for Karnataka and Kerala losing on devolution is that their per capita income growth has been faster than most other States.

- The difference from the highest per capita income in both Karnataka and Kerala is just about 10% now as compared to 34% and 23%, respectively for the two States, when the 14th Finance Commission made the recommendation.

- Major changes:

- Revenue deficit grants

- It also recommended revenue deficit grants for the States, which had post-devolution gaps.

- It has not deviated from the past practice even though the terms of reference given to the Commission indicated, “The Commission may also examine whether revenue deficit grants be provided at all”.

- Grants to Panchayats

- The recommended grants for panchayats amount to Rs. 60,750 Cr.

- All the three layers of panchayats will receive the grant and 50% of the grant is tied to improving sanitation and supply of drinking water, the remaining is untied. However the 14th FC recommended one-tenth of the grants to be performance-based.

- Grants to municipalities

- In the case of municipal bodies, Rs. 9,229 Cr is allocated to cities with a million-plus population and the remaining Rs. 20,021 Cr is allocated to other towns.

- Disaster relief

- The Commission recommended the creation of Disaster Mitigation Fund at the Central and State levels.

- For disaster management, a total of Rs. 28,183 crore has been determined, of which the Central contribution will be Rs. 22,184 crore.

- Inter-State allocation is made based on past expenditures, area and population and disaster risk index.

Other sectoral recommendations

- For 2020-21, it has recommended Rs. 7,735 crore for improving nutrition, based on the number of children in the 0-6 age group and lactating mothers.

- It also proposed to give grants for police training, maintenance of the Pradhan Mantri Gram Sadak Yojana roads, strengthening the judicial system and improving the statistical system.

- It also presented a broad framework for recommending monitorable performance grants for agricultural reform, development of aspirational districts and blocks, power sector reforms and incentives to enhance trade including exports and pre-primary education.

Conclusion

The real challenge is to design and dovetail sectoral and performance grants with the existing plethora of Central Sector and Centrally Sponsored Schemes.