Context

Recently, after Rajasthan and Chhattisgarh, Punjab has become the latest State that has announced its plan to revert to the Old Pension Scheme (OPS) rather than to apply New Pension system which has attracted several criticisms around the country.

Background

- The history of the Indian pension system dates back to the colonial period of British-India.

- The Royal Commission on Civil Establishments, in 1881, first awarded pension benefits to the government employees.

- The Government of India Acts of 1919 and 1935 made further provisions.

|

Increasing population: The number of senior citizens increase – from 10.38 Crore in 2011 to an estimated 17.3 Crore in 2026 and 30 Crore in 2050. |

About

How Pension system works in India?

- All pension plans in India provide guaranteed maturity benefit. This is the reason why pension plans in India are also known as guaranteed pension plans.

- The maturity benefits are generally the fund value or 101% of Premium paid, whichever is higher.

|

Old pension Scheme (OPS): |

New Pension Scheme |

|

|

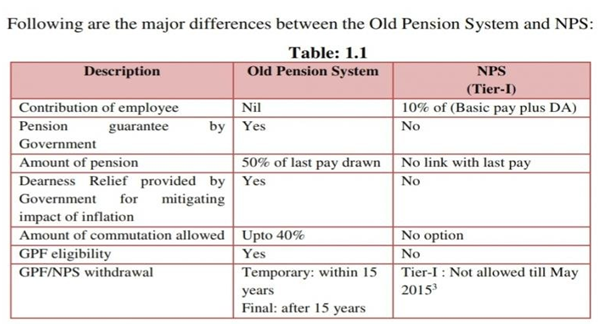

What are the issues associated with NPS?

- Low amount: The amount of monthly pension one would draw (for the same contribution during service) with three hypothetical market rates of return is significantly lower for NPS.

- Dependent on market price: It is dependent on the vagaries of the market prices of equity/bonds in which the corpus is invested. To be sure, the markets do not crash often and in the long run they go up rather than down.

- If there is a crash, the downside has to be absorbed by the retirees.

|

According to a 2008 OECD study, the global financial crisis had wiped a total of $5 trillion off the value of private pension funds in rich countries compared to the start of the year 2022. |

Why Old pension scheme is getting support from few State governments?

- The OPS is fixed government expenditure irrespective of an economic slowdown or a stock market crash, which makes it a good counter-cyclical policy measure during a crisis. In fact, the Sixth Pay Commission in India did precisely this during the Great Recession of 2008.

|

Reasons to shift from Old to New Pension scheme: |

Required interventions |

|

|