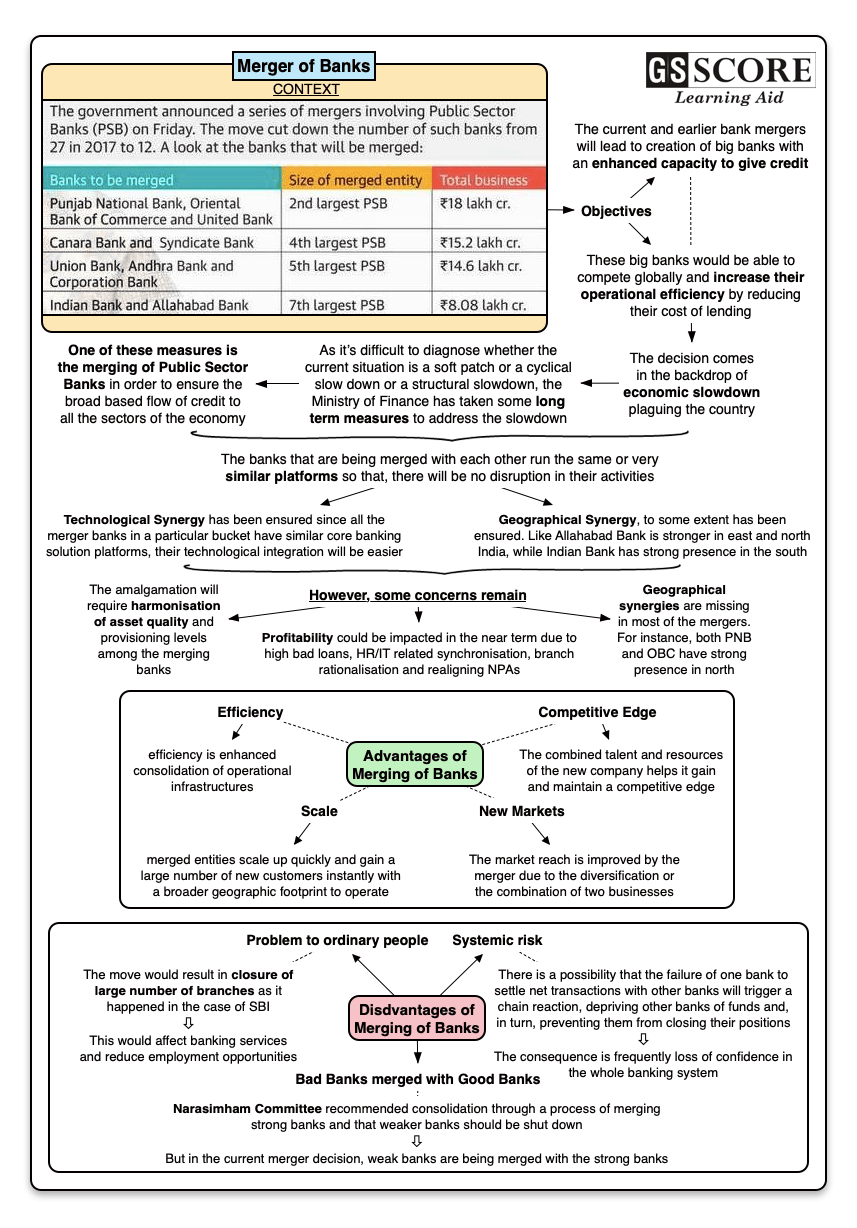

Finance Minister Nirmala Sitharaman had recently announced a slew of banking reform measures, including merger of 10 public sector banks into four entities.

Issue

Context

Finance Minister Nirmala Sitharaman had recently announced a slew of banking reform measures, including merger of 10 public sector banks into four entities.

Background

- After the second half of 2018, the global economic growth continues to get weaken in advanced as well as emerging market economies.

- Several forces responsible for this slowdown are: escalations of trade tensions, uncertainty over BREXIT, volatile crude prices, slowing down of Chinese Economy etc.

India’s Economic Scenario

- In this environment, India’s gross domestic product (GDP) growth rate slowed to a sixyear low of 5% in the first quarter of the 201920 financial year.

- This loss of speed of economic growth became evident with reduced private investments and consumptions, especially in the Fast-moving consumer goods (FMCG) sector. Investment demand also remained lacklustre and fixed capital formation grew 4%. Automobile production is also on an all time low.

- Moreover, Union Budget 2019 announced additional surcharges of Foreign Portfolio Investors due to which investors were pulling out their investments from the Indian shores.

- In this backdrop, Securities and Exchange Board of India and Ministry of Finance took a slew of short term measures to retain the investments and increase the private demand in the economy. Like increasing the depreciation rate for automobiles by 15%, keeping CSR violations only as a Civil Offence and not a criminal offence, front loading Public Sectors banks with a Rs. 70,000 Crore package etc. The government had also announced measures to support non-banking financial companies (NBFCs) and housing finance companies (HFCs).

- But since it is difficult to diagnose whether the current situation is a soft patch or a cyclical slow down or a structural slowdown, the Ministry of Finance took no time in taking some the long term measures to address the current economic slowdown.

- Another long term measures is the Merging of Public Sector Banks in order to ensure the broad based flow of credit to all the sectors of the economy..

- The decision is justified as the earlier merger of Bank of Baroda, Vijaya Bank and Dena Bank led to enhanced customization and rationalization of operations without any retrenchment.

Analysis

Current Merger Decision

- The decision would take the number of banks in the country from 27 in 2017 to 12.

- The banks that are being merged with each other run the same or very similar platforms, and so there will be no disruption in their activities.

- There will be no retrenchment due to these mergers.

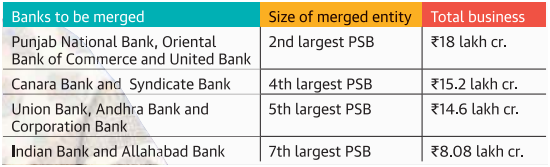

- The largest of the mergers announced is that of Punjab National Bank with Oriental Bank of Commerce and United Bank. The amalgamated entity — to be called Punjab National Bank — will become the secondlargest public sector bank in India, after the State Bank of India.

- The second merger announced was that of Canara Bank and Syndicate Bank, which would render the merged entity the fourthlargest public sector bank.

- The third merger is of Union Bank of India with Andhra Bank and Corporation Bank which would make the merged entity the fifth largest public sector bank.

- The fourth merger is of Indian Bank and Allahabad Bank.

- The merger process of 10 public sector banks is expected to be completed by March 31, 2020.

- Technological Synergy has been ensured since all the merger banks in a particular bucket have similar core banking solution platforms, their technological integration will be easier.

- Geographical Synergy, to some extent has been ensured. Like Allahabad Bank is stronger in east and north India, while Indian Bank has strong presence in the south.

Concerns while implementing the decision

- The amalgamation will require harmonisation of asset quality and provisioning levels among the merging banks.

- Due to high bad loans of the merged entities, profitability could be impacted in the near term

- Merger related issues including HR/IT related synchronisation, branch rationalisation and realigning NPAs could impact interim profi

- Geographical synergies are missing in most of the mergers. For instance, both PNB and OBC are northbased, with strong presence. Similarly, both Canara Bank and Syndicate Bank have strong presence in the south.

- Plenty of prospective bank mergers and acquisitions only look at the two banks on paper – without taking their people or culture into account

Advantages of Merging of Banks

- Scale: A bank merger helps the merged entities scale up quickly and gain a large number of new customers instantly. It also provides a broader geographic footprint to operate.

- Efficiency: Every bank has an infrastructure in place for compliance, risk management, accounting, operations and IT – and now that two banks have become one, it will be able to more efficiently consolidate and administer those operational infrastructures.

- Business Gaps Filled: Acquiring a smaller bank that offers a unique revenue model or financial product is sometimes easier than building that business unit from scratch.

- Synergy: The synergy created by the merger is powerful enough to enhance business performance, financial gains, and overall shareholders value in long term.

- Cost Efficiency:The merger results in improving the purchasing power of the company which helps in negotiating the bulk orders and leads to cost efficiency. The reduction in staff reduces the salary costs and increases the margins of the company. The increase in production volume causes the per unit production cost resulting in benefits from economies of scale.

- Competitive Edge:The combined talent and resources of the new company helps it gain and maintain a competitive edge.

- New Markets:The market reach is improved by the merger due to the diversification or the combination of two businesses. This results in better sales opportunities.

Disadvantages of Merging of Banks

- Systemic risk: It is the possibility that the failure of one bank to settle net transactions with other banks will trigger a chain reaction, depriving other banks of funds and, in turn, preventing them from closing their positions. The consequence is frequently loss of confidence in the whole banking system.

- “Too big to fail” factor: As a result, any substantial disruption in the particular institution’s operations would be likely to have a serious effect on a country’s financial markets, either preventing the markets from operating properly or raising questions about their integrity. The consequence of the “too big to fail” factor is that countries extend protection to large institutions and their customers that is not granted to others

- Problem to ordinary people: The move would result in closure of large number of branches as it happened in the case of State Bank of India, affect banking services and reduce employment opportunities.

- Bad banks merged with Good Banks: Narasimham Committee in the late 1990s recommended consolidation through a process of merging strong banks. It also recommended that weaker banks should be shut down and they should not be merged with strong Banks. But in the current merger decision, weak banks are being merged with the strong banks.

Amalgamation vs Merger – Key Differences

|

Basis- Merger vs Amalgamation |

Merger |

Amalgamation |

||

|

Definition |

Two or more companies are combined together to form either a new company or an existing company absorbing the other target companies. A merger is a process to consolidate multiple businesses into one business entity. All the Amalgamations are part of the Merger. |

It is a type of merger process in which two or more companies combine together to form a new entity. All the mergers are not Amalgamation. |

||

|

Number of Entities Required |

Minimum 2 companies are required as one absorbing company will survive after absorbing the target company |

Minimum 3 companies are required as an Amalgamation of two companies results in a new entity |

||

|

Size of the Companies |

In the merger process, the size of the absorbing company is relatively larger than the absorbing company. |

In Amalgamation, the size of the target companies is comparable. |

||

|

Resultant Entity |

One of the existing company may absorb the target company for a merger, hence may retain its identity. |

Existing companies lose their identity and a new company is formed. |

||

|

Impact on Shareholders |

Shareholders of the absorbing entity retain their ownership however shareholders of the absorbed entity gain ownership in the absorbing company. |

All the shareholders in the existing entities become shareholders in the new entity. |

||

|

Impact on Shares |

Shares of the absorbing company are given to shareholders of the absorbed company. |

Shares of the new entity formed in the process are given to the shareholders of the existing entities. |

||

|

Driver for Consolidation |

Mergers are mostly driven by the absorbing Company |

Amalgamation process is initiated by both the companies interested in the Amalgamation process |

||

|

Accounting Treatment |

Asset and liabilities of the absorbed/acquired company is consolidating |

Asset and liabilities of the existing entities are housed and transferred into the Balance sheet of the newly formed entity |

||

|

Examples of Amalgamation vs Merger |

Consolidation of two entities Tata Steel and UK based Corus Group with the resulting entity being Tata Steel. Corus Group lost its identity in the process. |

Consolidation of two entities Mittal Steel and Arcelor resulting in the new entity named Arcelor Mittal. Both Mittal Steel and Arcelor Group lost their identity in the process. |

Conclusion

The recent wave of rapid measures taken by the Government for igniting the flow of investments and spur demand in the economy are expected to being results both in short term and long term as well. More structural reforms like amending the FRBM Act are needed to take India to the $5 Trillion Economy by 2024.

Learning Aid