Context

Andhra Pradesh has re-joined the crop insurance scheme Pradhan MantriFasalBimaYojana after having opted out in 2019-20.A few states remain out.

This brief aims to analyse the current status of the scheme and issues associated with it.

Background

- Andhra Pradesh was one of six states that have stopped the implementation of the scheme over the last four years.

- The other five, which remain out, are Bihar, Jharkhand, West Bengal, Jharkhand, and Telangana.

|

Reasons for Andhra Pradesh opting out of the scheme: The state had mentioned several reasons:

|

Analysis

About Pradhan MantriFasalBimaYojana:

- The scheme was launched in 2016 and is being administered by the Ministry of Agriculture and Farmers Welfare.

- At that time, 27 states and Union Territories had implemented the scheme.

- It replaced the National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS).

- Pradhan MantriFasalBimaYojana is the flagship scheme of the government for agricultural insurance in India in line with the One Nation-One Scheme theme.

- Eligibility:Farmers including sharecroppers and tenant farmers growing notified crops in the notified areas are eligible for coverage.

Coverage of Crops:

- Food crops (Cereals, Millets, and Pulses)

- Oilseeds

- Annual Commercial / Annual Horticultural crops.

In addition, for perennial crops, pilots for coverage can be taken for those perennial horticultural crops for which standard methodology for yield estimation is available.

Responsibility of the Farmers:

- Timely Information/claim lodging for damage to crops due to localized calamities and post-harvest losses.

- To ensure that the insured crop is the same as the crop sown.

Risks covered under the scheme

- Yield Losses (standing crops, on a notified area basis).

- Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as Natural Fire and Lightning, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, and Tornado. Risks due to Flood, Inundation, landslides, Drought, Dry spells, and Pests/ Diseases also will be covered.

- In cases where the majority of the insured farmers of a notified area, having the intent to sow/plant and incurred expenditure for the purpose, are prevented from sowing/planting the insured crop due to adverse weather conditions, shall be eligible for indemnity claims up to a maximum of 25 percent of the sum insured.

- In post-harvest losses, coverage will be available up to a maximum period of 14 days from harvesting for those crops which are kept in “cut & spread” condition to dry in the field.

- For certain localized problems, Loss/damage resulting from the occurrence of identified localized risks like hailstorms, landslides, and Inundation affecting isolated farms in the notified area would also be covered.

Issues Related to the Scheme:

- Financial Constraints of States: The financial constraints of the state governments and low claim ratio during normal seasons are the major reasons?for the non-implementation of the Scheme by these States.

- States are?unable to deal with a situation?where insurance companies compensate farmers less than the premium, they have collected from them and the Centre.

- The State governments?failed to release funds on time?leading to delays in releasing insurance compensation.

- This defeats the very purpose of the scheme which is to provide timely financial assistance to the farming community.

- Claim Settlement Issues:Many?farmers are dissatisfied with both the level of compensation?and delays in settlement.

- Implementation Issues:Insurance companies?have shown no interest in bidding?for clusters that are prone to crop loss.

- Insurance companies making windfall gains: It is said that it helps insurance companies more than the farmers. Farm leaders claim insurance companies have made windfall gains at the behest of the public exchequer and farmers.

- Delayed pay-outs: Delayed pay-outs and denial of claims are other common complaints against insurance companies.

- Identification Issues: Currently the PMFBY scheme doesn’t distinguish between large and small farmers and thus raises the issue of identification. Small farmers are the most vulnerable class.

Why is Pradhan Mantri Fasal Bima Yojana being revamped?

- To make farmers self-sufficient to manage risk in agriculture production.

- To stabilize the farm income.

- To enable farmers of North-Eastern states to manage agriculture risks.

- Enable faster claims settlements through quick and accurate yield estimation.

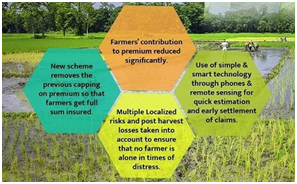

Restructuring of the scheme: The revamped PMFBY is often called PMFBY 2.0, it has the following features:

- Investing in Information, Education, and Communication (IEC) activities ICE Activities: Insurance companies have to now spend 0.5% of the total premium collected on Information, Education, and Communication (IEC) activities.

- Limit to Central Subsidy: The Centre has decided to limit the PMFBY premium rates - against which it would bear 50% of the subsidy - to a maximum of 30% in un-irrigated and 25% in irrigated areas.

- The scheme is now optional for all the farmers: Initially, the scheme was compulsory for loanee farmers; in February 2020, the Centre revised it to make it optional for all farmers. Earlier, it was compulsory for loanee farmers availing Crop Loan/Kisan Credit Card (KCC) account for notified crops.

- More Flexibility to States: The government has given the flexibility to states/UTs to implement PMFBY and given them the option to select any number of additional risk covers/features.

Conclusion

There is a need for comprehensive rethinking among states and the central governments to further resolve all the pending issues around the scheme so that the farmers could get benefit from this scheme. Further, rather than paying subsidies under this scheme, the state government should invest that money in a new insurance model.

‘Beed model is being followed’, of Maharashtra where a company assumes liability only up to 110% of the premium collected or shares gains in a good year with the State government. This model can emerge as a way out of the current mess.If the farmer is not enthused by crop insurance despite the 95-98% subsidy on premium, it means that the product per se needs improvement.