Context

Recently India observed the 53rd anniversary of bank nationalisation where on the other hand in the Union Budget 2021-22, the government announced its decision to privatise two public sector banks.

Background

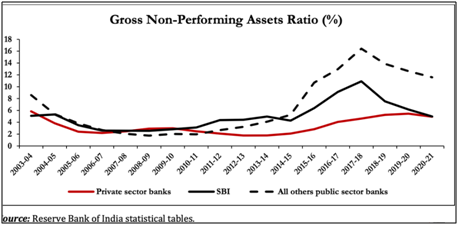

- Over the past decade, India’s public sector banks have struggled with high levels of non-performing assets (NPAs).

- NPAs are loans that the borrower fails to pay back to the bank. Predictably, high levels of NPAs erode a bank’s profitability.

- In the case of many PSBs, even the RBI, which is the banking sector regulator, had to restrict the normal functioning of the banks and forced them to improve their financial performance metrics before being allowed to resume normal banking activities.

- High levels of NPAs, and the ensuing actions, meant that PSBs struggled to finance India’s growth needs.

This brief aims to analyse the need and pros & cons of privatization of PSBs.

Analysis

What ais the need for Privatisation?

- Degrading Financial Position of Public Sector Banks: Many of the banks have higher levels of stressed assets than private banks, and also lag the latter on profitability, market capitalization and dividend payment record. This makes a case for considering them for privatisation.

- Private sector banks (PVBs) are far more efficient, far more productive and far less corrupt than the PSBs. This is evident in the figure given below, where the red line indicates lower NPSs for the Private sector banks.

- Private sector banks (PVBs) are far more efficient, far more productive and far less corrupt than the PSBs. This is evident in the figure given below, where the red line indicates lower NPSs for the Private sector banks.

- Part of a Long-Term Project: This will free up the government, the majority owner, from continuing to provide equity support to the banks year after year.

- Strengthening Banks: The government is trying to strengthen the strong banks and also minimise their numbers through privatisation to reduce its burden of support.

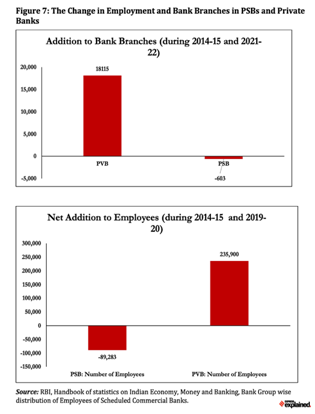

- Private sector Banks are creating more employment: Private banks have not only added more branches but have also created new jobs while the public sector banks saw declines on both counts.

- Recommendations of Different Committees: Many committees had proposed bringing down the government stake in public banks below 51%:

- The Narasimham Committee proposed 33%.

- The P J Nayak Committee suggested below 50%.

Does India require Privatization of all PSBs?

- According to a recent paper released, all PSBs should be privatised. But they also realise that this might be a tad too drastic for any government in India to do and they suggest privatising all except the State Bank of India.

|

Banking Laws (Amendment Bill 2021)

|

Pros and Cons of privatization of PSBs:

|

Pros |

Cons |

|

|

|

Public sector banks which got privatized:

- The four banks that were placed on the initial list for privatisation were;

- Bank of Maharashtra

- Bank of India (Bank of India),

- Indian Overseas Bank and;

- Central Bank of India

Conclusion

The governance and management of PSBs have to improve. The way to do this was outlined by the PJ Nayak committee, which recommended distancing between the government and top public sector appointments (everything the Banks Board Bureau was supposed to do but could not).