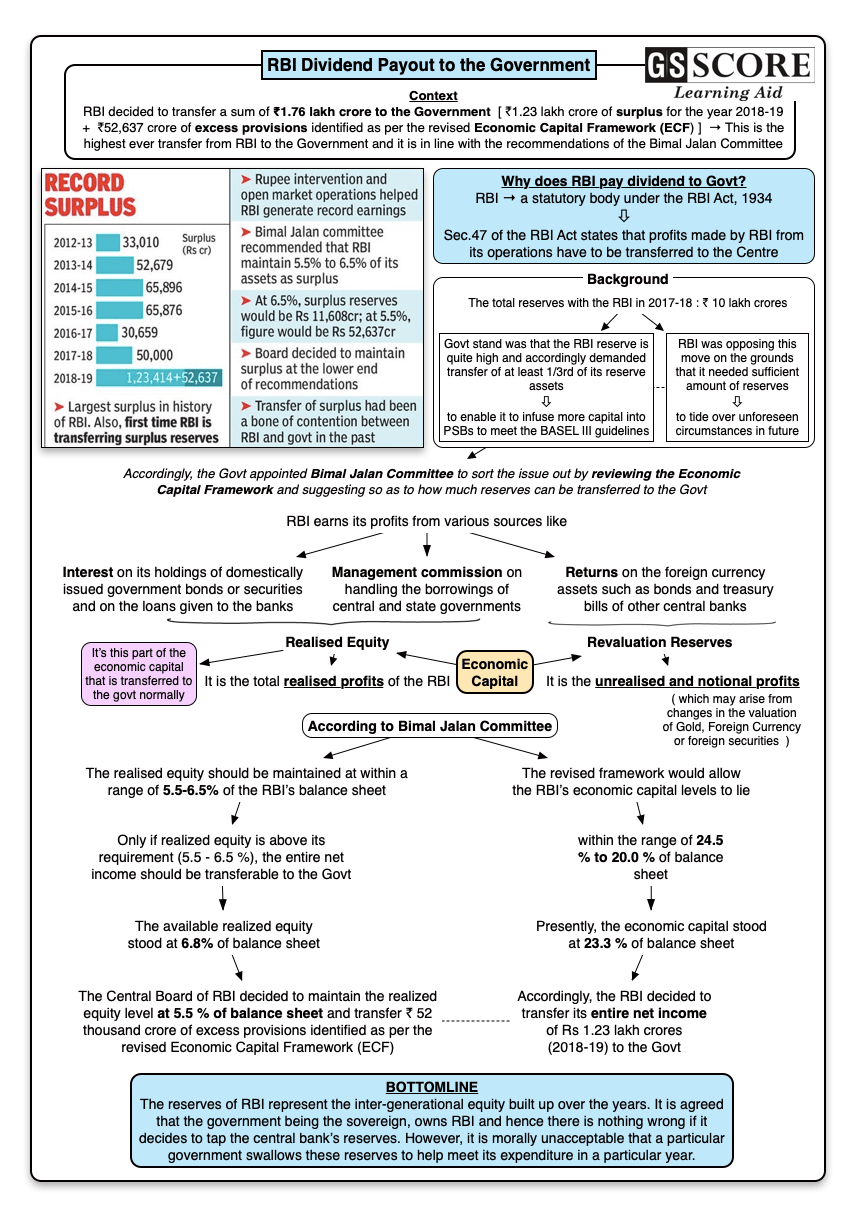

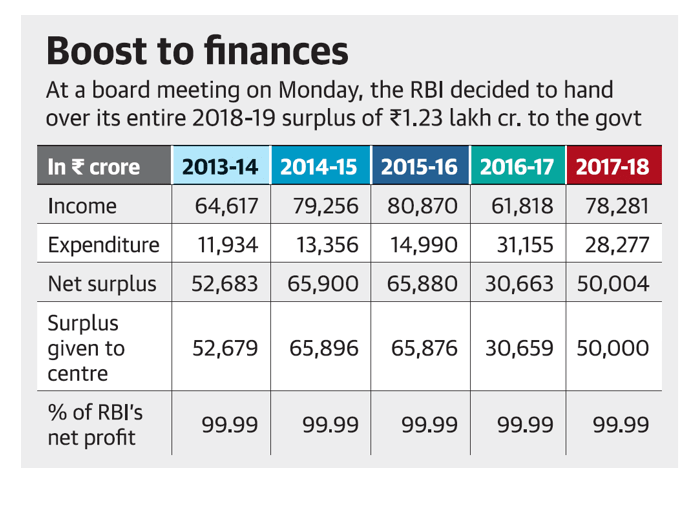

- The Reserve Bank of India (RBI) had decided to transfer a sum of ?1,76,051 crore to the Government of India (Government) comprising of ?1,23,414 crore of surplus for the year 2018-19 and ?52,637 crore of excess provisions identified as per the revised Economic Capital Framework (ECF).

- This marks the first time the RBI will be paying out such a huge amount, a one-off transfer. Earlier, the government had budgeted for Rs 90,000 crore from the RBI as dividend for this fiscal year.

Issue

Context

- The Reserve Bank of India (RBI) had decided to transfer a sum of ?1,76,051 crore to the Government of India (Government) comprising of ?1,23,414 crore of surplus for the year 2018-19 and ?52,637 crore of excess provisions identified as per the revised Economic Capital Framework (ECF).

- This marks the first time the RBI will be paying out such a huge amount, a one-off transfer. Earlier, the government had budgeted for Rs 90,000 crore from the RBI as dividend for this fiscal year.

Background

- Economic capital is a measure of risk in terms of capital. More specifically, it's the amount of capital that an institution needs to ensure that it stays solvent given its risk profile.

- The concept of economic capital has gained significance especially after the global financial crisis in 2008. The crisis forced many of international banks to pump in liquidity to boost confidence in the financial system.

- In general, the Economic Capital Framework (ECF) reflects the capital that an institution requires as a counter against unforeseen risks or events or losses in the future.

- As a result, in 2015, the RBI put in place a draft Economic Capital Framework, or ECF. It provided methodology for determining the appropriate level of risk provisions for the Bank.

- The RBI and the Finance Ministry have been at loggerheads over how much should be transferred to the Centre for a while.

- In order to resolve this contentious issue, in 2018, the RBI constituted an Expert Committee to review the extant ECF of the RBI under the Chairmanship of Bimal Jalan.

- Now, the Central Board accepted all the recommendations of the Committee and finalized the RBI’s accounts for 2018-19 using the revised framework to determine risk provisioning and surplus transfer.

Issues due to transfer of surplus

- Traditionally, central banks have been factoring in risks such as credit risk — when there could be a potential default by an entity in which there has been an investment or exposure.

- There is also interest rate risk — when interest rates either move up or slide, depending on the price of which securities or bonds held by a central bank or banks can be impacted.

- There is also an operational risk — when there is a failure of internal processes.

- Contingent risks arising from its public policy role in fostering monetary and financial stability.

- There were increased risks to its balance sheet. A weak balance sheet could force the central bank to rely more on excessive seigniorage income, which would run in conflict to its price stability mandate.

Profits and Expenditures of RBI

- The RBI is a “full service” central bank which is supposed to manage the borrowings of the Government of India and of state governments; supervise or regulate banks and non-banking finance companies; and manage the currency and payment systems.

- While carrying out these functions or operations, it makes profits. Typically, the central bank’s income comes from the returns it earns on its foreign currency assets, which could be in the form of bonds and treasury bills of other central banks or top-rated securities, and deposits with other central banks.

- It also earns interest on its holdings of local rupee-denominated government bonds or securities, and while lending to banks for very short tenures, such as overnight.

- Its expenditure is mainly on the printing of currency notes and on staff, besides the commission it gives to banks for undertaking transactions on behalf of the government across the country, and to primary dealers, including banks, for underwriting some of these borrowings.

- Generally, the central bank’s total expenditure is only about a seventh of its total net interest income.

- This implies that it certainly generates a large surplus out of the excess of income over expenditure.

Profit Transfer Mechanism from RBI to Government

- The Government of India is the sole owner of India's central bank, the RBI.

- So, the RBI transfers the “surplus” – that is, the excess of income over expenditure – to the government, in accordance with Section 47 (Allocation of Surplus Profits) of the Reserve Bank of India Act, 1934.

- In 2018, the RBI paid out an interim dividend of Rs 10,000 crore.

- Then in February 2019, the government asked for an interim surplus as well as the amount retained by the RBI from surpluses of the previous two years.

- The current transfer is expected to help keep the fiscal deficit at the projected 4% of GDP for 2018-19.

Recommendations of Bimal Jalan Committee

- RBI’s economic capital: A clearer distinction between the two components of economic capital (realized equity and revaluation balances) was recommended by the Committee as realized equity could be used for meeting all risks/ losses as they were primarily built up from retained earnings, while revaluation balances could be reckoned only as risk buffers against market risks as they represented unrealized valuation gains and hence were not distributable.

- Risk provisioning for market risk: The Committee has recommended the adoption of Expected Shortfall (ES) methodology under stressed conditions (in place of the extant Stressed-Value at Risk) for measuring the RBI’s market risk on which there was growing consensus among central banks as well as commercial banks over the recent years.

- Size of Realized Equity: The Committee recognized that the RBI’s provisioning for monetary, financial and external stability risks is the country’s savings for a ‘rainy day’ (a monetary/ financial stability crisis) which has been consciously maintained with the RBI in view of its role as the Monetary Authority and the Lender of Last Resort.

- Surplus Distribution Policy: The Committee has recommended a surplus distribution policy which targets the level of realized equity to be maintained by the RBI, within the overall level of its economic capital vis-à-vis the earlier policy which targeted total economic capital level alone.

- In case of Contingency Reserve (built out of retained earnings), the committee said that it should be maintained within a band of 6.5% - 5.5% of the total assets.

International Practice

- Almost all central banks, the US Federal Reserve, Bank of England, Reserve Bank of Australia and Germany’s Bundesbank are owned by their respective governments.

- They have to transfer their surplus or profits to the Treasury, or the equivalent of India’s Finance Ministry.

- The UK has a formal Memorandum of Understanding on the financial relationship between the Treasury and the Bank of England.

- It lays down a clear framework for passing on 100% of net profits to the government.

- The US Fed too, transfers all its net earnings to the Treasury.

Conclusion

The reserves of RBI represent the inter-generational equity built up over the years. It is agreed that the government being the sovereign, owns RBI and hence there is nothing wrong if it decides to tap the central bank’s reserves. However, it is morally unacceptable that a particular government swallows these reserves to help meet its expenditure in a particular year.

Question – Discuss the reasons behind the constitution of Bimal Jalan Committee on Economic Capital Framework. Also analyze, how far its recommendations will resolve the conflict between the Reserve Bank of India and the Finance Ministry regarding the transfer of surplus from Central Bank to the Government.

Learning Aid