Context

Recently, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) was convened to formulate its response to the Government of India regarding the on-going high rate of inflation for three-consecutive quarters in the country.

Background

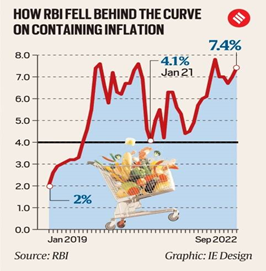

- The current obtained Retail inflation for September 2022 was 4 per cent, which means the price level for retail consumers last month was 7.4 per cent higher than what it was in September 2021.

- This also means that retail inflation — which is calculated using the Consumer Price Index (CPI) — has been outside the RBI’s comfort zone for three consecutive quarters beginning from January 2022.

About

The Monetary Policy Committee:

- Composition: The MPC has six members including;

- The RBI Governor

- Three each nominated by the RBI and the government.

- Meetings: The MPC meets every two months — that is, six times a year — in February, April, June, August, October, and December to evaluate the current status and outlook for inflation and economic growth.

- Functions: Based on the assessment, it regulates the repo rate, which is the interest rate at which the RBI loans money to the banking system.

- It is for this reason that movements in the repo rate influence the overall interest rates in the economy.

- When the MPC wants to contain inflation, it raises the repo rate.

- Such a “dear money” policy makes all types of borrowing — both for consumers (say, car loans) and producers (say, fresh business investments) costlier and effectively slows down economic activity in the Country.

|

Dear Money Policy: Dear money policy refers to a monetary policy by the central bank where the central bank sets high-interest rates so that credit is not easily available to the general public to decrease the rate of inflation in the economy by curbing demand. |

Reasons behind the Failure to curb inflation:

- India had been witnessing high headline inflation since late 2019. While there was some relief on the headline inflation front in the first half of 2021, core inflation became a concern by October.

- It underscored India’s vulnerability to sudden spikes in inflation if either food or fuel prices went up. However, the RBI kept the repo rate unchanged at 4 per cent.

- By this time, headline and core inflation were converging at the 6 per cent level. But the MPC still refused to raise interest rates, stating that “inflation is likely to moderate” between December 2021 and September 2022.

What happens if inflation targets by the Central Bank do not get achieved?

Under the RBI Act, of 1934, if the central bank fails to meet the inflation target for three consecutive quarters, it is required to provide the following information to the government:

- Reasons for the failure to achieve the inflation target;

- Remedial actions proposed to be taken; and

- An estimate of the time period within which the inflation target shall be achieved pursuant to the timely implementation of the proposed remedial actions.