Context

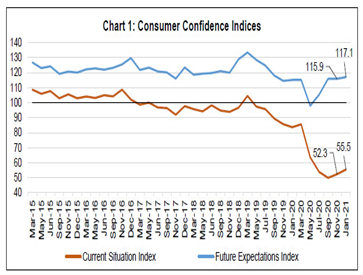

The Reserve Bank of India’s (RBI) latest consumer confidence for May 2022 has shown that consumer confidence has improved compared to last year, but the consumer survey index is still below 100, which is in the ‘pessimistic’ territory.

About

- CCS is a Bi-monthly exercise, done to indicate the comparison between current economic scenarios in the country with the last survey.

- Consumer confidence for the current period has been consistently improving since July 2021.

- The key parameters like employment and household income improved further in the latest round of the survey, though they remained in a ‘pessimistic’ zone.

- Though the consumer confidence index has improved and stands at 9, it is still in the negative territory, since consumers are now being pessimistic, the survey revealed.

- In March 2022, the consumer confidence index was 7.

|

An Index figure below 100 is considered to be in ‘pessimistic’ zone, but if the index is above 100, it indicates ‘optimism’. |

Key Highlights of the survey

According to the survey, the following are the various variables and consumers’ expectations earlier when compared with the current situation:

- Economic Situation: In March 2022, the economic situation index was at 13.5, and in May 2022, it was at 6.

- This shows that there is a positive sentiment among consumers, but with deterioration when compared with the previous round of the survey.

- Price Level: In March 2022, the price level index was at 68.6, while in May 2022 it was at 71.7

- This shows that there is a negative sentiment with signs of deterioration when compared with the previous round held in March 2022.

- Employment: In March 2022, the employment index was at 22.7, while in May 2022 it was at 19.2.

- This shows that there is a positive sentiment among consumers, but with deterioration when compared with the previous round, the survey revealed.

- Spending: In March 2022, the spending index was at 64.1 and in May 2022 it was at 66.7.

- This shows that consumer sentiments were improved when compared with the previous round of survey.

- Income: In March 2022, the spending index was at 44.3, while in May 2022; it was at 44, shows that there is a positive sentiment among consumers, but with deterioration when compared with the previous round.

Analysis

Why this survey does is important?

- The CCS is a survey that indicates how optimistic or pessimistic consumers are regarding their expected financial situation.

- If the consumers are optimistic, spending will be more, whereas if they are not so confident, then their poor consumption pattern may lead to recession.

What are the implications of the survey?

- Increase in Inflation: The RBI has projected the CPI inflation for the first quarter of FY23 at 7.5 per cent against 6.3 per cent earlier, while it has estimated it at 7.4 per cent against the 5.8 per cent projected earlier for the second quarter. For the third and fourth quarters, the CPI inflation is projected at 6.2 per cent and 5.8 per cent.

- Increase in Household Income: According to the survey, thehouseholds expect their spending to increase in the next one year with expenses on essentials going up while they plan to cut down on non-essential expenditure.

- Food Inflation: The Monetary Policy Committee (MPC) stated that continuing shocks to food inflation could sustain pressures on headline inflation.

width="634">

|

Consumer confidence survey (CCS)

|

What can be the future challenges?

- These data of this survey showcase the challenge facing by the Indian economy.

- If the government’s strategy for fast economic growth — expecting the private sector to lead India out of this trough by investing in new capacities — is to succeed, then consumer spending (especially on non-essentials) has to go up sharply.

- But for that to happen, household incomes have to go up; and for that to happen, the employment prospects have to brighten; and for that to happen, again, companies have to invest in new capacities.

Conclusion

The consumer confidence survey by the RBI obtains current perceptions compared to a year earlier and one-year ahead expectations on general economic situation, employment scenario, overall price situation, and own income and spending. Hence it is one of the major sources of survey on economic terms to identify future implications and challenges.