Context

Recently, Reserve bank of India (RBI) has brought Non-Banking Finance Companies (NBFCs) under the Prompt corrective action (PCA) framework, to enable Supervisory intervention at appropriate time and to restore financial health of the country.

Background

- NBFCs have been growing in size and have substantial interconnectedness with other segments of the financial system.

- Accordingly, it has now been decided by RBI to put in place a PCA Framework for NBFCs to further strengthen the supervisory tools applicable to NBFCs.

- It will come into effect from October 1, 2022.

Analysis

What is PCA Framework?

- Prompt Corrective Action or PCA is a framework under which NBFC with weak financial metrics are put under watch by the RBI.

- NBFCs will face restrictions if they slip below certain norms on three parameters i.e.

- Capital Ratios

- Asset Quality

- Profitability

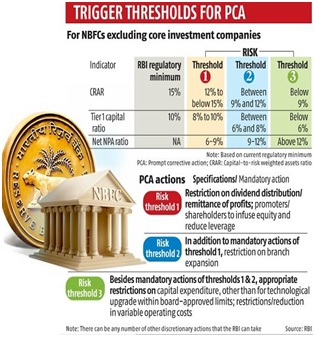

- PCA Framework has three risk threshold levels (1 being the lowest and 3 being the highest) based on where a NBFC stands. Application of PCA framework-

- Threshold 1- If NPA is between 6-9 per cent and CRAR falls 300 basis points from the current level of 15-12 per cent

- Threshold 2- If NPA is between 9-12 per cent and CRAR falls 300-600 bps from the levels of 12-9 per cent.

- Threshold 3- If NPA is >12% per cent and CRAR falls by 600 bps from 9 per cent.

- Impact on NBFCs-

- First threshold- It will restrict NBFCs on dividend distribution and promoters will be asked to infuse capital and reduce leverage. The RBI will also restrict issuance of guarantees or taking other contingent liabilities on behalf of group companies, in case of core investment companies.

- Second threshold- The NBFC will be prohibited from opening branches.

- Third threshold- Capital expenditure will be stopped, other than for technological upgradation.

- Exemptions- NBFC that do not deposits and have an asset size of less than Rs 1,000 crore, primary dealers, government-owned NBFCs, and housing finance companies are exempted from this framework

Earlier, RBI has also proposed Scale based regulations (SBR) framework for NBFCs that was to come into effect in October 22. It takes into consideration capital requirements, governance standards, prudential regulation and other aspects of NBFCs.

|

What is a Non-Banking Financial Company (NBFC)?

|

What is the need of bringing NBFC under PCA Framework?

There has been debate about the need of bringing NBFCs under the PCA Framework. It is needed in the recent times as-

- As on March 31, 2021, the non-banking finance company (NBFC) sector (including housing finance companies/ HFCs) had assets worth more than ?54 lakh crore, equivalent to about 25 per cent of the asset size of the banking sector.

- Over the last five years the NBFC sector assets have grown at cumulative average growth rate of 17.91 per cent.

- The NBFC sector’s gross bad loans as a proportion of total loans increased from 5.8% in 2017-18 to 6.6% in 2018-19

- Failure of big NBFCs in the recent times likes DHFL and (IL&FS) having multiple impact on the entire financial system.

- NBFCs are the largest net borrowers of funds from the financial system and banks provide a substantial part of the funding to NBFCs and HFCs. Therefore, failure of any large NBFC or HFC may translate into a risk to its lenders.

Reason of recent failures of NBFCs-

In the last few years, country witnessed failure of big NBFCs and declining performance of many others. The main reasons behind this can be-

- Lack of corporate governance and non-disclosure of possible NPA- For instance, IL&FS gave huge dividends to shareholders despite continuous negative cash flows.

- Timing Mismatch: NBFCs have been borrowing money short term and have been lending it out long term. This asset liability timing mismatch is obviously a recipe for disaster. However, the NBFCs have been able to roll it over and pay their debts when due.

- Mutual Funds: NBFCs also heavily rely on mutual funds, thus resulting in a narrow base.

- Asset Quality Issues: A lot of NBFCs have invested heavily invested in the housing sector and Indian housing sector is not performing well, thus affecting asset quality of NBFCs.

Challenges due to the recent guidelines-

While the intention behind the PCA framework is good, few issues have arisen. These are-

- The recent PCA framework will be applicable for only a few NBFCs while the vast majority of the nearly 10,000 such entities will be excluded. However, the central bank can take any action irrespective of the size of an NBFC

- As NBFCs has been slowly recovering from the COVID pandemic, the new norms may bring new challenges for the sector.

Suggestions and way forward-

Realizing the significance of NBFCs for the financial sector and the Indian economy, following steps can be taken-

- There is a need to create a culture of responsible governance in theorganizations where every employee feels responsible towards the customer, organization, and society.

- Self-accountability is needed to be promoted so that early identification of the challenges can be done and the need of RBI intervention can be avoided.