Context

The Securities and Exchange Board of India (SEBI) has proposed the concept of blue bonds as a mode of sustainable finance as such securities can be utilised for various blue economy-related activities, including oceanic resource mining and sustainable fishing.

Background

- In the Union Budget of India 2019 the Finance Minister laid out the Vision 2030 while highlighting India’s transformation in the last five years.

- India is poised to become a USD 5 trillion economy by 2025 and aspires to become a USD10 tn economy by 2030.

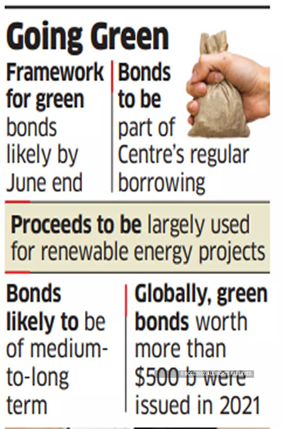

- In 2007, green bonds were launched by few development banks such as the European Investment Bank and the World Bank.

- Subsequently, in 2013, corporates too started participating, which led to its overall growth.

- India has tremendous scope for deployment of blue bonds in various aspects of the blue economy" like oceanic resource mining, sustainable fishing and national offshore wind energy policy and in the area of blue flag beach eco-tourism model.

About

- SEBI has suggested for strengthening the framework of ‘green bonds’ by enhancing the definition of green debt securities and disclosures.

- The proposals are aimed at aligning with the updated Green Bond Principles (GBP) published by the International Capital Market Association (ICMA).

- It also suggested adding two categories of projects; pollution prevention and control and circular economy adapted products -- as eligible green projects.

|

What are Green Debt securities (GDS)?

|

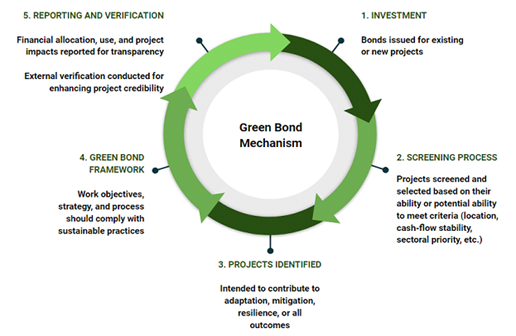

- The regulator has suggested that the issuer should inform investors about the intended types of temporary placement for the balance of unallocated net proceeds. Also, the utilisation of proceeds from each issue of GDS made by an issuer should be tracked and disclosed separately.

- In addition, the issuer should disclose any taxonomies, green standards or certifications, if referenced in the project selection.

Analysis

What is Blue economy?

- According to the World Bank, the blue economy is the "sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of ocean ecosystem".

What are Green Bonds?

- A green bond is a debt instrument with which capital is being raised to fund ‘green’ projects, which typically include those relating to renewable energy, clean transportation, sustainable water management etc.

- A bond is a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental).

- Bonds traditionally paid a fixed interest rate (coupon) to investors.

Who regulates Green bonds in India?

- The Securities and Exchange Board of India (SEBI)has put in place disclosure norms for issuance and listing of green bonds.

How Green Bonds can help Blue economy to grow?

- India’s potential: India has a 7,500 kilometre-long coastline and 14,500 kilometres of navigable inland waterways, and the development of the blue economy can serve as a growth catalyst.

- At present, the blue economy comprises 4.1 per cent of India's economy.

- Enhances Reputation: Green bonds enhance an issuer’s reputation, as it helps in showcasing their commitment towards sustainable development.

- Fulfillment of Commitments: Ability to meet commitments, for signatories to climate agreements and other green commitments.

- India’s Intended Nationally Determined Contribution (INDC) document puts forth the stated targets for India's contribution towards climate improvement and following a low carbon path to progress.

- Rise at Lower Costs: Green bonds typically carry a lower interest rate than the loans offered by the commercial banks.

- With an increasing focus of foreign investors towards green investments, it could help in reducing the cost of raising capital.

- Support Sustainable Growth: These green bonds have been crucial in increasing financing to sunrise sectors like renewable energy, thus contributing to India’s sustainable growth.

What are the Challenges for expanding Green bonds in India?

- High Coupon Rate: The average coupon rate for green bonds issued since 2015 with maturities between 5 to 10 years have generally remained higher than the corporate government bonds with similar tenure.

- High Borrowing Cost: It has been the most important challenge due to the asymmetric information. High coupon rate is one of the reasons for high borrowing cost.

- Lack of Credit Ratings: Lack of credit rating or rating guidelines for green projects and bonds.

- Shorter Tenor: Green bonds in India have a shorter tenor period of about 10 years whereas a typical loan would be for a minimum 13 years. Further Green Projects require more time to bring returns.

Conclusion

Appropriate capacity building efforts for issuers in emerging markets to spread knowledge on the benefits and related processes and procedures pertaining to green bonds, would help in addressing the institutional barriers to entry into this market.

In the context of green bonds, strategic public sector investment could help in attracting private investment as well as inspire investor confidence in the green bond market overall.