Context

Recently, RBI Governor Shaktikanta Das urged that fintech firms to create a Self-Regulatory Organisation (SRO) for transparent, fair, and consumer-centric practices.

About

About Fintech:

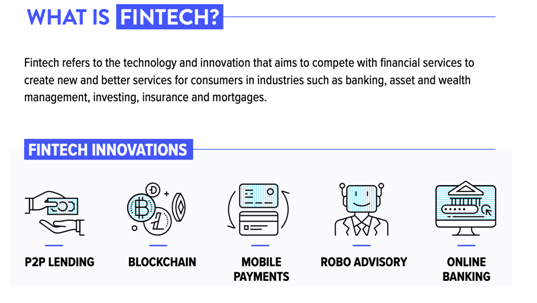

- Fintech" is a term that combines "financial" and "technology".

- It refers to companies and technologies that leverage digital innovations to provide financial services in a more efficient, accessible, and innovative manner.

- Fintech encompasses a wide range of services, including digital payments, peer-to-peer lending, robo-advisors, blockchain technology, and more.

- These technologies are made to go beyond traditional financial systems and offer new solutions to consumers and businesses.

What is an SRO?

- An SRO is a non-governmental organization that sets and enforces rules and standards relating to the conduct of entities in the industry (members) with the aim of protecting the customer and promoting ethics, equality, and professionalism.

- SROs typically collaborate with all stakeholders in framing rules and regulations.

- Functions:

- To serve as a two-way communication channel between its members and the RBI.

- To work towards establishing minimum benchmarks and standards and help instill professional and healthy market behavior among its members.

- Toimpart training to the staff of its members

- To establish a uniform grievance redressal and dispute management framework across its members.

How can an entity become an SRO?

- Those entities who are interested in being recognized as SROs will have to apply to the RBI.

- Once the regulator finds an entity suitable, it will issue a letter of recognition.

RBI's Expectations from Fintech Players:

- Industry Best Practices and Compliance: Fintech firms are urged to develop and adopt industry best practices, aligning with local laws. This includes establishing robust privacy and data protection norms.

- Avoiding Mis-Selling and Ensuring Ethical Business Practices: Fintech entities should set standards to prevent mis-selling and uphold ethical conduct in their operations.

- Transparency in Pricing: It is expected that fintech companies maintain transparency in pricing, ensuring that customers have a clear understanding of the costs involved in their services.

How SRO can solve the purpose?

- SROs could play a pivotal role in the fintech industry by promoting responsible practices and maintaining ethical standards.

- There have been many instances where a few fintech players were involved in unethical practices such as charging exorbitant higher interest rates and harassment of borrowers for recovering loans.

- It will help to address issues like market integrity, conduct, data privacy, cybersecurity, and risk management.

- SROs can help build trust among consumers, investors, and regulators.

Why fintech industry is important?

- Financial Inclusion: Through digital platforms and mobile apps, fintech companies have made it easier for people to access banking, payments, lending, and investment services.

- Innovation and Disruption: Fintech companies are known for their innovative approaches to financial services. They leverage technology to create new products, services, and business models.

- Efficiency and Cost Reduction: Fintech companies often use automation, artificial intelligence, and blockchain technology to streamline operations.

- Improved Customer Experience: Fintech companies place a strong emphasis on user experience and design.

- Innovative Payment Solutions: They revolutionized the way we make payments. This includes the development of digital wallets, peer-to-peer payment platforms, and cryptocurrency.

- Access to Capital for Small Businesses: Fintech platforms, such as peer-to-peer lending and crowdfunding, have provided alternative sources of funding for small businesses and startups.

- Data-Driven Insights and Personalization: Fintech companies often leverage big data and advanced analytics to provide customers with personalized financial advice and insights.

RBI’s role in fintech administration:

The Reserve Bank of India (RBI) plays a crucial role in the administration and regulation of the fintech sector in India.

- Regulatory Oversight: RBI is the central regulatory authority for the financial sector in India. It formulates policies and regulations that govern various aspects of fintech operations, including payment systems, digital banking, cryptocurrencies, and other innovative financial technologies.

- Licensing and Authorization: RBI is responsible for granting licenses and authorizations to fintech companies, especially those involved in critical financial activities like payment processing, lending, and other regulated services. This ensures that only qualified and compliant entities operate in the financial sector.

- Setting Standards and Guidelines: RBI establishes industry standards and guidelines to ensure the safety, security, and efficiency of fintech operations. This includes rules for data protection, cybersecurity, anti-money laundering (AML), and customer protection.

- Monitoring and Supervision: RBI monitors the activities of fintech firms to ensure compliance with regulatory requirements. This involves conducting audits, inspections, and assessments to verify adherence to prescribed norms.

- Consumer Protection: RBI takes measures to protect the interests of consumers in fintech transactions. This includes setting rules for fair practices, dispute resolution, and grievance redressal mechanisms.

- Fostering Innovation: While regulating the sector, RBI also encourages innovation in fintech. It provides a conducive environment for experimentation and adoption of new technologies that can benefit the financial industry and consumers.

- Risk Management: RBI assesses and addresses the potential risks associated with fintech activities. This involves identifying and mitigating risks related to cyber security, fraud, market stability, and systemic risks.