Context:

As per the report on State finances, it has been found that States face substantial challenges in their finances, marked by high committed expenditure and a persistent revenue deficit.

Background:

- Recently, the Union Ministry of Statistics and Programme Implementation has also released figures for the Gross State Domestic Products.

- The economies of 19 states and Union Territories exceeded their pre-Covid levels, with 7 recording double-digit growth rates during 2021-22.

- The growth rates of 11 states including Gujarat and Maharashtra were not available for 2021-22.

About the Report:

- The findings are based on the 'State of State Finances' report by PRS Legislative Research.

- Objective: The report is shedding light on the complex fiscal landscape for states Post-GST and Post-pandemic.

Key Findings:

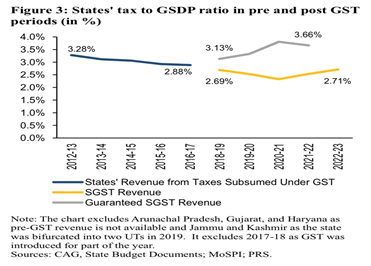

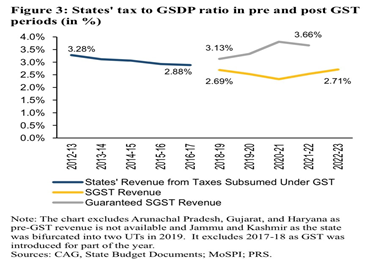

- State GST (SGST) accounts for over 40% of states’ own tax revenue but SGST to GSDP ratio continues to be lower than pre-pandemic level.

- SGST revenue is also lower than the level of guaranteed revenue for five years.

- In FY24, 11 states have budgeted a revenue deficit–gap between revenue expenditure and receipts. Of these, Andhra Pradesh, Himachal Pradesh, Kerala, Punjab, and West Bengal did so after accounting for revenue deficit grants.

|

About Gross State Domestic Product (GSDP):

|

- Over the past several years, states have spent around 8-9% of their revenue receipts on subsidies, with a significant portion on power subsidy.

Report Outcomes:

- Despite overall state revenue returning to pre-pandemic levels, GST collections as a percentage of Gross State Domestic Product (GSDP) remain below the pre-GST era.

- The cessation of GST compensation grants in June 2022 has adversely affected some states, highlighting the need for revenue rationalization.

Challenges Highlighted:

- States grapple with high committed expenditure and persistent revenue deficits.

- Non-merit subsidies have increased, pension reforms are being reversed, and state-owned discoms face financial strain.