Context

Kerala recently `

1: Dimension- Concerns highlighted by Kerala’s plea

- Federal Fiscal Relations: The dispute between Kerala and the Union government underscores the complexities of fiscal federalism in India.

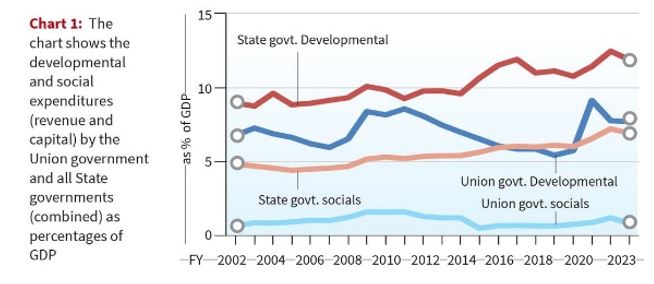

- State Expenditure Priorities: The significant disparity between Union and State government spending, particularly in social sectors like health and education, raises questions about allocation priorities and the respective roles of different tiers of government in addressing societal needs.

2: Dimension- Complex Resource Sharing System in India:

In resource sharing, there are majorly four kinds of flows:

- Statutorily Defined Share for States: Defined set of tax revenues garnered by the Centre is shared with States as per recommendations of Finance Commissions. Principles governing the share devolved and distributed to individual States.

- Statutorily Mandated Grants: Includes revenue deficit grant to identified States to cover revenue account gap post-devolution. Grants-in-aid to States have decreased from Rs.1,95,000 crore in 2015-16 to Rs.1,65,000 crore in 2023-24.

- Discretionary Spending: Previously mediated by the Planning Commission, now solely at the discretion of the Centre. Involves Centre’s share of expenditure in Centrally sponsored schemes implemented in States, with States meeting a specified proportion of projected expenditure.

- Central Sector Schemes: Implemented by Centre in individual States' jurisdictions, with all expenditure met by Central government.

3: Dimension- Significance/Need of State’s spending:

Kerala's plea prompts broader discussions on the role of government spending in fostering economic growth.

- Economic growth: Spending by the states has helped to alleviate the livelihood crisis in India, caused due to the slow growth of rural incomes and employment.

- Positive transformation: State’s spending positively transform a region’s economy and society.

- Social growth: A sizeable chunk of the government expenditure on social services is in the revenue account, paid as salaries and for covering day-to-day expenses. In states, teachers, nurses, and other government employees are key drivers of social achievements.

|

Fact Box: The Spending Structure

|