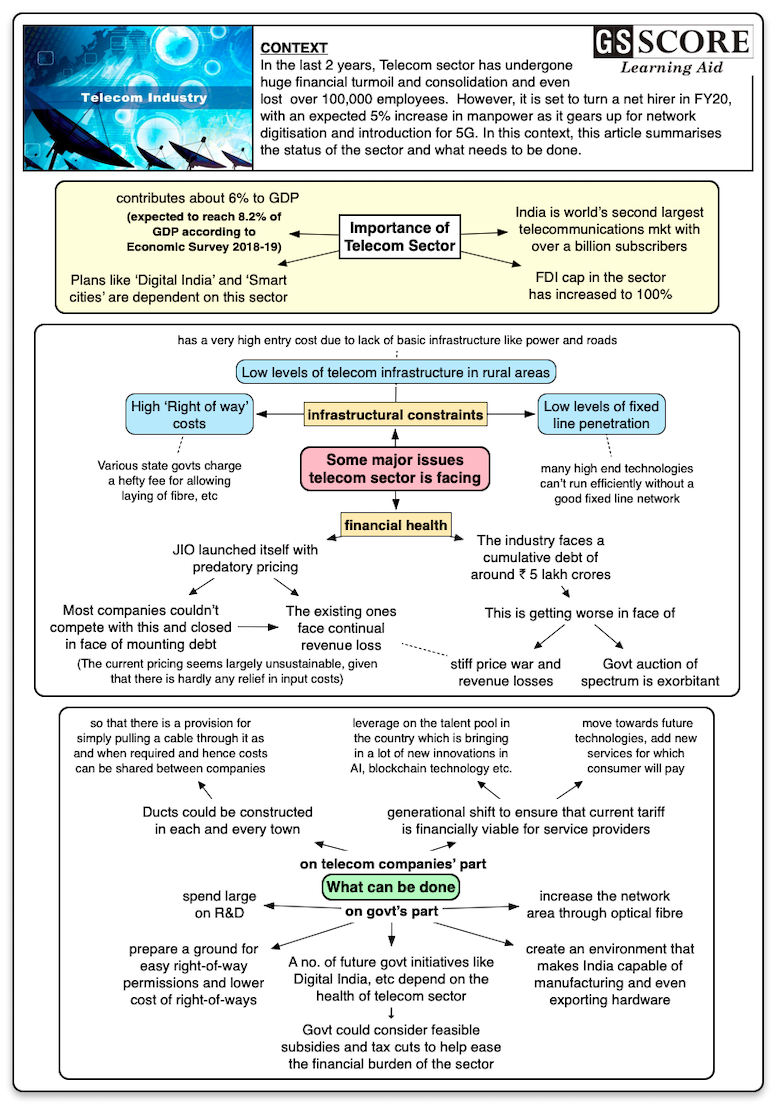

In the last 2 years, Telecom sector lost over 100,000 employees because of financial turmoil and consolidation of various telecom companies.

Issue

Context

- In the last 2 years, Telecom sector lost over 100,000 employees because of financial turmoil and consolidation of various telecom companies.

- According to the experts, it is set to turn a net hirer in FY20, with an expected 5% increase in manpower from companies such as Microsoft, Google, Tata Consultancy Services, HCL Technologies etc.

- The current demand is primarily for highly specialised skills in the junior to mid-level hierarchy in the two-five years (experience) bracket.

Background

- The Department of Telecommunications (DoT) is a department of the Ministry of Communications of the executive branch of the Government of India. The Department has been formulating developmental policies for the accelerated growth of the telecommunication services.

- The Department is also responsible for grant of licenses for various telecom services like Unified Access Service Internet and VSAT service.

- The Department is also responsible for frequency management in the field of radio communication in close coordination with the international bodies. It also enforces wireless regulatory measures by monitoring wireless transmission of all users in the country.

Why this recent step of hiring?

- Earlier, an intense competition forced some operators to exit as they became defunct, resulting in the number shrinking to three companies: Bharti Airtel, Vodafone Idea and Reliance Jio Info comm. Even the towers industry has seen consolidation.

- While some senior level hiring took place at salary levels upward of Rs 1 crore in the past few years, recruitment has started for other grades as well.

- Advent of 5G is one of the main reasons why the industry, including handset makers, original equipment makers (OEMs) etc., will hire people. 5G will not only improve network performance and productivity but eventually will create more high-skilled job opportunities. The job creation estimate for first half of the current fiscal is 33,100.

- Even field positions, which at times have an attrition rate of 30%, are also opening up. A specialist staffing company that works with telecom, junior posts for engineering graduates are also opening up “but the main demand is for IT, digital marketing, innovation and R&D”.

- Industry revenue is expected to rise in FY20 and recruiters say that hiring will happen across all levels like digital marketing, machine-to-machine (M2M), internet of things (IoT), artificial intelligence (AI), etc.

Analysis

Current Scenario of Telecom Industry in India

- India is the world's second-largest telecommunications market, with around 1.2 billion subscribers as of September 2018.

- This sector has contributed around 6% to the GDP of India and it is expected to increase to an even more significant level.

- The year 2018 saw the consolidation of the Indian mobile telecommunications market into three large private players, Reliance Jio, Bharti Airtel and Vodafone Idea, accounting for more than 90% of revenue and 80% of spectrum holding.

- Government's ambitious plans like Digital India and Smart-cities are dependent on this sector and its sound financial health.

- Foreign Direct Investment (FDI) cap in the telecom sector has been increased to 100% from 74%. Out of 100 per cent, 49 per cent will be done through automatic route and the rest will be done through the FIPB approval route.

- Growth in the wireless sector (technology getting upgraded from 1G to 4G) has resulted in a significant boom in the data usability space, providing users with mobile broadband and fast speed data services.

- While Telecom sector is witnessing spectacular growth, it is also facing some major hurdles both in the area of government regulations as also consistent demand from customers to enhance customer service.

- There is a cumulative debt of around Rs.5 lakh crore in the telecom sector.In rural areas, the tele-density is far lower (56.9%) than that in urban India (171.1%). Also, the revenues are constantly falling down, further worsening the debt crisis.

- Telecom service providers pay as much as 30 % of their revenues in taxes and levies for spectrum and operating licences.The increased 18% under the GST regime has made the services more expensive at a time when it should have been reduced.

Strength of Telecom sector in India

- Strong demand: World’s second largest in terms of telecom network (a subscriber base of 119.1 crore), internet subscribers (internet users of 51.2 crore) as well as app downloads

- it is estimated by the current demand that telecom sector will likely to have economic value of $217 billion by 2020.

- Increasing data usage: India is also one of the largest data consumers (an average 1 GB data per day per user) globally. Data prices in India have historically been lower than global benchmarks, given the sheer number of service providers. The entry of Jio has only made competition fiercer, forcing telecom companies to bring down tariffs.

- Good telecom infrastructure: Large telecom companies have been investing on network infrastructure to improve customer experience for last few years. Over the past couple of years, the Indian telecom industry has been going through a paradigm shift from a voice-centric market to a data-centric market.

- Fast-tracked reforms provide room for growth: National digital communications policy, 2018 aims to attract $100 billion worth of investments in the sector by 2022 and it is both customer-focussed and application-driven, given the pace of global transformation in the sector, particularly, in emerging technologies such as 5G, IoT (internet of things) and M2M (machine to machine) communications.

Key Challenges Faced by the Telecom Industry in India

Inefficiency in Technology

- The mobile operators need a spectrum to provide access to enhance performance but it is a scarce resource. As compared to other countries, in India, the amount of spectrum available for commercial use is quite low.

- The practice of the government to auction spectrum at an exorbitant cost makes it difficult for mobile operators to provide services at a lower price and at reasonable speeds. This discourages adoption and usage. However, the launch of Jio has helped to some extent to overcome this challenge. But there is a long way to go.

Lack of Telecom Infrastructure in Semi-rural and Rural areas

- Service providers haveto incur huge initial fixed cost to enter semi-rural and rural areas. Key reasons behindthese costs are lack of basic infrastructure like power and roads, resulting in delays in rolling out the infrastructure. Lack of trained personnel to operate and maintain thecellular infrastructure is another challenge.

Lack of automation

- Sales teams in the telecom industry in India continue to rely on largely manual processes to collect intelligence on prospects. This process needs automation since it’ll provide intelligence in real time.

- Without this information, teams may expand sales and resources in competitive markets where termination would not be effective, locations where serviceability is not aligned, or may not participate in the market until it is too late.

Lack of fixed line penetration

- India has very little penetration of fixed line in its network whereas, most of the developed countries have a very high penetration of fixed lines (telephone line that travelled through a metal wire or optical fibre as part of a nationwide telephone network).

- Though India has almost 1.2 billion connections the fixed line is around 18 million. Broadband Connectivity on fixed line is also poor.

- Only around 25% of Towers in India are connected with fibre networks, whereas in developed nations, it is in excess of 70%.

- 5G Network requires towers to be connected to with very high-speed systems. Those high speeds are not possible on the present radio systems. But are possible on fibre system.

High Right-of-Way (ROW) cost

- Sometimes, states governments charge a huge amount for permitting the laying of fibre etc. (A right of way is a type of easement that allows a person to pass through another's land)

- It takes a long time to get right-of-way permissions and thus India is yet not able to exploit the full potential of 4G networks.

Current System of Tariffs

- Major telecom Operators are reporting losses and financial stress. This shows that the current tariff system is not financially viable for telecoms.

Content constraints

- Today, mostly the content that is available on the Internet is in English, which is still spoken by a small fraction of the people in India. There is a need to make more and more content available in all the regional languages. Additionally, the content should be focused on addressing local problems.

- The experience of using the internet or browsing is not a pleasant one on the small screens of a mobile phone. So, mostly the usage is restricted to chatting on applications such as WhatsApp and playing games. However, reading documents on mobile phones is still difficult.

Threats

- Interconnection charges: Interconnection charges will be zero effective Jan 1, 2020 from current rate of 6 paisa/min. This would impact the revenues of incumbents.

- Spectrum auctions: Government of India has kept a high reserve price for spectrum auction. Given ongoing pressure on ARPU and margins, purchasing the spectrum at a high price (in circles like Mumbai) put further stress on the balance sheet.

- External Sources: There is a potential threats by the induction of Chinese Telecom Equipment or from any other source. So far, no specific issue has arisen due to equipment originating from any specific country. However, as and when any specific issue arises or a report is received, the regime can be further tightened for the equipments coming from a specific country or source or group of countries or companies.

Initiatives by Government

- The Government of India launched a new National Telecom Policy 2018 in lieu of rapid technological advancement in the sector over the past few years. The policy has envisaged attracting investments worth US$ 100 billion in the sector by 2022.

- The Department of Information Technology intends to set up over 1 million internet-enabled common service centres across India as per the National e-Governance Plan.

- FDI cap in the telecom sector has been increased to 100 % from 74 %; out of 100 %, 49 % will be done through automatic route and the rest will be done through the FIPB approval route.

- FDI of up to 100 % is permitted for infrastructure providers offering dark fibre, electronic mail and voice mail.

- The Government of India has introduced Digital India programme under which all the sectors such as healthcare, retail, etc. will be connected through internet

Recent Government Initiatives

- Department of Telecommunication launched ‘Tarang Sanchar’, a web portal sharing information on mobile towers and EMF Emission Compliances.

- Six-fold increase in Government spending on telecommunications infrastructure and services in the country

- Over 75 % increase in internet coverage

- Country-wide Optical Fibre Cable (OFC) coverage doubled

- Five-fold jump in FDI inflows in the Telecom Sector

Way Forward

- Future of Telecom Sector is very bright as its role will be seen in almost everything, from networking of CCTV Cameras to the safety and security of people to providing education in remote places. A long term vision plan should be made accordingly. For the time being, the government needs to provide an easy and soothing environment for telecom operators.

- The government should increase the network area through optical fibre instead of copper which is expensive. This is necessary to ensure last mile connectivity.

- The government needs to prepare a ground for easy right-of-way permissions and lower cost of right-of-ways.

- It is time to go for a generational shift to ensure that current tariff is financially viable for service providers.

- Telecom Operators should move towards future technologies, should add new services for which consumer will pay and will keep the telecom companies doing well.

- Telecom Operators should leverage on the talent pool in the country which is bringing in a lot of new innovations in AI, block-chain technology etc.

- New Infrastructure on sharable basis just like the way telecom service providers share the cost of towers is need of the hour. Every establishment requires a cable for one reason or other and roads cannot dig every day. Ducts should be constructed in each and every town so that there is a provision for simply pulling a cable through it as and when required and hence costs can be shared.

- The government should spend large on R&D and create an environment that makes India capable of manufacturing and even exporting hardware components like mobile handsets, CCTV Cameras, touch screen monitors etc.

Learning Aid

Practice Question:

“India is the world's second-largest telecommunications market, but it is facing many road-blocks in its growth.” Comment.