Context

The government is now considering a regulatory framework for special purpose acquisition companies (SPACs) to lay the ground for the possible listing of Indian companies.

- Listing of Indian companies through this route has been advised by the company law committee to boost the ease of doing business in India.

Background

- SPACs have emerged since 1990s but surged in popularity only in the last few years.

- In 2020, SPAC IPOs raised more capital than traditional IPOs for the first time.

- In 2021, the SPACs rally gained further momentum and the capital raised in the first quarter itself surpassed the total of 2020.

- However, there has been a slowdown in the SPAC IPOs since then.

- In 2020, 247 SPACs were created with $80 billion invested, and in 2021, there were a record 613 SPAC IPOs. By comparison, only 59 SPACs came to market in 2019.

- The main methods by which a private company can become a public company are; the traditional Initial Public Offering (IPO) method, the direct listing method, or the method of merger with a Special Purpose Acquisition Company (SPAC).

SPACs in India

- While SPAC deals in India are still at a nascent stage, the number of SPAC related conversations in the Indian transactions space is swiftly growing.

- Some of the examples are:

- Grofers has taking advantages from SPACs platform

- A renewable energy company ReNew power has merged with the RMG Acquisition Corp II, a SPAC company.

What are Special purpose Acquisition companies?

- A special purpose acquisition company (SPAC) is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering (IPO) or the purpose of acquiring or merging with an existing company.

- Also known as "blank check companies," SPACs have been around for decades, but their popularity has soared in recent years.

- Objectives of SPACs-

- A special purpose acquisition company (SPAC) is formed to raise money through an initial public offering (IPO) to buy another company.

- At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition.

- Investors in SPACs can range from well-known private equity funds and celebrities to the general public.

- SPACs have two years to complete an acquisition or they must return their funds to investors.

|

Initial Public Offering

|

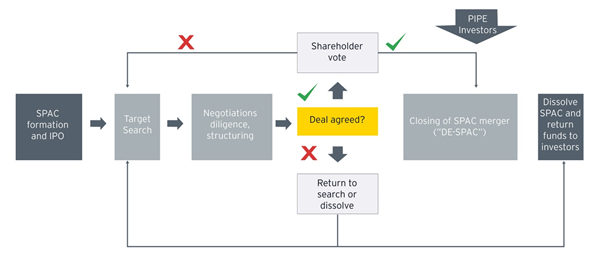

How a Special Purpose Acquisition Company (SPAC) Works

- SPACs are generally formed by investors or sponsors with expertise in a particular industry or business sector, to pursue deals in that area.

- In creating a SPAC, the founders sometimes have at least one acquisition target in mind.

- This is why they are called "blank check companies." IPO investors typically have no idea about the company in which they will ultimately be investing.

- SPACs seek underwriters and institutional investors before offering shares to the public.

- The funds SPACs raise in an IPO are placed in an interest-bearing trust account. These funds cannot be disbursed except to complete an acquisition or to return the money to investors if the SPAC is liquidated.

- A SPAC generally has two years to complete a deal or face liquidation. In some cases, some of the interest earned from the trust can serve as the SPAC's working capital. After an acquisition, a SPAC is usually listed on one of the major stock exchanges.

Advantages of a SPAC

- Less tedious -SPACs offer some significant advantages for companies that have been planning to become publicly listed.

- Firstly, a company can go public through the SPAC route in a matter of months, while the conventional IPO process is an arduous process that can take anywhere from six months to more than a year.

- Less Un-certainity-The soaring popularity of SPACs in 2020 may partly be due to their shorter time frame for going public, as many companies chose to forego conventional IPOs because of the market volatility and uncertainty triggered by the global pandemic.

- Easy to exit-The owners of the target company may be able to negotiate a premium price when selling to a SPAC because the latter has a limited time window for making a deal. In addition, being acquired by or merging with a SPAC that is sponsored by prominent financiers and business executives can give the target company experienced management and enhanced market visibility.

The India’s stand

- India currently does not have a specified SPAC regime in place.

- The International Financial Services Centres Authority (IFSCA), being the regulatory authority for development and regulation of financial products, financial services and financial institutions in the Gujarat International Finance Tec-City (GIFT City).

- The proposed scheme defines critical parameters such as offer size to public, compulsory sponsor holding, minimum application size, minimum subscription of the offer size, etc.

- According to data sourced from SPAC, a portal that maintains a record of SPAC deals, of the 755 IPOs has diverted to SPAC routes.

- The gross proceeds raised by SPACs in 2020 amounted to over $83 billion, while for 2021 the number stands at $91.65 billion as of now.

- According to a report, venture capital firms Elevation Capital and Think Investments are expected to launch a SPAC focused on Indian technology companies seeking to list in America.

- Furthermore, while India has not taken an official regulatory stand on allowing the listing of SPACs here, the Security and Exchanges Board of India (SEBI) has reportedly formed a group of experts to study the feasibility of bringing SPACs under the regulatory ambit.

- However, the Indian regulatory framework does not allow the creation of these blank cheque companies as yet.

- For example, the Companies Act 2013 stipulates that the Registrar of Companies can strike off a company if it does not commence operations within a year of incorporation.

|

What were the Recommendations of the Company Law Committee 2022?

|

Risks associated

- Risk of investor fradulant- An investor in a SPAC IPO is making a leap of faith that its promoters will be successful in acquiring or merging with a suitable target company in the future.

- The reduced degree of oversight from regulators, coupled with a lack of disclosure from the typical SPAC, means that retail investors run the risk of being saddled with an investment that could be massively overhyped or occasionally even fraudulent.

- Low returns- Returns from SPACs may be well below expectations when the initial hype has worn off in the market.

- SPACs vs IPOs- As many as 70% of SPACs that had their IPO in 2021 were trading below their $10 offer price as in 2021, according to a Renaissance Capital strategist.

- This dismal performance could mean that the SPAC bubble that some market experts had warned about may be in the process of bursting.

- Increased regulations-Towards the end of 2021 and early 2022, it is evident that SPACs have lost some of their luster due to increased regulatory oversight and less than stellar performance.

- And the purpose of its establishment with independent mergers will not be fulfilled.

Way forward

- India Should Reap the Benefits of SPACs:

- For India, it is to tread SPACs with cautious optimism and greater regulatory oversight, given that instances of underwhelming performances by SPACs have slowly begun to surface.

- In order to strengthen the regulatory framework governing them and mitigate accompanying risks, it is necessary to extend statutory recognition to such companies and employ sophisticated safeguards to protect the interests of investors.

- SPACs should also be allowed for Global Exchanges:

- It is essential that SPACs incorporated in India should be allowed to list not only on domestic stock exchanges, but also on global exchanges, to enable target companies to ride the SPACs wave and achieve their fullest possible potential.

- Need to Analyse the Issues Related to SPACs:

- While recognising SPACs within the contours of the Companies Act is a welcome step, it may still require a more sophisticated analysis of SPAC-related issues based on prevailing market practices, in consultation with Securities and Exchange Board of India (SEBI).

- Additionally, the foreign listing of Indian incorporated SPACs can only be achieved after the commencement of Section 23(3) and Section 23(4) of the Companies Act, which enables certain classes of companies to list their securities on stock exchanges in permissible foreign jurisdictions.

|

Practice Questions Q1. Why Special Purpose Acquisition Company (SPAC) is called a blank-cheque company? Comment on its growing relevance in India. Q2. Amidst the unicorn revolution in India, there is a need for right policy support and regulatory direction to ensure start-ups reach their potential. Examine. |