- Recently, the US President Donald Trump’s administration raised import tariffs on $200 billion of Chinese imports from 10% to 25%, effectively making them 25% more expensive for US consumers.

- China said it will raise tariffs on $60 billion worth of U.S. goods from June 1, in retaliation to this U.S. tariff hike. The new rates will target a number of American imports with tariffs ranging from 5% to 25%. In addition, China may stop purchasing U.S. agricultural products and energy, reduce Boeing orders and restrict the bilateral service trade.

Issue

Context:

- Recently, the US President Donald Trump’s administration raised import tariffs on $200 billion of Chinese imports from 10% to 25%, effectively making them 25% more expensive for US consumers.

- China said it will raise tariffs on $60 billion worth of U.S. goods from June 1, in retaliation to this U.S. tariff hike. The new rates will target a number of American imports with tariffs ranging from 5% to 25%. In addition, China may stop purchasing U.S. agricultural products and energy, reduce Boeing orders and restrict the bilateral service trade.

- Further, US Trade Representative has published plans to increase tariffs on another 3805 Chinese imports valued at $300 billion hence covering almost all of China’s import products.

Analysis

Origin of this US-China trade war:

- Since 1990s, the Chinese government has been consistently declining the value of its currency, the yuan against US dollar. This artificial cheapness of yuan gave Chinese exporters an advantage in world markets and harmed the US exports.

- The currency devaluation is similar to sales stores which are able to sell more of their products due to cheap rates. As the yuan gets cheaper from the perspective of American consumers, the dollar gets more expensive from the perspective of Chinese consumers. That means it's getting more expensive for Chinese people to import American-made goods, so they're likely to import fewer of them. Lower demand for US goods would slow down the economic growth in the US.

- The US launched an investigation into Chinese trade policies in 2017. It imposed heavy tariffs on billions of dollars’ worth of steel and aluminium items from China in March last year, and China responded by imposing tit-for-tat tariffs on billions of dollars’ worth of American imports.

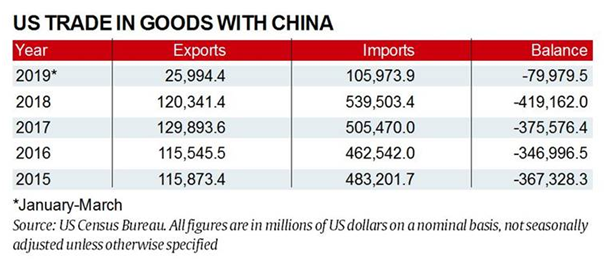

- This dispute escalated after US demanded that China reduce its $375 billion trade deficit with the US (2017), and introduce verifiable measures for protection of Intellectual Property Rights, technology transfer, and more access to American goods in Chinese markets.

- In 2018, the US imposed three rounds of tariffs on more than $250bn worth of Chinese goods. The duties of up to 25% cover a wide range of industrial and consumer items - from handbags to railway equipment.

- China hits back with tariffs on $110bn of US goods, accusing the US of starting the largest trade war in economic history. China has targeted products including chemicals, coal and medical equipment with levies that range from 5% to 25%.

Impact on US economy:

- Tariffs imposed on Chinese goods, in theory, make US-made products cheaper than imported ones, and encourage consumers to buy American. This will boost the consumption of domestic products and increase the profits of American manufacturers rather than Chinese manufacturers.

- The increased tariffs by China could hamper the US export industry, as the products of these US industries will now have to compete will locally available cheaper products of China.

Impact on Chinese economy:

- The biggest Chinese import sector impacted by the fresh round of tariff hikes is the $20 billion-plus category of Internet modems, routers, and other data transmission devices segment.

- This is followed by about $12 billion worth of printed circuit boards used in a vast array of US-made products.

- Furniture, lighting products, auto parts, vacuum cleaners, and building materials also face higher levies.

- The increased tariffs will lower the demand of Chinese products in American market thereby decreasing the profits earned by the Chinese companies.

Impact on world:

- The IMF has lowered its forecast for global growth this year and next. It said that a full-blown trade war between the US and China would put a significant dent in economic recovery.

- Global economic growth is now expected to reach 3.7% in 2018 and 2019, down from the IMF's previous prediction of 3.9% in July.

- This also exacerbates the uncertainty in the global trading environment, affects global sentiment negatively, and adds to risk aversion globally.

- The higher tariffs could lead to the repricing of risk assets globally, tighter financing conditions, and slower growth.

- The trade tensions could result in an increasingly fragmented global trading framework, weakening the rules-based system that has underpinned global growth, particularly in Asia, over the past several decades.

- Of the $300 billion in Chinese exports that are subject to US tariffs, only about 6% will be picked up by firms in the US.

- EU members are expected to benefit the most, as exports in the bloc are likely to grow by $70 billion; and Japan and Canada will see exports increase by more than $20 billion each. Other countries set to benefit from the trade tensions include Vietnam, with 5% export gains, Australia (4.6%), Brazil (3.8%), India (3.5%), and Philippines (3.2%).

Impact on India:

- The US manufacturers are setting up their bases in India, in addition to already existent bases in China. This will provide them an alternative source for export of their products to deal with such trade wars like situations. For India, this will be beneficial as it would create more jobs for us.

- There is a possibility that China could soon start flooding excess steel and aluminium into India’s market after this raised tariffs on Chinese products by US.

- Besides the steel sector, products in other sectors like mobile phones, refrigerators, washing machines, ACs, water purifiers, and possibly electric vehicles will now see increased investment flow directed towards India.

- The Indian consumers will get the products at a cheaper rate but the domestic producers of India will have to compete with the Chinese imports or else face loss.

- With this increased tariffs on Chinese products by the US, the Indian producers will get an opportunity to fill this generated gap and penetrate in the US market. This will increase their trade and profit.

- Besides this, there will be a short-term impact on the stock markets. The benchmark Sensex at the Bombay Stock Exchange has been falling in line with global markets that have been spooked by the escalating trade war between the US and China.

Possibility of this trade war to be taken up at WTO level:

- While it is not clear yet whether the matter would go to the World Trade Organisation (WTO), data show that the US generally wins trade disputes, particularly against China, before the global trade arbitrator. In the last 16 years, the US has challenged Chinese practices 23 times in the WTO, with a win-loss record of 19-0 — with four cases pending.

- In the most recent decision, the WTO panel found that China’s agricultural subsidies were inconsistent with WTO rules, and upheld US claims.

Way forward:

-

- The head of the WTO has said that global free trade is facing its worst crisis since 1947 due to the protectionist nature of this US-China trade war.

- Both the countries- US and China should hold talks and deliberate on a better course of action.

- The US is a developed country, hence, it is no longer in the stage of primary and secondary based economy. Neither its people are poor enough, they have an appreciable standard of living. Hence the US companies should not fear of the competition from their Chinese counterparts. They should make themselves competent enough that their government need not to impose protectionist measures.

Learning Aid

Practice Question:

Recently, US has increased tariffs on $200 billion worth imports from China and in retaliation China has increased tariffs on $60 billion worth of imports from US. Discuss, how these actions would impact the global economy.