The Union Cabinet approved the Wage Code Bill which seeks to subsume 13 existing laws related to workers remuneration and enable the Centre to fix minimum wages for workers in un-organised sector.

Issue

Context:

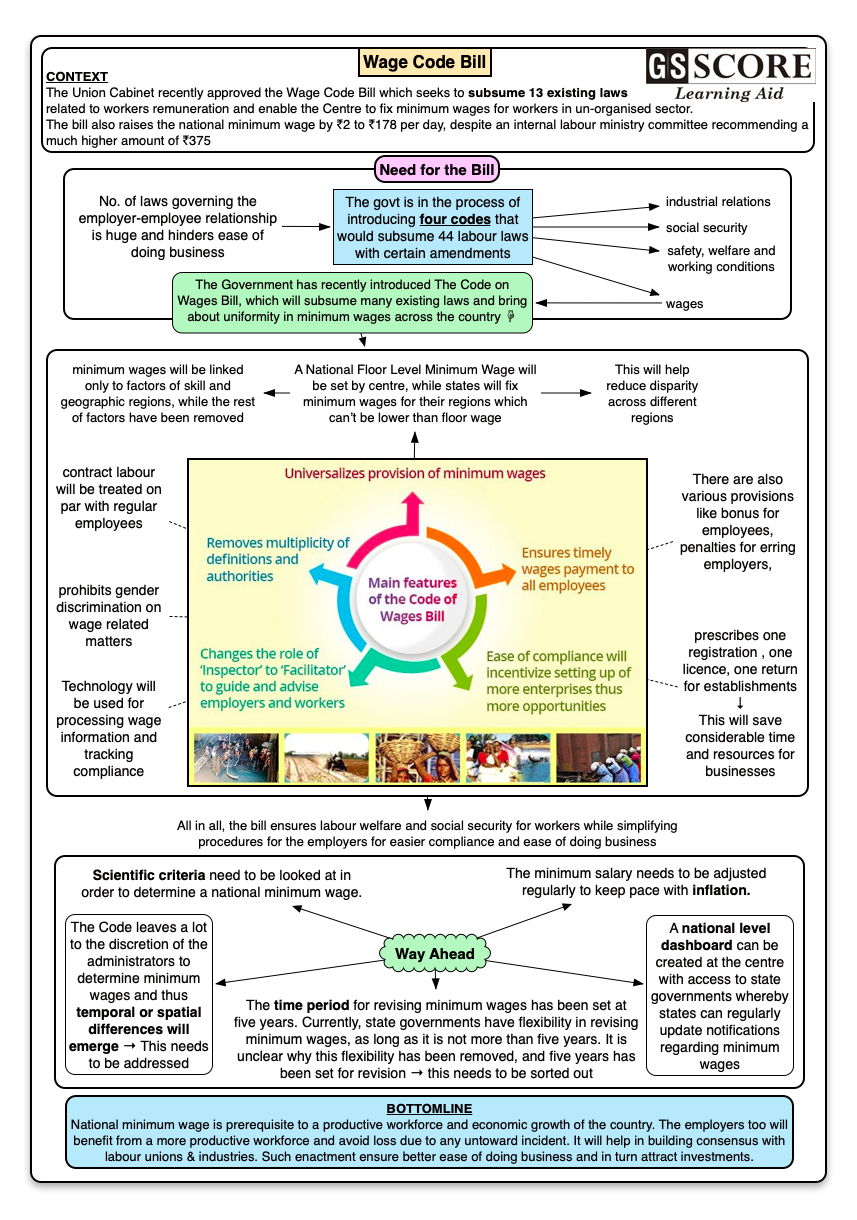

- The Union Cabinet approved the Wage Code Bill which seeks to subsume 13 existing laws related to workers remuneration and enable the Centre to fix minimum wages for workers in un-organised sector.

- The bill also raises the national minimum wage by ?2 to ?178 per day, despite an internal labour ministry committee recommending a much higher amount of ?375.

Background

- One of the biggest issues faced by employers in India is the number of laws governing the employer-employee relationship. This issue has been on the government’s radar for a very long period of time.

- The government is in the process of introducing four codes that would subsume 44 labour laws with certain amendments such as (i) industrial relations, (ii) wages, (iii) social security, (iv) safety, welfare and working conditions. This would also allow for uniformity in the coverage of various labour laws that are in force.

- Notably, the Centre started notifying a uniform national floor level minimum wage from 1996, which is non-binding on states.

- The national floor level was last revised by 10% to Rs 176 a day in July 2017.

- The Government has recently introduced The Code on Wages Bill ,2017 , which is regarded as the significant step towards reduction in number of labour laws in India.

- It will codify relevant provisions of four existing laws like The Minimum Wages Act, 1948, Payment of Wages Act 1936, Payment of Bonus Act, 1965 and Equal Remuneration Act 1976. After the enactment of the Code on Wages, all these four Acts will get repealed.

- The bill is expected to benefit over 50 crores employees across the country.

Analysis

Issues in Current Framework

- Multiplicity of Labour Laws

- Labour is in the concurrent list. Hence, more than 40 Central laws and around 100 state laws govern the subject of labour welfare in the country. India has a very pernicious set of labour laws and that is the reason why Indian firms have remained so small on average.

- As our economy evolved and the labour force grew, the government kept adding new laws without considering that contradictions might arise with older laws. So, 2014-19 saw a repeal of over 10 laws seen as redundant.

- Worker’s Issues

- Wages had always been the central concern of workers and entrepreneurs. The provisions of the Minimum Wages Act and the Payment of Wages Act do not cover substantial number of workers, as the applicability of both these Acts is restricted to the Scheduled Employments / Establishments.

- Laws on wages do not cover workers getting monthly wage of more than Rs 18,000.

- Even there are about half a dozen definitions of wages in various acts across the Centre and states, which employers have to grapple with.

- Present minimum wage system in India has 1,915 minimum wages for various scheduled job categories across states.

- 1 in every 3 wage worker in India is not protected by the minimum wage law.

- Variations in wage rates

- The current system has led to over 1,700 minimum wage rates, fixed by both states and the Centre. Different rates turn out as a huge compliance burden on industries.

- It has the potential of unleashing inspector raj, and largely works against the welfare of workers. The variations call for a statutory floor across the country.

- Lack of a uniform criteria for fixing the minimum wage rate:

- Different minimum wages for the same occupation across different states, along with a wide range between the lowest and highest minimum wages, trigger migration of industries towards low wage regions.

- This can also cause distress migration of labour to better paying states.

- Gender Bias

- Analysis of minimum wage data also shows a systemic gender bias. For example – male-dominated job of security guards pays better than being a domestic worker, most of whom are women.

Significance of the Bill

- Improves Worker’s Condition

- The labour code on wages has a provision for a minimum wage. Hence, it brings uniform standard of living across the country

- It is expected to treat contract labour on par with regular employee to have dignified life. The wage conditions of unskilled workers will also improve.

- Sets overtime wage at two times the normal wages.

- This bill ensures timely payment of wages to all employees irrespective of the sector of employment without any wage ceiling.

- Thus, this bill ensures labour welfare and wage and social security for workers.

- ‘Mandatory national wage floor’

- It will ensure decent minimum wage for all which will result into increase in disposable incomes, which in turn help in eradicating poverty and hunger.

- Thereby enabling us to achieve SDGs goals.

- This bill seeks to define the norms for fixing minimum wages that will be applicable to workers of organised and unorganised sectors, except government employees and MNREGA workers.

- As per the bill, the minimum wages across the country would be only linked to factors of skills and geographical regions, while the rest of the factors have been removed.

- Reduces Regionalism

- A National Floor Level Minimum Wage will be set by the Centre to be revised every five years, while states will fix minimum wages for their regions, which cannot be lower than the floor wage. It will help in reducing wage disparity across different regions.

- The bill provides that the central government will fix minimum wages for certain sectors, including railways and mines (except members of armed forces), while the states would be free to set minimum wages for other category of employments.

- Easier compliance

- Bill would allow for easier implementation and compliance with the minimum wage law. Thereby aligning with the international practices like the United States of America and United Kingdom which has a single minimum wage

- Influence on Indian Economy

- The bill is expected to go for digital mode/cheques as the mode of payment of wages. This would promote digitization. It will also lead to formalisation of economy.

- National minimum wage is mandatory to ensure that India will touch its ambitious mark of $5 trillion economy.

- No Gender bias

- The Code prohibits gender discrimination on wage-related matters. It will enhance India’s ranking in Global Gender gap Report, which is currently 108 out of 149 countries.

- Penalties

- Employers who pay less than what is due under the Code will pay a fine of up to Rs 50,000. If an employer is guilty of repeat offence within five years, penalties include imprisonment up to three months or a fine of up to Rs 1 lakh or both.

- Employers who do not comply with any other provision of the Code will pay a fine of up to Rs 20,000. If an employer is guilty of the same offence again within five years, penalties include imprisonment up to one month or a fine of up to Rs 40,000 or both.

- Bonus

- All employees, whose wages do not exceed a particular monthly amount to be notified by the central or state governments, will be entitled to a minimum bonus of 8.33% of their annual wage. The bonus cannot exceed 20% of the annual wage of the employee. This is similar to current provisions.

- It regulates bonus payments in all employments where any industry, trade, business or manufacturing is carried on.

- Inspections

- Bill provides appointment of a Facilitator to carry out inspections, and information to employers and employees for better compliance.

- Inspection will be done on the basis of an inspection scheme, which will include a web-based inspection schedule. The inspection scheme will be decided by the central or state governments.

- Ensures Ease of Doing Business

- The proposed bill prescribes one registration for an establishment, one license, one return and this will help save time, resources and other efforts of the organisations.

- Earlier, out of the 13 labour laws six required separate registration. With the proposed ‘one licence one return’ businesses will save considerable time and resources.

- MSME cope up with new laws

- Any legislation requires lots of discussion and debate.

- Convincing trade unions is an on-going event.

- Industry wants the minimum wages to be low while the trade unions want it to be higher.

- Since the subject is in the concurrent list various states have amended various laws to meet its demands in states.

- Removes Multiplicity of definitions

- The codification of labour laws will remove the multiplicity of definitions and authorities that will facilitate easier compliance by establishments.

- Role of Technology:

- Technology will play an important role in both the processing of information around wages as well as tracking compliance.

- Networking technologies could facilitate the collection and analysis of labour statistics, assist with the dissemination of information about labour laws and policies, reduce costs and improve transparency.

Key Issues with the bill

- Implementation: This bill sets separate national minimum wages for different states or regions. In this context, two questions arise: (i) the rationale for a national minimum wage, and (ii) whether the central government should set one or multiple national minimum wages.

- Conflict between centre and state: States have to ensure that minimum wages set by them are not lower than the national minimum wage. If existing minimum wages set by states are higher than the national minimum wage, they cannot reduce the minimum wages. This may affect the ability of states to reduce their minimum wages if the national minimum wage is lowered.

- Time Period: The time period for revising minimum wages will be set at five years. Currently, state governments have flexibility in revising minimum wages, as long as it is not more than five years. It is unclear why this flexibility has been removed, and five years has been set for revision.

- Gender Bias based on recruitment: The Equal Remuneration Act, 1976, prohibits employers from discriminating in wage payments as well as recruitment of employees based on gender. While the Code prohibits gender discrimination on wage-related matters, it does not include provisions regarding discrimination during recruitment.

- Variations in consumer’s needs: There is a major difficulty in constructing the National Minimum Wage as there are large variations in consumption patterns of persons in different regions, the wide variety of items used by them, regional price variations and so on.

- Determination of minimum wages: The Code stipulates that minimum wages will be determined by skill, arduousness at the workplace, and geographical peculiarities. Employers have been calling for fixing minimum wages on the basis of paying capacity of the industry and productivity of workers.

- Bad legal principle: The Code leaves a lot to the discretion of the administrators to determine minimum wages and thus temporal or spatial differences will emerge.

- Inspection problem: The Code labels inspectors as “facilitators” and provides for web-based transparent and accountable inspection and a responsive prosecution system. The organisational measures to reform inspection and prosecution prevent harassment, remove discretion at the lower levels and pave the way for a persuasive/educative system. But the reforms shift the probability of incidence of discretion to the higher officials in the hierarchy, hence abuse is still possible.

- Failure of digitization: Digitization is unlikely to be successful for several reasons, primarily the lack of adequate banking/digital infrastructure, awareness on the part of workers and inspection mechanisms. Envisaging digital payments to construction workers or even domestic workers in rural areas shows up its impracticality.

Way Forward

- National minimum wage is prerequisite to a productive workforce and economic growth of the country. The employers too will benefit from a more productive workforce and avoid loss due to any untoward incident.

- With such enactment, it will ensure to the country to achieve its pioneering rank in Ease of doing business in country.

- It helps in building consensus with labour unions & industries.

- Scientific criteria need to be looked at in order to determine a national minimum wage.

- The minimum salary needs to be adjusted regularly to keep pace with inflation. A mechanism should be developed to adjust minimum wages regularly and more frequently.

- A national level dashboard can be created at the centre with access to state governments whereby states can regularly update notifications regarding minimum wages and the portal must be made available at Common Service Centres and rural haats.

Learning Aid