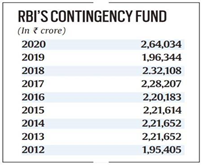

The Reserve Bank of India (RBI), the government’s banker, has retained a whopping amount of Rs 73,615 crore within the RBI by transferring it to the Contingency Fund (CF) of the central bank, thus leading to a sharp fall in the transfer of surplus to the government in the current year.

Context

The Reserve Bank of India (RBI), the government’s banker, has retained a whopping amount of Rs 73,615 crore within the RBI by transferring it to the Contingency Fund (CF) of the central bank, thus leading to a sharp fall in the transfer of surplus to the government in the current year.

About

- The Contingency Fund of India is established under Article 267 of the Indian Constitution. It is in the nature of an imprest (money maintained for a specific purpose).

- This is a specific provision meant for meeting unexpected and unforeseen contingencies, including depreciation in the value of securities, risks arising out of monetary/exchange rate policy operations, systemic risks and any risk arising on account of the special responsibilities enjoined upon the Reserve Bank.

- Simply put, the fund that is set up specifically to meet the challenges at the time of a crisis

- This amount is retained within the RBI.

- The Secretary to the Government of India, Ministry of Finance, Department of Economic Affairs holds the fund on behalf of the President.

|

Contingency Funds for States

|

- Any expenditure incurred from this fund requires a subsequent approval from the Parliament and the amount withdrawn is returned to the fund from the Consolidated Fund.

|

Consolidated Fund of India

|

What’s the CGRA account?

- The Currency and Gold Revaluation Account (CGRA) is maintained by the Reserve Bank to take care of currency risk, interest rate risk and movement in gold prices.

- Unrealised gains or losses on valuation of foreign currency assets (FCA) and gold are not taken to the income account but instead accounted for in the CGRA.

- Net balance in CGRA, therefore, varies with the size of the asset base, its valuation and movement in the exchange rate and price of gold.

- CGRA provides a buffer against exchange rate/ gold price fluctuations.

- It can come under pressure if there is an appreciation of the rupee vis-à-vis major currencies or a fall in the price of gold.