After a period of divergence, domestic and global food prices are rising in tandem. Coronavirus, global crude prices, and an expected bumper rabi harvest could determine the scenario in the coming months.

Context

After a period of divergence, domestic and global food prices are rising in tandem. Coronavirus, global crude prices, and an expected bumper rabi harvest could determine the scenario in the coming months.

About

- The United Nations Food and Agriculture Organisation’s (FAO’s) food price index — which is a measure of the change in international prices of a basket of major food commodities with reference to a base period touched 182.5 points in January 2020, the highest since the 185.8 level of December 2014.

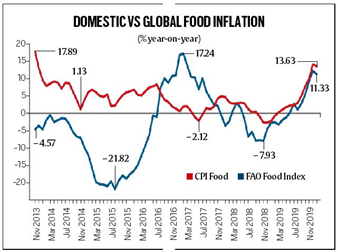

- Also, the year-on-year inflation rate based on this index has risen steadily from 1.13% in August 2019 to 2.86% in September, 5.58% in October, 9.33% in November, 12.22% in December, and now, 11.33% for January 2020.

- This sharp surge in global food prices is reflected in trends in India as well.

- Annual consumer food price index (CFPI) inflation stood at just 2.99% in August 2019, before climbing to 5.11%, 7.89%, 10.01%, 14.19% and 13.63% in the succeeding five months.

- The year-on-year inflation in the wholesale price index for “food articles” began rising somewhat earlier — reaching 7.8% in August 2019 from 2.41% in January last year.

- Retail and wholesale food inflation rates for December 2019 were the highest since November 2013 and December 2013 respectively. Simply put, since October or so, food inflation has made a comeback, both in India and globally.

Local and ‘foreign’ factors

- While the recent rise in domestic food prices has been blamed largely on “local” factors — poor rainfall during the first half of the monsoon season and too much of it thereafter till about mid-November, leading to both reduced/delayed Kharif sowings and damage to the standing crop at maturity/harvesting stage — some of it is also “imported”.

- While global prices can be transmitted to the domestic market too through exports — traders would sell abroad if realisations are better relative to the local market — the government has foreclosed that possibility by banning/restricting onion shipments.

The period of divergence

- The chart above shows that the domestic CFPI and FAO food price index inflation rates started moving in tandem only from around March 2018, while exhibiting significant divergence in the period prior to that.

- The FAO index peaked at 240.1 in February 2011 but remained at 200-plus levels until July 2014.

What can happen now?

- The first is, of course, the novel coronavirus epidemic that has reduced Chinese buying of everything from palm oil and soya bean to milk powder and meat.

- Palm oil prices in Malaysia have plunged over the last month.

- The second is crude oil. Brent crude prices had touched $70 per barrel.

- The third is the prospect of a bumper rabi (winter-spring) crop in India.

- The Kharif harvest turned out to be not so good because of excess and unseasonal rain.

- That same rain, though, has helped boost rabi acreage by 9.5% compared to last year.

- If Brent crude too, were to rally again — making it attractive for sugarcane and corn to be diverted for ethanol production and also palm oil towards bio-diesel — there could be uncertainty ahead.