NSDL Payments Bank has commenced operations as a payments bank.

Context

NSDL Payments Bank has commenced operations as a payments bank.

About

Background:

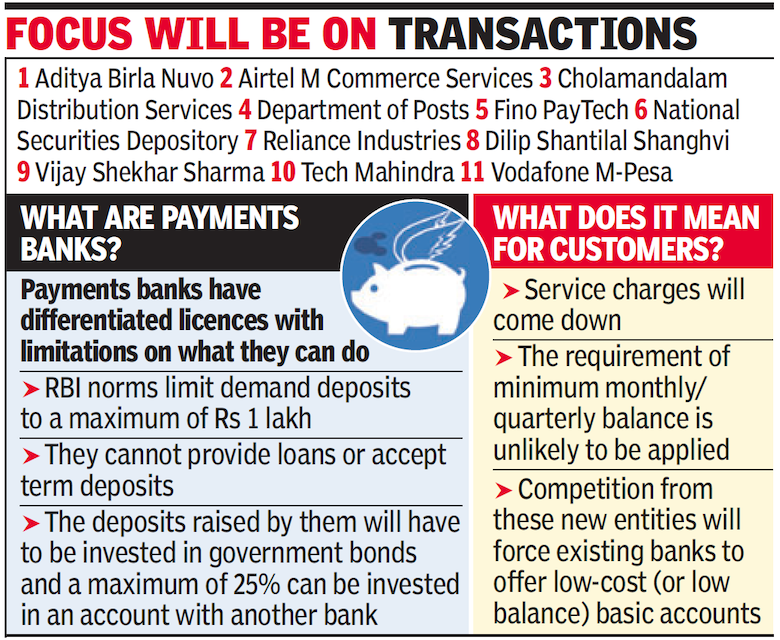

- In November 2014, the RBI had granted 'in-principle' approval to 11 applicants, including National Securities Depository Ltd (NSDL) to set up payments banks.

- The Reserve Bank has issued a license to the bank under Section 22 (1) of the Banking Regulation Act, 1949, to carry on the business of payments bank in India.

- NSDL Payments Bank Limited has commenced operations as a payments bank with effect from October 29, 2018.

- The launch comes at a time when other payments banks are under scrutiny of the RBI regarding compliance with operating guidelines.

- Other payments banks that have started operations are India Post Payments Bank, Airtel Payments Bank, Aditya Birla Idea Payments Bank and Jio Payments Bank.

Nachiket Mor Committee:

- In 2013, the Reserve Bank of India constituted a committee headed by Dr Nachiket Mor to study 'Comprehensive financial services for small businesses and low income households'.

- The objective of the committee was to propose measures for achieving financial inclusion and increased access to financial services.

- The committee submitted its report to RBI in January 2014. One of the key suggestions of the committee was to introduce specialized banks or ‘payments bank’ to cater to the lower income groups and small businesses so that by January 1, 2016 each Indian resident can have a global bank account.

Payments Banks:

- A payments bank is like any other bank, but operating on a smaller scale without involving any credit risk, i.e, it can carry out most banking operations but can’t advance loans or issue credit cards.

- It can accept demand deposits (up to Rs 1 lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers. They also can distribute non-risk sharing simple financial products like mutual funds and insurance products.

- The main objective of payments bank is to widen the spread of payment and financial services to small business, low-income households, and migrant labour workforce in secured technology-driven environment.

Learning Aid