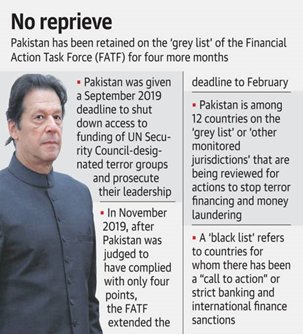

In a major setback for Pakistan, the country will remain on the FATF Grey List till June 2020 and has been warned of stern action if it fails to check the flow of money to terror groups like the LeT and the JeM.

Context

In a major setback for Pakistan, the country will remain on the FATF Grey List till June 2020 and has been warned of stern action if it fails to check the flow of money to terror groups like the LeT and the JeM.

About:

- The Financial Action Task Force (FATF) is an inter-governmental body established in 1989.

- The objectives of the FATF are to set standards and promote effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system.

- The FATF is, therefore, a “policy-making body” which works to generate the necessary political will to bring about national legislative and regulatory reforms in these areas.

- The FATF has developed a series ofrecommendationsthat are recognised as the international standard for combating of money laundering and the financing of terrorism and proliferation of weapons of mass destruction.

- They form the basis for a coordinated response to these threats to the integrity of the financial system and help ensure a level playing field.

- First issued in 1990, the FATF Recommendations were revised in 1996, 2001, 2003 and most recently in 2012 to ensure that they remain up to date and relevant, and they are intended to be of universal application.

- The FATF monitors the progress of its members in implementing necessary measures, reviews money laundering and terrorist financing techniques and counter-measures, and promotes the adoption and implementation of appropriate measures globally.

- In collaboration with other international stakeholders, the FATF works to identify national-level vulnerabilities with the aim of protecting the international financial system from misuse.

- India became an Observer at FATF in 2006. Since then, it had been working towards full-fledged membership. On June 25, 2010, India was taken in as the 34th country member of FATF.

What as FATF 'grey list' and 'blacklist'?

- FATF has 2 types of lists:

- Black List: Countries knowns as Non-Cooperative Countries or Territories (NCCTs) are put in the blacklist. These countries support terror funding and money laundering activities. The FATF revises the blacklist regularly, adding or deleting entries.

- Grey List: Countries that are considered a safe haven for supporting terror funding and money laundering are put in the FATF grey list. This inclusion serves as a warning to the country that it may enter the blacklist.

-

-

- Currently, there are 18 jurisdictions identified as having strategic deficiencies, including Mauritius and Pakistan, as per the FATF.

-

The decision:

- The Financial Action Task Force (FATF) in October decided to keep Pakistan on its Grey List for failure to curb funnelling of funds to terror groups Lashkar-e-Taiba, Jaish-e-Mohammed and others.

- It has also warned Pakistan that if it does not complete a full action plan by June, it could lead to consequences on its businesses.

- The organization noted that Pakistan addressed only a few of the 27 tasks given to it in controlling funding to terror groups like the Lashkar-e-Taiba (LeT), the Jaish-e-Mohammad (JeM) and the HizbulMujahideen, which are responsible for a series of attacks in India.

- The FATF said Pakistan has to swiftly complete its full action plan by June.

- If Pakistan fails to comply with the FATF directive, there is every possibility that the global body may put the country in the 'Black List' along with North Korea and Iran.

India's focus:

- India has been focusing on strengthening its case against Islamabad, to place it in the FATF Black List, for its failure in taking action against terror-financing and the Fake Indian Currency (FICN) menace.

- The continuing worry of the Indian security agencies is the inability so far to dismantle the sophisticated currency production machines, which produce ‘high quality’ FICN, close imitations of genuine Indian Currency Notes (ICN).

- New Delhi has been taking steps to gather strong evidence against Pakistan, foremost being to strengthen the FCORD (FICN Coordination Cell) set up within the Intelligence Bureau in 2010 to have effective coordination with state agencies for higher seizures.