Rural Employment and MGNREGA

- Farm risks and uncertainties, population pressure on cultivable land, lack of alternate occupational choices, differentials and rising rural economic distress had, rural-urban income earlier, prompted massive rural-urban migration in India.

- The farm and non-farm sectors are expected to experience various ill-effects of under-employment and unemployment due to swelling in the existing workforce, in the respective regions.

- It is thus important to ensure adequate livelihoods through broadened occupational choices to the millions of workforce of the countryside.

- MGNREGA, an entitlement-driven and self-target oriented employment generation scheme, aims at enhancing the livelihood and economic security of the rural poor households.

MGNREGA's Role in Self-reliant Rural India

- MGNREGA, being a public works programme, has the capability to effectively harness the productive power of rural unemployed towards their socio-economic development.

- It is also capable of not only supplementing the income of jobseekers; the whole process would actually roll out an excellent social security and insurance mechanism by stabilising employment during the off-peak agriculture seasons in the rural areas.

- Considering its employment generation potential and productive absorption capacity of surplus work force during and after the pandemic, the government has additionally allocated Rs. 60,000 crore under the package of Aatmanirbhar Bharat.

MGNREGA: The Game Changer?

- Low levels of education and limited skill-set of the country's rural labour force have always impacted the labour productivity and the resultant income growth.

- In this situation, MGNREGA accords an opportunity to broaden the occupational choices and wage income for the willing less-educated, unskilled-job seekers by tapping their productivity through execution of quality community asset creating projects.

- MGNREGA has the capability to empower rural households to withstand economic poor shocks.

- It can manage and deal with situations to address effects of business cycles in a large rural economy like India.

- MGNREGA can effectively give a stimulus to the rural economic activities viawage income disbursals resulting in rising purchasing power of rural population.

Suggestions

- At least 60 percent of public works in terms of cost at the district level under MGNREGA should be devoted to creation of quality productive assets directly linked to Agriculture and Allied Activities.

- The States must take immediate steps to ensure social protection and productive absorption of surplus rural workforce.

- The district administration should ensure that the data on returnee migrants are collected, compiled and checked with the existing scheme database. Accordingly, household surveys/verifications shall be immediately conducted by each Gram Panchayat to register/ re-register the surplus yet excluded job-seekers under MGNREGA within the next 15 to 30 working days.

- All job-seekers, through a campaign mode, should be made aware of the processes leading to offer of works.

- On-going works must be assessed and an additional labour budget exercise initiated to ensure adequate block/GP wise additional shelf of projects along with their timely technical and financial approvals.

- While identifying and prioritising additional works under MGNREGA for 2020-21, attempts shall be made to ensure creation of more and more quality community assets in the areas of NRM and agriculture and allied activities.

- Since excellence of community MGNREGA assets rely on quality grass-root level decentralised planning, the human resource base at GP level needs to be adequately strengthened.

- A panel of experts drawn from line departments of Agriculture, Rural Development, Panchayati Raj, Soil Conservation, Forestry, etc. could be immediately directed to assist GPs to effectively implement MGNREGA works.

- MGNREGA allows work site amenities like medical aid, shade, drinking water creche facilities. This should be made a frequent feature at least for a year or until the fear about the pandemic subsides with addition provision of masks, soaps, water, sanitizer, etc.

- Programme administration should ensure timely wage payments to encourage adequate job response.

- States need to ensure implementing a strong quality management system to ensure that the assets created under the Act is functional by location, design, operational management and with the provision of adequate and regular maintenance support services.

- Just before utilising the funds of MGNREGA, the asset generating potential and technical viability of the projects should be reviewed and revisited.

- MGNREGA can play a vital role in raising agricultural productivity by incentivising the surplus workforce to carry out with farming and shifting themselves from casual labourers to cultivators.

- The programme is capable of ensuring livelihood security and can be a game changer in rural economy provided the implementing States take extra positive actions towards fulfilling the legal provisions with a well-coordinated approach.

Social Security: Issues, Challenges and Initiatives

- The balanced and overall development of any country requires not only attaining high GDP but also improvement in the quality of life of citizens.

- Therefore, to promote improvement in the quality of life, ensuring provision of adequate social security to citizens becomes highly significant, especially in a developing country like India.

- Thus, social security can help in reduction of poverty and inequality and therefore support inclusive growth through enhancing human capital and its productivity.

- It indirectly also influences domestic demand and facilitates growth of an economy.

- However, as per International Labour Organization (ILO-2014 records) only 27 percent of the global population enjoys social security in any form.

- The need for such highly subsidized programmes arises in India because nearly 90 percent of workers in India earn their livelihood in the unorganised sector, which lacks social security.

- The indirect cost of absence of social security might well be increasing social costs resulting from monitoring and managing of ill health accompanied by various related social and labour problems, including absenteeism.

Suggestions

- A work force with higher capability and social security could contribute to higher growth, which in turn would enhance aggregate demand in an economy through higher purchasing power of the vast mass of the work force in the unorganised sector.

- Well-defined social security programmes need to be welfare-oriented, inclusive, wider-based and better implemented. Making schemes targeted and contributory could negatively affect these features.

- Considering that government is already spending nearly 3 percent of GDP on pensions, it is thus argued that a universal pension and gratuity schemes are possible within a limited expenditure, without placing any significantly large additional stress on the fiscal.

- In order to meaningfully implement the proposed universal schemes, collaborative exercise with post offices in addition to banks can be considered. Thus, people having accounts in post offices can also be offered these schemes.

- Further, even if people have bank accounts in cooperative banks, they can also be offered the schemes to ensure wider coverage.

- Another dimension of universal pension scheme can be that preference for a male child as a support in old age could come down though this area needs further research to empirically establish a causal relationship.

- This could improve the sex ratio in the country, something that the governments have been trying since the last few decades.

- It goes without doubt that adequate social security enhances economic growth and thus reduces the burden of tax financed schemes through generation of additional revenue.

- Unlike present set of social security schemes, a non-contributory universal scheme is probably the need of the country that has remained ignored till date.

- It would be advantageous to have universal schemes at least for the next few decades, until India achieves a better per capita income and has achieved total eradication of poverty.

Agriculture and Social Security

- Social security is inbuilt and intrinsic to agriculture through income augmentation and the mammoth population and rural workforce it absorbs.

- Social security is also contextualised in terms of food and nutritional security, bringing resilience in the masses to absorb shocks and stresses, of both, the natural on and manmade extremes, augmenting income and employment to narrow the social and economic exclusion.

- The agriculture, however, due to several challenges, became less remunerative and attractive over time which has to be transformed for reversing the trend.

- While agriculture, in the rural ecosystem, has been the prime source of social security, the agriculturists were often left out from the social security net.

- The initiatives of PM-Kisan Sarnman Nidhi (PMKISAN) and Kisan Maandhan Yojana are the two very significant initiatives for the income support and old-age pension support for those who are the most vulnerable and require financial assistance the most.

Employment and Poverty: The Key Determinants for Social Security

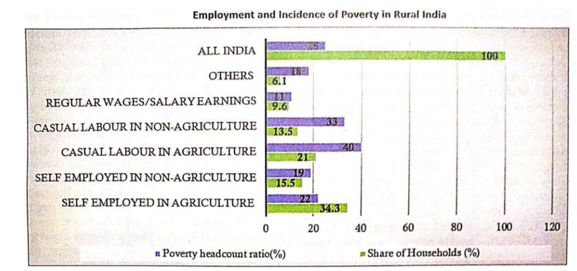

- The poverty estimates based on the state level poverty line estimated by the Tendulakar methodology for 2011-12 (Government of India, 2014) and the employment based on Consumer Expenditure Survey data 2011-12 indicated about 54.3 percent households of rural India get employment in agriculture either as self-employed or as casual labourers.

- This is a huge number given that rural India constitute over 65 percent of the India's population. The social security net for this large population is the prime necessity.

- While providing alternate source of employment is one way for those earning as wage labourers in agriculture and non-agriculture activities, enhancing income of those who are self-employed in agriculture is also important for sustainable development of the rural-agri space.

- A major transformation in agriculture planning and development is required to realise the vision of the Prime Minister for Aatmanirbhar Bharat.

- This is more important and needed because the population of agricultural workers as percentage of rural population has gone down but in absolute terms, due to increase in overall population, the number of agricultural workers available in rural areas increased.

- It is estimated that number of agricultural workers will increase to about 336 million in 2032-33 (NITI Aayog, 2018). To absorb such a huge workforce with a meaningful employment and income, we need to reorient our strategy and policies for rural India.

Food and Nutrition for Social Security

- The Third Advance Estimates of food grain production was released recently by Department of Agriculture, Cooperation & Farmers Welfare and the estimates implies that the country is well secure for food.

- To bring sufficiency in edible oils and pulses, the Government has already moved for National Mission on Edible Oils and augmenting pulses production through production and price incentives under NFSM and PM-Annadata Aay Sanrakshan Abhiyaan (PM-AASA).

- The Government has also focused on promotion of nutri-cereals and bio-fortified crops along with Public Distribution System (PDS) to bring in nutritional security as well as achieving the second and third pillar of food security i.e. access and affordability of food.

- The country is poised to move towards nothing less than second Yellow Revolution through technological breakthrough and productivity gains along with utilisation of additional area for production to accomplish the near sufficiency in edible oils.

Income Augmenting Opportunities

- Income to farmers and others who engage in agriculture is the prime contribution of the agriculture and allied sector in imparting social security.

- The unemployment rate in rural India rose to ~20 percent post COVID-19 outbreak indicating that while the outbreak started off as an urban phenomenon, the economic impact is also being felt in rural areas.

- The situation of both the self-employed and casual workers has deteriorated in terms of earning. This calls for a paradigm shift in the most important job provider sector in rural India.

- Both policies and programmes have to be redesigned to convert the low paid and underemployment providing agriculture into competitive activity with other sectors of economy.

- The seasonality in agriculture has to be converted into an opportunity. The cropping in India is one of the biggest employers.

- Based on the CACP data it has been estimated that cropping alone in India generates employment of over 14089 million man-days in a year. However, the low farm holding and limited marketed surpluses with the majority of tillers yield much low wages or income to the people employed in cropping.

- In India, the farm endowments are diverse and so is their orientation towards commercial farming.

- The incomes of these (small and marginal) are difficult to increase exclusively through increased productivity in cropping, hence the high value commodities (vegetables, dairying, poultry, piggery) can make them prosperous but with great risk as they have to put essentially all their land into vegetables or fodder.

- The strategy for landless and less than 2 ha. holdings are to earn from rural non-farm sector stimulated by income growth of the small commercial farmer.

- The farmers with half to one hectare of land could achieve a substantial increase in family income from improved farming practices but compared to the large farmer (those with more than 4 ha land) they are more risk averse, deficit in capital and unable to obtain institutional credit.

Diversify Towards More Income and Employment

- Diversification has been recognised as a potent tool with a potential to cater the future concerns of food, nutrition and income for social security.

- While other sub-sectors were almost on the same scale, the significant shift was noticed in livestock which has moved from 23 to 26.4 percent and the agroforestry which declined from 9.9 to 7.3 percent.

- The future needs reorientation for product diversification. While green revolution technologies favouring intensification was important in first 30 years of independence, the technologies leading to diversification particularly towards product and process diversification favouring fruits, vegetables, flowers, and high value commodities are crucial catalysts to increase income from declining and depleting land and water.

- Vertical diversification in these high value commodities can provide better and quality employment fetching more returns to the small-sized farms.

- The competitiveness for export promotion would be needed. Added to that, a strong hand holding with small growers is needed for credit and risk management.

- The diversified farming has been attributed as one of the major drivers for attracting more employment in agriculture for social security.

- It is an established fact that the states with higher diversification and positive towards diversified farming employment in agriculture while shift of rural workforce from agriculture to non-agricultural activities has been a general phenomenon.

- There has been a regional disparity too. While northern and southern regions together contributed about 50 percent of the value of output initially, the contribution of western arid region increased from close to 10 percent in 1999-2000 to about 14 percent.

- India is endowed with the largest livestock population in the world. Animal husbandry, dairying and fisheries activities, thus play an important role in the socio-economic development of rural India while contributing to the food basket, nutrition security and household income of the farmers. Livestock are the best insurance for farmers against vagaries of and other natural calamities.

Government Initiatives in Agriculture for Social Security

- The PM-Kisan Samman Nidhi Yojana (PM-KISAN) is one of its kind scheme which provides direct income support to the farmers.

- The risk of crop failure make a farmer and his dependents vulnerable in society. To offset such vulnerability, PM-Fasal Bima Yojana was launched in 2016 and further improved over time.

- One of the biggest social security net for old age farmers has been introduced in the form of Kisan Maandhan Yojana under which a farmers will get Rs. 3000 per month when he/she attains the age of 60 years.

- The insurance of fishermen under Fishermen welfare scheme has been operational for social security against any eventuality in the risk prone profession.

- While direct benefit transfer in the form of PM-KISAN is operational with a universal coverage, the much larger inclusion that will impart social security to millions of the landless is providing agricultural credit to lessee cultivators (those who cultivate on leased-in land) and the equivalent credit and interest subvention to animal husbandry and dairying.

- The reforms in agriculture has set the tone for price-led prosperity in agriculture and allied activities which is likely to be a game changer in inclusive development of rural India to make the country aatmanirbhar in all spheres of economic and social activities.

Related Articles