Introduction:

- The recent collapse of the Silicon Valley Bank (SVB) due to the sudden increase in US‘s interest rates which was taken to curb Inflation was seen as a neglect of the government’s ratings and risks for the people money.

- It has been predicted that it is the USA’s biggest loss after 2008 economic crisis.

- The collapse is likely to have impacts on Indian-American start-ups and remittances of India.

- Further it will definitely drag other institutions into its losses across world.

- The US government has assured that taxpayers will not be impacted by the event, though which is a false statement by the US President.

Experts view:

Major highlights:

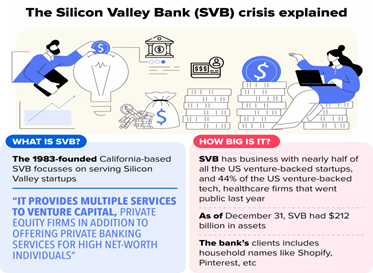

- SVB Financial Group runs one of the largest American commercial banks – Silicon Valley Bank.

- The bank suffered a sudden, swift collapse, marking the second-largest bank failurein US history.

- It had announced a $1.75 billion share sale programme to further strengthen its balance sheet. This programme triggered a massive sell-off in the group’s shares.

- Thereafter, market went severely bearish and bear rampage wiped out over $80 billion of its market value.

- Alongside, the bond prices of the group collapsed and created a panic in the market.

- The bank has heavenly invested in bonds, Long term equities and small term investments.

- With the sudden increase in banks interest rate, caused its loss in long-term investments.

Probable reasons for Bank Crisis:

- Downturn of tech stocks: The bank was hit hard by the downturn in technology stocks over the past year as well as the Federal Reserve’s aggressive plan to increase interest rates to combat inflation.

- Lower bond yield due to lower interest rates: SVB bought billions of dollars’ worth of bonds over the past couple of years, using customers’ deposits as a typical bank would normally operate.

- Mostly Startups account holders: SVB’s customers were largely start-ups and other tech-centric companies that started becoming needier for cash over the past year.

- Drying VC funding: Venture capital funding was drying up; companies were not able to get additional rounds of funding for unprofitable businesses.

- Fear over deposit insurance: Since its customers were largely businesses and the wealthy, they likely were more fearful of a bank failure since their deposits were over $250,000, which is the government-imposed limit on deposit insurance.

Impacts on Indian start-ups:

- Loss of Jobs: SVB was a significant lender to companies doing business in the US-India market.

- Because of this, a significant impact on the businesses/firms can take place and force them to implement drastic cost-cutting measures like employment cuts or recruiting freezes.

- Business dependent on US Exports: Indian financial system could get impacted if the exporters who are dependent on US market start seeing slowdown in their businesses and that would impact job growth and ability to repay debt to their banks.

- A lot of venture capital investment coming into India would also slow down.

Value Addition:

About Silicon Valley Bank (SVB):

- It is a financial institution that provides banking services to the technology industry and venture capital firms.

- Founded in 1983, it has since become the go-to bank for Startups and entrepreneurs in Silicon Valley and beyond.

- It is unique in that it understands the specific needs and challenges of the tech industry, and provides a range of services that cater to start-ups, including loans, deposits, and investment management.

|

It was one of the first banks in the United States to accept account opening without a social security number (SSN) or a local address. As a result of these start-up-centric schemes, it became the first-to-go location. |

- It has become a critical player in the start-up ecosystem, providing funding and financial services to many of the world’s most successful start-ups, including Tesla, Uber, and LinkedIn.

Important Terms

- Sell-off: A sell-off occurs when a large volume of securities are sold in a short period of time, causing the price of a security to fall in rapid succession. As more shares are offered than buyers are willing to accept, the decline in price may accelerate as market psychology turns pessimistic.

- Venture Capital Fund: A venture capital fund is a type of investment fund that invests in early-stage start-up companies that offer a high return potential but also come with a high degree of risk. The fund is managed by a venture capital firm, and the investors are usually institutions or high net worth individuals.

More Articles