Economy: Basics of Economy

Basics of Economy

National Income Definition

- National income is the total value of a country’s final output of all new goods and services produced in one year. However, there are practical difficulties in estimating the national income as per this concept; hence we use the Pigouvian definition.

- C. Pigou has in his definition of national income included that income which can be measured in terms of money. In the words of Pigou, “National income is that part of objective income of the community, including the income derived from abroad which can be measured in monetary terms.”

National Income Concepts

Gross Domestic Product at Market Prices (GDPMP )

- GDP is the market value of all final goods and services produced within a domestic territory of a country measured in a year. •

- All production done by the national residents or the non-residents in a country gets included, regardless of whether that production is owned by a local company or a foreign entity.

- Everything is valued at market prices.

- GDP MP = C+ I +G +X –M

GDP at Factor Cost (GDPFC)

- GDP at factor cost is gross domestic product at market prices, less net product taxes.

- Market prices are the prices as paid by the consumers Market prices also include product taxes and subsides. The term factor cost refers to the prices of products as received by the producers. Thus, factor cost is equal to market prices, minus net indirect taxes. GDP at factor cost measures money value of output produced by the firms within the domestic boundaries of a country in a year.

- GDPFC =GDPMP –NIT

Net Domestic Product at Market Prices (NDPMP)

- This measure allows policy-makers to estimate how much the country has to spend just to maintain their current GDP. If the country is not able to replace the capital stock lost through depreciation, then GDP will fall.

- NDP MP =GDP MP –DEP

NDP at Factor Cost (NDPFC)

- NDP at factor cost is the income earned by the factors in the form of wages, profits, rent, interest, etc., within the domestic territory of a country.

- NDPFC =NDPMP -Net ProductTaxes-Net ProductionTaxes

Gross National Product at Market Prices (GNPMP)

- GNPMP is the value of all the final goods and services that are produced by the normal residents of India and is measured at the market prices, in a year.

- GNP refers to all the economic output produced by a nation’s normal residents, whether they are located within the national boundary or abroad.

- Everything is valued at the market prices.

- GNPMP= GDP MP + NFIA

GNP at Factor Cost (GNPFC)

- GNP at factor cost measures value of output received by the factors of production belonging to a country in a year.

- GNP FC =GNP MP -Net ProductTaxes-Net ProductionTaxes

Net National Product at Market Prices (NNPMP)

- This is a measure of how much a country can consume in a given period of time. NNP measures output regardless of where that production has taken place (in domestic territory or abroad).

- NNPMP =GNPMP –Depreciation

- NNPMP= NDPMP+ NFIA

NNP at Factor Cost (NNPFC)

- NNP at factor cost is the sum of income earned by all factors in the production in the form of wages, profits, rent and interest, etc., belonging to a country during a year.

- It is the National Product and is not bound by production in the national boundaries. It is the net domestic factor income added with the net factor income from abroad.

- NI =NNPMP - Net ProductTaxes-Net ProductionTaxes

GVA at basic prices

- GVAMP - Net Product Taxes

GVA at factor cost

- GVA at basic prices - Net Production Taxes

Three Measurements of National Income

National Income calculated by three ways:

Consider the following while calculating National Income through:

Value Added Method (or the Product Method)

- The value added or production method is used by economists to calculate GDP at market prices, which is the total values of outputs produced at different stages of production. It needs to be mentioned that caution should be taken to take final Goods and not Intermediate goods, as it will result in Double Counting.

- Some of the goods and services included in production are:

- Goods and services actually sold in the market.

- Goods and services not sold but supplied free of cost. (No Charge/Complementary

- Some of the goods and services not included in production are:

- Second hand items and purchase and sale of the same. Sale and purchase of second cars, for example, are not a part of GDP calculation as no new production takes place in the economy.

- Production due to unwarranted/ illegal activities.

- Non-economic goods or natural goods such as air and water.

- Transfer Payments such as scholarships, pensions etc. are excluded as there is income received, but no good or service is produced in return.

- Imputed rental for owner-occupied housing is also excluded

Income Method

- This method emphasises on aggregating the payments made by firms to households, called factor payments.

- It is defined as total income earned by citizens and businesses of a country. There are four types of factors of production and four types of factor incomes accordingly i.e. Land, Labour, Capital and Entrepreneur/Organization as Factors of Production and Rent, Wages, Interest and Profit as Factor Incomes correspondingly.

- GDP = Wages+ Interest Income + Rental Income +Profit +Indirect Taxes-Subsidies+ Depreciation

- The term Profit can be further sub-divided into: profit tax; dividend to all those shareholders; and retained profit (or retained earnings).

- Such an approach is adopted in India to calculate the contribution of services sector to the economy.

- Any income corresponding to which there is no flow of goods and services or value added, it should not be included in calculation by Income method.

Expenditure Method

- The expenditure method measures the final expenditure on GDP. Amount of Expenditure refers to all spending on currently-produced final goods and services only in an economy. In an economy, there are three main agencies, which buy goods and services. These are: Households, Firms and the Government

- This final expenditure is made up of the sum of four expenditure items, namely:

- Consumption (C): Personal Consumption made by households, the payment of which is paid by households directly to the firms which produced the goods and services desired by the households.

- Investment Expenditure (I): Investment is an addition to capital stock of an economy in a given time period. This includes investments by firms as well as governments sectors

- Government Expenditure (G): This category includes the value of goods and service purchased by Government. Government expenditure on pension schemes, scholarships, unemployment allowances etc. are not included in this as all of them come under transfer payments.

- Net Exports (X-IM): Expenditure on foreign made products (Imports) are expenditure that escapes the system, and must be subtracted from total expenditures. In turn, goods produced by domestic firms which are demanded by foreign economies involve expenditure by other economies on our production (Exports), and are included in total expenditure. The combination of the two gives Net Exports.

GDP= C+I+G+X-IM C = consumption

I = Investment

G = Government expenditure

X = Export

IM = Import

What are the factors that affect National Income?

Several factors affect the national income of a country. Some of them have been listed below:

Factors of Production

Normally, the more efficient and richer the resources, higher will be the level of National Income or GNP.

1. Land

Resources like coal, iron and timber are essential for heavy industries so that they must be available and accessible. In other words, the geographical location of these natural resources affects the level of GNP.

2. Capital

Capital is generally determined by investment. Investment in turn depends on other factors like profitability, political stability, etc.

3. Labour

The quality or productivity of human resources is more important than quantity. Manpower planning and education affect the productivity and production capacity of an economy.

4. Entreprise

The size of the national income also greatly depends upon the number and skill of the entrepreneurs. If the captains of the industries! are efficient, they will combine; the various factors of production to the optimum proportion and so the volume of total production will be quite large, if managerial skill is lacking in the country, the size of the national income will be small.

5. Technology

This factor is more important for Nations with fewer natural resources. The development in technology is affected by the level of invention and innovation in production.

6. Government

Government can help to provide a favourable business environment for investment. It provides law and order, regulations.

7. Political Stability

A stable economy and political system helps in appropriate allocation of resources. Wars, strikes and social unrests will discourage investment and business activities.

New Methodology for Calculation of GDP in India

- Earlier domestic GDP was calculated at factor or basic cost, which took into account prices of products received by producers.

- The new formula takes into account market prices paid by consumers. It is calculated by adding GDP at factor price and indirect taxes (minus subsidies). It is in line with international practice and is expected to better capture the changing structure of the Indian economy.

- The government has also changed the base year for estimating GDP from 2004-05 to 2011-12. This has been done to incorporate the changing structure of the economy, especially rural India.

- Data for the new GDP series will now be collected from 5 lakh companies (against 2,500 companies earlier). Under-represented and informal sectors as well as items such as smartphones and LED television sets will now be taken into account to calculate the gross domestic product.

Green GDP

- Green GDP is a term used generally for expressing GDP after adjusting for environmental damage. When information on economy’s use of the natural environment is integrated into the system of national accounts, it becomes green national accounts or environmental accounting.

- The process of environmental accounting involves three steps viz. Physical accounting; monetary valuation; and integration with national Income/wealth Accounts. Physical accounting determines the state of the resources, types, and extent (qualitative and quantitative) in spatial and temporal terms. Monetary valuation is done to determine its tangible and intangible components. Thereafter, the net change in natural resources in monetary terms is integrated into the Gross Domestic Product in order to reach the value of Green GDP.

National Logistics Policy

Context

Union Minister of Commerce and Industry of the policy reviewed the draft National Logistics Policy and proposed action plan for implementation prepared by the Department of Logistics, Ministry of Commerce and Industry.

About

- The draft National Logistics Policy has been prepared in consultation with the Ministries of Railways, Road Transport and Highways, Shipping and Civil Aviation and forty-six Partnering Government Agencies (PGAs).

- Objective: To streamline rules, address supply-side constraints, lower logistics costs and ensure greater competitiveness for Indian products worldwide.

- National Logistics e-marketplace: A National Logistics e-marketplace will be created as a one stop marketplace.

- It will involve simplification of documentation for exports/imports and drive transparency through digitization of processes involving Customs, PGAs etc. in regulatory, certification and compliance services.

- Institutional Framework for policy: For purpose of the new logistics framework, four committees/councils will be constituted:

- National Council for Logistics, chaired by the Prime Minister.

- Apex inter-ministerial Committee, chaired by the Minister of Commerce and Industry.

- India Logistics Forum chaired by the Commerce Secretary with representation from key industry/business stakeholders and academia.

- Empowered task force on logistics will be created, as a standing committee chaired by the head of the Logistics Wing.

Need for National Logistics Policy

- Unregulated and fragmented logistics sector: India’s logistics sector has remained fragmented and unregulated, despite its centrality to economic growth.

- Complex sector: The sector is very complex with more than 20 government agencies, 40 PGAs, 37 export promotion councils, 500 certifications, 10000 commodities, 160 billion market sizes along with 12 million employment base.

- The national logistics policy will clarify the roles of the Union government, state governments and key regulators

- High cost: The cost of logistics for India is about 14 per cent of its GDP and it is far higher as compared to other countries.

- Lack of adequate infrastructure: Almost 25-30% of fruits and vegetables produced in India are wasted due to lack of cold chain infrastructure

The draft National Logistics Policy

- Optimize modal mix: The draft policy has sought to optimize the modal mix (road-60%, rail-31%, water-9%) to global benchmarks (road - 25-30%, rail - 50-55%, water - 20-25%) and promote the development of multi-modal infrastructure.

- Logistics Wing: The policy recommends setting up a Logistics Wing that will be the nodal agency tasked to identify key projects for driving first mile and last mile connectivity and to optimize the modal mix to identify commodity and corridor for the most cost-effective mode of transport.

- Logistics center of Excellence: Encourage industry, academia and government to come together to create a logistics Centre of Excellence, and drive innovation in the logistics sector.

Objectives of the Logistics Policy

- Providing an impetus to trade and hence economic growth by driving competitiveness in exports.

- Doubling employment in the logistics sector by generating additional 10-15 million jobs and focus on enhancing skills in the sector and encouraging gender diversity.

- Improve India’s ranking in the Logistics Performance Index.

- Strengthening the warehousing sector in India by improving the quality of storage infrastructure including specialized warehouses across the country.

- Reducing losses due to agro-wastage to less than 5% through effective agro-logistics.

- Providing impetus to MSME sector in the country through a cost-effective logistics network.

- Promoting cross regional trade on e-commerce platforms by enabling a seamless flow of goods.

- Encouraging adoption of green logistics in the country.

Benefits

- Impetus to employment and growth: The Indian logistics sector provides livelihood to more than 22 million people and improving the sector will facilitate 10% decrease in indirect logistics cost,leading to a growth of 5 to 8% in exports.

- Growth potential in logistics sector: Further, it is estimated that the worth of Indian logistics market will be around $215 billion in the next two years, compared to about $160 billion at present.

Way Forward

The development of multi-modal logistics parks and rules to do with motor vehicle movement, come under the ambit of state governments. So, there is need of alignment between the Centre and states, for better implementation and coordination of this policy.

Indian Protectionism

Context

Recent escalation of protectionist steps between US and China has raised questions about India’s policy response.

About

- After independence in 1947, India spent decades trying to survive without international trade.

- While this protection succeeded in creating a large and highly diversified industrial base, it also led to inefficiency in the use of resources.

- India ditched its model of local production for local consumption following a currency crisis in early 1990s. It open up to foreign investment and removed trade barriers in exchange of help from

- Since 1991, the tariff policy of India has led to a systemic reduction in India’s weighted effective average tariff.

- Decline in average tariff has coincided with a sharp rise in GDP and higher growth rate. Lower tariffs offered following few benefits:

- Rise in exports and reduction in poverty at the fastest pace in India’s history.

- India emerged as a leader in exports of IT services, and is now a key player in

- It also helped India run a trade surplus - whereby it sells more than it buys - in goods and services with US.

- Trade liberalization fostered an atmosphere of intense competition, leading to better use of inputs and innovation, driving productivity growth.

- Current Scenario: Recent trade experience has been mixed.

- Export growth is slow paced.

- The current economic slowdown has led to a drop in the value of imports, thus shrinking the current account deficit.

India a “tariff King” and growing protectionism

- A few months back, President Donald Trump described India as “the tariff king", accusing it of imposing “tremendously high" tariffs on American products.

- When higher tariffs are supplemented by higher current account deficit and fall in rupee, they reinforce a growing trend of protectionism.

- India is among the most heavily protected economies in the world:

- Among members of BRICS grouping—Brazil, Russia, India, China, South Africa—India has the highest effective tariff rates on food items, automobiles and industrial inputs.

- Data from the Global Trade Alert (GTA) database shows that India and the US introduced the most trade restrictions in 2018.

- Number of harmful interventions implemented by India has increased in last decade.

- A recent World Bank report accused India of increasingly resorting to trade remedy measures such as anti-dumping and safeguard actions.

- In its latest report on global trade barriers, the US trade department singled out India as having the highest tariffs "of any major world economy" - averaging 13.8%.

- While import tariffs may provide the economy with short-term relief, growing protectionism can have long term adverse consequences.

Case against growing protectionism

- At a time when other economies are also raising trade barriers, it is easy to fall into the protectionist trap.

- Will undo trade liberalization benefits: India’s trend to protectionism threatens to undo more than two decades of trade liberalization measures that have powered India’s growth over the past quarter century, boosting incomes and helping cut poverty levels.

- Will be hardest hit: A recent OECD report warned that India, Australia and China would be the biggest losers in terms of per-capita income growth if the current wave of trade protectionism escalates and slows down global growth.

Higher tariffs do not aid Make in India

- Disincentive competition: There is adequate empirical evidence, including India’s experience, that suggests protectionism and tariff barriers act as a disincentive for domestic industries to become competitive.

- Higher input cost: A higher tariff on imported inputs result in higher input costs for manufacturers, which could otherwise be competitive if they could import cheaper inputs.

- Hence, a comprehensive view of the supply chain must be taken while making any changes to tariff policies.

- High-level advisory group suggestions: Amidst US-China trade war, it is possible that higher tariffs might be imposed by other countries on Indian goods and services. It would be beneficial for India does not retaliate with tariffs.

- Any move to raise tariffs must consider the integrated supply chains and the fact that Indian imports are largely for domestic consumption.

Suggested policy response

- As production takes place through supply chains, India should integrate with global markets to ensure adequate labor-intensive manufacturing jobs.

- As India has a natural comparative advantage in labor-intensive economic activities, such activities should benefit from provision of adequate infrastructure for manufacturing and the elimination or reform of crippling anti-business labor laws.

- Tariffs can be part of a revenue-raising strategy, but it is better to have a small, uniform (same for all goods) tariff, rather than large tariffs in seemingly arbitrary sectors.

- This would help avoid the problem of “effective" rate of protection deviating from the nominal rate, and the possible worsening of the problem of tariff inversion.

‘The significance of the Kolkata port’

Context

In a recent development, Prime Minister Narendra Modi renamed the Kolkata Port Trust after Bharatiya Jana Sangh (BJS) founder Dr Syama Prasad Mookerjee, at an event to mark its 150th anniversary.

About Kolkata Port:

- Kolkata Port is the only riverine Major Port in India, situated 232 kilometers up-stream from the Sandheads, having arguably the longest navigational channel amongst Major Ports of India and its navigational channel is one of the longest in the world.

- KoPT is India’s oldest operational port and the first among the 12 major ports (government-owned) of India. Kolkata Port System includes three ports:

- Kolkata

- Haldia

- Sagar Island

- The port facility has aided in industrialization, employment generation and major economic activity in the region while serving a vast hinterland as well as landlocked neighbouring countries such as Bhutan and Nepal.

- The river Hooghly, on which it is located, has many sharp bends, and is considered a difficult navigational channel.

- Throughout the year, dredging activities have to be carried out to keep the channel open.

- The Farakka Barrage, built in 1975, reduced some of the port’s woes as Ganga waters were diverted into the Bhagirathi-Hooghly system.

Historical background:

- In the early 16th century, the Portuguese first used the present location of the port to anchor their ships, since they found the upper reaches of the Hooghly river, beyond Kolkata, unsafe for navigation.

- Job Charnock, an employee and administrator of the East India Company, is believed to have founded a trading post at the site in 1690. Since the area was situated on the river with jungle on three sides, it was considered safe from enemy invasion.

- After the abolition of slavery in the British Empire in 1833, this port was used to ship lakhs of Indians as ‘indentured labourers’ to far-flung territories throughout the Empire.

- As Kolkata grew in size and importance, merchants in the city demanded the setting up of a port trust in 1863.

- The colonial government formed a River Trust in 1866, but it soon failed, and administration was again taken up by the government.

- Finally, in 1870, the Calcutta Port Act (Act V of 1870) was passed, creating the offices of Calcutta Port Commissioners.

- In 1869 and 1870, eight jetties were built on the Strand. A wet dock was set up at Khidirpur in 1892. The Khidirpur Dock II was completed in 1902.

- As cargo traffic at the port grew, so did the requirement of more kerosene, leading to the building of a petroleum wharf at Budge Budge in 1896.

- In 1925, the Garden Reach jetty was added to accommodate greater cargo traffic. A new dock, named King George’s Dock, was commissioned in 1928 (it was renamed Netaji Subhash Dock in 1973).

- During World War II, the port was bombed by Japanese forces.

- After Independence, the Kolkata Port lost its preeminent position in cargo traffic to ports at Mumbai, Kandla, Chennai, and Visakhapatnam.

- In 1975, the Commissioners of the port ceased to control it after the Major Port Trusts Act, 1963, came into force.

Who was Dr. Shyama Prasad Mookerjee?

- Shyama Prasad Mookerjee was born in Calcutta on 6th July, 1901. He was the youngest (33) ever Vice-Chancellor of Calcutta University and Independent India’s first Minister of Industry and Supply.

- After India’s independence, Prime Minister Jawaharlal Nehru made Dr. Shyama Prasad Mookerjee Ministry for Industry and Supply in the interim Central Government.

- However he resigned from the Cabinet in 1950 as he was against the ‘Nehru-Liaquat Ali Pact’.

- After he formed Bhartiya Jana Sangh on 21st October, 1951 and became its first President

National Investigation Agency (Amendment) Bill, 2019

-Bill,-2019-min.jpg)

Protection of Human Rights (Amendment) Bill, 2019

-Bill,-2019-min.jpg)

National Medical Commission Bill

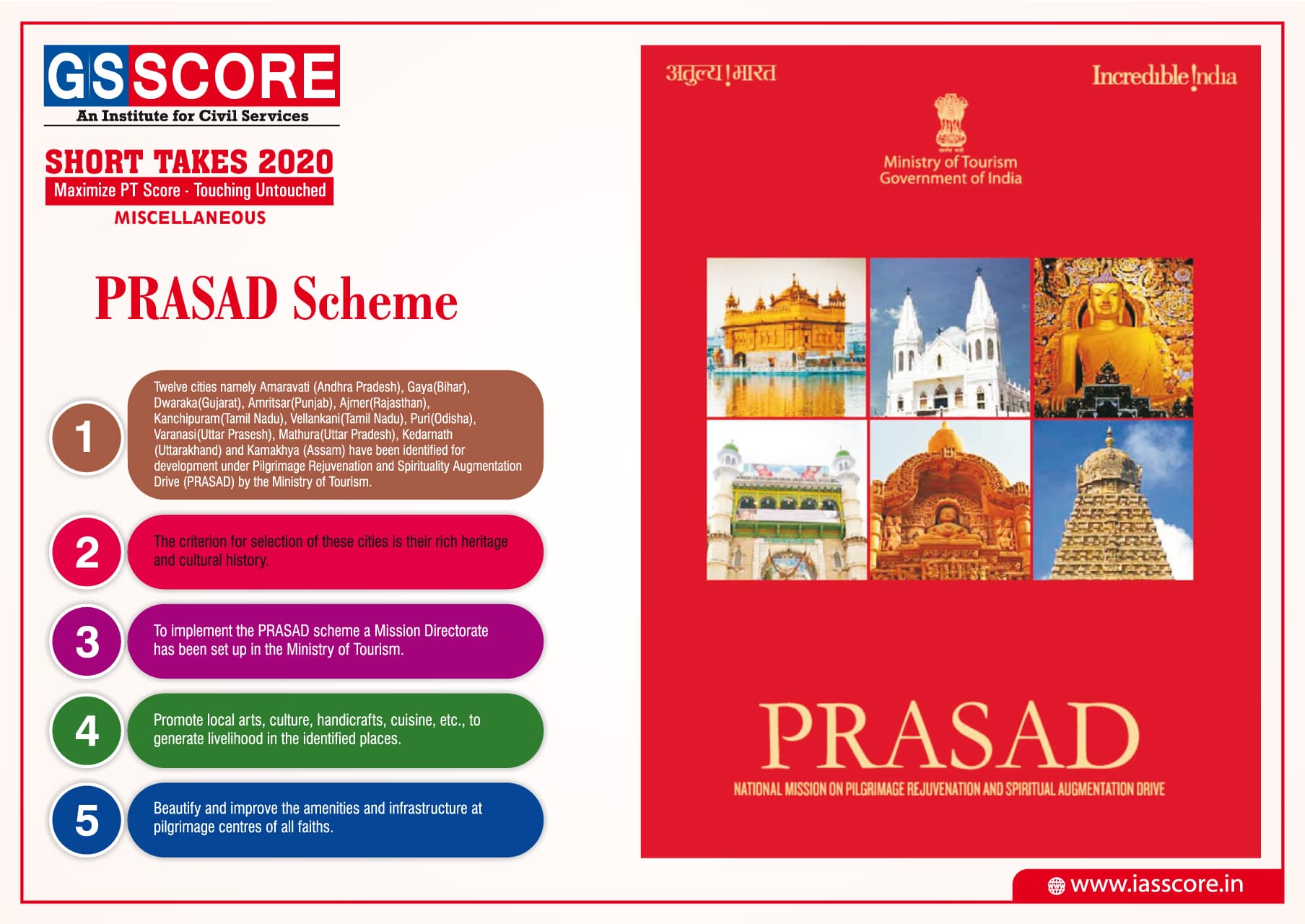

PRASAD Scheme

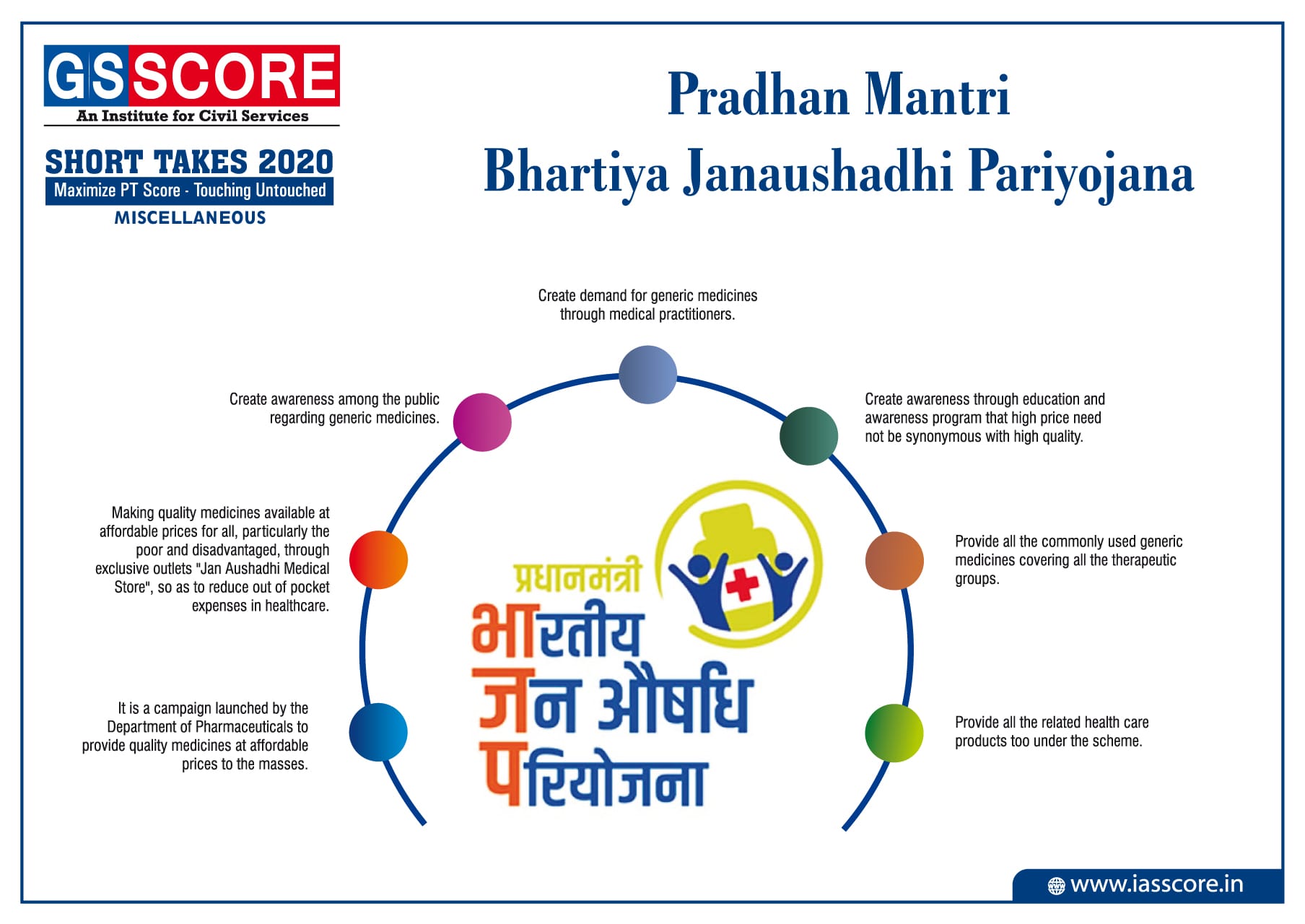

Pradhan Mantri Bhartiya Janaushadhi Pariyojana