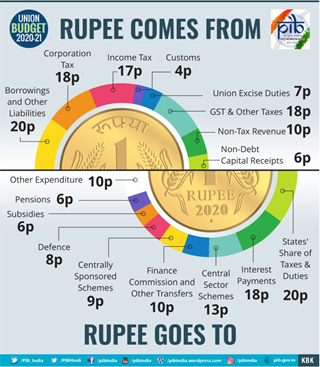

Economy: Economic Budget

Budget Highlights (2020): Sector-wise Analysis

Growth Forecasts and fiscal projections to be achieved by Budget 2020

- Fiscal deficit of 3.5% of GDP has been set for current financial year.

- Nominal GDP growth rate has been targeted at 12%of GDP.

- Overall GDP growth rate has been forecasted for 2020-21 growth at 6%-6.5% by Economic survey.

- To sustain fast GDP growth rate and achieve 5 trillion economy target, India needs to invest 1.4 trillion dollars in infrastructure.

This budget is woven around three prominent themes:

-

- Aspirational India in which all sections of the society seek better standards of living, with access to health, education and better jobs.

- Economic development for all, indicated in the Prime Minister’s exhortation of “Sabka Saath , Sabka Vikas , Sabka Vishwas”. This would entail reforms across swathes of the economy. Simultaneously, it would mean yielding more space for the private sector. Together, they would ensure higher productivity and greater efficiency.

- Caring Society: Ours shall be a Caring Society that is both humane and compassionate. Antyodaya is an article of faith

Aspirational India:

1. Agriculture, Irrigation and Rural Development: Sixteen Point Agenda for doubling the farmer’s income by 2022

-

- Adoption of Model Laws such as: These laws have already been enforced to be adopted by state government:

- Model Agricultural Land Leasing Act, 2016

- Model Agricultural Produce and Livestock Marketing (Promotion and Facilitation) Act, 2017;, and

- Model Agricultural Produce and Livestock Contract Farming and Services (Promotion and Facilitation) Act, 2018.

- Water Security: It aims to address the water stress issue in hundred water stressed districts.

- Solar Pumps under KUSUM Scheme: It aims to 20 lakh farmers for setting up stand-alone solar pumps and further to help another 15 lakh farmers solarise their grid-connected pump sets under KUSUM Scheme.

- Sustainable use of fertilizers: The budget has sought to use all kinds of fertilizers including the traditional organic and other innovative fertilizers in a sustainable manner with a ‘balanced approach’.

- Development of forward-linkages:

- Proposal of geo-tagging of all warehouses which are present in the country.

- Proposal of setting up of warehouses in accordance with norms set by Warehouse Development and Regulatory Authority (WDRA) at block/taluk level with Viability Gap Funding by the central government.

- Village Storage scheme to be run by Self help Groups (SHGs) in order to store the agricultural produce and provide farmers a good holding capacity and reduce their logistics cost.

- National Cold Supply Chain and “Kisan Rail” to be setup to provide better storage and transportation facilities for perishable agricultural goods.

- Proposal of refrigerated coaches in Express and Freight trains to transport perishable agricultural products.

- Krishi Udaan Scheme: This will be launched by Ministry of Civil Aviation on international and national routes to transport agricultural products specially fish, meat and dairy products across globe.

- “One product one district” Scheme in horticulture sector to be supported by central government by providing incentives to those states which supports cluster-wise production of horticulture products.

- Promotion of ‘Integrated Farming System’ in rainfed areas to counter the vagaries of monsoon or unseasonal rain.

- This will include Multi-tier cropping, bee-keeping, solar pumps, solar energy production in non-cropping season. Zero-Budget Natural Farming will be promoted in this area to reduce the on-farm expenditure by farmers.

- Budget proposes to strengthen Negotiable Warehousing Receipts (e-NWR) which will be integrated with e-NAM.

- Agricultural Credit:

- The budget proposes to strengthen agricultural credit by expanding refinance by NABARD and has set target of Rs. 15 lakh crore for agricultural credit.

- It has further intended to cover all eligible beneficiaries of PM-KISAN under the KCC scheme.

- Livestock and Animal Husbandary: Budget proposes to eliminate Foot and Mouth disease and brucellosis in cattle and also peste des petits ruminants (PPR) in sheep and goat by 2025.

- It also proposes to increase coverage of artificial insemination from existing 30% to 70%, development of fodder farms to produce quality fodder and doubling milk processing facility by 2025.

- Blue Economy: It proposes to put in place a framework for development, management and conservation of marine fishery resources.

- It aims to raise the production of fish and promotion of growing of algae, sea-weed and cage Culture. It will further employ ‘Sagar Mitras’ to involve youths in marine processing industries and form 500 Fish Farmer Producer Organisations.

- It aims to further help SHGs under Deen Dayal Antyodaya Yojana for alleviation of poerty.

- Adoption of Model Laws such as: These laws have already been enforced to be adopted by state government:

2. Wellness, Water and Sanitation

- It proposes to setup more hospitals tier-2 and tier-3 cities under PPP model and will provide assistance in form of viability gap funding.

- They will be setup in first phase with priority in those ‘Aspirational District’, which do not have empanelled hospitals under ‘Ayushman Bharat’ scheme.

- It reiterates to eliminate TB from India by 2025 and setting up of Jan Ausadhi Kendras offering 2000 medicines and 300 surgicals to all districts by 2024.

3. Education and Skills

- Budget proposes to announce ‘The New Education Policy’ which proposes to start a programme whereby urban local bodies across the country would provide internship opportunities to fresh engineers for a period up to one year.

- ‘National Police University’ and ‘National Forensic Science University’ have been proposed. It has also proposed to provide degree level full-fledged online education programme.

- It is proposed to attach a medical college to an existing district hospital in PPP model with availability of Viability Gap Funding from the government

Economic Development

1. Industry, Commerce and Investment

-

- The budget proposed Investment Clearance Cell that will provide “end to end” facilitation and support, including pre-investment advisory, information related to land banks and facilitate clearances at Centre and State level.

- It also proposed to develop five new smart cities in collaboration with States in PPP mode and sites will be chosen on the basis of location (near economic corridors and industries to be developed) and other factors.

- National Technical Textiles Mission has been proposed to create export oriented industry of technical textile.

- NIRVIK (Niryat Rin Vikas Yojana) has been proposed by the budget to achieve higher export credit disbursement to small exporters. This includes higher insurance coverage, reduction in premium for small exporters and simplified procedure for claim settlements.

2. Infrastructure

-

- National Infrastructure Pipeline to be strengthened which has already been launched with 103 lakh crore investment having 6500 projects across sector.

- Budget proposed for a National Logistics Policy to strengthen logistic sector.

- The budget proposed to replace conventional energy meters by prepaid smart meters in the next 3 years.

- It proposed to expand the national gas grid from the present 16200 km to 27000 km.

- “Arth Ganga” Plans to energise economic activity along river banks will be realised. It also proposed to complete NW-2 (Dhubri to Sadiya) by 2022.

- It has proposed to build infrastructure to harness solar power along the Railway track. It also proposed to run 150 more trains and on PPP model.

3. New Economy: Assimilating new technologies and governance ideas

-

- Budget proposed a policy to enable private sector to build Data Centre parks throughout the country.

- Fibre to the Home (FTTH) connections through Bharatnet will link 100,000 gram panchayats this year.

- The budget Proposed National Mission on Quantum Technologies and Applications to be setup with a corpus of 8000 crore rupees.

- The budget proposed ‘Fibre to the Home (FTTH) connections’ through Bharatnet to link 100,000 gram panchayats this year.

- It proposed to create two new national level Science Schemes to create a comprehensive database of genetic landscape of India.

Caring Society

1. Women & Child, Social Welfare

-

- Budget proposed to do away with manual scavenging by introducing automated cleaning of sewer lines with new technologies.

- It has also allocated a significant amount to nutrition-related programmes, programmes related to women and child development and welfare of’ schedule caste and schedule caste.

2. Culture & Tourism

-

- The budget proposed to develop five archaeological sites as iconic sites with onsite Museums. They are: Rakhigarhi (Haryana), Hastinapur (Uttar Pradesh) Shivsagar (Assam), Dholavira (Gujarat) and Adichanallur (Tamil Nadu).

- A museum on Numismatics and Trade will be opened at Old Mint building Kolkata and ‘Tribal Museum’ in Ranchi will be supported by the government.

- It also proposed to setup a maritime museum at Lothal, the Harrapan age maritime site near Ahmedabad, by Ministry of Shipping.

3. Environment & Climate Change

-

- Budget proposed to achieve targets set up by Paris Climate Deal by cutting emission and closing down those thermal plants whose emission is higher than pre-set limit.

- It also proposed to help state government to cut air pollution in cities.

Governance

-

- India will host G-20 presidency in the year 2022 - the year of 75th anniversary of Independence of Indian Nation. Budget has allocated a sum of Rs. 100 crore to begin the preparations for the event.

- It has also proposed a special package for newly created union territories of Jammu and Kashmir and Ladakh.

Financial Sector

-

- It has proposed to increase Deposit Insurance Coverage for a depositor under Deposit Insurance and Credit Guarantee Corporation (DICGC) from one lakh to Rs. five lakh per depositor.

- It has proposed to strengthen the Cooperative Banks by amendments to the Banking Regulation Act.

- It has proposed to sell the balance holding of Government of India IDBI Bank to private, retail and institutional investors through the stock exchange.

- Credit Guarantee Trust for Medium and Small Entrepreneurs (CGTMSE) has been proposed by the budget to provide subordinate debt for entrepreneurs of MSMEs.

Taxation System

-

- PAN to be allotted online on the basis of Aadhaar details without any requirement of detailed application.

- There have a lot of modifications for simplification of paying GST.

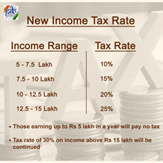

- Budget has proposed new taxation slabs for paying income tax

-

- Budget has proposed to abolish Dividend Distribution Tax (DDT) and instead proposed and adopt the classical system of dividend taxation under which the companies would not be required to pay DDT.

- The dividend shall be taxed only in the hands of the recipients at their applicable rate.

- It has proposed concessional corporate tax rate of 15% to new domestic companies engaged in the generation of electricity.

- It has proposed to grant 100% tax exemption to interest, dividend and capital gains income in respect of investment made in infrastructure and other notified sectors by the Sovereign Wealth Fund of foreign governments.

- Budget has proposed ‘Vivad Se Vishwas’ scheme under which will cover disputes related to Direct Taxes.

- Under this scheme, a taxpayer would be required to pay only the amount of the disputed taxes and will get complete waiver of interest and penalty provided he pays by 31st March, 2020.

- Option to be provided to cooperative societies to be taxed at 22% plus 10% surcharge and 4% cess, with no exemptions or deductions.

Stages of Economic Integration

Context

The Regional Comprehensive Economic Partnership (RCEP) is a proposed FTA of which India rejects to join. The BREXIT proposal has also created pressure on India to form FTAs with the UK. In this context it is important to consider the meaning of FTA, and various other stages of economic integration.

About

Independent Economy

- In order to implement the principle of economic self-sufficiency, one must build an independent national economy.

- If an independent national economy is to be built, the economy must be developed in a diversified and integral manner. It requires development of heavy industry and light industry and agriculture simultaneously.

- It is necessary to establish reliable and independent sources of raw materials and fuel. Technical independenceis also necessary.

- An independent economy is opposed to foreign economic domination and subjugation; but it does not rule out international economic cooperation.

Preferential Trade Area

- A preferential trade area/agreement (PTA) is a trading bloc that gives preferential access to certain products from the participating countries.

- This is done by reducing tariffs but not by abolishing them completely. A PTA can be established through a trade pact. It is the first stage of economic integration.

- Today simple PTA has evolved into bilateral PTAsand Mega-PTAs. Mega-PTA is wide regional trade agreements, such as the Transatlantic Trade and Investment Partnership (TTIP) or Trans Pacific Partnership (TPP).

- These tariff preferences create departures from the normal trade relations principle.

Free Trade Area

- A Free Trade Area (FTA) is a group of countries who have mutually agreed to limit or eliminate trade barriers- tariffs or quotas - among them.

- FTAs tend to promote free trade and the international division of labor, allowing countries to increase specialization in their respective comparative advantages.

- To develop a FTA, participating nations must develop rules for how the new FTA will operate and decide upon the following:

- Customs procedures that each country will follow

- Tariffs, if any, that will be allowed and their costs

- Trade despite resolution mechanism

- Transportation of goods

- Intellectual property rights protection and management

- FTA rules decide the scope and degree of how “free” trade will actually be.

- Advantages:FTAs can benefit consumers, who get increased access to less expensive and/or higher quality foreign goods. Population may also see increased living standards.

- Disadvantages:Producers can struggle with increased competition, but they might also acquire a greatly expanded market of potential customers or suppliers.

- Some jobs may be lostas production moves to areas with comparative advantage.

- Outcomes of FTA may represent the influence of pressure groups, and rent-seekingbehaviors may increase.

- FTAs may actually distort patterns of international specialization and division of laborby biasing and limiting trade toward trade blocs, as opposed to allowing natural market forces to determine patterns of production and trade across countries.

Customs Union

- A Customs Union (CU) involves the removal of tariff barriers between members, and acceptance of a common (unified) external tariff against non-members.

- Countries that are part of a CU only need to make a single payment (duty), once the goods have passed through the border. Once inside the union goods can move freely without additional tariffs. Tariff revenue is then sharedbetween members.

- Advantage: A common external tariff effectively removes the possibility of arbitrage and is one of the fundamental building blocks of economic integration.

- Disadvantage:CU members are not free to negotiate individual trade deals with non-members. For example, if a member wishes to protect a declining or infant industry it cannot do so through imposing its own tariffs.

Common Market

- A common (or single) market is the most significant step towards full economic integration.

- A common market is the extension of free tradefrom just tangible goods, to include all economic resources. This means that all barriers are eliminated to allow the free movement of goods, services, capital, and labour.

- Tariffs and all non-tariff barriers are also reducedand eliminated.

- For a common market to be successful there must also be a significant level of harmonisation of micro-economic policies, and common rules regarding product standards,monopoly power and other anti-competitive practices.

- There may also be common policies affecting key industries, such as the Common Agricultural Policy (CAP) and Common Fisheries Policy (CFP)

Economic Union

- An Economic Union is a type of trade bloc which is composed of a common market with a customs union. It has common trade policy towards non-members, although members are free to pursue independent macro-economic policies.

- The member countries have common policies on product regulation, freedom of movement of goods, services and factors of production (capital and labour) and a common external trade policy.

- The European Union (EU) is the best known Economic union, and came into force on November 1st 1993, following the signing of the Maastricht Treaty (formally called the Treaty on European Union.)

Monetary Union

- Monetary union is the first major step towards macro-economic integration, and enables economies to converge even more closely.

- In monetary union, members adopt a single, shared currency, such as the Euro for the Euro-17 countries, and the East Caribbean Dollar for 11 islands in the East Caribbean.

- This means that there is a common exchange rate, a common monetary policy, including interest rates and the regulation of the quantity of money, and a single central bank, such as the European Central Bank or the East Caribbean Central Bank.

Fiscal Union

- A fiscal union is an agreement to harmonise tax rates, to establish common levels of public sector spending and borrowing, and jointly agree national budget deficits or surpluses.

- The majority of EU states agreed a fiscal compact in 2012. Though it is a less binding version of a full fiscal union.

Economic and Monetary Union

- Economic and Monetary Union (EMU) is a key stage towards compete integration, and involves a single economic market, a common trade policy, a single currency and a common monetary policy.

- Complete Economic Integration

- Complete economic integration involves a single economic market, a common trade policy, a single currency, a common monetary policy, together with a single fiscal policy, including common tax and benefit rates – in short, complete harmonisation of all policies, rates, and economic trade rules.

Electoral Bond Scheme

Context

Recently, the union government notifies Electoral Bonds due to Delhi Legislative Elections.

About

- A bond is a debt security which borrowers issue to raise money from investors, who are willing to lend them a sum for a certain amount of time.

- Electoral bondsare bearer instrument in the nature of a Promissory Note that is payable to the bearer on demand.

- Bond can be purchased by an Indian citizen or a company incorporated or established in India.

- Only political parties registered under Section 29A of the Representation of the Peoples Act, 1951, which have secured no less than 1% votesin the last Lok Sabha elections, are eligible to receive electoral bonds.

- These bonds can be bought from selected branches of State Bank of India only.

- Political parties are allotted a verified account by the Election Commissionand all the electoral bond transactions are done through this account only.

- The donors can buy these electoral bonds and transfer them into the accounts of the political parties as a donation.

- The electoral bonds are available in denominations from Rs 1,000 to Rs 1 crore.

- Electoral bonds will be valid for 15 days from the date of purchase.

- No interestwill be given by the banks on these bonds.

- Donations will be tax deductible, and the benefitting political party will get a tax exemptionfor the amount received.

- They can be bought by a donor with a KYC-compliantNames of the donors are kept

- Bonds can be purchased in January, April, July and October months of each year.

Previous System of funding

- Before the budget of 2017, if a political party got a donation of less than Rs. 20,000from a donor, then it was not mandatory to reveal the source of fund.

- This rule was misused and near about all the political parties said that they received 90% of their political fund in the denomination of less than Rs. 20000.

- So a huge amount of black money was generated and used in the election campaigning.

- On the basis of the recommendation of the Election Commission, in Budget 2017 the government reduced the limit of anonymous donation to Rs. 2000

- The concept of Electoral bonds was introduced in the Finance Bill 2017, and was facilitated through multiple amendments in the Finance Act 2017.

Examples from around the world

- While there have been electoral trusts in India, the concept of electoral bonds is new for India and the world.

- United Stateshas Political Action Committees which receives money from individual and corporate donors, and manages them. They do not have any scheme that allows the citizen to directly purchase a bond and donate the same to a political party.

Criticism

- The Communist Party of India (Marxist) and the NGO Association for Democratic Reforms (ADR) had moved to the Supreme Court against the electoral bonds.

- They argued, ordinary citizens will not know who is donating how much to which political party, and it would add to the woes of the Indian democracy.

- It may also tilt the balancein favour of one political party. For example, in FY 2018, the ruling party received 95% of the total bonds

- Private corporate interests may take precedence over the needs and rights of the people of the State in policy considerations.

Supreme Court’s stand

- According to SC, if the identity of the buyersof electoral bonds is not known, the efforts of the government to curtail black money in elections would be "futile".

- It has directed the Finance Ministry to reduce window of purchasing electoral bonds.

- It has directed all political parties to furnish receipts of fundingreceived through electoral bonds and details of identity of donors in a sealed cover to the Election Commission.

Central Governments stand

- Electoral Bond Scheme is an alternative to cash donations to ensure transparencyin political funding, and check the use of black money for funding elections.

- Political party have to file returns before the EC as to how much money has come through electoral bonds, which will provide

- The right of the buyer to purchase bonds without having to disclose his preference of political party is in furtherance of his right to privacy.

- Keeping the identity of the donor anonymous is also an extension to his right to votein secret ballot.

- Allegations that nobody would know about the donors is wrong, as the Income Tax department will have accessto this information.

Conclusion

- It can be said that the release of electoral bonds will restrict the generation of black money up to some extent. But the rule that identity of the donors will be kept confidential may make futile the exercise to eliminate black money, as it may just end up making Black money White.

Marginal Cost of Funds-based Lending Rate (MCLR)

Context

Public sector lender, Bank of Baroda (BoB) has reduced marginal cost of funds based lending rate (MCLR) on one-year tenor by 10 basis points (bps).

About

- The marginal cost of funds-based lending rate (MCLR) is the minimum interest rate that a bank can lend at.

- MCLR is determined internally by the bank depending on the period left for the repayment of a loan.

- The RBI introduced the MCLR methodology for fixing interest rates from 1 April 2016. It replaced the base rate structure, which had been in place since July 2010.

- It is calculated based on four components:

- The marginal cost of funds is thecost which one has to bear to raise new (incremental) fund. Suppose I have funds of average interest rate of 10% per annum. I raise some new fund bearing interest rate of 8% per annum then marginal cost of my fund is 8%.

- The tenor premiumis not borrower-specific and is uniform for all types of loans.

- Operational expensesinclude the cost of raising funds, barring the costs recovered separately through service charges. It is, therefore, connected to providing the loan product as such.

- Negative carry on the CRR (Cash Reserve Ratio)takes place when the return on the CRR balance is zero. Negative carry arises when the actual return is less than the cost of the funds. This will impact the mandatory Statutory Liquidity Ratio Balance (SLR) – reserve every commercial bank must maintain.

- Under the MCLR regime, banks are free to offer all categories of loans on fixed or floating interest rates.

- After the implementation of MCLR, the interest rates are determined as per the relative risk factor of individual customers. Previously, when RBI reduced the repo rate, banks took a long time to reflect it in the lending rates for the borrowers. Under the MCLR regime, banks must adjust their interest rates as soon as the repo rate changes.

How is MCLR different from Base Rate?

- MCLR is an improved version of the base rate. It is a risk-based approach to determine the final lending rate for borrowers. It considers unique factors like the marginal cost of funds instead of the overall cost of funds. The marginal cost takes into account the repo rate, which did not form part of the base rate.

- When calculating the MCLR, banks are required to incorporate all kinds of interest rates which they incur in mobilizing the funds. Earlier, the loan tenure was not taken into account when determining the base rate. In the case of MCLR, the banks are now required to include a tenor premium. This will allow banks to charge a higher rate of interest for loans with long-term horizons.

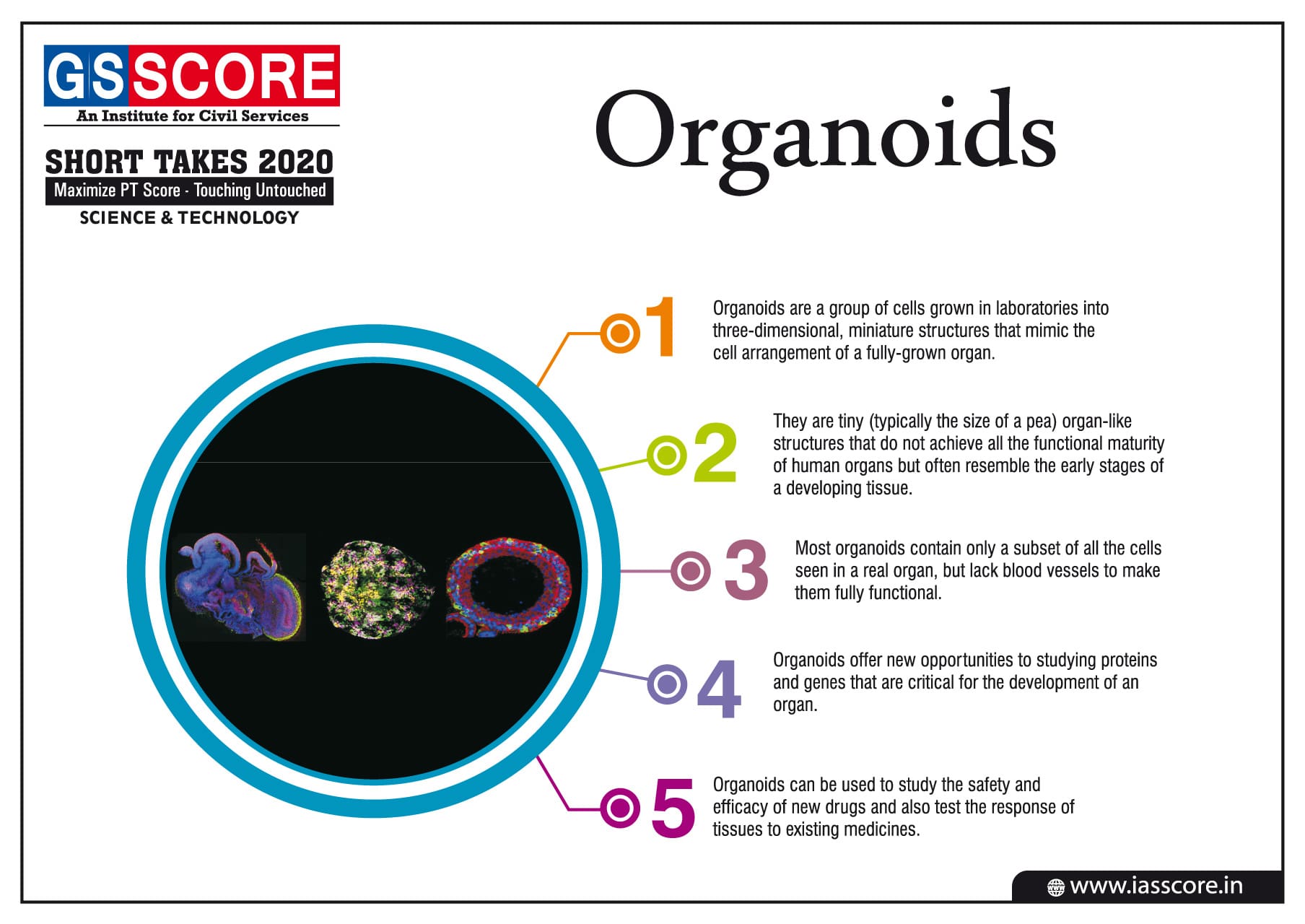

Organoids

Za’ir-Al-Bahr (Roar of the Sea)

-min.jpg)

Project Soli

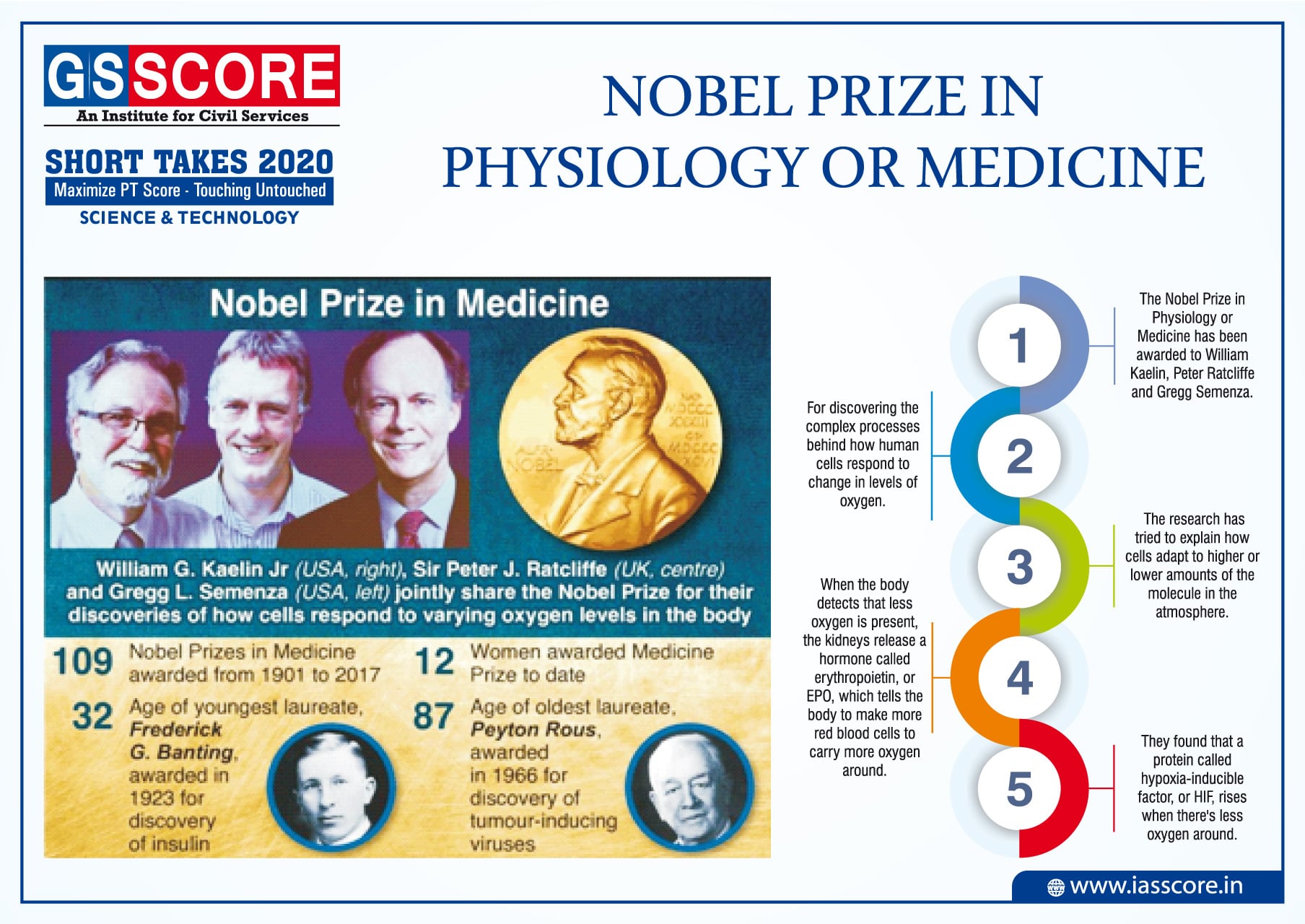

NOBEL PRIZE IN PHYSIOLOGY OR MEDICINE

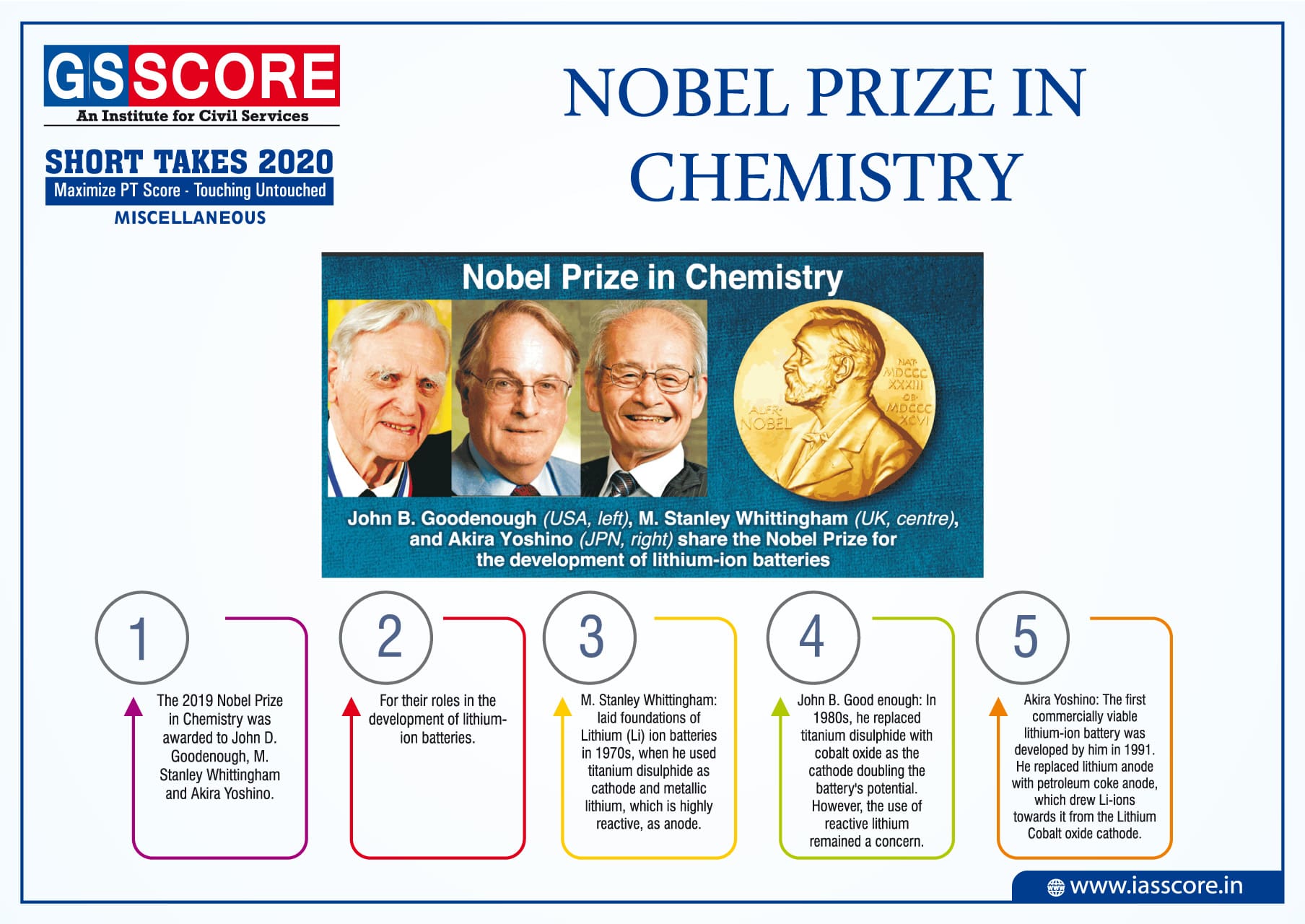

NOBEL PRIZE IN CHEMISTRY